你可能会喜欢

La banca y la inminente devaluación del tipo de cambio nominal riosmauricio.com/2025/11/la-ban…

La banca y la inminente devaluación del tipo de cambio nominal riosmauricio.com/2025/11/la-ban…

Tremendo dato!! A pesar de la incertidumbre electoral y el ataque político, la economía registró un crecimiento de 1,38% desestacionalizado septiembre contra junio!! A nada de máximos históricos en el nivel de actividad! 🇦🇷🇦🇷🇦🇷

En septiembre de 2025, el Estimador Mensual de la Actividad Económica (EMAE) mostró un crecimiento de 5% respecto al mismo mes del año pasado y un incremento de 0,5% en comparación con agosto de 2025. En tanto, para el acumulado de los primeros 9 meses del año, la actividad…

#DatoINDEC La actividad económica subió 5% interanual en septiembre de 2025 y 0,5% respecto de agosto indec.gob.ar/uploads/inform…

Ampliamente advertido en @MacroAlertness: Irremediable oportunidad perdida. riosmauricio.com/2025/11/irreme…

Ray Dalio on the Five Forces That Make This a Historical Moment | Odd Lots youtube.com/watch?v=5-uGWS…

youtube.com

YouTube

Ray Dalio on the Five Forces That Make This a Historical Moment | Odd...

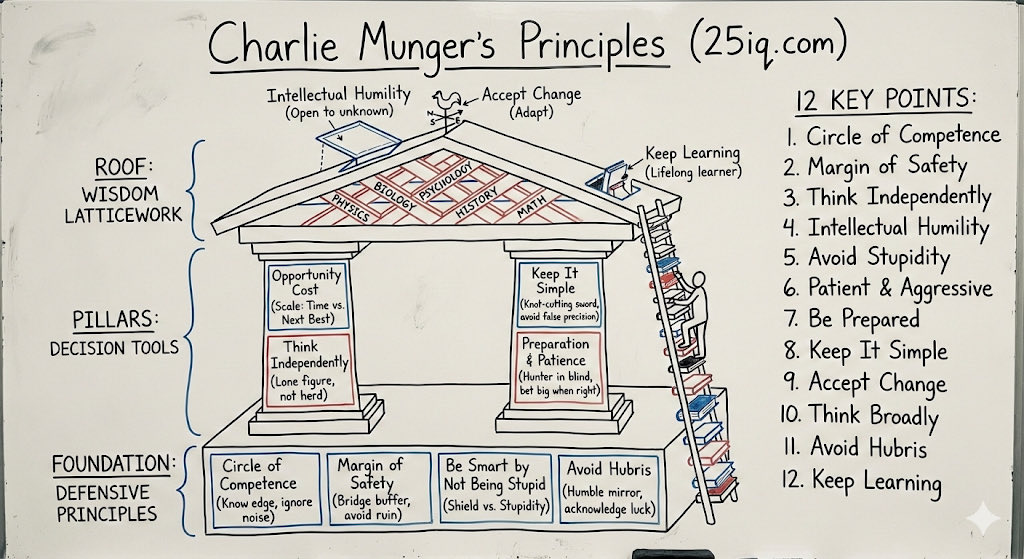

I plan to re-ignite my blog in the new year. 25iq.com/featured-indiv… There are well over million words there already. You can use AI to create whiteboard versions of posts or themes. Of course, I have lots of Charlie Munger posts.

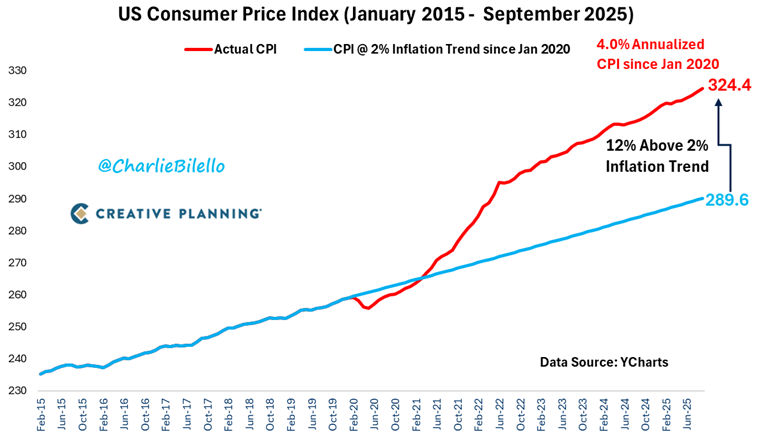

The Fed should hike rates 50 basis points in December. Inflation has been running at over 2x their target level (2%) for 5+ years now. The stock market and home prices are at record highs. Stop pursuing policies that will only create more inflation and worsen affordability.

The Fed should cut rates 50 basis points in December.

