The Long View Portfolio

@LongViewPort

Investor Journal | Equities allocations, Roth IRA breakdowns, BTC hedge & long-term compounding | Follow Along | http://tlvp.org | nfa

You might like

Join a growing list for my monthly portfolio email — simple insights on equities sleeve, BTC position, compounding plays, and long-term strategy. No spam or ads ever. Subscribe if that sounds useful: tlvp.org Personal views only, not advice.

tlvp.org

The Long View Portfolio

Monthly portfolio updates | Aggressive equities + Bitcoin hedge | Real allocations & investment process

If something only works when conditions are perfect, it isn’t a strategy. Real portfolios are built for uncertainty.

A reminder this morning: Most bad trades are NOT bad ideas; they are emotional timing. Silver ripped above $115. Everyone felt late. A lot of people chased it. Price corrected. That is why I try to avoid making decisions in the middle of excitement, and certainly not in…

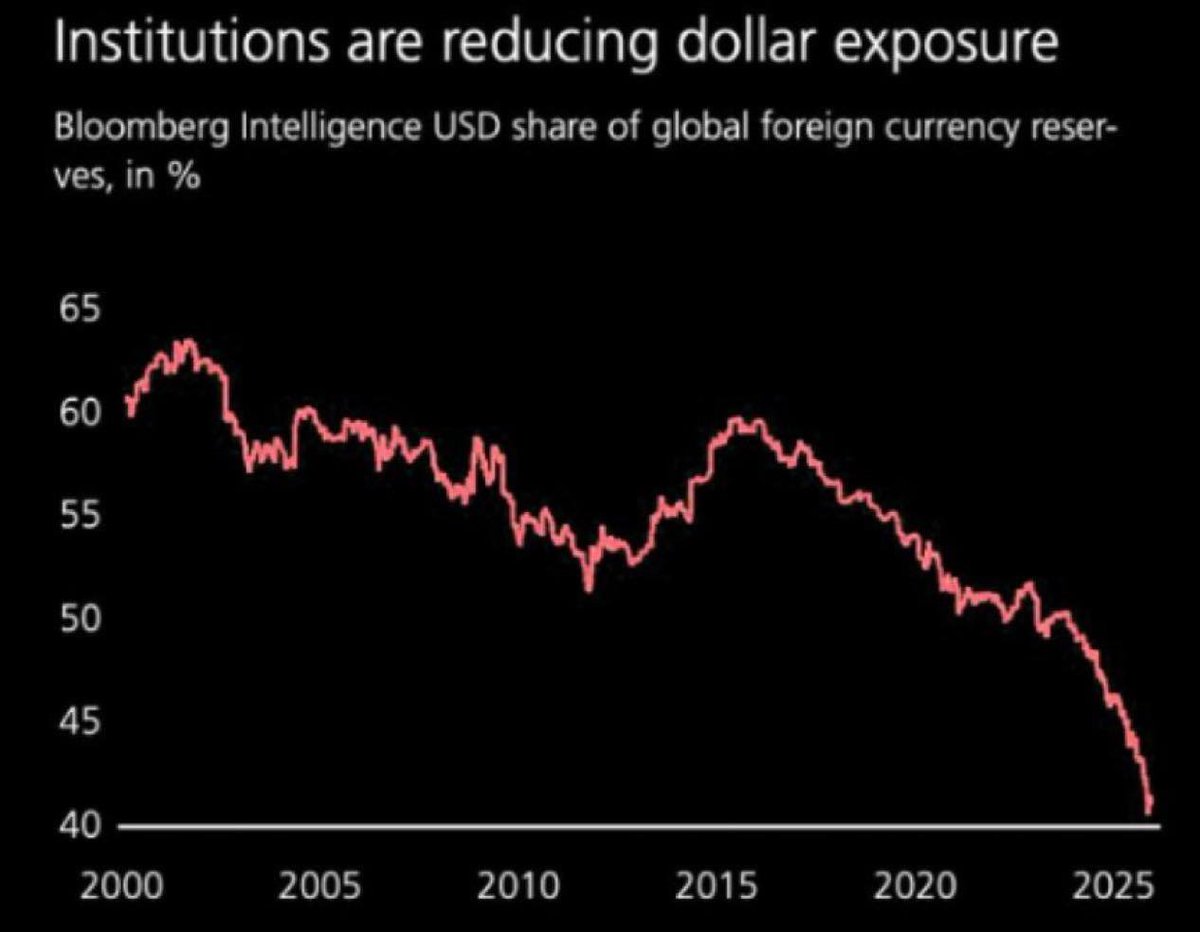

This is the clearest articulation I’ve seen of where the U.S. is right now. We are moving from stage 5 to 6. Knowing which part of the cycle you’re in matters. Global diversification across asset classes is the best hedge.

Investing is about buying GREAT COMPANIES, not narratives. When a company is no longer great, it’s time to rebalance.

I got out of my huge $APPL position at $270. Watching it ride to $285 was rough but now we’re back at $250. Why did I sell? Ask yourself, when was the last time Apple made a new, great product?

