Taylor Sohns MBA, CIMA, CFP

@LifeGoalInvest

CEO of LifeGoal Advisors

You might like

$2,000 in rent gets you shockingly little in America’s priciest cities. Here’s what $2,000 a month buys you: NYC: 267 sq ft Boston: 336 sq ft San Francisco: 340 sq ft San Jose: 427 sq ft San Diego: 458 sq ft 267 sq ft is just 1/3 of a pickleball court …

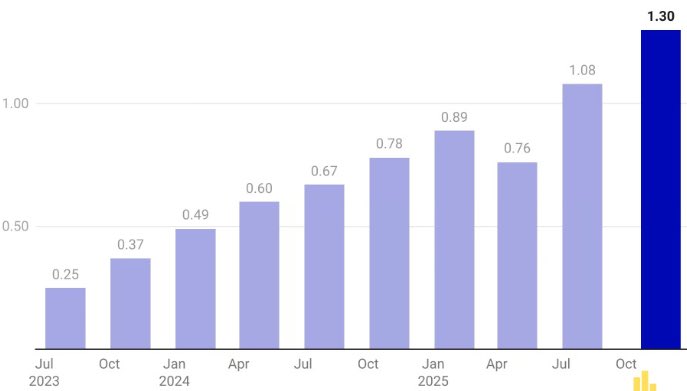

Nvidia just torched earnings again 🚀 The AI boom clearly isn’t slowing. Nvidia’s Earnings Per Share (EPS) continues to trend up:

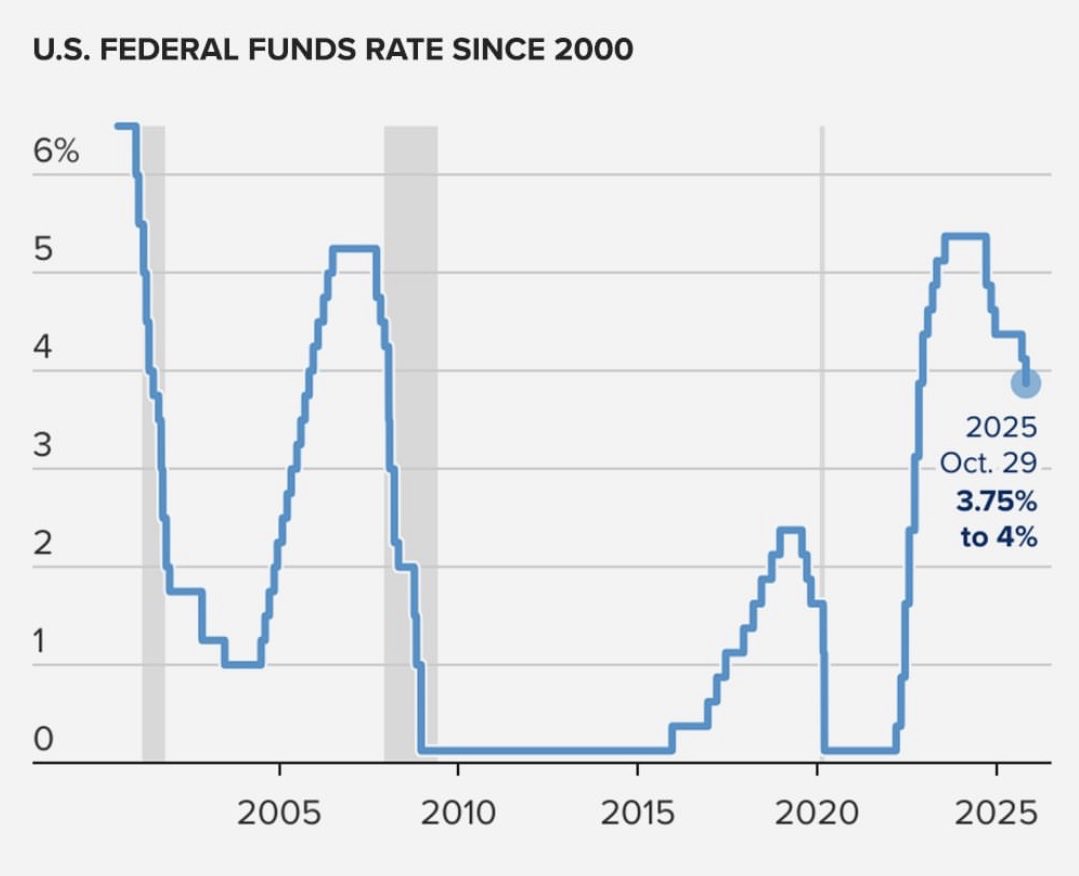

Two cuts down. Markets are whispering about a third. What’s next for the Fed?

If you’re 30 and haven’t started investing, read this twice. Assume an 8% return until age 65: - Start at 40 -> $500/month -> $440k - Start at 30 -> $500/month -> $1.1M Same Effort. Same money. Different start time. $700k Difference. That’s the power of compounding.

