MacroStrategy Partnership

@MacrostrategyP

Cutting-edge independent research on global macro and markets. Including areas such as derivatives, commodities, equities & fixed income.

قد يعجبك

A lot of people still can't imagine that there are central planners that wish to run what they call large-scale social experiments on us - usually aimed at making us easier to manage, and/or reducing the population. Please check out the frightening events in China, rated as…

The logic is backwards. Those "productive assets" aren't backing the debt, they're the reason for China’s debt explosion. Sustainable investment is defined by cash flows that retire the debt that funded it. When debt outruns income, the assets are not productive. They are…

Nope. Unlike ours, China's debt is backed by productive assets. The HSR network for example has an ROI of 6%-8% ROI. Besides, all China's debt is domestic.

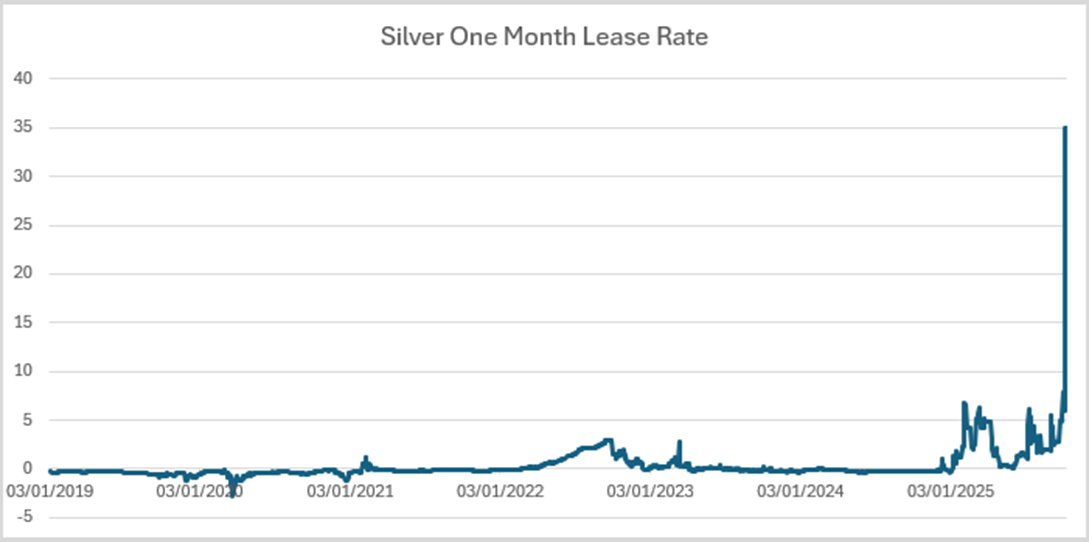

***** Silver - Lease rates show a HUGE problem... Silver lease rates went ballistic yesterday. The 1-, 3- and 12-month lease rates jumped to 35%, 20% and 8.6% respectively. This highlights the shortage of silver, and the cost, therefore, of holding short positions, or…

***** The Road to Serfdom continues... IMF has been highlighting a chart, taken from a 2017 Harvard report, showing the share of American 30 year olds earning more than their parents is down to 50% and falling. The statistic highlights the stagnation of innovation and…

***** Rev Repo is now empty! The overnight reverse repo fell to USD4.5bn, so it is now pretty much exhausted.

***** Silver lease rates suggest a possible short squeeze.... Silver lease rates have shot up. The 1-, 3- and 12-month lease rates are now 11.1%, 8.2%, and 4.1% respectively. This suggests a massive short paper position relative to the physical silver available for delivery,…

Gold just hit a new all time high. First gold, then oil.

The whole world economy depends on Microsoft and Oracle and Nvidia investing money into OpenAI and OpenAI using this money to rent GPUs from Oracle and Microsoft and Oracle and Microsoft buying GPUs from Nvidia and AMD and the stock price of these companies continuing to go up

Welcome to the party, pal.

***** AMD -> OpenAI and the carousel spins... The deal covers hundreds of thousands of AMD’s AI chips or GPUs, equivalent to 6 gigawatts, over several years beginning in the second half of 2026. This is roughly equivalent to the energy needs of 5 million U.S. homes, or about 3…

I hope this chart I made helps everyone, from professional to retail investors, to understand what's truly going on among #OpenAI $NVDA $AMD $ORCL $MSFT $CRWV and $NBIS

JustDarioCigarTime - Podcast Episode 45 ⚠️THE AI BUBBLE’S BREAKING POINT: OPENAI, NVIDIA AND THE CIRCULAR FINANCING SCAM IS COMING TO AN END🎙️ 🔗 to podcast youtu.be/6qa5nyIErHQ?si…

youtube.com

YouTube

THE AI BUBBLE'S BREAKING POINT: OPENAI, NVIDIA, AND THE CIRCULAR...

Copilot in Excel is a global financial crisis waiting to happen.

the plot thickens

Axe the Carbon Tax. Scrap Ed Miliband’s old rip-off wind farm subsidies. Cut electricity bills by 20%. Ed could do this tomorrow if he wanted to.

