LiquidityLlama

@Llama_Liquidity

Liquidity Llama 💧🦙 | Treasury Markets | Ex-JPM | Tech Junkie

OpenAI needs to raise at least $207 billion by 2030 so it can continue to lose money, HSBC has estimated

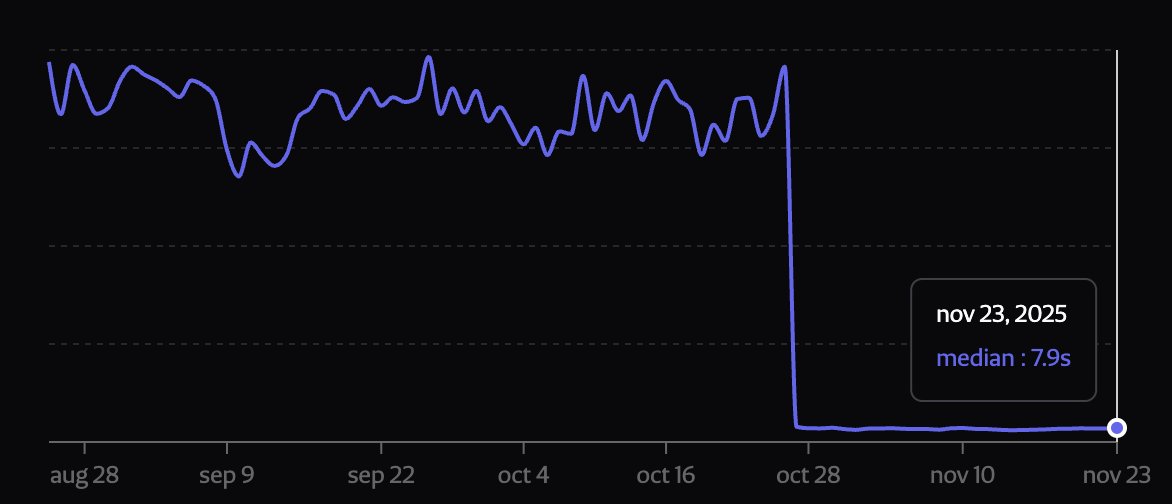

Latency to prove Ethereum blocks have dropped to 7.5 sec (from 3m30) in the past 30 days, while cost have dropped by 66%. 🤯 zkEthereum 🤯

*FED'S DALY SUPPORTS DECEMBER RATE CUT, CITING LABOR MARKET: WSJ

Jane is now the 3rd largest holder of ETHA (21.8mm shares), after buying 14.9mm in Q3. It sold 10.8mm IBIT in Q3 to fund it

20 mins until Jane unleashes the SBF slam algo to make ETF purchases cheaper. Rinse repeat