Wake up

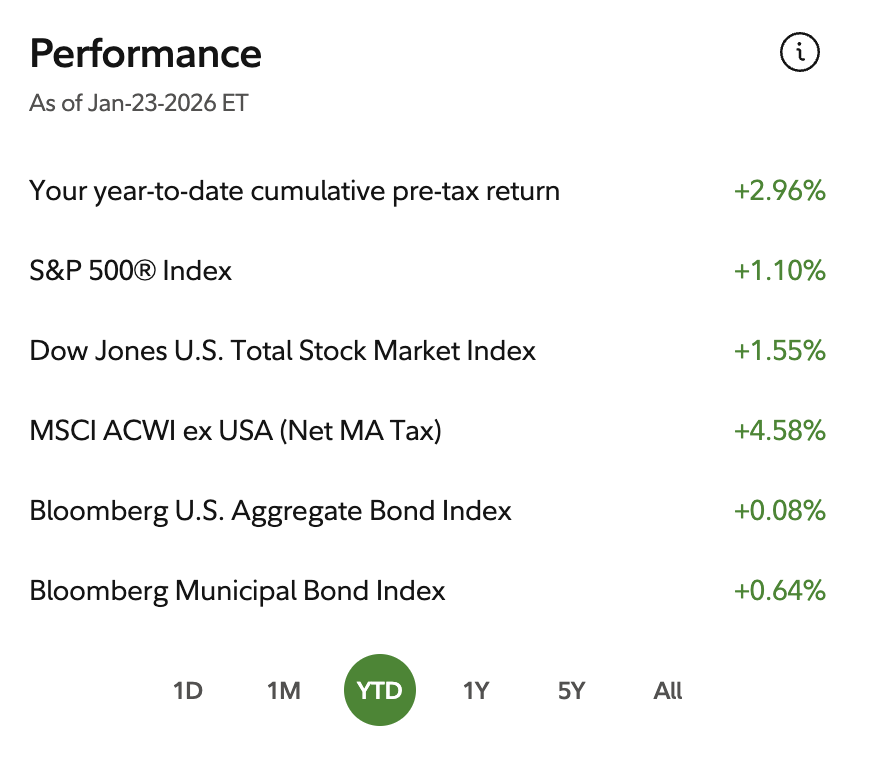

Quick YTD snapshot: 📊 My portfolio +2.96% vs. S&P 500 +1.10% vs. Total U.S. Market +1.55% vs. MSCI ACWI ex USA +4.58% vs. U.S. Agg Bonds +0.08% The aggressive equities sleeve is holding up well in early chop. Semis are contributing meaningfully. If you're interested in…

Once again asset owners win and savers lose.

🇺🇸 THE FED IS PREPARING TO SELL U.S. DOLLARS AND BUY JAPANESE YEN FOR THE FIRST TIME THIS CENTURY. The New York Fed has already done rate checks, which is the exact step taken before real currency intervention. That means the U.S. is preparing to sell dollars and buy yen. This…