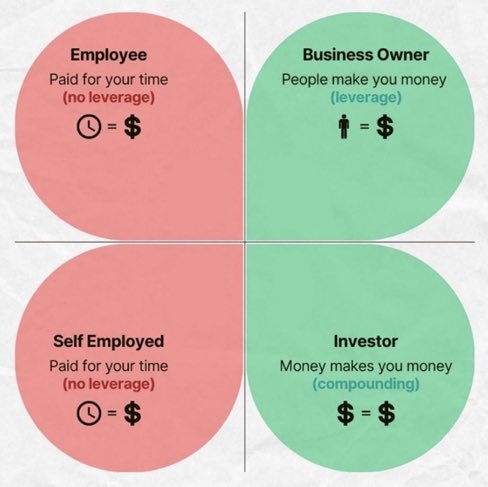

Everyone starts in the red — trading time for money. But you can’t scale time. The key difference between rich and poor isn’t effort — it’s leverage. Learn to make systems, people, or capital work while you don’t #Wealth #Investing #Leverage #FinancialFreedom

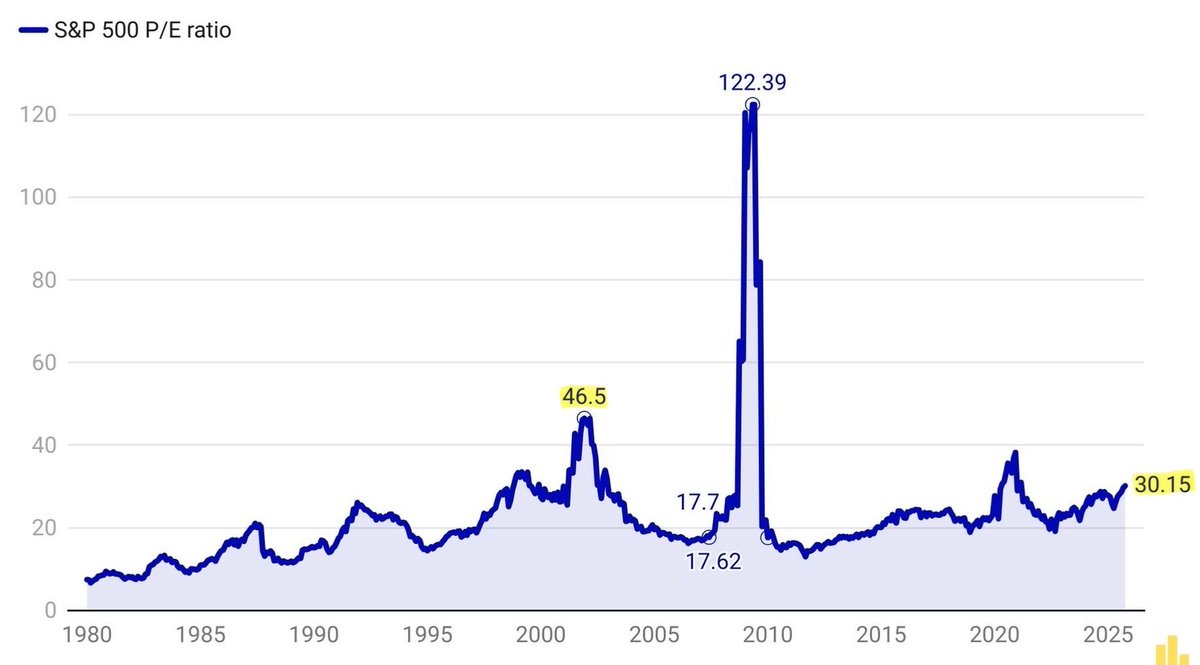

The S&P 500’s P/E ratio hit nearly 47x during the dot-com bubble. Today? Around 30x. Still elevated, but backed by real profits, cash flow, and scale. Different era, different fundamentals.

There are 3 currencies in life: 1. Knowledge 2. Time 3. Money To gain one, invest the other two wisely.

In 1985, $100 = $299 today Price check 1985 vs 2025: 🥛 Milk: $2.27 -> $4.16 / gal ⛽️ Gas: $1.24 -> $3.29 / gal 🥚 Eggs: $0.79 -> $3.60 / doz 🧈 Butter: $2.13 -> $4.80 / lb 🥩 Ground Beef: $1.20 -> $6.25 / lb Imagine walking into a 1985 grocery store with $100 …

Wealth by Generation! The Silent Gen (before 1946): $20 trillion Baby Boomers (1946-1964): $83 trillion Generation X (1965-1980): $43 trillion Millennial & Gen Z (1981+): $17 trillion Four Generations, One Economy … and a very uneven scoreboard.