Lol

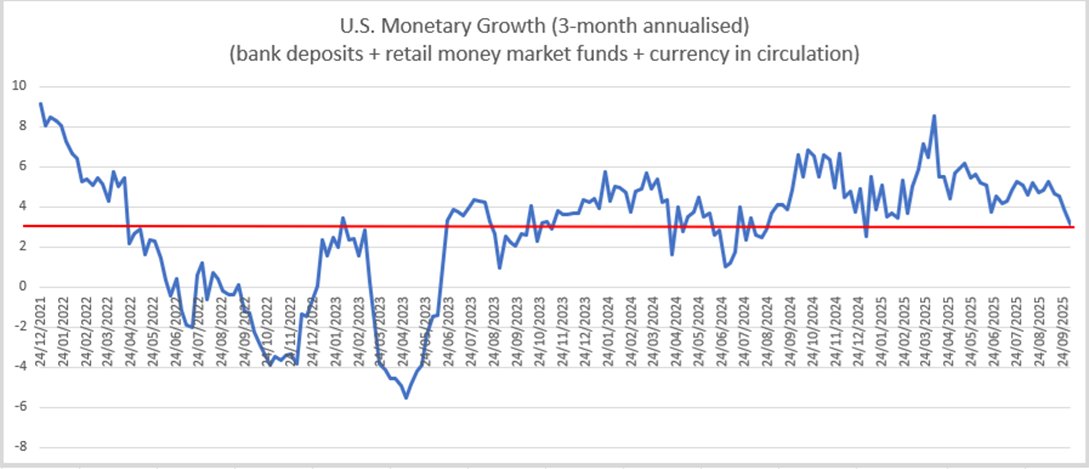

***** Money Supply..... very tight! U.S. Money supply - (bank deposits + retail money market funds + currency in circulation) - rose a 3-month annualised 3.2% - (1 month annualised 1.3%). It was up USD184.6bn, made up of base money down USD72.7bn and commercial money up…

Almost half the world's food supply relies on ammonia fertilizer. Guess what is absolutely necessary to create ammonia fertilizer? Lots of natural gas. Getting rid of natural gas = killing literally billions of people.

Fossil Fuels Are a Uniquely Cost-Effective Source of Energy Fossil fuels are a uniquely cost-effective source of energy, providing energy that is 1) low-cost, 2) on-demand, 3) versatile, and 4) on a scale of billions of people in thousands of places.

***** Expand that A.I Bubble! Trap more investors Big Tech is diverting its cash flow into speculative investments. The current surge in profit generated by AI investment is unlikely to last. After the TMT boom ended, the returns on the internet hardware companies collapsed.…

You’re right that the US could have stopped it by restricting inflows or changing the rules. But it failed to do so bc it is politically difficult - as you are seeing now as the Trump administration attempts to opt out of the system. But its also why the Trump administration is…

@michaeljmcnair Floating an idea... You repeatedly say that the US was "forced" to absorb the rest of the world's surplus. I object to that. The US built this model and exploited it. At any time the US could have erected barriers preventing countries from dumping into its assets.

***** Silver....more upside on the way! Analysts have argued that the silver market today resembles palladium in the mid-2010’s. Back then, years of structural deficits eventually forced investors to notice what the fundamentals had been signalling all along; supply was…

United States الاتجاهات

- 1. Cowboys 45.9K posts

- 2. James Franklin 43.7K posts

- 3. Drake Maye 14.2K posts

- 4. Pickens 14.1K posts

- 5. Jets 104K posts

- 6. Penn State 59.9K posts

- 7. Steelers 50.4K posts

- 8. Panthers 44.1K posts

- 9. Rico Dowdle 3,756 posts

- 10. Diggs 7,443 posts

- 11. Colts 44.6K posts

- 12. Justin Fields 22K posts

- 13. Saints 52.8K posts

- 14. #Browns 3,100 posts

- 15. Cooper Rush 2,915 posts

- 16. Eberflus 2,341 posts

- 17. Gabriel 52.4K posts

- 18. Zay Flowers 1,948 posts

- 19. #RavensFlock 2,454 posts

- 20. Huntley 3,051 posts

قد يعجبك

-

EponymouslyAnonymous

EponymouslyAnonymous

@EponymouslyAnon -

Paper Alfa

Paper Alfa

@paper_alfa -

ً

ً

@turintrader -

EM Credit Hedge Fund

EM Credit Hedge Fund

@em_credit_fund -

©️redit From Ⓜ️acro to Ⓜ️icro

©️redit From Ⓜ️acro to Ⓜ️icro

@Credit_Junk -

Bill

Bill

@wabuffo -

Leftskewed Investment Management

Leftskewed Investment Management

@LeftskewedIM -

Cumberland

Cumberland

@CumberlandSays -

Global_Macro

Global_Macro

@Marcomadness2 -

Citrini

Citrini

@Citrini7 -

Kieran Goodwin

Kieran Goodwin

@kieranwgoodwin -

3Fourteen Research

3Fourteen Research

@3F_Research -

Craig Shapiro

Craig Shapiro

@ces921 -

Daniel Baeza

Daniel Baeza

@dbaeza13 -

Stephen Miran

Stephen Miran

@SteveMiran

Something went wrong.

Something went wrong.