James Seyffart

@JSeyff

CFA. CAIA. ETFs. Cryptos. Asset Management. @Bloomberg. @bbgintelligence. Runner. Opinions my own. Likes, RT's & Follows≠endorsements

내가 좋아할 만한 콘텐츠

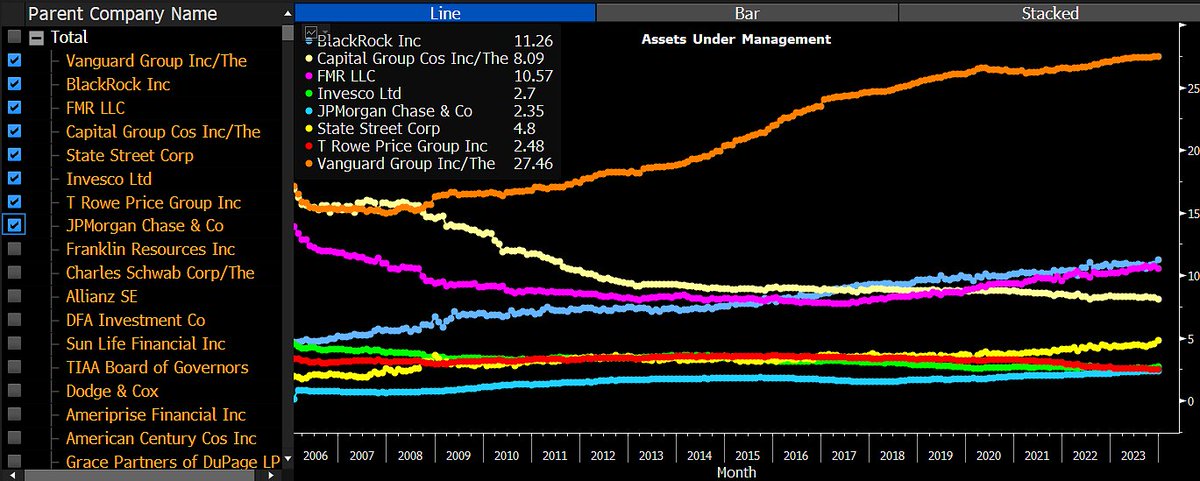

Big news! We just launched a new function that allows @TheTerminal users to analyze the US asset management industry in a fully customized fashion. I've personally been working towards doing this for 8 years and today's the day. Here's a sample of US fund market share since 2006

Good.

Looks like SEC is pushing back on all the 3x and 5x filings, calling them out on the loophole they were trying to use, to get around the 200% VAR, and "requests them to revise the obj and strategy to be consistent with 18f-4 or withdrawal" Honestly, it's for the best. I'm as…

this thursday, i’ll speak before the SEC’s Investor Advisory Committee about tokenization of equities the event will stream live on the SEC’s website starting at 2:15pm ET i’ll join panelists from blackrock, citadel, nasdaq, robinhood, and coinbase we advocate for native…

Starting tmrw vanguard will allow ETFs and MFs tracking bitcoin and select other cryptos to begin trading on their platform. They cite how the ETfs have been tested performed as designed through multiple periods of volatility. Story via @emily_graffeo

So Louisiana's Governor went on a rant saying Brian Kelly's contract was financially irresponsible and that the next coach would be given a performance-based contract...only for LSU to give Lane Kiffin a 7-year, $91 million deal with an 80% buyout and no offset clause.

LSU and Lane Kiffin agreed to a seven-year, $91 million deal, according to a copy of his term sheet. If he wins a national title, it includes an automatic escalator that makes him the highest-paid coach in the country. Full details: nola.com/sports/lsu/lan…