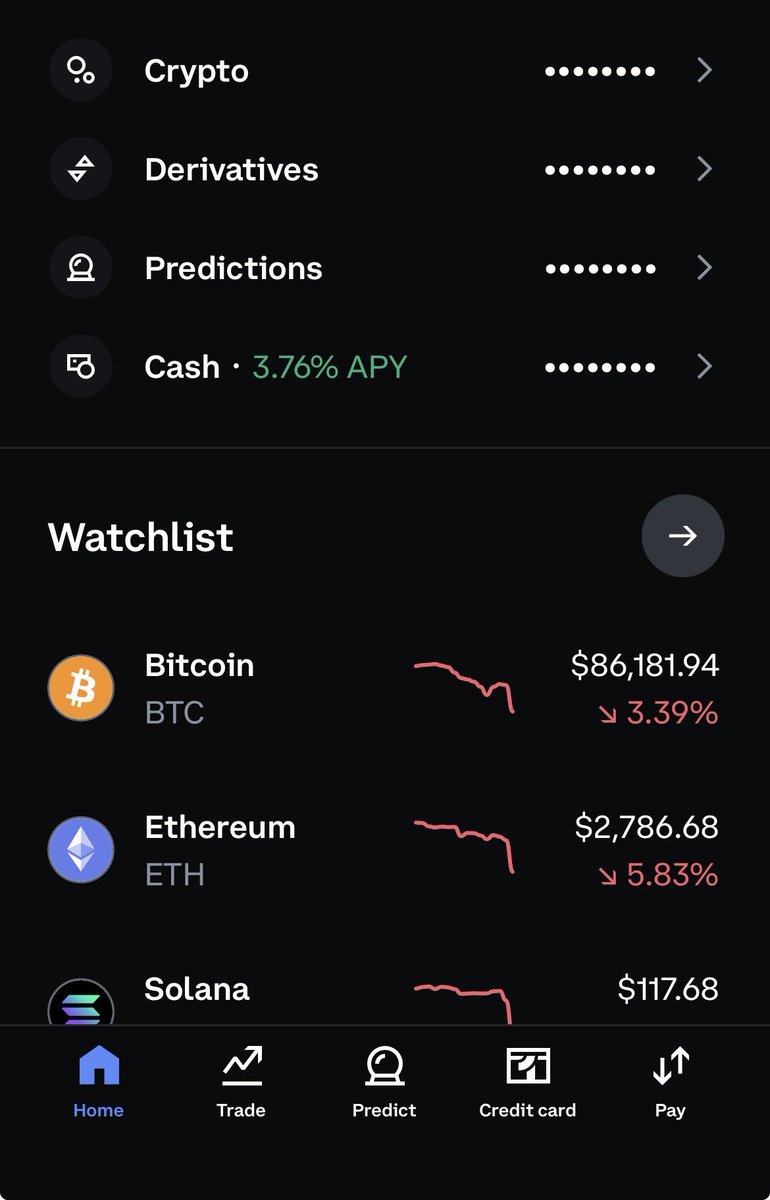

Coinbase rolled out prediction markets. Does anyone else not like the idea of combining true investment accounts with gambling products?

This is insane… US Dollar share of global reserve currency has fallen to its lowest levels this century. It’s literally unprecedented.

Check out my exact allocations and portfolio weights: tlvp.org

tlvp.org

The Long View Portfolio

Monthly portfolio updates | Aggressive equities + Bitcoin hedge | Real allocations & investment process

2.67 years of AI progress

One a scale of 1 - barbecue chicken how cooked are new college grads?

35% of entry-level positions on LinkedIn required at least 3 years of experience, per Forbes.

Silver hits a new high today, inching past $100/oz, but the rally CANNOT last forever📉 • High prices will draw more supply: Miners ramp up production (New projects in Central and South America could add 10-15% output over the next three years) • Recycling will surge: Highly…

I sold Apple at $270. It ran to ~$286. Now it’s back under $250. I didn’t sell because of price. I sold because I asked myself a simple question: When was the last time Apple shipped a new product that felt meaningfully better? Couldn’t answer it. So I sold. Buy and hold ≠…

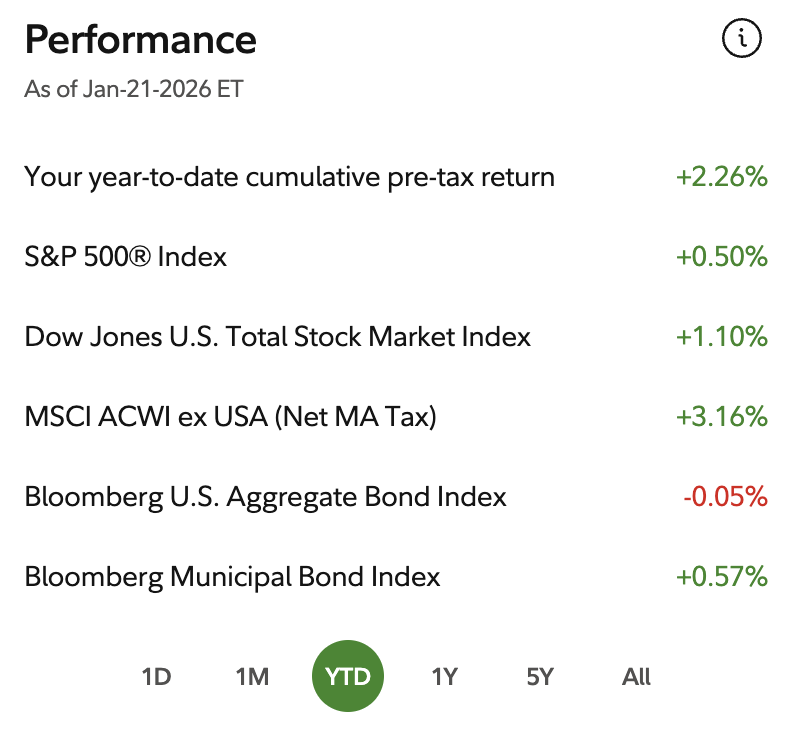

Portfolio Update - TLVP continues to outperform📈 📊Year to Date: • TLVP +2.26% • S&P 500 +0.5% • DJ Total Market +1.1% Biotech and innovation positions are killing it. Follow @LongViewPort for more breakdowns and updates.

Your portfolio is your corporation. Run it on 10-year plans, not 7-day emotions.

United States Trends

- 1. Joe Brady N/A

- 2. Aaron Glenn N/A

- 3. Holocaust N/A

- 4. Shams N/A

- 5. #Budweiser150 N/A

- 6. Philip Glass N/A

- 7. Engstrand N/A

- 8. Woody N/A

- 9. Newt N/A

- 10. Taxation N/A

- 11. Lee Hunter N/A

- 12. Senior Bowl N/A

- 13. Daboll N/A

- 14. Iowa N/A

- 15. Kennedy Center N/A

- 16. Babich N/A

- 17. Doomsday Clock N/A

- 18. #Jets N/A

- 19. #JimRomeOnX N/A

- 20. H-1B N/A

Something went wrong.

Something went wrong.