Loki Futures Trading

@LokiFutures

An Australian Shepherd's take on markets. Follow entirely at your own risk. After all... who in their right mind would trade based on a dog?

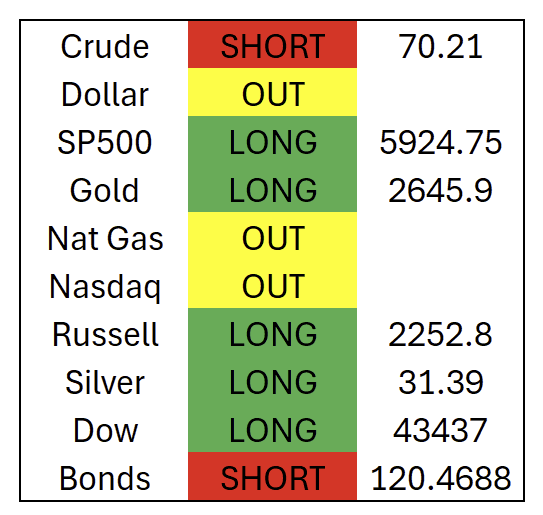

On vacation but ran the signals. Lots of changes. The signals P/L since 10/10 inception is a bit over 24k. What's interesting in not the amount but the fact that the vast majority of that p/l is from gold & silver.

We're taking a break until after the election. Top long: silver. Top short: bonds. Top like: oil. Not big on stocks but the fed will support them until they can't. Therein lies the rub.

Love silver (per monthly cup and handle), but it is (Loki's interpretation) in a 5th elliot wave and at a .618 fib extension (wave 2 low/wave 3 high/wave 4 low). Could go higher but also ripe for a pullback. Don't know the golden ratio? Grasshopper...

Energy is in a chop zone and we continue to like it. So it took us a nanosecond to agree to ignore the short crude signal. Besides the captain of the ship's decision is final so I have no choice but to go along with Loki.

From 8:30am.. Out Crude (-410) and long Nat Gas. Been going long Nat Gas in varying degrees since the 1.52 low. Hard to be short energy (other than a flip) given the geopolitical catalyst and Fed acceptance for higher inflation. Bond yields tell you all you need to know.

We're commiserating that these metal markets feel like that first date. Can't be sure how it will go but big expectations. Building miner positions (SIL, GDX). Monthly silver futures just leaving huge cup and handle from 2011. Train is just leaving the station...

Out SP500 and Dow (-2035). Short Bonds. Looking to short stocks ever since our Fed induced pop in early Oct. Big story is metals. Perfect storm for silver & gold. Nothing but upside and ballistic upside with another big Fed print. More beer we drink, the more we're convinced.

How does Loki trade the signals? Futures, options (outright & spreads), and ETFs.

Methodology.... All one lots. Unless otherwise noted prices and signals will generally be around 8am EST. Will accompany any signal (long, short, out) with an associated real time price. Prices are nearby futures.

Updated EOD Fri. Closed Russell (+1920) and Bonds (+218). Since 10/10 +3253. All one lots. Take P/L's with grain of salt. Just lends color to how system is performing. Remember this is not trading advice. Loki drinks too much beer.

Whippy out there. Taking it slow on short term plays here. Loki is meditating on noise vs trend.

Four out of ten positions equals chop. Election season is here. Loki is taking the opportunity to work on his third eye chakra. Something about enhanced market perception…

Tough to short crude especially given the geopolitical environment . Probably good case for long option premium or bear call spreads. Bank earnings on deck. Hedges reportedly unwinding shorts. Stocks feeling lofty with everyone long. No worries with Loki as he sucks down a beer.

Stock signals are long but I find myself waiting with baited breath to get short. 10yr yields have tacked on 50 bp's since mid Sep. Gov spending on steroids guarantees inflation. Shifting rate expectations will be a hard rain for the stocks. So says Loki as he drinks beer.....

Inflation isn't coming in according to script. The Fed made a mistake going all in on employment and taking inflation for granted. That's why 10yr yields went up and not down after the rate cut. Watch crude. A further Israel/Iran escalation could ignite it.