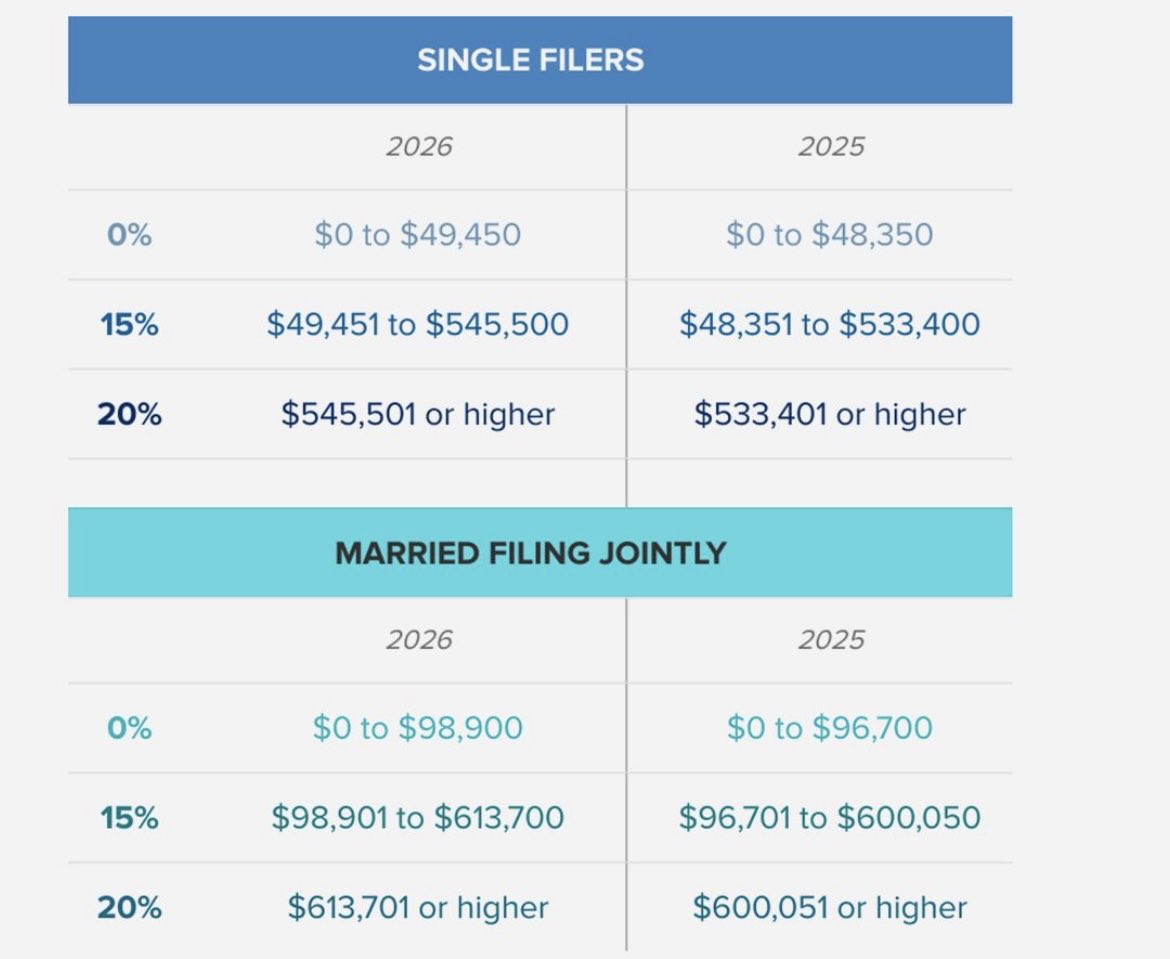

Long-Term Capital Gains Rates for 2026!