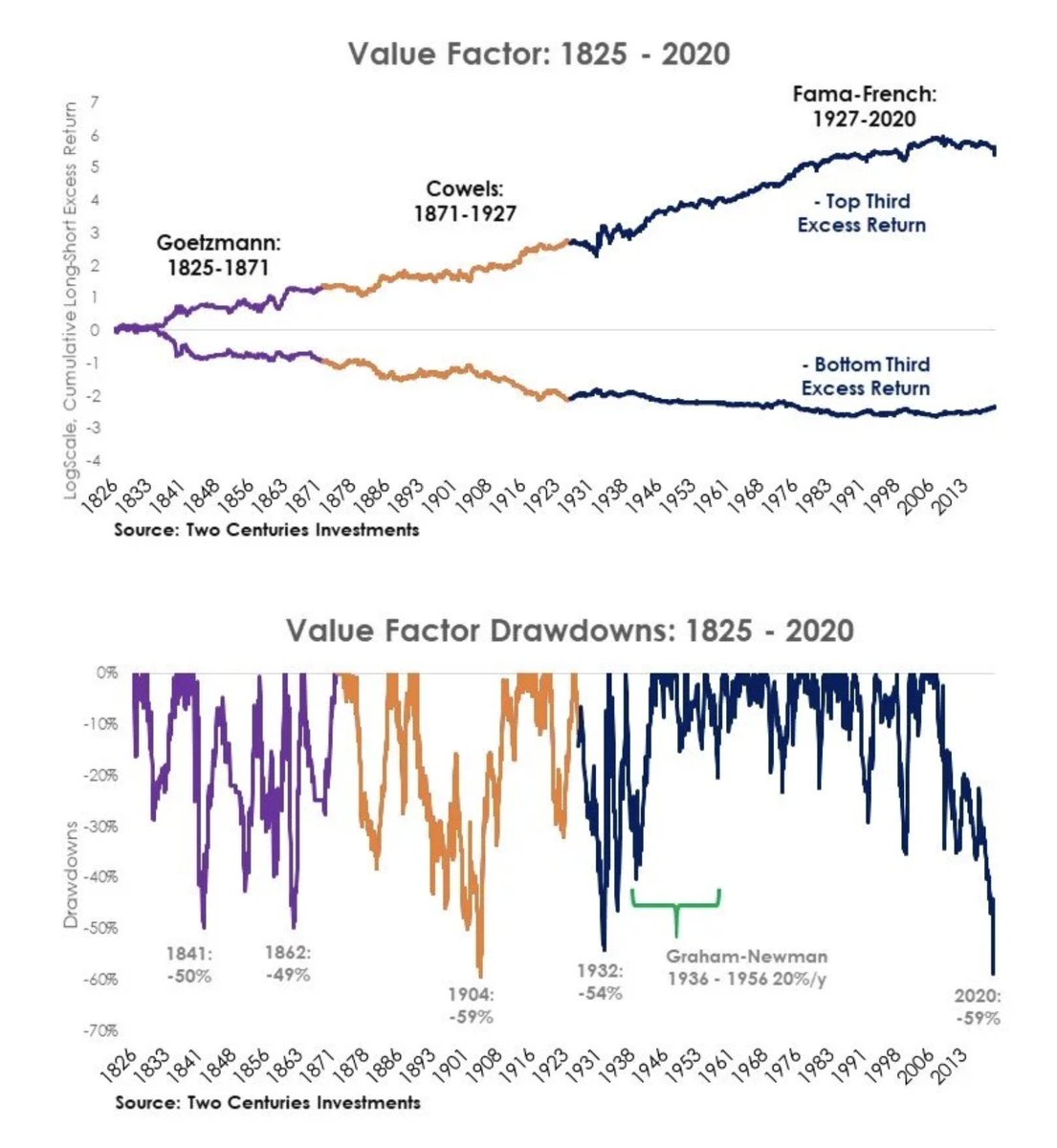

200 years of the value factor (1825 to 2020).

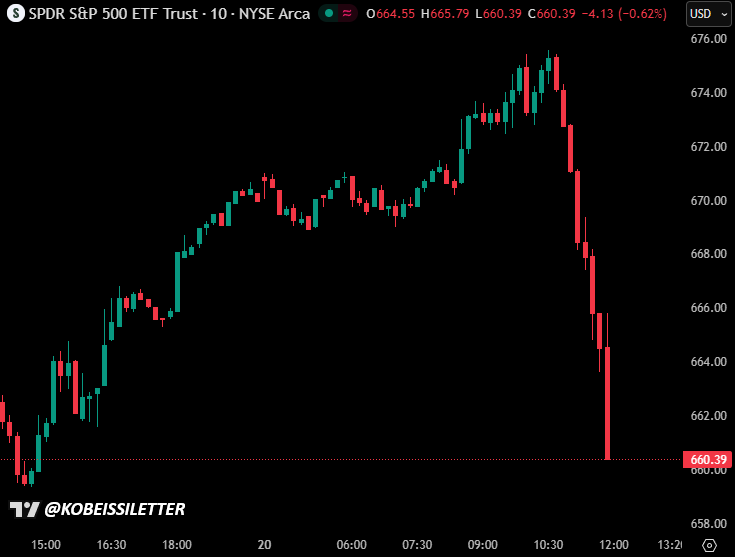

BREAKING: The S&P 500 has now erased -$1.5 trillion in market cap between 10:40 AM ET and 12:20 PM ET. That's -$15 billion PER MINUTE for 100 minutes straight. The craziest part? There hasn't been a single material headline yet.

