John Toohig

@KOperations12

Head of whole loan Trading on the Raymond James whole loan Desk and President Raymond James Mortgage Company.

A weekly newsletter on what's trading and trending in the banking and loan market as seen by the chatter from the Raymond James whole loan desk. #loans #banking #creditunions #credit #markets #trading linkedin.com/newsletters/69…

Podcast. Looking for a conversation surrounding commercial real estate? Give @TreppWire podcast a listen. Hosted by Lonnie Hendry, CRE and Hayley Keen we had a good discussion about the lending markets. We covered not only commercial real estate but also consumer lending and…

Mortgages. What's the impact on the housing market at 7.5% coupons? Perhaps FNMA is a good barometer. "FNMA struggled with single-family loan purchase volume in the seasonally weak Q1, when it fell to depths not seen since Q3 of 2000" americanbanker.com/news/fannie-ma…

americanbanker.com

Fannie Mae single-family volume drops close to 24-year low

But strong g-fees, a positive credit-loss adjustment and stable home prices bolstered results despite declines in mortgage purchases to lows not seen in some time.

Thanks @TheBondFreak, @JackFarley96 This link should get you there: linkedin.com/pulse/lets-tal… Happy New Year! Thanks for all you do!

linkedin.com

Top Content on LinkedIn

Explore top LinkedIn content from members on a range of professional topics.

Rates. A concerning article in the Financial Times by Mohamed El-Erian. "The US bond market is losing its strategic footing, whether in economics, policy, or technical aspects" on.ft.com/46DXq9e

"A significant portion of the large domestic institutional investor base, such as pension funds and insurance companies, already holds substantial quantities of bonds at large mark-to-market losses"

"Fortunately, the bond market still possesses some short-term stabilisers" "it’s important to note that their resilience should not be taken for granted. No matter how you look at it, the world’s most crucial benchmark market is on an unpredictable journey"

Discussing the market impacts of the proposed Basel III capital rules on the lending ecosystem are John Toohig with @RJWholeLoans, Becky Crain with Regions Mortgage, Kurt Johnson with @MrCooper and Jay Plum with @FifthThird. #MBAAnnual23

Recession watch. Mohamed El-Erian has been one of the economists I've most closely followed throughout the pandemic. He's been right about higher for longer. So when I see a headline that says he thinks we can't avoid a recession, I read it. See below. on.ft.com/3ZXX3DX

"For well over a yr now, I have argued that the US is able to avoid the 23 recession that many were repeatedly calling. I am now less confident about what’s in store for 24 given how the recent surge in rates compounds the erosion in financial, human and institutional resilience"

"If congressional dysfunction spreads further, and if the Fed continues to drag its feet on changing key underpinnings of its policy formulation, the turn in US economic surprises will not be pleasant for either the domestic economy or the rest of the world" #recession #economy

I'm hearing chatter that we're already seeing 8% for some home buyers -- e.g. those who are non-prime Others tell me it's only a matter of time before the rest of us get quoted 8% @RJWholeLoans

‘We’re right at the cusp’: 8% mortgage rates are already here for some buyers trib.al/869cvl7

marketwatch.com

8% mortgage rates are already here for some buyers

Mortgage rates continue to rise, and some lenders are already quoting certain home buyers a rate of over 8%, mortgage experts say.