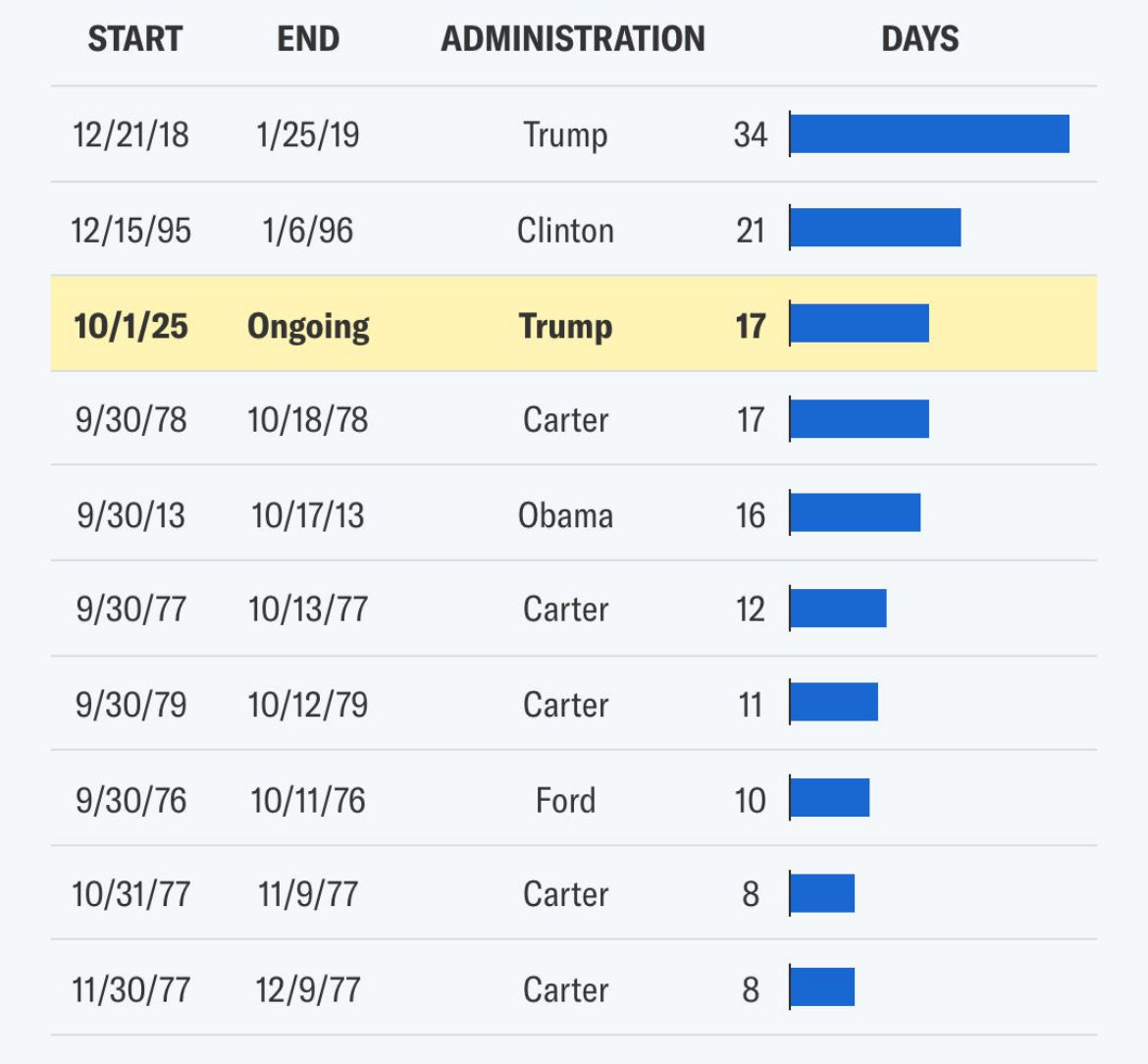

3rd Longest Government Shutdown in U.S. History! How do you explain to your kids that the government just … stopped working?