BREAKING: The S&P 500 falls nearly -2.5% in 80 minutes and turns negative on the day as crypto collapses.

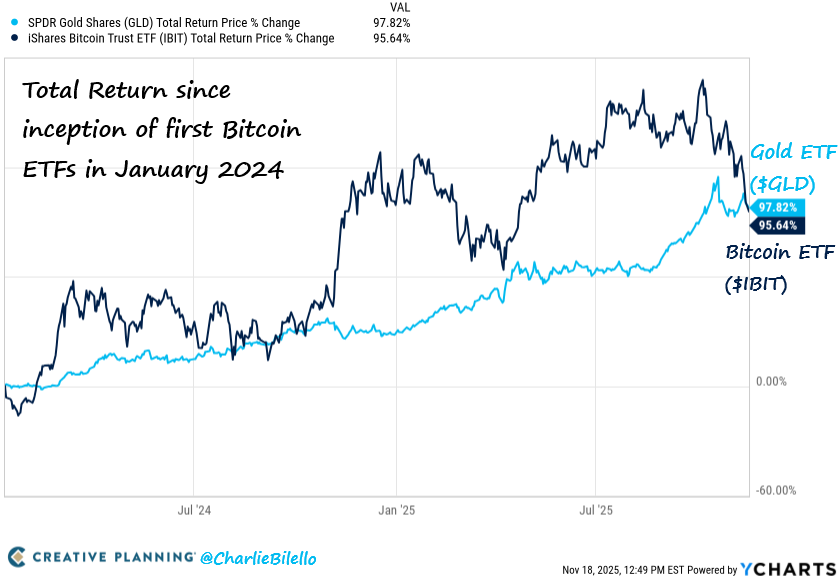

Gold is now outperforming Bitcoin since the inception of the first Bitcoin ETFs in January 2024. $GLD $IBIT

The last time bitcoin was here, global liquidity was $7 trillion lower

Bitcoin just dropped below $90,000. It’s down 28.5% from its high. But more significantly, with gold still trading above $4,000, Bitcoin is down 40% priced in gold. Bitcoin’s collapse relative to gold exposes the digital-gold hype as a fraud. Those who bought into it will sell.

United States 趋势

- 1. Cyber Monday 50.8K posts

- 2. Admiral Bradley 3,210 posts

- 3. TOP CALL 11.6K posts

- 4. GreetEat Corp. N/A

- 5. #GivingTuesday 3,200 posts

- 6. Shakur 6,626 posts

- 7. Adam Thielen 2,765 posts

- 8. #Rashmer 18.9K posts

- 9. Token Signal 3,890 posts

- 10. Check Analyze N/A

- 11. MSTR 30.2K posts

- 12. Alina Habba 37K posts

- 13. MRIs 2,244 posts

- 14. Toosii 1,177 posts

- 15. Hartline 3,057 posts

- 16. LA PIJAMADA VIRAL 58.6K posts

- 17. Marty Supreme 3,762 posts

- 18. Market Focus 3,112 posts

- 19. UCLA 7,209 posts

- 20. #WorldAIDSDay 37K posts

你可能会喜欢

-

Domenico DG

Domenico DG

@DDG_2000 -

bootzgp

bootzgp

@bootzgp -

Campbell Bailey

Campbell Bailey

@kembull797 -

Jordi

Jordi

@jordi_gp88 -

Pepito1971

Pepito1971

@b953d3aec47e485 -

Doug Melaas

Doug Melaas

@doug_melaas -

Mauricio Ríos García

Mauricio Ríos García

@riosmauricio -

D. Martinez

D. Martinez

@DanielM99085913 -

Elsa Hung

Elsa Hung

@ElsaHung6 -

Ted

Ted

@T4Investing -

Peter Hans Frohwein

Peter Hans Frohwein

@peter_frohwein -

Crusoe Research

Crusoe Research

@CrusoeResearch -

Angel Cascales

Angel Cascales

@AngelCascalesp -

Maninthehighcastle

Maninthehighcastle

@Maninthecastle2 -

Freddy Tovar

Freddy Tovar

@FreddTovar

Something went wrong.

Something went wrong.