Philip Trinder

@MLP_Protocol

Sitting in the cheap seats for the end of the world...

You might like

This video is definitely worth watching, it’s long but extremely informative and I somehow just managed to watch the whole thing. Now to figure out portfolio adjustments... #OOTT #oilandgas #energy youtube.com/watch?v=qWyhKo…

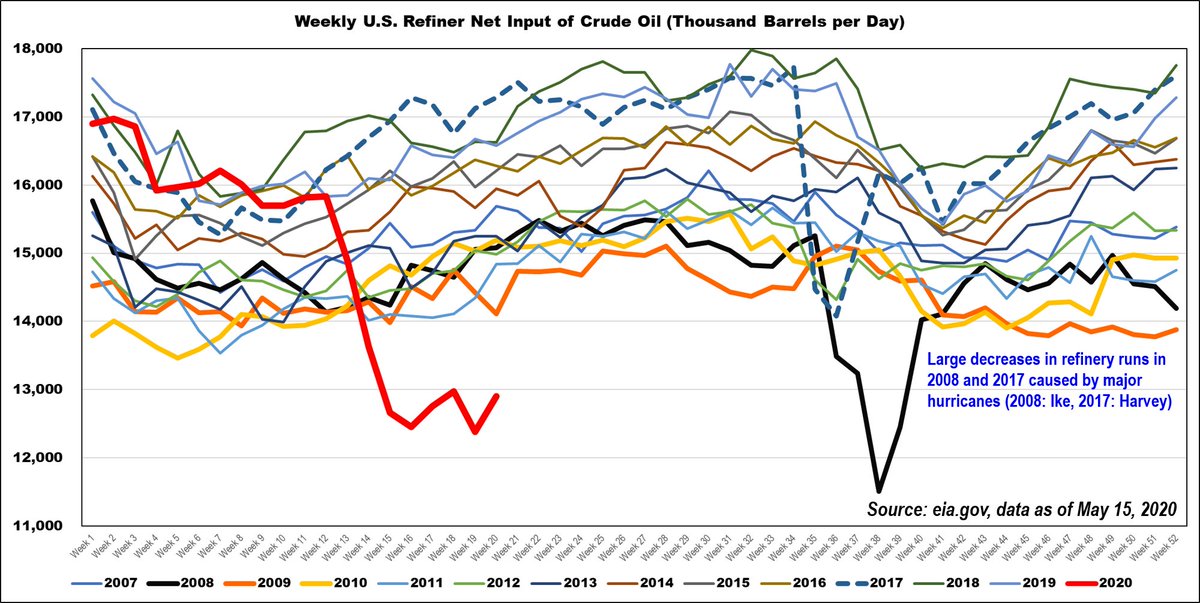

U.S. refiners increased their crude inputs 2.7% week over week (red line below is 2020, data for week ended July 24). Now running at 79.5% of capacity and 14.1% below 2019 crude input levels. Net crude oil stocks now at 59.5% of working storage capacity. #OOTT

U.S. refiners increased their crude inputs 4.2% week over week (red line below is 2020, data for week ended May 15). Now running at 69.4% of capacity. Net crude oil stocks now at 61.1% of working storage capacity. #OOTT