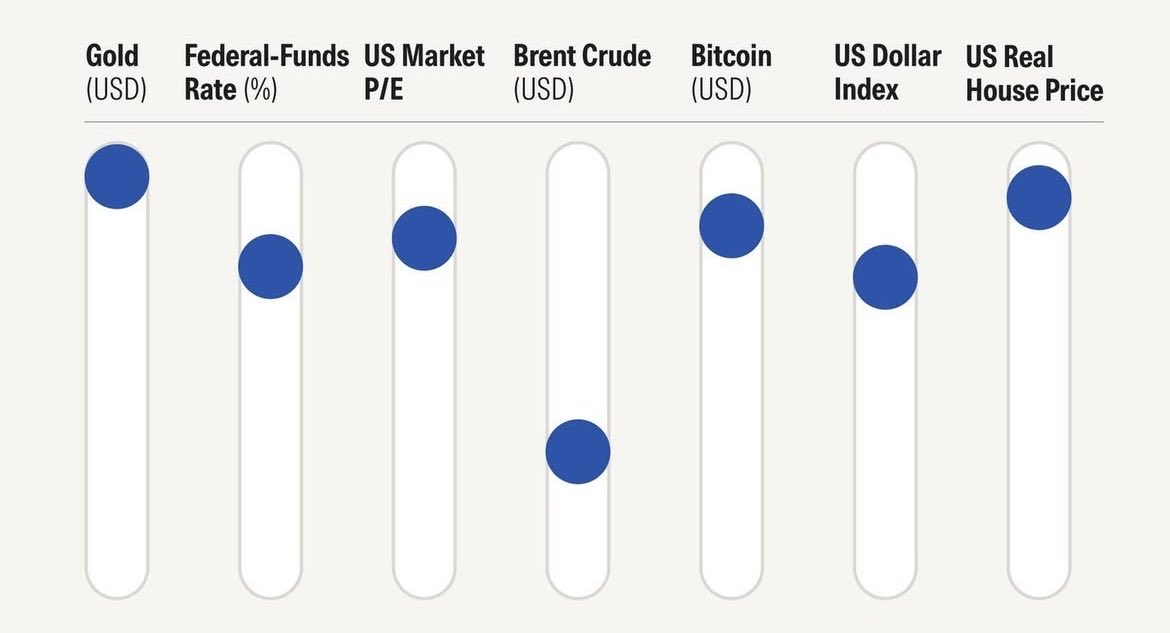

7 Key Market Indicators. Where does the balance lie? ⚖️

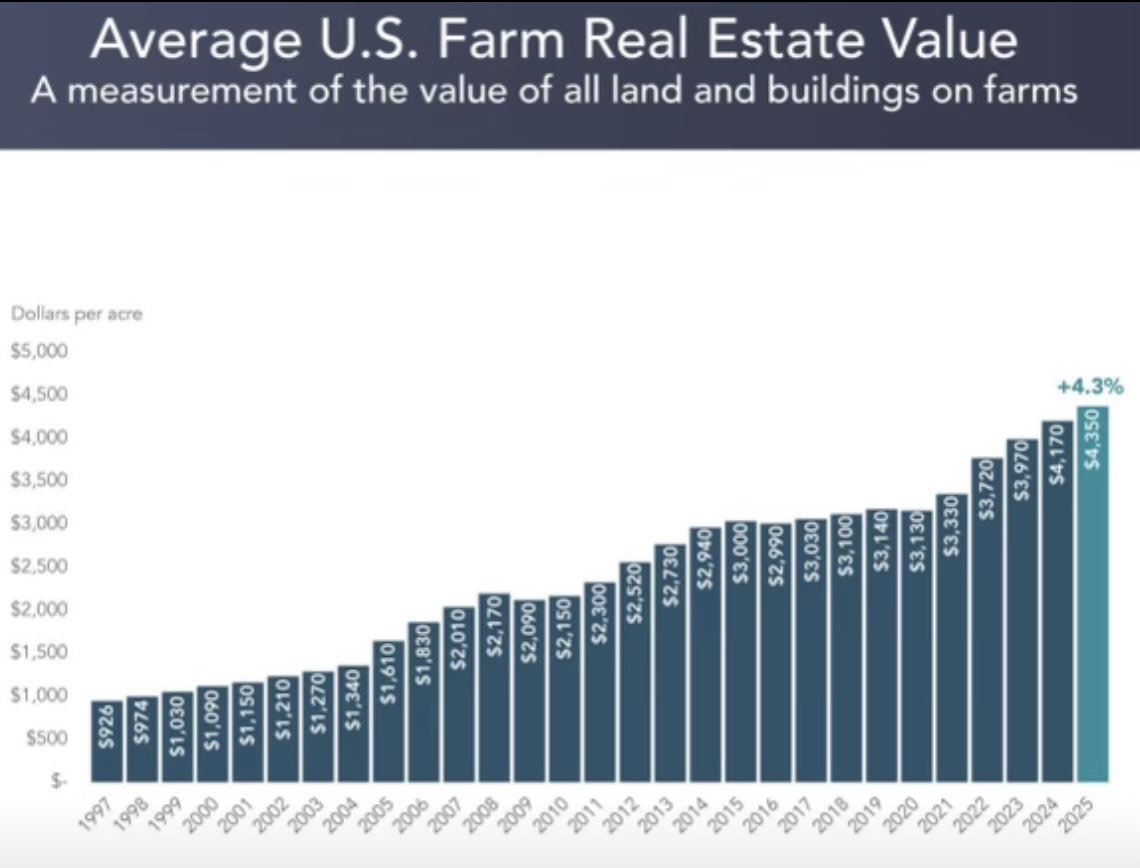

They’re not making more farmland 🌽 But the world keeps making more people… Rising demand + limited supply = timeless returns. Steady growth. Reliable income. An investment in farmland is as solid as the ground itself 💪🏻