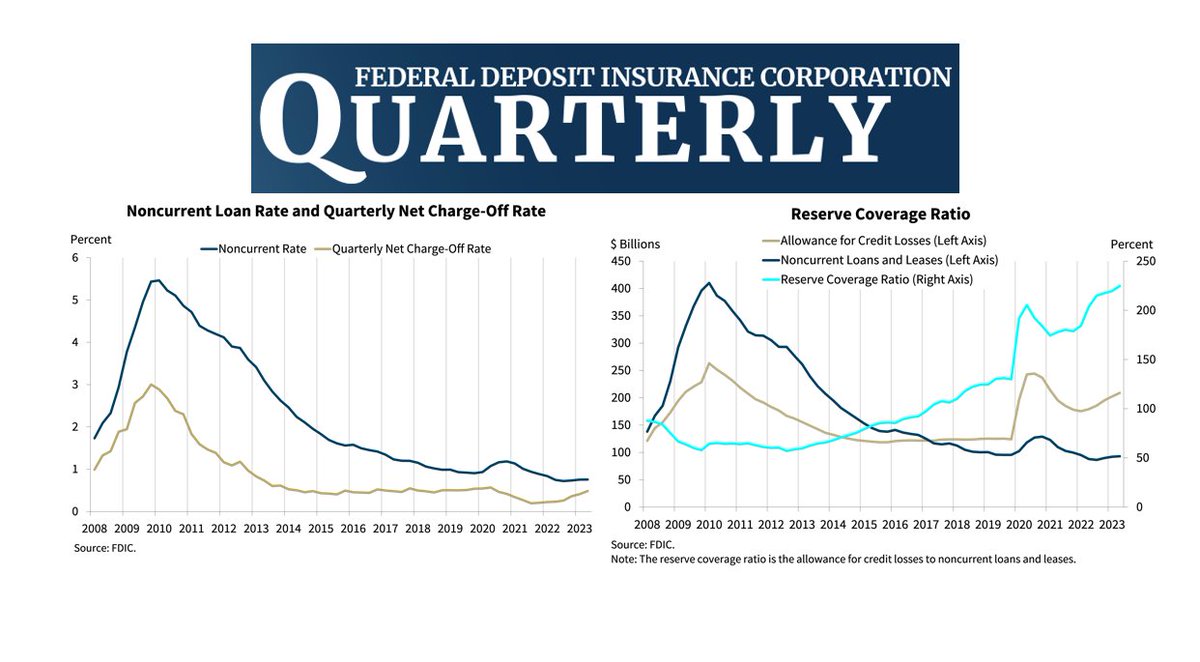

"The ratio of the allowance for credit losses to noncurrent loans increased from 203.6 percent one year ago to 224.8 percent this quarter, the highest level since we began publishing the Quarterly Banking Profile in 1986"