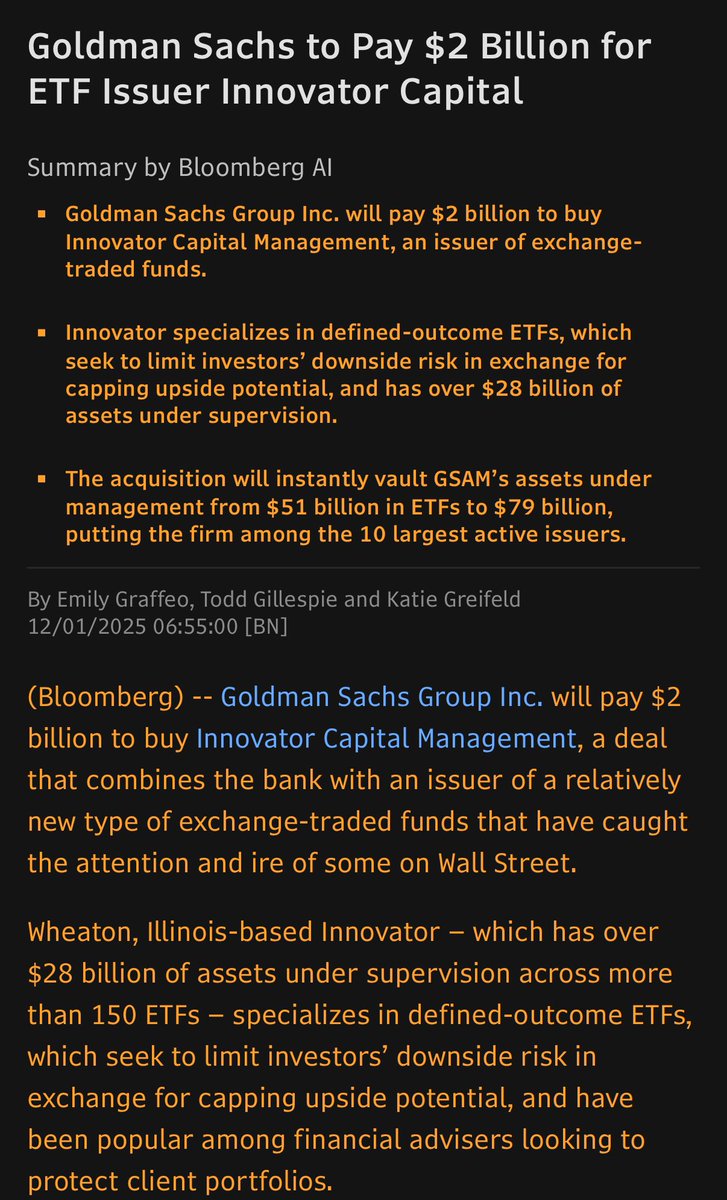

HUGE: Goldman Sachs to acquire Innovator ETFs (the Buffer ETF people) for $2b. Wow. This product set has ‘only’ $28b but they all charge like 80bps = revenue machines (hard to find in Vgrd Era). This also gives Goldman a huge lift, they were eerily quiet since ex-JPM star Bryon…