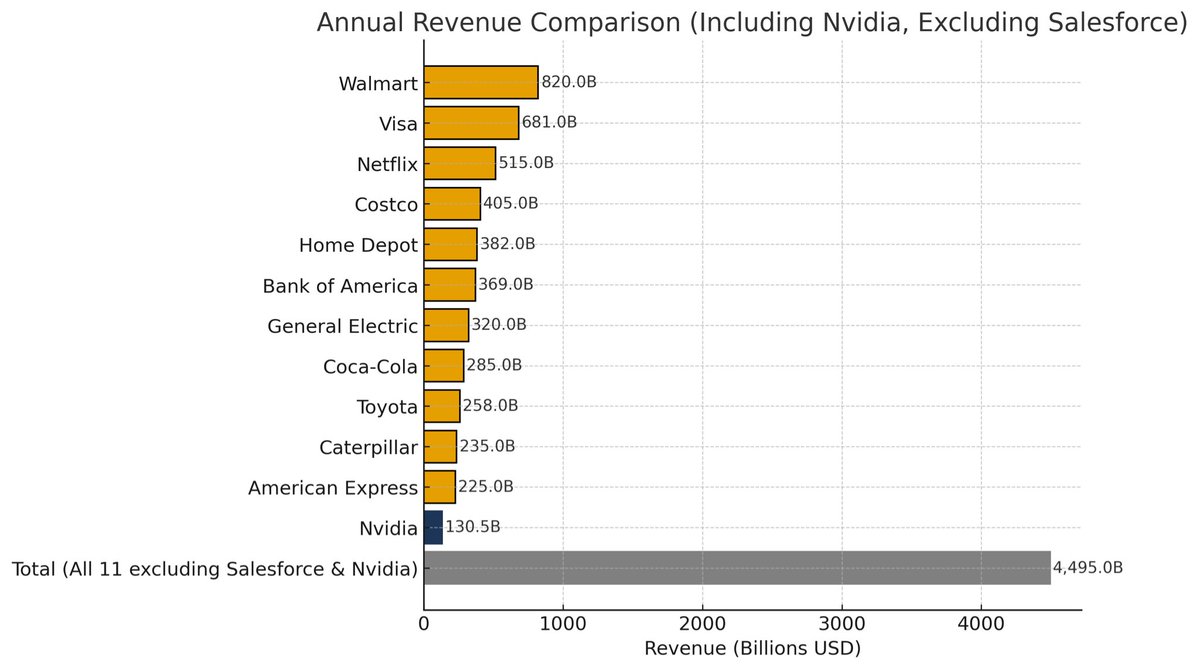

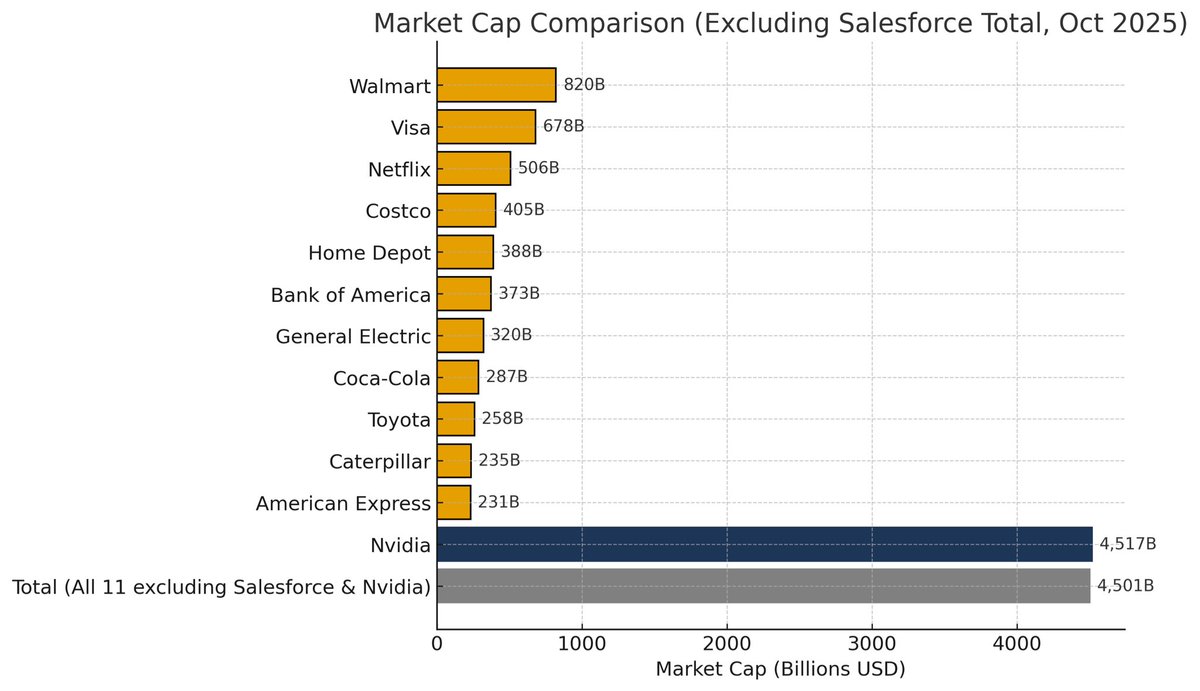

Nvidia earns a FRACTION of what corporate giants bring in. Yet it has the largest market cap in the world! Proof that the AI era is pricing the future, not the present.