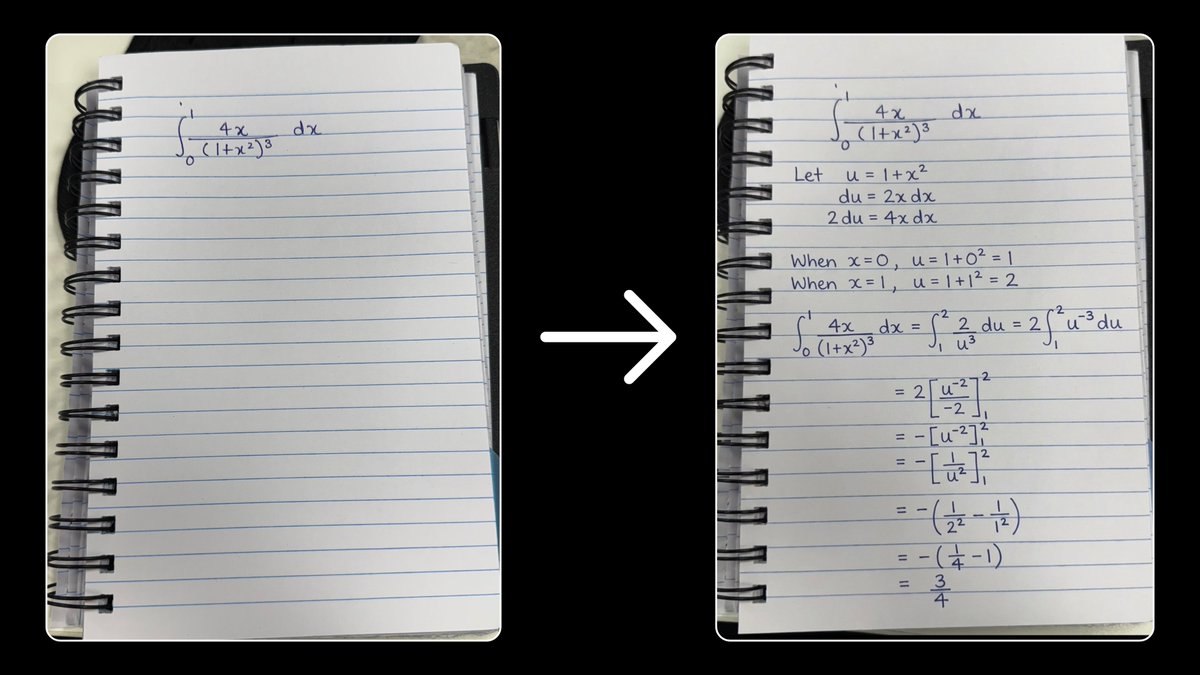

Google’s Nano Banana Pro is by far the best image generation AI out there. I gave it a picture of a question and it solved it correctly in my actual handwriting. Students are going to love this. 😂