Which one of you degenerates is this ? Hahahaha

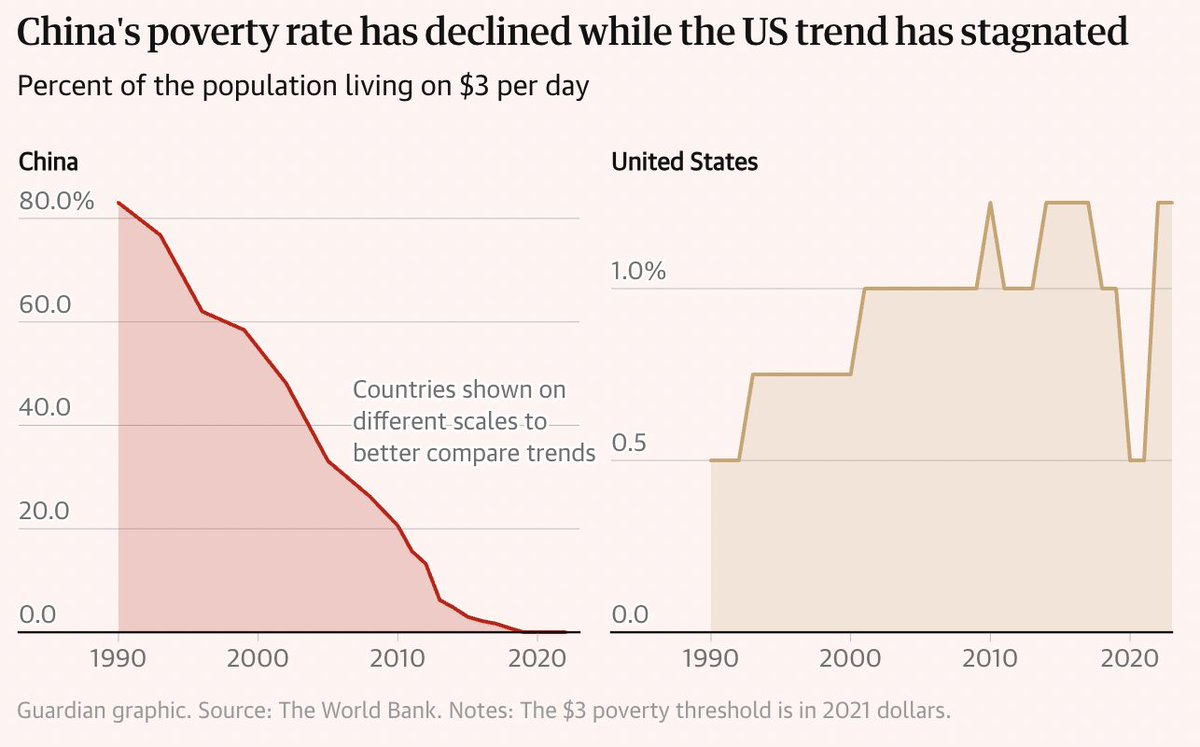

Hey @elonmusk. I know we aren’t banning people anymore. But can we revoke posting ability for a period of time for certain people as a pseudo timeout? This is an absolutely heinous chart crime for someone to post. Cc @EconomPic

The share of the population living in extreme poverty is now higher in the United States than in China.

Physical Gold and Silver ETFs with metal held in Texas filed. Retail investors can redeem in kind! Y'all Street Gold ETF Y'all Street Silver ETF Tickers/fees/effective date: tba Custodian: Texas Precious Metals LLC Headquartered in Shiner, TX (between San Antonio and Houston).…

Introducing BWOW today

Introducing the Bitwise Dogecoin ETF. $BWOW starts trading tomorrow. We weren’t expecting to launch this product, but the $DOGE community requested, nay demanded, this. Dogecoin is: - Seventh-largest crypto asset by market weight (as of 11/25/25) - $22B market cap - $1B traded…