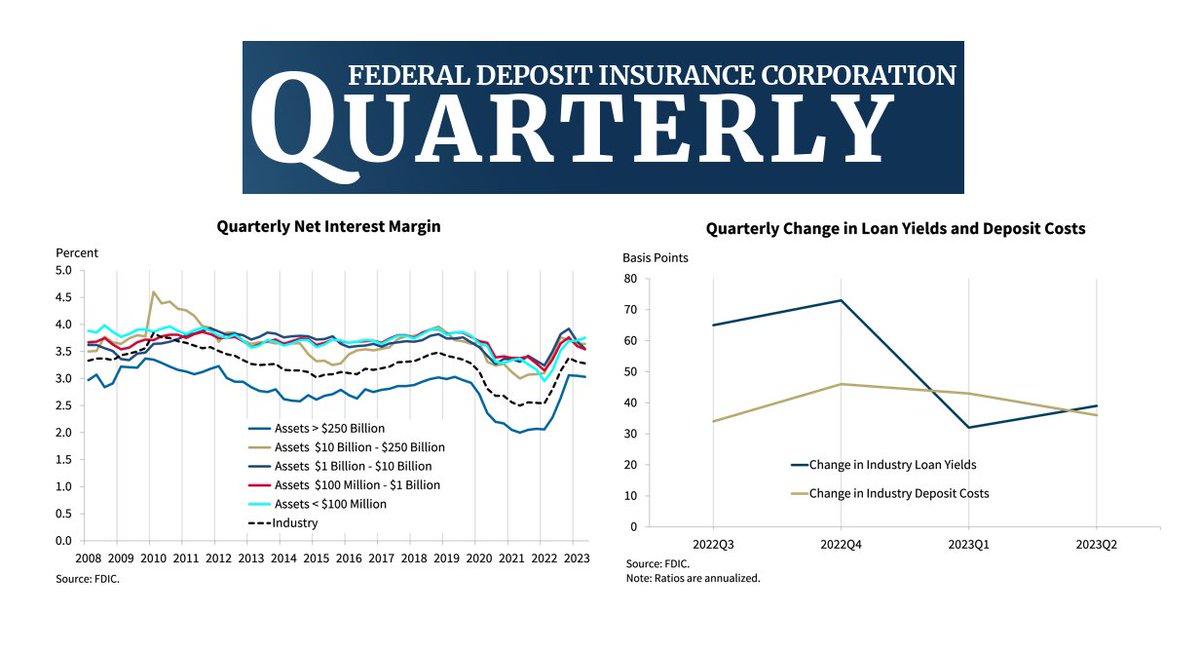

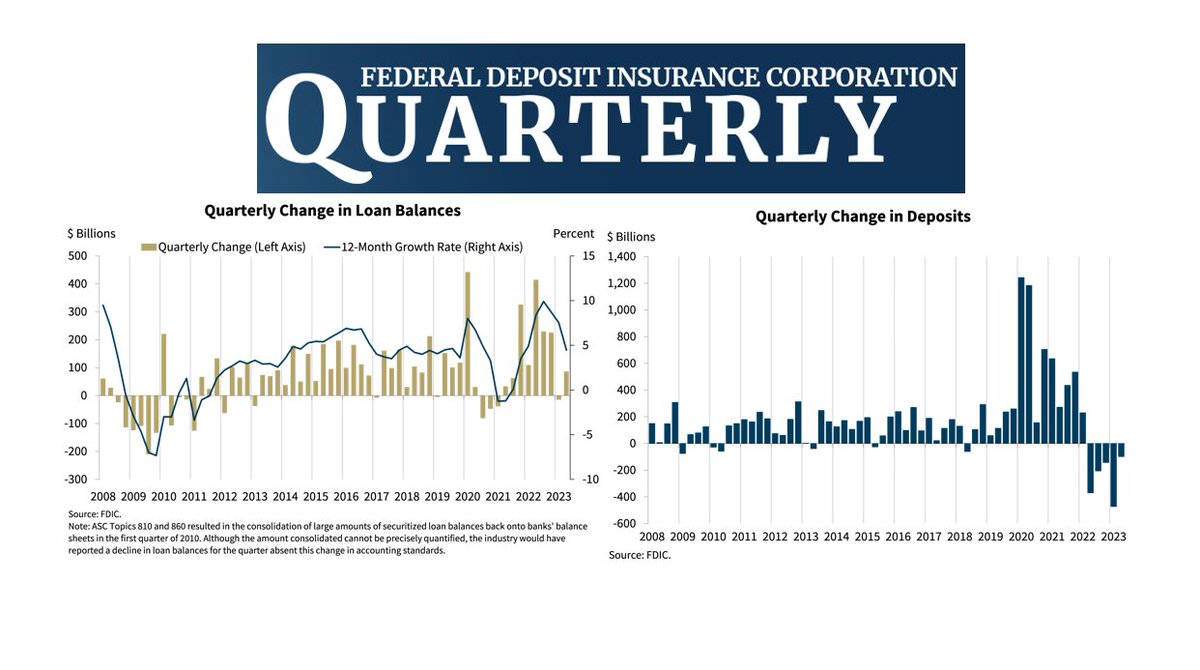

FDIC's Q2 guidance on banking. NI Decreased From the Prior Qtr NIM Declined for the 2nd Straight Qtr Unrealized Losses Increased QoQ Total Deposits Declined For a Fifth Consecutive Quarter Loans Increased From Last Qtr and One Year Ago fdic.gov/news/speeches/…

"Although the rates earned on loans increased more than the rates paid on deposits, the rates banks paid on non-deposit liabilities, such as FHLB advances and borrowings from the BTFP, increased by a larger amount, pushing up the overall cost of funds for the industry"

"in Q2, total deposits declined for the 5th consecutive quarter. Deposit outflows moderated substantially from the large outflows reported last quarter" "loan growth has normalized over the past two quarters after the large spike in lending that occurred last yr"