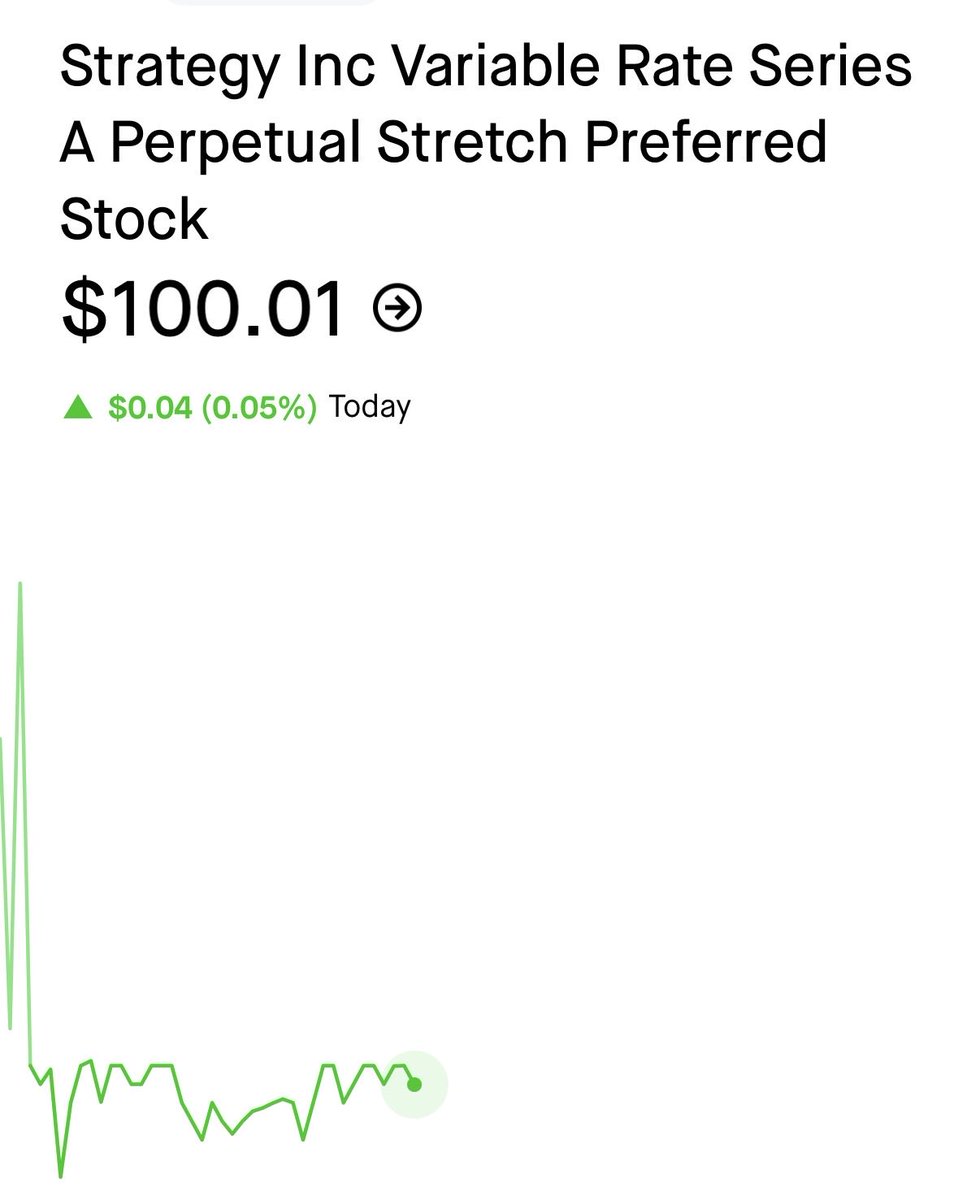

What the market is going to learn through this fun little exercise is that the leverage in the treasury space is quite low. If you’re waiting for the “forced selling” to begin from these companies, don’t hold your breath.

For the record. The logic is straightforward: Wall Street is selling risk assets because the Federal Reserve, already well behind the curve, refuses to act. A December rate cut that should have been preemptive, a risk control measure, will now come too late, and even then, its…

Think and act like an owner ✅

ethereum fusaka upgrade dec 3 will burn more eth through L2 transactions EIP 7918 adds a reserve price floor for blob fees which link them to execution base fees so blobs aren't free when execution costs are high tldr; L2s give more to ETH holders by burning ETH in exchange,…

The Crown Prince of Saudi Arabia just referenced the polymarket about him wearing a suit & tie. Simulation confirmed?

