Juniper Capital Management

@JuniperCM

Discretionary multi-strategy equity | Posts are not financial advice & for informational purposes only

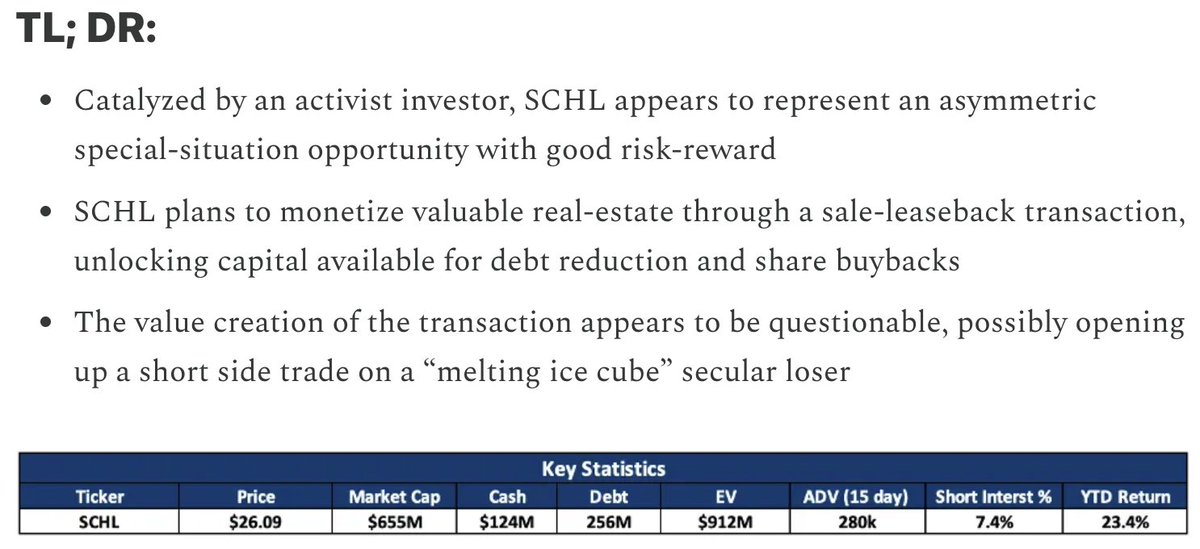

We are passing on $SCHL for now - though it could be an interesting opportunity from the short side eventually. Full post is here: open.substack.com/pub/junipercap…

A bit surprised at this $GOOGL purchase from Buffett. At ~22x pre-tax earnings and ~24x post, it's a bit more expensive than he usually goes for. Not sure if this is Abel, Weschler, or Combs, but either way I would assume Buffett signed off on it.

$OI

$OI turnaround on track as Company raises guide to $1.55-1.65 from $1.30-1.55 as margins expand even in a subdued demand environment. FCF of $150-200M inclusive of $150M in cash restructuring costs, which means we're looking at $2/sh+ in FCF moving forward on a $12 stock!!