Out now- my interview on Commercial Real Estate (CRE) - Payment Shock from surge in interest rates - Maturity defaults have skyrocketed for office CMBS loans - Commercial Real Estate needs to reckon with "higher for longer" - Gaps between buyers' and sellers' price…

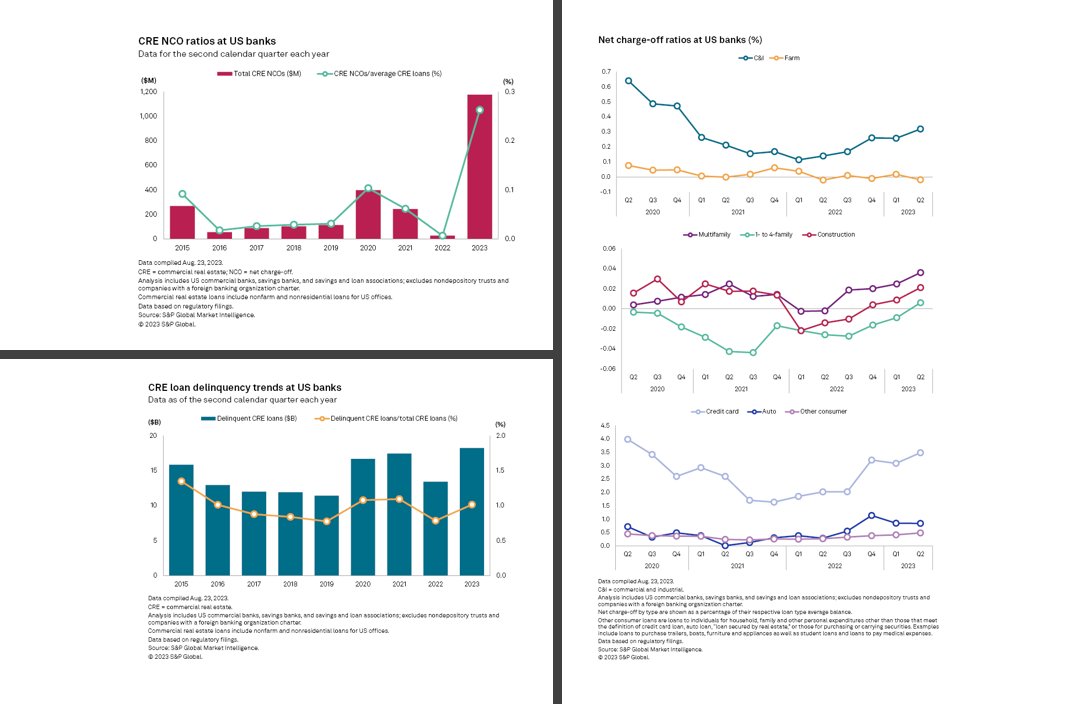

CRE performance. Headline says "net charge offs surge". A look at the S&P data. "Total commercial real estate (CRE) loan net charge-offs exploded 4,138.6% year over year to $1.17 billion in the second quarter, from just $27.7 million in the 2022 second quarter" @JackFarley96

"The delinquent CRE loan balance for banks totaled $18.21 billion in the second quarter, up 35.7% from $13.42 billion a year earlier. Delinquent CRE loans as a percentage of total CRE loans stood at 1.01%. Total CRE loans at US banks grew 5.2% year over year to $1.796 trillion"

United States Trends

- 1. Good Tuesday N/A

- 2. #tellmelies N/A

- 3. Stewart N/A

- 4. Bridges N/A

- 5. Kansas N/A

- 6. #WWERaw N/A

- 7. Pistons N/A

- 8. Duren N/A

- 9. Hornets N/A

- 10. Les Wexner N/A

- 11. Allen Fieldhouse N/A

- 12. $WAR N/A

- 13. Reaves N/A

- 14. Laravia N/A

- 15. Arizona N/A

- 16. Patagonia N/A

- 17. Peterson N/A

- 18. Caruso N/A

- 19. Anran N/A

- 20. Bill Self N/A

Something went wrong.

Something went wrong.