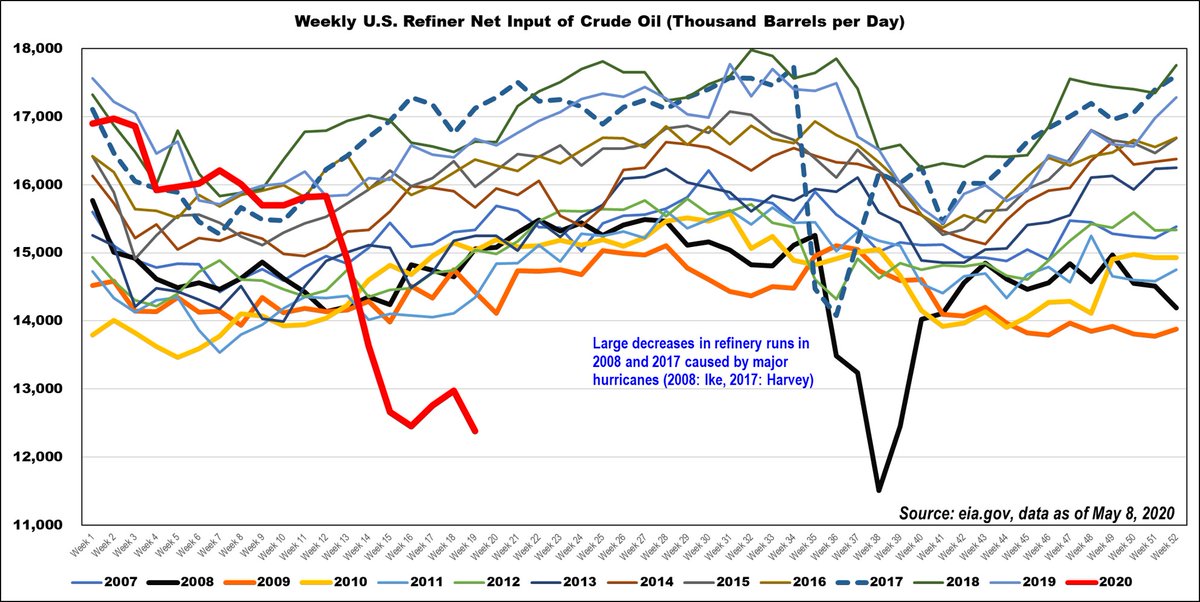

U.S. refiners have reduced their crude inputs week over week (red line below is 2020, data for week ended May 8). Now running at 67.9% of capacity. Net crude oil stocks now at 61.6% of working storage capacity. #OOTT

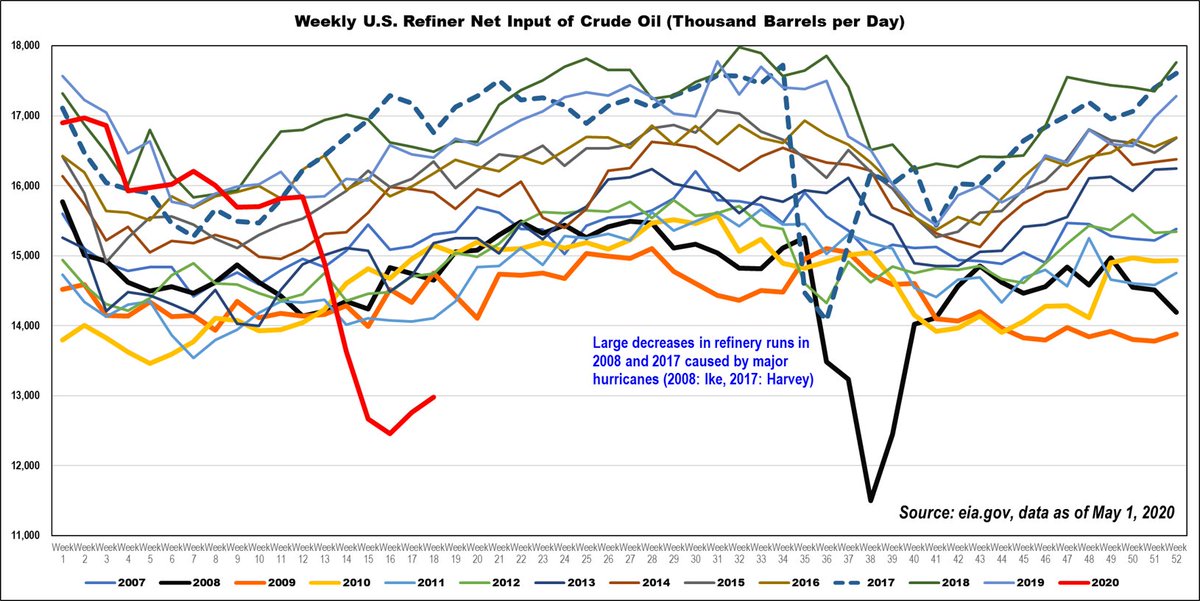

U.S. refiners have slightly raised their crude inputs, red line below is 2020, data as for the week ended May 1. Now running at 70.5% of capacity. Net crude oil stocks now at 62% of working storage capacity.