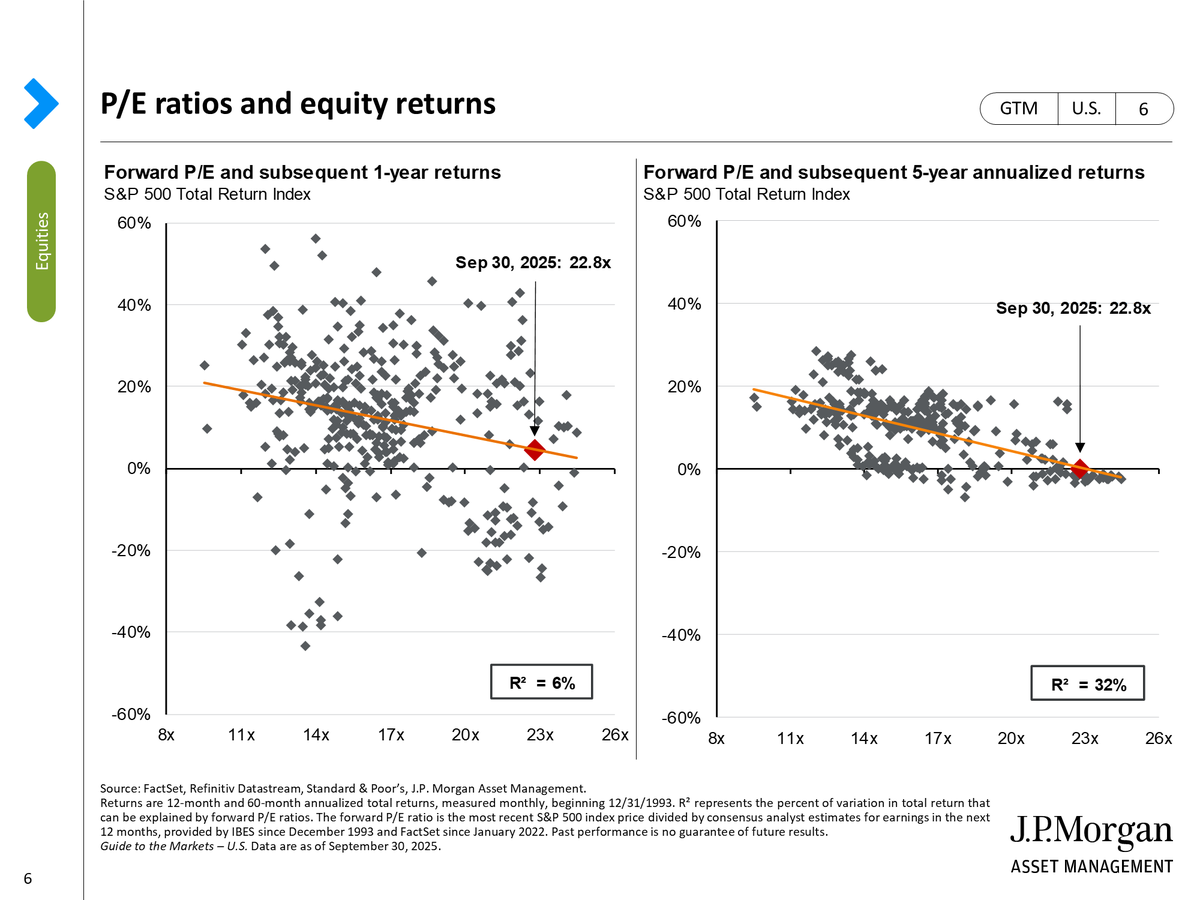

Really wish more people would understand that many different things can be responsible for moving a stock. Most of the time, especially over short time frames, fundamentals/valuation does not play a part.

If your timeframe is 12 months or less, valuation has got NOTHING to do with stock price performance. Even if your timeframe is 5 years, 68% of a stock's return can be explained by things other than valuation. Many people refuse to accept this.

Could not have said this any better myself

Why Your Portfolio is a Mirror of You Most people think a portfolio is just a collection of stocks. In reality it is a reflection of the person who built it. Your portfolio shows how you think about risk, how patient you are, how much you chase hype, and whether you truly…

The Shiller PE cracked 40 for the first time since 2000. Only the December 1999 summit at 44.19x remains, ya filthy animals.

Quarterly earnings status quo should be left untouched. Ppl have vilified earnings season b/c of pods but the reality is quarterly disclosure is fine even for LT investors. Let’s not make a charade out of a simple issue.

Have to imagine a second derivative impact would likely be rising importance of alt-data

BREAKING: Trump: companies and corporations should no longer be forced to "Report" on a quarterly basis