👀

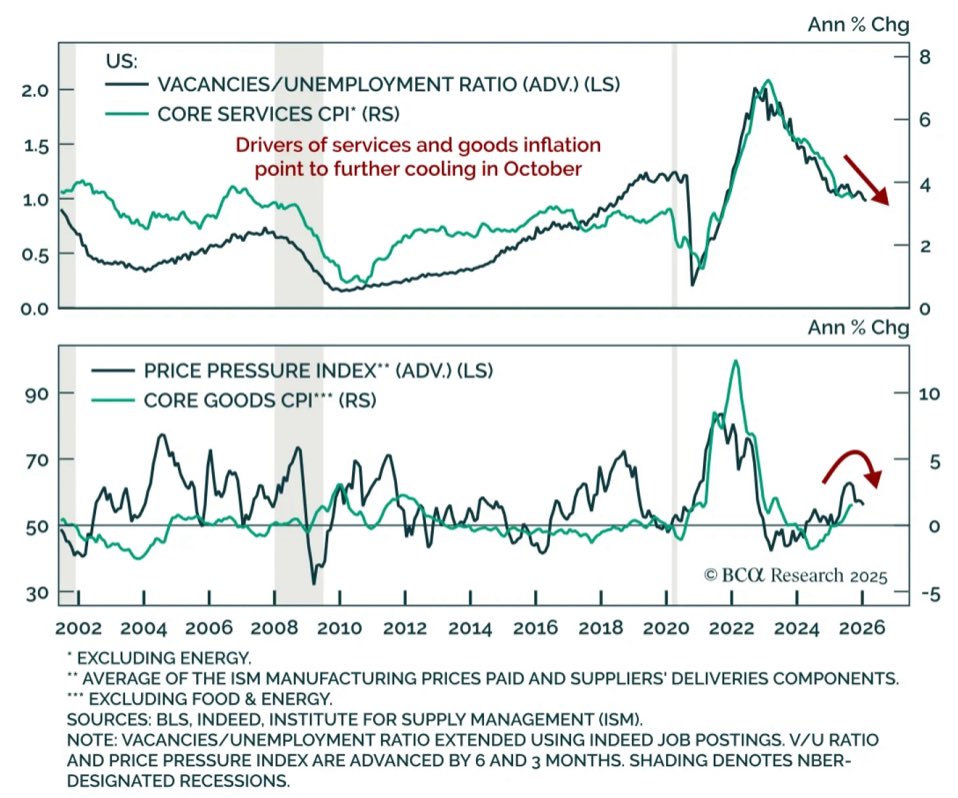

The White House says Oct jobs & CPI reports will likely not be published. Alternative data show weaker labor & inflation momentum: job growth stalling, layoffs ticking up inflation peaking. Fed easing should continue, whether in Dec or Jan

We're getting close to the Peter Lynch quotes stage.

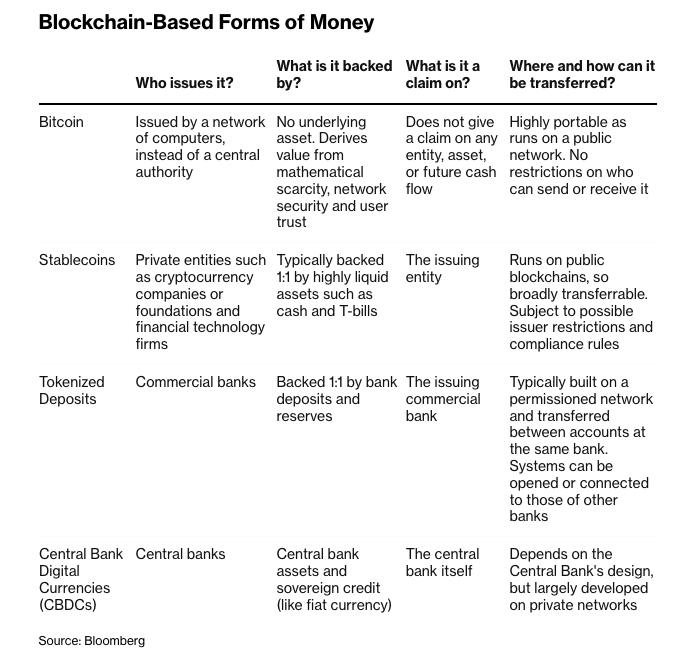

JPMorgan has begun rolling out its new deposit token, JPM Coin, to institutional clients. The token represents dollar deposits at the bank and runs on Coinbase’s Base blockchain, allowing instant 24/7 payments. $JPM's blockchain network already moves over $3B a day

The average person has no idea what this means

Thank you Mr Trump for $2000 and an extra 20 years to pay off my mortgage I will not let you down I will use this to trade derivatives

LOL imagine still reading Forbes

Me: "ChatGPT, are these berries poisonous?" ChatGPT: "No, these are 100% edible. Excellent for gut health." Me: "Awesome" # eats berries .... 60 minutes later Me: "ChatGPT, I'm in the emergency ward, those berries were poisonous." ChatGPT: "You're right. They are incredibly…

Stocks don't buy it: market thinks deal imminent

*REPUBLICANS REJECT DEMOCRATS' OFFER TO END SHUTDOWN: GOP AIDE

Bitcoin is a liquidity sniffing hound. It will sniff out the US Government re-opening and the corresponding liquidity surge before any other asset. It has a long track record of doing this kind of thing. This dog can hunt!

