Wealth can be created during long run marathon. The real compounding will take place after eight years. We have to make a goal planner with your long term goals (Child UG / PG and Retirement) to arrive the SIP (systematic Investment Plan) value.

For long-term SIPs in the Nifty 50 TRI over 20 years, the choice of SIP date within the month has very little effect on overall returns. Investors can choose a date based on convenience rather than trying to optimize returns.

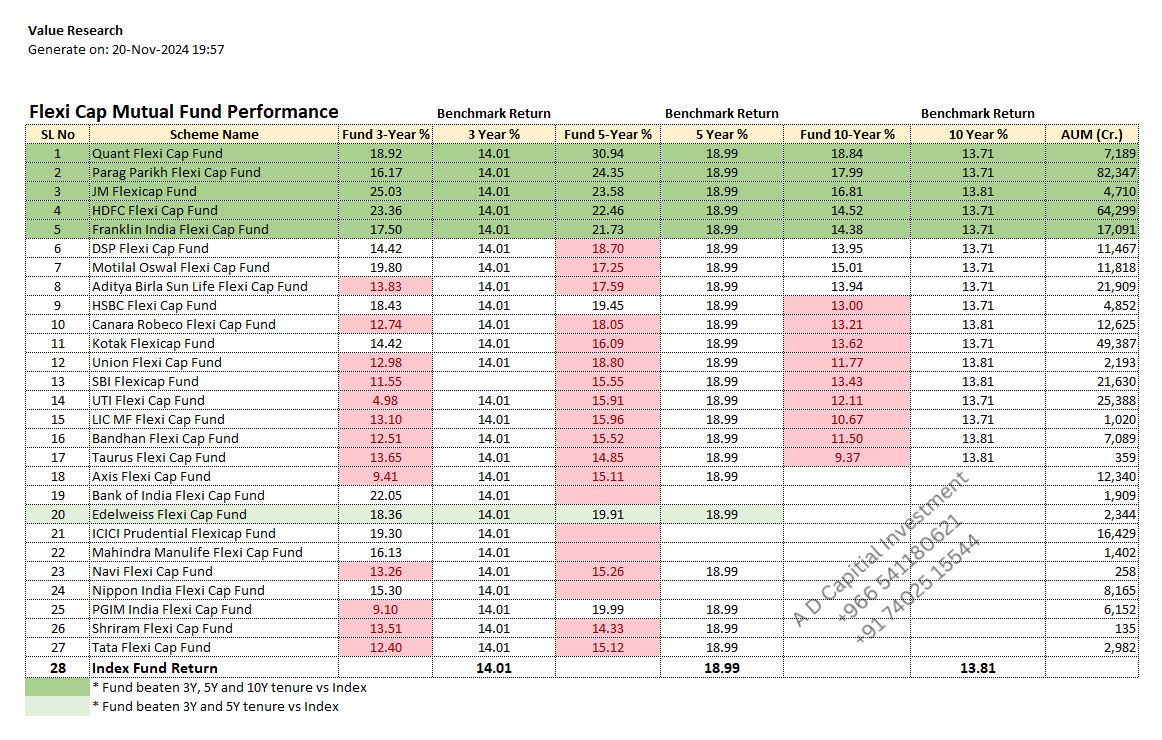

Only 21% flexi cap mutual fund beaten the bench mark in 3Y, 5Y and 10Y tenure vs Index. Remaining 79% fund not generated additional alpha over a long period.

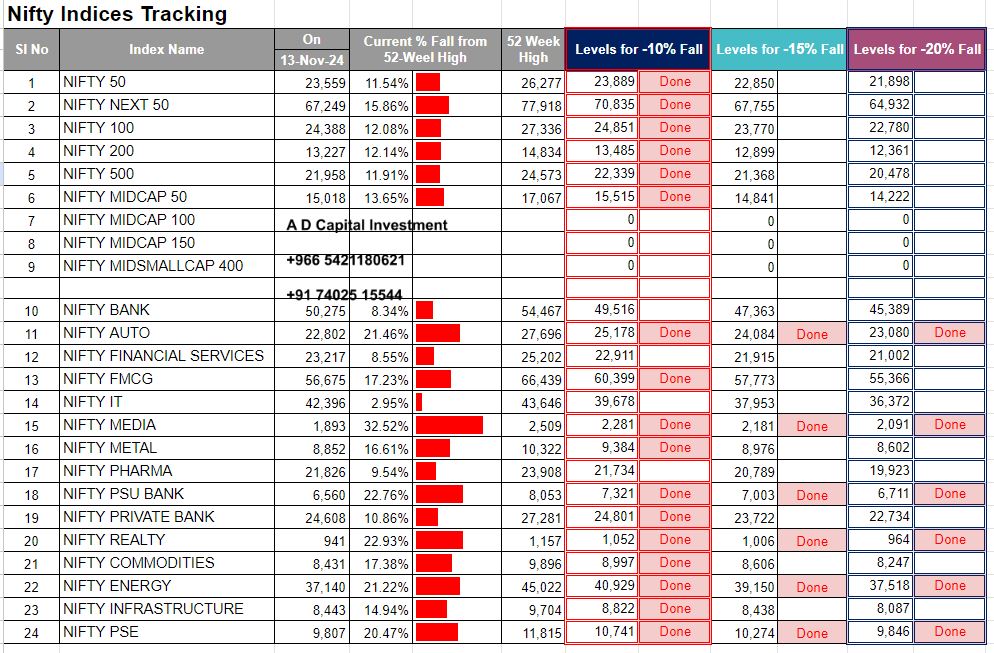

Nifty Indices tracking. Good time to make small lumpsum in nifty next 50 Mutual Fund. Around 15% down from peak

Fall in NAVs of large cap Funds from 52-Week High

This chart can be very insightful for small-cap mutual fund investors, especially during periods of market volatility. The drawdown percentages from their 52-week highs help identify funds that are currently down from their peak, presenting potential opportunities.

Midcap Mutual Fund Analysis....Only 20% MF beaten the bench mark return.

Gold Returns have beaten inflation in the long term but goes through long intermittent periods of subdued returns

SIP fiscal year wise contribution @ CAGR 25.82% since 2020

Start your SIP early. Finally you can create plenty of wealth

United States Trends

- 1. Bears 78K posts

- 2. Jake Moody 9,836 posts

- 3. Bills 135K posts

- 4. Falcons 46.7K posts

- 5. Snell 19.2K posts

- 6. Josh Allen 23.7K posts

- 7. Caleb 42.3K posts

- 8. #Dodgers 13.6K posts

- 9. #BearDown 1,653 posts

- 10. Swift 288K posts

- 11. Jayden Daniels 9,370 posts

- 12. Bijan 29.1K posts

- 13. Turang 3,610 posts

- 14. #NLCS 12.2K posts

- 15. phil 150K posts

- 16. Roki 5,679 posts

- 17. Brewers 44.9K posts

- 18. #RaiseHail 7,930 posts

- 19. AFC East 8,424 posts

- 20. Ben Johnson 3,292 posts

Something went wrong.

Something went wrong.