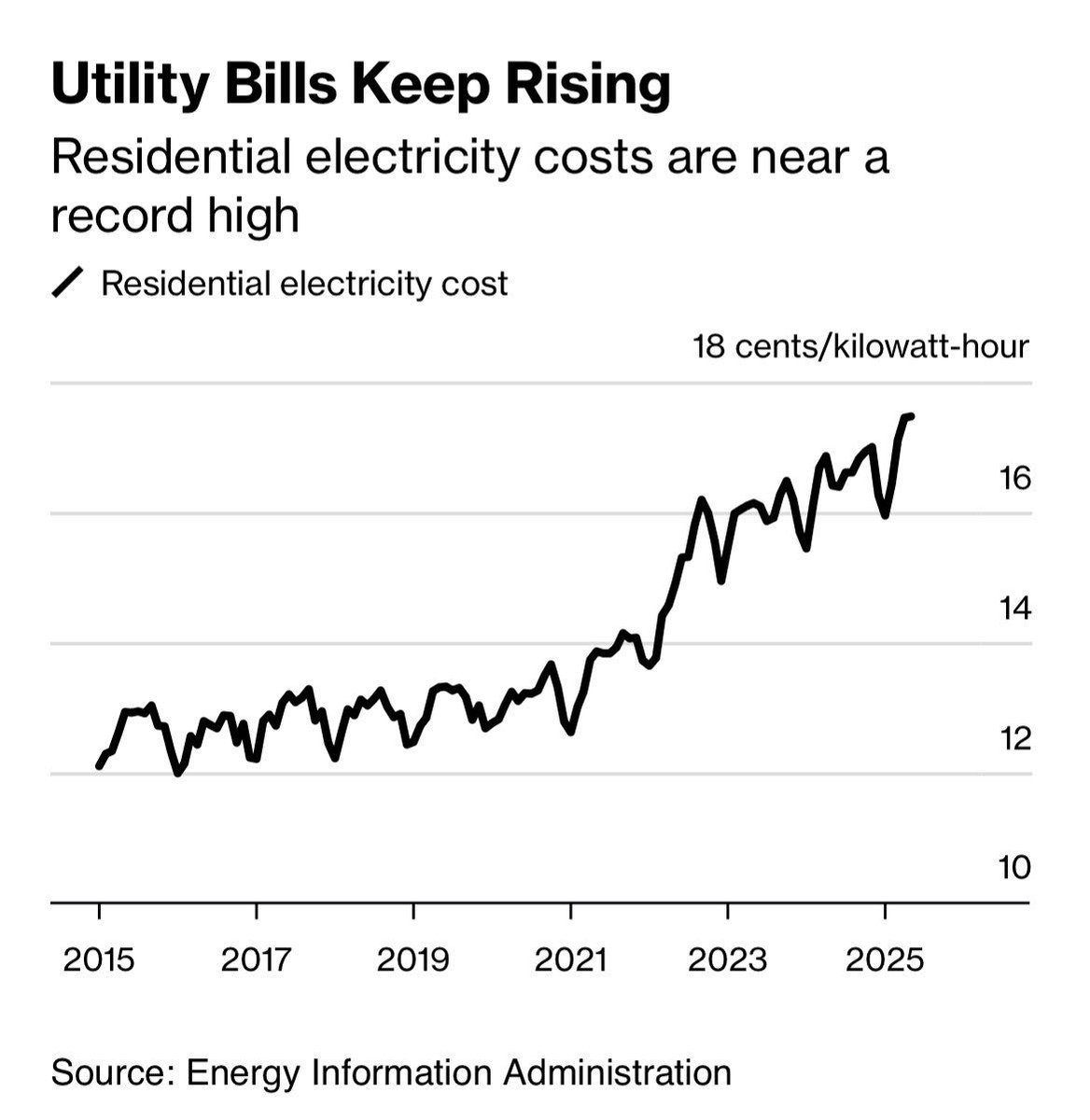

At what point do politicians pushback on the rising power needs of AI increasing consumer electricity prices?

Residential electricity costs are near a record high, per Bloomberg:

I like it, but weird to see an activist stake when the stock is near ATH's $NYT

The financiers that led a high-profile activist campaign at the New York Times three years ago have now taken a stake in the iconic newspaper company via their new investment firm. bloomberg.com/news/articles/…

Well that didn't take long

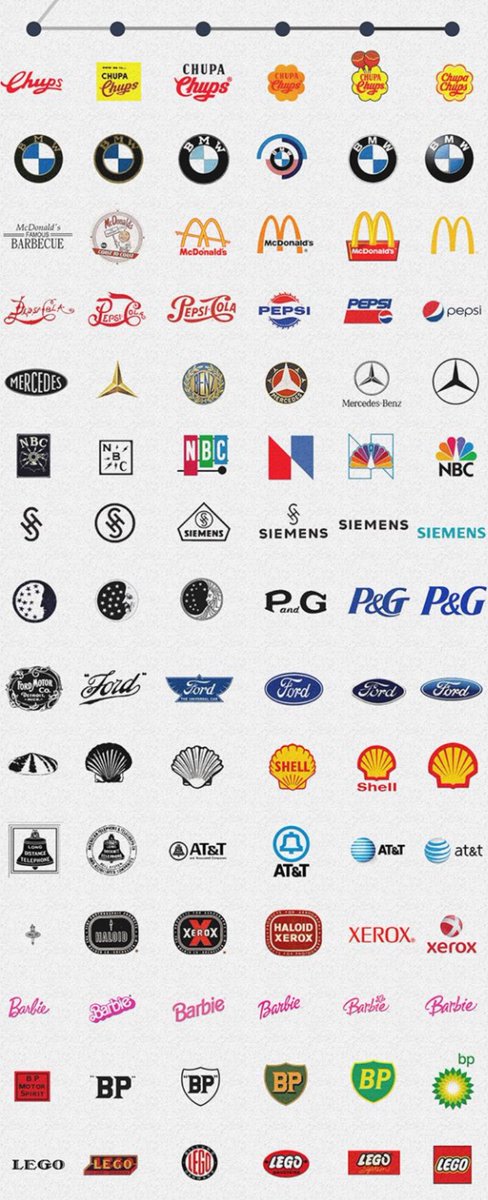

Cracker Barrel is reverting to its "Old Timer" logo after a rebrand ignited a culture war on.wsj.com/4fTb4dM

$SCHL

For those who care about K-12 education and the future of AI in the classroom, this is a must-listen podcast with Joe Liemandt, principal of @AlphaSchoolATX.