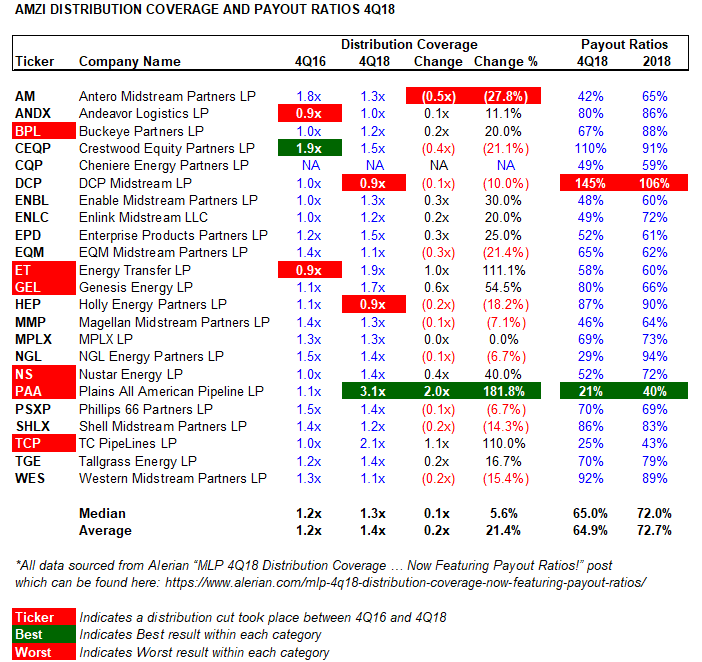

Here's a quick chart of the data from the Alerian article I retweeted earlier (alerian.com/mlp-4q18-distr…) Anyone else interested to see what $PAA will do with their next distribution announcement? Full Disclosure: Yes I'm long $PAA and talking up my book.

For anyone interested in the InfraCap MLP ETF $AMZA I've posted some historical financial info and portfolio tracking data here: mlpprotocol.com/2019/01/02/amz… Disclosure: No $AMZA position