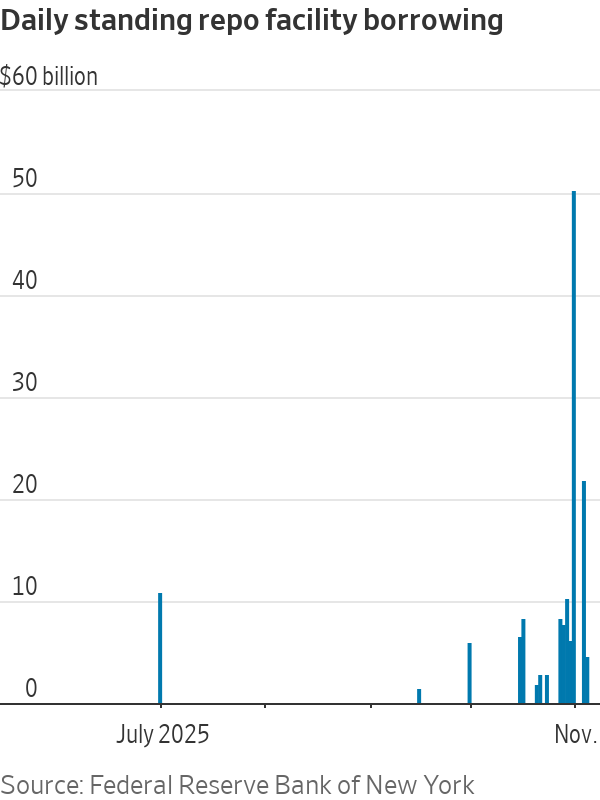

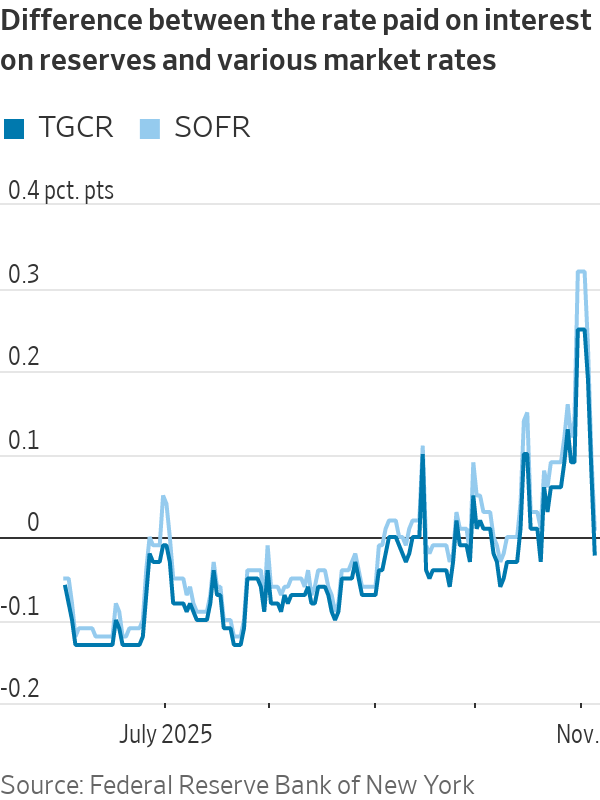

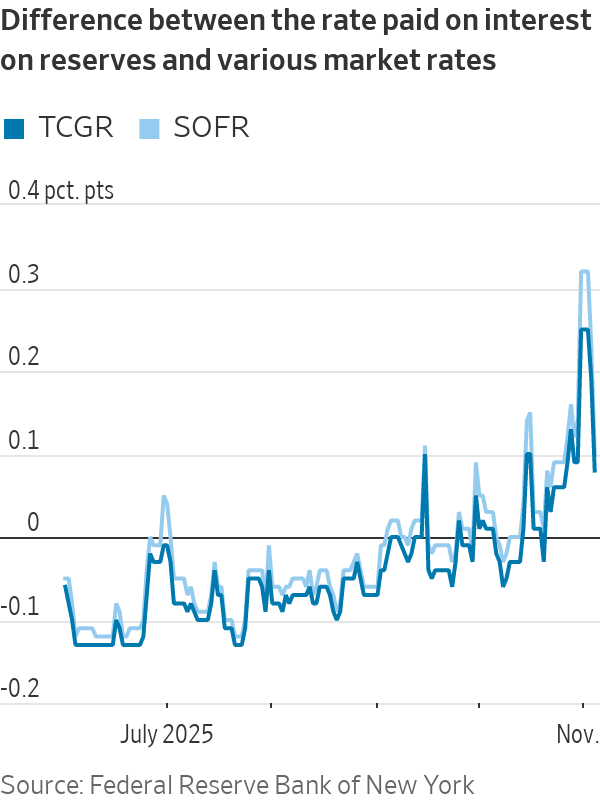

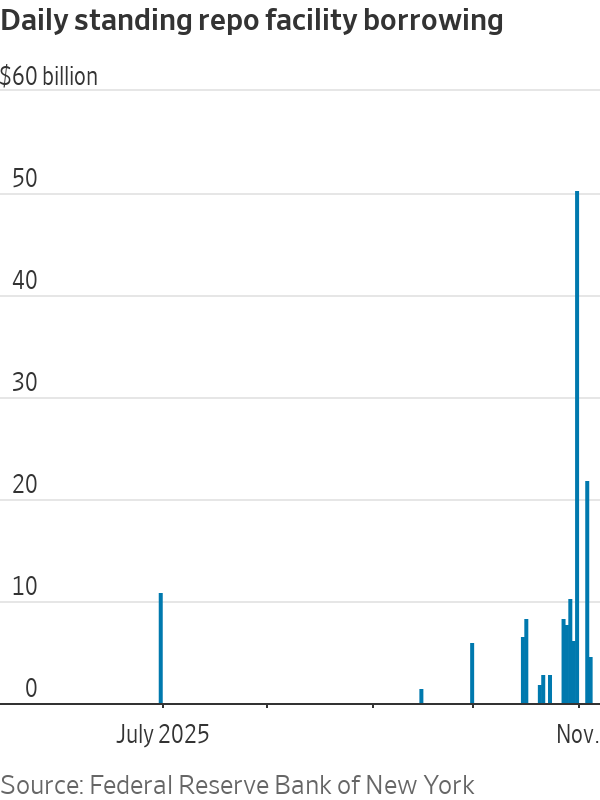

Overnight borrowing rates have settled out at a more normal level following the month-end pressures last week. Standing repo facility usage was nil for the second straight day, and repo rates are now back in the same range the Fed has set for its benchmark fed-funds rate.

Overnight borrowing rates firmed notably around month end (which was also year end for Canadian banks), moving well above the Fed's rate for IOR. Standing repo facility usage also increased meaningfully around month end to a new high of $50 billion, but fell to zero on Tuesday,…

United States Trends

- 1. #StrangerThings5 268K posts

- 2. Thanksgiving 693K posts

- 3. BYERS 62.3K posts

- 4. robin 97.3K posts

- 5. Afghan 300K posts

- 6. Reed Sheppard 6,334 posts

- 7. Dustin 89.7K posts

- 8. Holly 66.8K posts

- 9. Podz 4,837 posts

- 10. Vecna 62.7K posts

- 11. Jonathan 76.3K posts

- 12. hopper 16.6K posts

- 13. Lucas 84.8K posts

- 14. Erica 18.5K posts

- 15. National Guard 675K posts

- 16. noah schnapp 9,172 posts

- 17. derek 20.2K posts

- 18. Joyce 33.7K posts

- 19. Nancy 69.6K posts

- 20. mike wheeler 9,855 posts

Something went wrong.

Something went wrong.