The comments doubting this are interesting. The lead time on CCGTs is around ~4-5 years (OEM's are not increasing capacity), and any new nuclear will take almost double that time. If you then add in to the equation disincentivizing the fastest growing form of power to the…

Solar executives warn that Trump attack on renewables will lead to power crunch that spikes electricity prices cnbc.com/2025/08/24/sol…

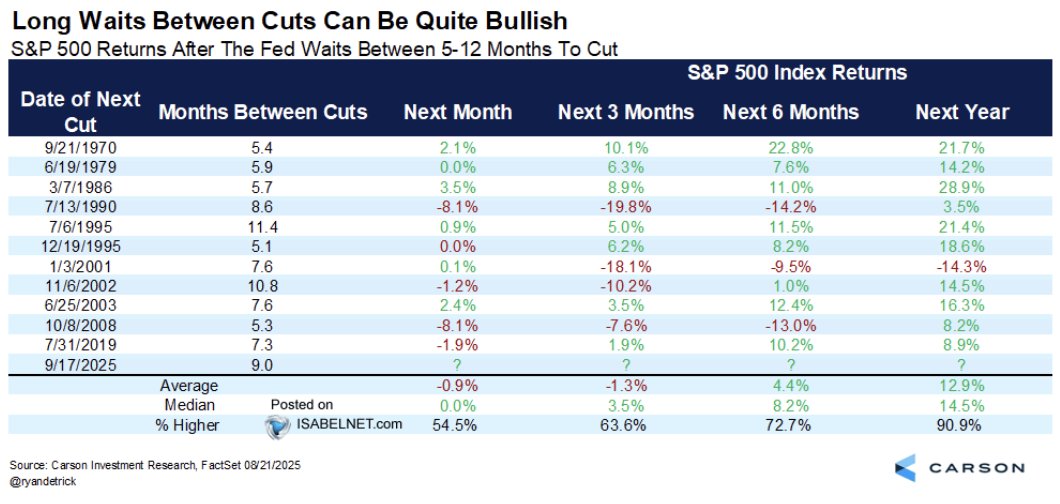

Who knew, unless we are going into the next dot-come bust the market might be up in the NTM. I guess the market goes up on average over time *insert sarcasm*

Yea it has to an "all of the above" approach

Heard on the Street: Rising electricity demand, in part due to AI needs, along with the increasing cost of alternatives should cushion the loss of subsidies for green energy on.wsj.com/4nfK2Qz

wsj.com

Why Solar and Wind Power Can Thrive Without Subsidies

Rising electricity demand, in part due to AI needs, along with the increasing cost of alternatives should cushion the impact for green energy.

Pretty sure I think about this dilemma daily. The market is historically expensive, yet it's being driven by companies that are historically better than those that drove the market in the past. The last thing I want to say is "this time is different". But I suppose it's like…

I mean to be fair to $CBRL, it’s really not normal to keep one logo forever. Evolution is natural, but I get it, a standard/perception had been set, making it an integral part of their brand/feel.

*Prompting Gemini to give me a deep research comparative analysis of Labubu vs Beanie Baby craze* $PMRTY

$VIK looks interesting - trades about ~in-line with $RCL on most metrics, yet currently expanding into ocean cruises, books a significant amount of revenue ahead of time at premium prices (vs peers $RCL $CCL $NCL) creating large deferred revenue cash inflows & negative working…

Never heard it phrased liked that, but I like it

Increasing your cost basis is not a mistake if the underlying company is increasing intrinsic value at a faster rate.

United States Trends

- 1. Rodri N/A

- 2. Davos N/A

- 3. Chloe N/A

- 4. Man City N/A

- 5. FINALLY DID IT N/A

- 6. Bodo N/A

- 7. Macron N/A

- 8. The REKT N/A

- 9. Life is Strange N/A

- 10. Pam Grier N/A

- 11. Wizkid N/A

- 12. Gulf of Trump N/A

- 13. #WWEUnreal N/A

- 14. The SPX6900 N/A

- 15. Manchester City N/A

- 16. Imposter N/A

- 17. Ryanair N/A

- 18. noah kahan N/A

- 19. Double Exposure N/A

- 20. #UniónPerfectaPorVenezuela N/A

Something went wrong.

Something went wrong.