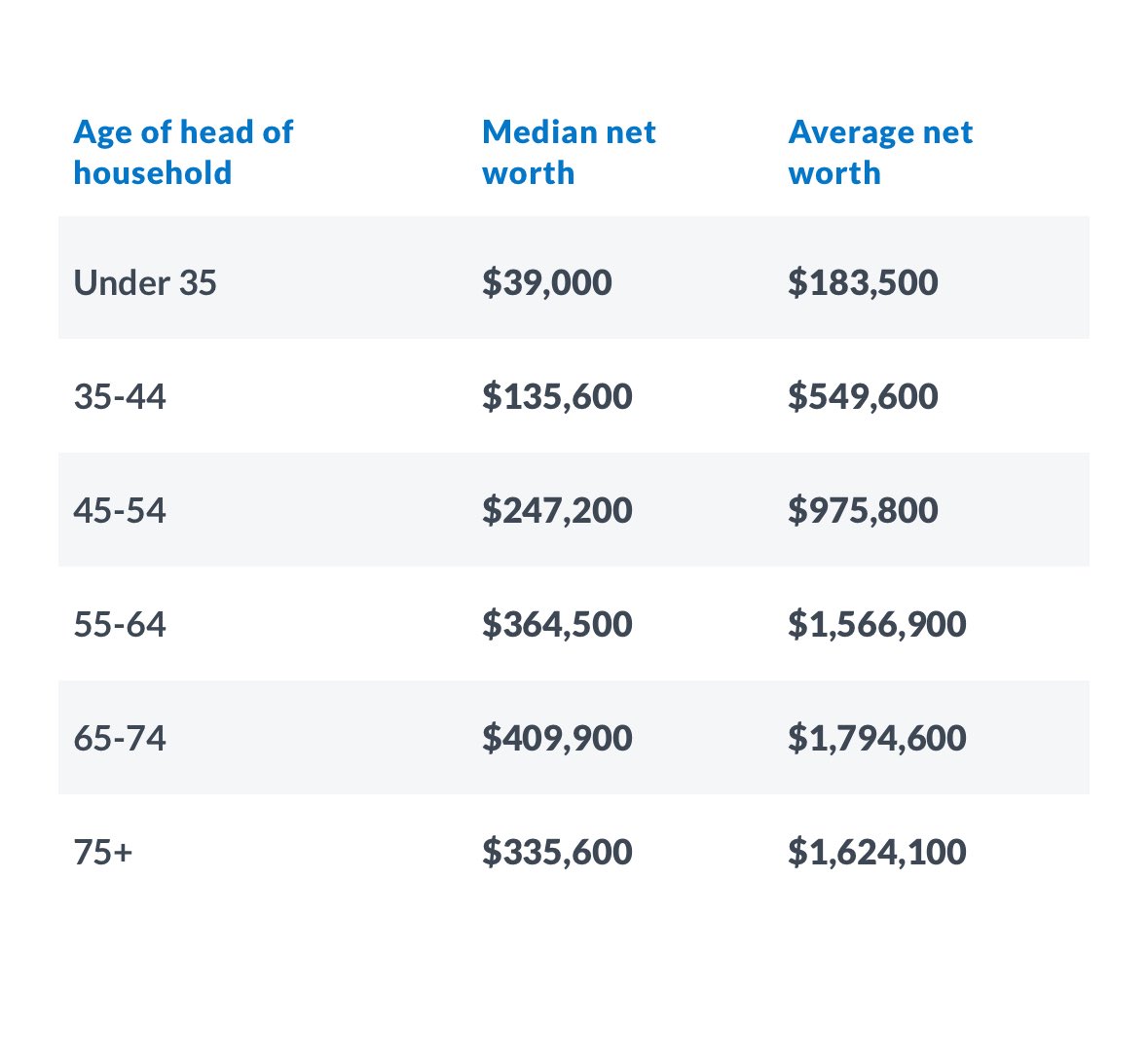

The spread between median and mean here is the foundation for a lot of the societal unrest we see in the world rn imo

Interesting report from the Fed on US family finances 1. Net worth:

There are 5 spot crypto ETFs launching over next 6 days. Beyond that we don't have exact but we expect a steady supply of them (likely over 100 in next six months). Nice chart showing what's launched and what's on deck from @JSeyff

The first spot Dogecoin ETF* in US launches today from Grayscale, ticker $GDOG (sounds like a late '80s one hit wonder rapper). Fee is 35bps but is waived to 0.00% for first 1b or until 3mo. Day One volume predictions welcome. I'm going with $12m. *33 Act

I think James is probably under-selling the flood here.

Here comes the DOGE

Launching tomorrow… Grayscale Dogecoin ETF. First ‘33 Act doge ETF. Some (many) might laugh, but I actually view this as a highly symbolic launch. IMO, best example of *monumental* crypto regulatory shift over past yr. Btw, GDOG might already be top 10 ticker symbol for me.

EPSTEIN BOMBSHELL: my staff is releasing a new report showing JPMorgan Chase executives – all the way to the top – enabled Epstein's sex trafficking operation. You're going to want to read this. nytimes.com/2025/11/20/us/…

Semi-shock: Bitcoin ETFs saw net *inflows* on Friday, as a group (the others picked up slack for IBIT, teamwork in effect). Cant deny Boomers showing serious mettle. Still over 95% of aum hanging tough despite, as their hero Billy Joel says, they didn't start the fire.

today in blockchains. some guy vibe coded an exploit which brought down the entire cardano blockchain

Sorry (I know the word isn't enough given the impact of my actions) Cardano folks, it was me who endangered the network with my careless action yesterday evening. It started off as a "let's see if I can reproduce the bad transaction" personal challenge and then I was dumb enough

United States 트렌드

- 1. Spotify 1.15M posts

- 2. Chris Paul 32.9K posts

- 3. Clippers 46.3K posts

- 4. Hartline 11.4K posts

- 5. Ty Lue 2,653 posts

- 6. Henry Cuellar 7,300 posts

- 7. ethan hawke 4,877 posts

- 8. #HappyBirthdayJin 108K posts

- 9. David Corenswet 8,215 posts

- 10. Jonathan Bailey 9,384 posts

- 11. GreetEat Corp 1,173 posts

- 12. Apple Music 253K posts

- 13. South Florida 6,752 posts

- 14. #NSD26 26.7K posts

- 15. SNAP 173K posts

- 16. Chris Henry 2,615 posts

- 17. Klein 17K posts

- 18. Adam Sandler 5,225 posts

- 19. #JINDAY 84.7K posts

- 20. Duncan 7,966 posts

내가 좋아할 만한 콘텐츠

-

Eric Balchunas

Eric Balchunas

@EricBalchunas -

Fidelity Digital Assets

Fidelity Digital Assets

@DigitalAssets -

Jack Mallers

Jack Mallers

@jackmallers -

Jameson Lopp

Jameson Lopp

@lopp -

Mayor Francis Suarez

Mayor Francis Suarez

@FrancisSuarez -

Jake Chervinsky

Jake Chervinsky

@jchervinsky -

AriannaSimpson.eth

AriannaSimpson.eth

@AriannaSimpson -

Mike McGlone

Mike McGlone

@mikemcglone11 -

Jurrien Timmer

Jurrien Timmer

@TimmerFidelity -

Jeremy Allaire - jda.eth / jdallaire.sol

Jeremy Allaire - jda.eth / jdallaire.sol

@jerallaire -

Michael Green

Michael Green

@profplum99 -

Nate Geraci

Nate Geraci

@NateGeraci -

SBF

SBF

@SBF_FTX -

nic carter

nic carter

@nic_carter -

Katie Greifeld

Katie Greifeld

@kgreifeld

Something went wrong.

Something went wrong.