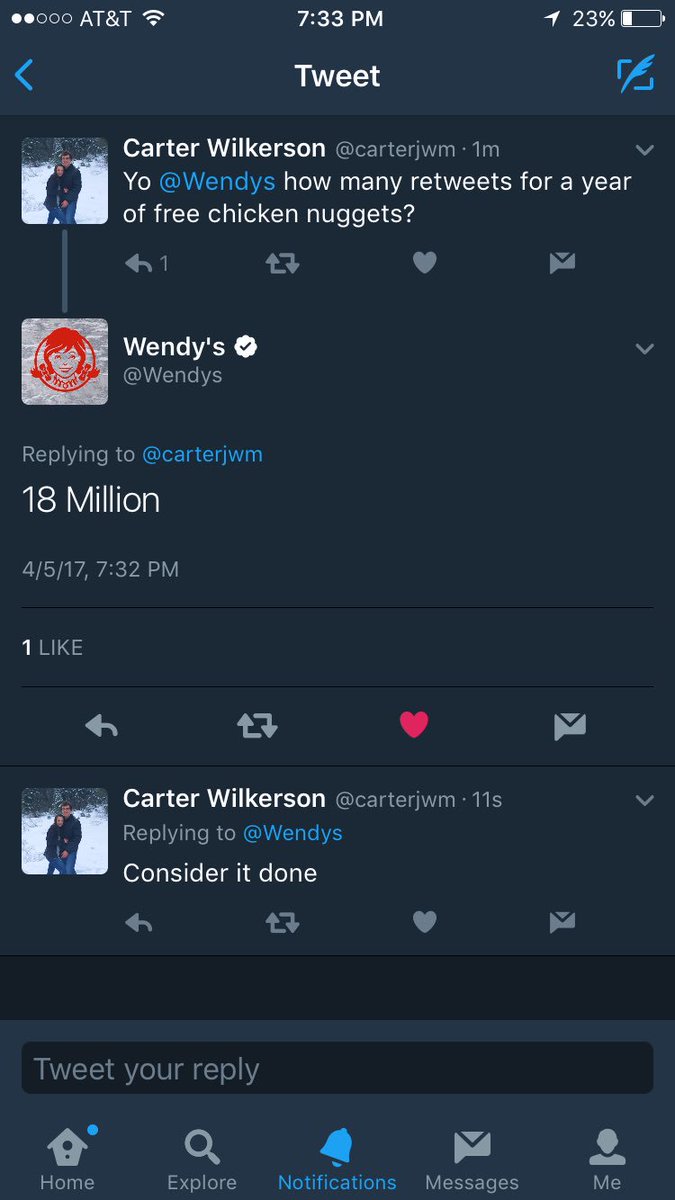

HELP ME PLEASE. A MAN NEEDS HIS NUGGS

Current song stuck in my head #Turkey youtube.com/watch?v=xo0X77…

youtube.com

YouTube

Istanbul (not Constantinople) - They Might Be Giants

Commented on BPT Distribution Rebound Offers 20% Yield And Short Squeeze Potential seekingalpha.com/article/398229… $BPT

Best Yield Now: #EmergingMarkets top #MLPs? blogs.barrons.com/emergingmarket… $AMLP $SSIZX $EMB $EMLC @barronsonline @MLPGuy @HewesComm @MLP_Protocol

America's #energy #pipelines may be indebted, but Berkshire likes @Kinder_Morgan Bary's fresh take. @MLP_Protocol

Why Berkshire’s Kinder stake probably isn't a #Buffett buy on.barrons.com/1Ogmfal $KMI $AMLP $BRKA $BRKB

barrons.com

Berkshire’s Kinder Stake: Likely Not a Buffett Buy

A Warren Buffett protégé probably made the decision to buy $450 million in Kinder Morgan stock.

Current #MLP market sentiment youtube.com/watch?v=M0RSQv…

youtube.com

YouTube

Coming to America- Clip- The bums

Commented on: "Some Thoughts About Plains All American Pipeline's Distribution" seekingalpha.com/a/27gjw $PAA $EPD $KMI $WPZ

Commented on: "MLPs - Yes, They're Okay In Your IRA And Other Tax Questions Answered" seekingalpha.com/a/1f9yv $LINE $LNCO $AMLP $AMJ

Noble Midstream Partners LP $NBLX #IPO pricing 11/19, Est Yield 6.25%, roadshow retailroadshow.com/sys/launch.asp… should be interesting

United States Trends

- 1. Thanksgiving 2.17M posts

- 2. Dan Campbell 3,900 posts

- 3. Lions 85.3K posts

- 4. Jack White 7,141 posts

- 5. Goff 8,367 posts

- 6. Jordan Love 9,159 posts

- 7. #GoPackGo 7,179 posts

- 8. Wicks 5,792 posts

- 9. Jamo 4,056 posts

- 10. #GBvsDET 3,952 posts

- 11. Gibbs 8,193 posts

- 12. Jameson Williams 2,204 posts

- 13. Watson 13.3K posts

- 14. #OnePride 6,446 posts

- 15. Thankful 435K posts

- 16. Green Bay 6,834 posts

- 17. Turkey 278K posts

- 18. Tom Kennedy 1,113 posts

- 19. Amon Ra 2,905 posts

- 20. Seven Nation Army N/A

You might like

-

Greenhaven Road

Greenhaven Road

@GreenhavenRoad -

MastersInvest.com

MastersInvest.com

@mastersinvest -

Fernando Valle, CFA

Fernando Valle, CFA

@HedgeyeENERGY -

Plan Maestro

Plan Maestro

@PlanMaestro -

GRANT'S

GRANT'S

@GrantsPub -

CB1 Capital

CB1 Capital

@CB1Cap -

Chris Sommers

Chris Sommers

@ChrisSommers79 -

STL Biotech

STL Biotech

@STL_Biotech -

DeFi, TradeFi, venture

DeFi, TradeFi, venture

@swaptions -

Tim Melvin

Tim Melvin

@timmelvin -

Hinds Howard

Hinds Howard

@MLPguy -

p

p

@pgoehaus33 -

LargeCapTrader

LargeCapTrader

@largecaptrader1 -

Union Square Research Group

Union Square Research Group

@UnionSquareGrp -

Zay Capital

Zay Capital

@cap_zay

Something went wrong.

Something went wrong.