Entertainment only please. Changed signal polls to morning from afternoon. There's a few changes this morning from that.

Entertainment only folks. Remember Loki is known to drink beer when generating signals....

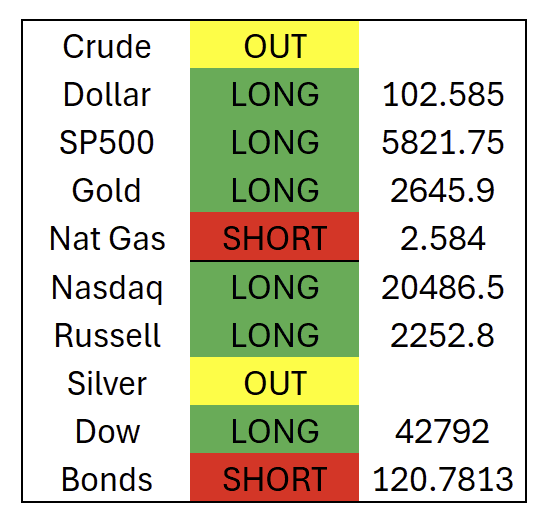

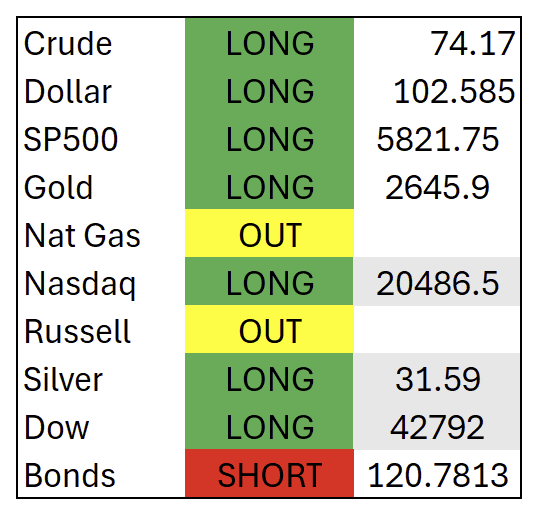

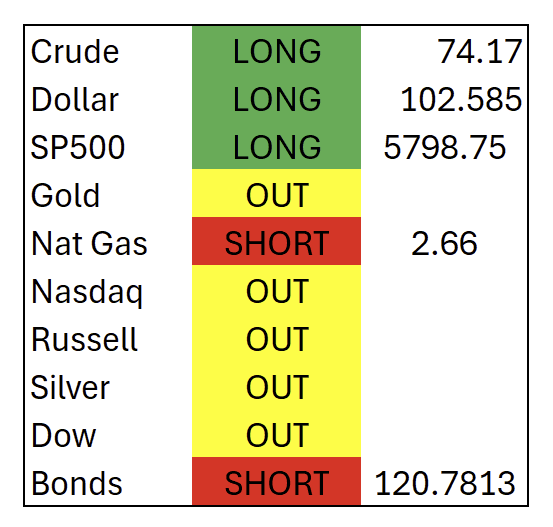

Here's Loki's current futures positions. Nearby futures prices are used. Remember.... not for trading. Only entertainment.

United States Trends

- 1. Auburn 44.4K posts

- 2. Brewers 62.4K posts

- 3. Georgia 66.7K posts

- 4. Cubs 54.7K posts

- 5. Kirby 23.3K posts

- 6. Arizona 41K posts

- 7. Michigan 62K posts

- 8. Hugh Freeze 3,184 posts

- 9. Gilligan's Island 4,431 posts

- 10. Utah 23.6K posts

- 11. #BYUFootball N/A

- 12. Amy Poehler 3,998 posts

- 13. Boots 49.7K posts

- 14. #AcexRedbull 2,869 posts

- 15. Kyle Tucker 3,133 posts

- 16. #GoDawgs 5,508 posts

- 17. #ThisIsMyCrew 3,210 posts

- 18. #Toonami 2,221 posts

- 19. Dissidia 5,188 posts

- 20. Tina Fey 3,066 posts

Something went wrong.

Something went wrong.