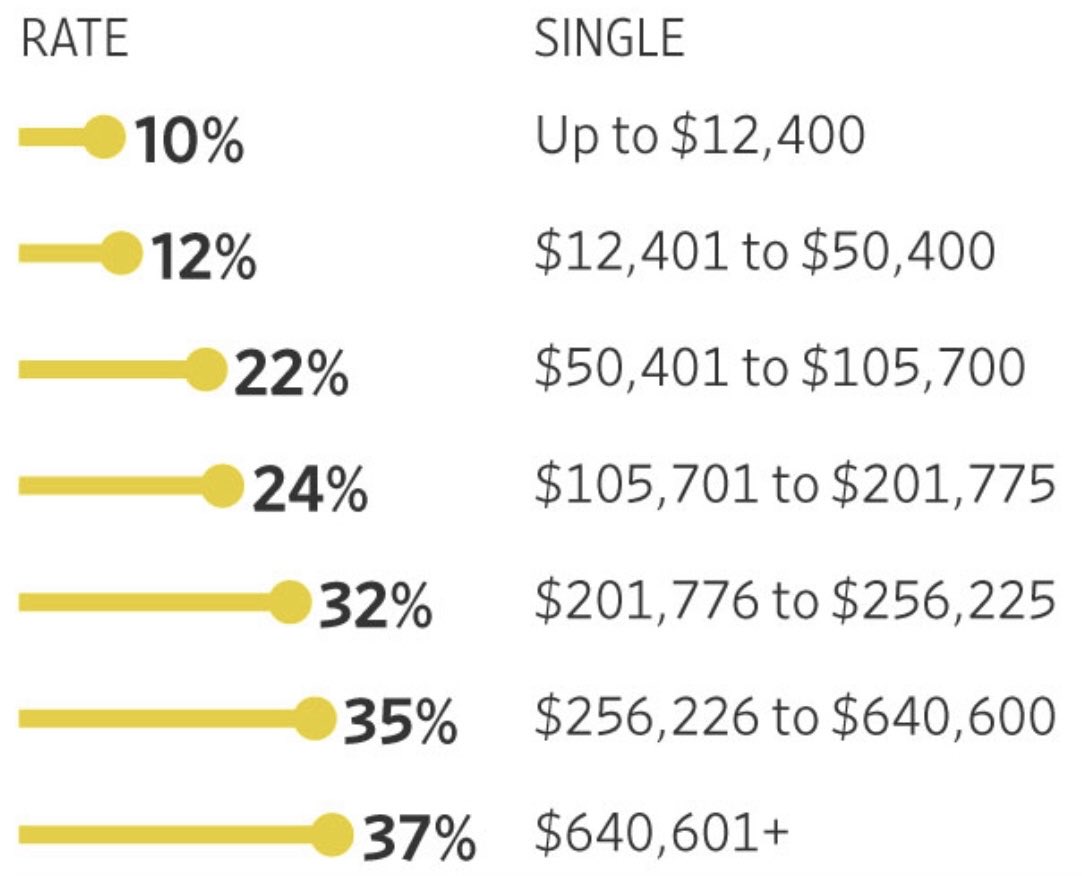

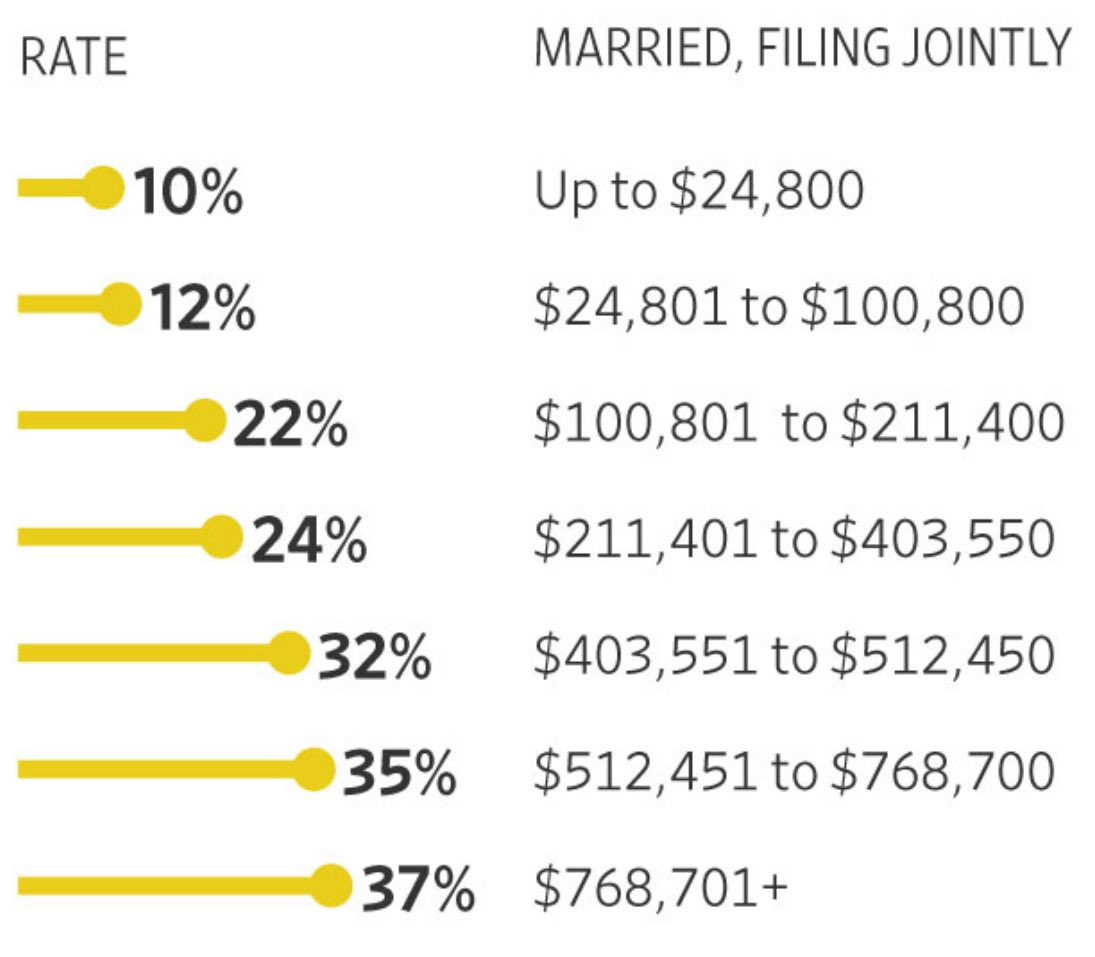

Think inflation only hits groceries? It’s moving your tax bracket too. Check out the new Inflation-Adjusted Tax Brackets for 2026!

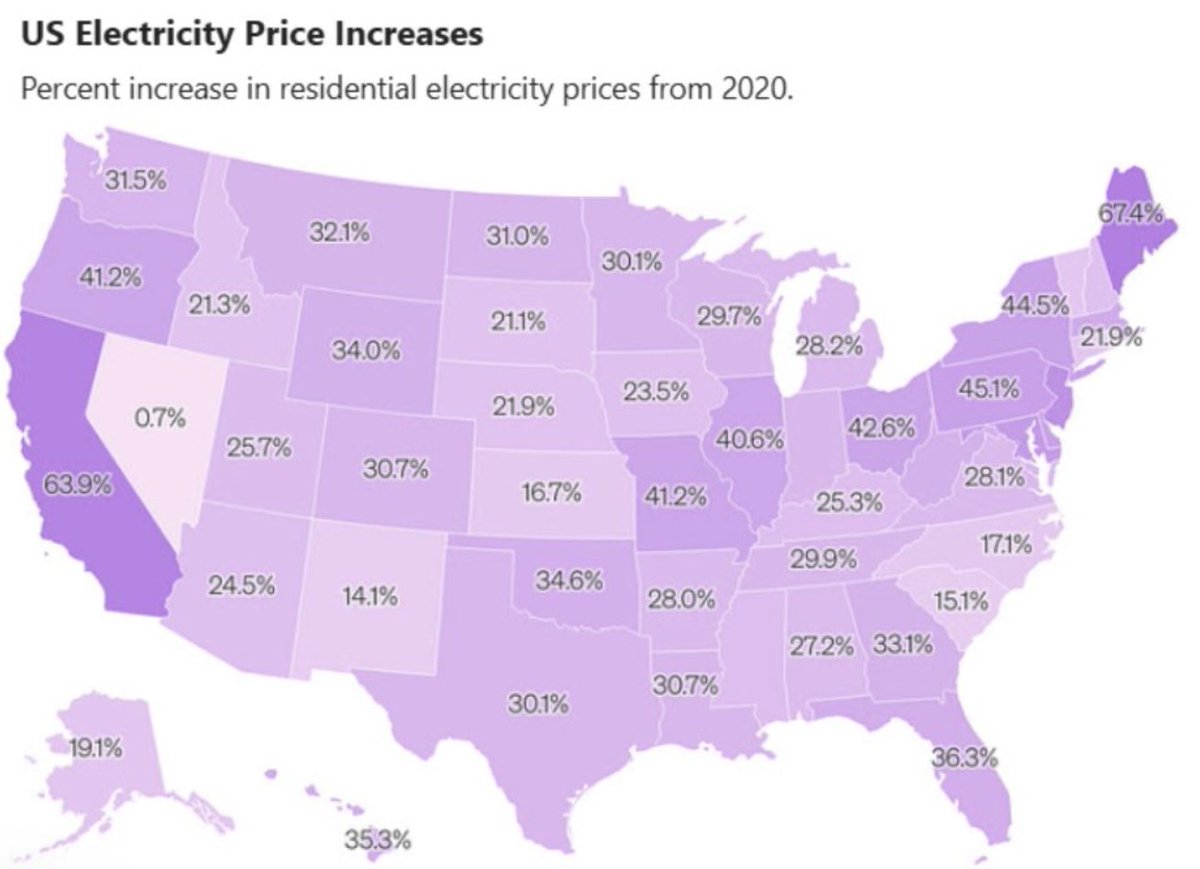

Electricity prices are Shocking ⚡️ Bad news for bills, good news for investors. The Power Shift is here … are you on the right side of it?

Projected 2026 Investment Account Limits!

United States Trends

- 1. Chargers 33,6 B posts

- 2. Texans 24 B posts

- 3. Herbert 14,9 B posts

- 4. CJ Stroud 4.312 posts

- 5. Greg Roman 1.120 posts

- 6. #PopTartsBowl 2.655 posts

- 7. Rich Eisen N/A

- 8. Georgia Tech 5.060 posts

- 9. #netflixreleasethevolume2files 16,6 B posts

- 10. Gadsden 1.810 posts

- 11. Clemson 12,2 B posts

- 12. #HOUvsLAC N/A

- 13. Nico Collins 1.607 posts

- 14. #BoltUp 1.434 posts

- 15. Dicker 2.369 posts

- 16. Bobby Hart N/A

- 17. Haynes King N/A

- 18. #HTownMade 1.603 posts

- 19. Dabo 3.187 posts

- 20. Lassiter N/A

You might like

-

Capelli Sport

Capelli Sport

@capellisport -

fxevolution

fxevolution

@fxevolution -

IBC Global

IBC Global

@ibcglobalinc -

Loomba Investment Group

Loomba Investment Group

@loombainvest -

Beth Malow

Beth Malow

@BethAnnMalow -

Saad Shakir

Saad Shakir

@SaadShakir111 -

David Porter

David Porter

@Retropd_dporter -

Boltfire 🔞

Boltfire 🔞

@Boltfiremedia -

Vegas Connect

Vegas Connect

@702connect -

Camden Freeman

Camden Freeman

@camkman -

Nereida Aguilera

Nereida Aguilera

@nereida_nadamas

Something went wrong.

Something went wrong.