MDS Transmodal

@MdsTransmodal

Consultancy providing analysis and advice on strategic and economic issues relating to freight transport & logistics. Retweets not necessarily an endorsement.

You might like

The latest PLSCI produced in collaboration between @UNCTAD and @MDST is now available! Explore the 6 Key Components and gain detailed insights on the world’s top 100 container ports via the MDST Port LSCI Portal: portlsci.com

📢Just released! UNCTAD Port Liner Shipping #Connectivity Index (Port LSCI) Q2/2025 ➡️stats.unctad.org/PLSCI in collaboration with @MdsTransmodal #MaritimeStatistics

📢Just released! UNCTAD Port Liner Shipping #Connectivity Index (Port LSCI) Q2/2025 ➡️stats.unctad.org/PLSCI in collaboration with @MdsTransmodal #MaritimeStatistics

Phil Roe, president of Logistics UK, speaking at @multimodal 2025, using data from @MdsTransmodal #multimodal2025

@MdsTransmodal attending UK Ports Conference 2025 looking forward to an interesting and informative debate on all matters ports #ports #logistics

🥳We’ve just released new data on #SeaborneTrade 📈Explore the latest seaborne trade flows by country! 🚢See how global goods move by sea, who’s loading and discharging the most, and more: ⬇️ unctadstat.unctad.org/datacentre/dat… #MaritimeStatistics

📢We’ve just released new data on #MaritimeConnectivity — now with monthly country data available from January 2023! In collaboration with @MdsTransmodal 📊Dive into the data: 🔽 unctadstat.unctad.org/datacentre/dat… 📄More about the #LSCI: 🔽 unctadstat.unctad.org/datacentre/rep… #MaritimeStatistics

In 2024Q4, the UK was the only major Northern European container port country to see an improvement in its LSCI, rising in the global rankings from 10th to 9th place. The Netherlands experienced the largest decline, mainly due to fewer services and reduced scheduled capacity.

China leads the global shipbuilding market, accounting for 70% of the total number of containerships on order. South Korea and Japan follow as the next largest contributors. #shipping #maritime

Ships from South Korea, China, and Japan dominate services calling at US ports. Together, these three countries account for 85% of total ships. Other countries play a smaller role, each contributing less than 4% of the total fleet. #USA #ports #shipping

✨ Farewell to the #SENATORProject: Paving the Way for Smarter #UrbanLogistics 🚛 Funded by the European Union’s #H2020 program, Senator has been at the forefront of shaping sustainable, technology-driven logistics solutions to meet the growing demands of urban mobility.

@MdsTransmodal attending @RailFreightUK transporting hydrogen by rail seminar at @unibirmingham. Looking forward to an interesting discussion ##railfreight #logistics #freight

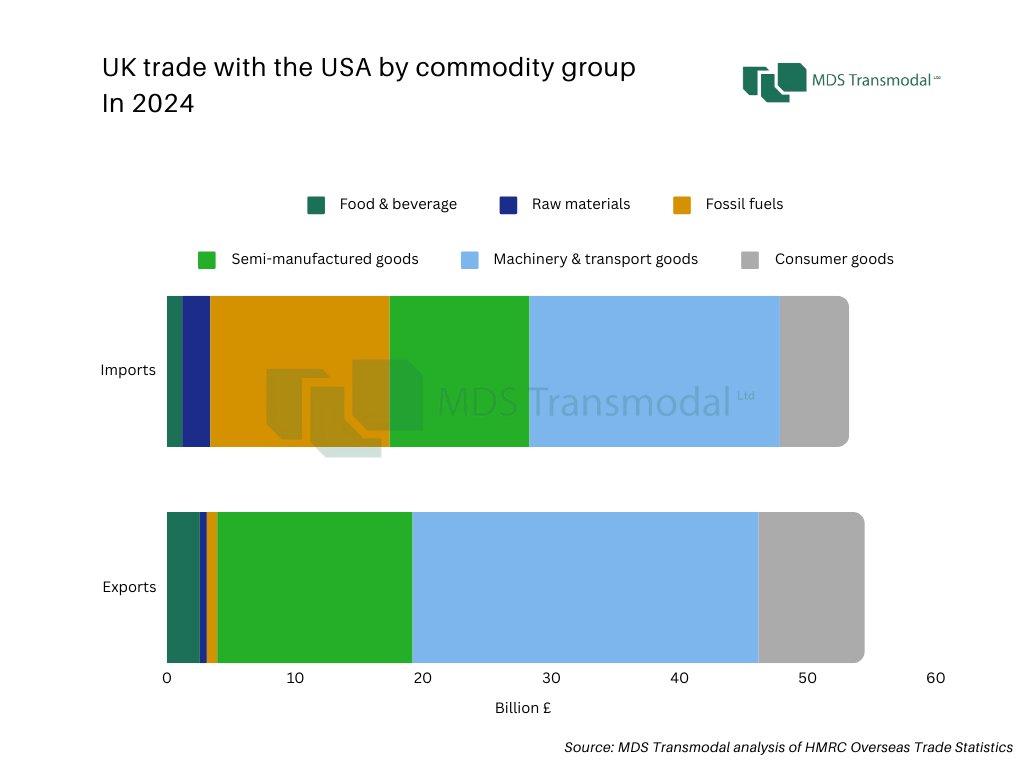

The value of UK trade with the USA is generally balanced. The UK imported £54.5 billion in goods from the USA in 2024, and exported £53.3 billion. To learn more, contact us at [email protected]. #trade #uk #usa #tariffs

The restructuring of the global container shipping market has led to the switch of Gemini and MSC services from Felixstowe to London Gateway, with knock-on impacts on rail services between both ports and their hinterlands. #shipping #maritime #alliances

The UK’s largest trading area is Europe & Med, mostly dominated by shortsea trades. In deep-sea markets, the principal trading partner is the Far East followed by America. Tariff increases on China could divert its goods elsewhere, potentially increasing UK-Far East trade #tariff

📢 Join SENATOR Final Event – Feb 26! 🚛✨ Join us to explore the SENATOR ICT platform, our urban living lab pilots, and the future of last-mile logistics with top experts. Don't miss this chance to be part of the conversation! 🔗 Register now! 👉 register.gotowebinar.com/register/85352…

A higher percentage of Far East exports to North America are consumer goods compared to elsewhere, implying this is where tariffs on China are most likely to have an impact. #trade #exports #tariffs #USA #China

Italian exporters depend more on the US than their counterparts in the rest of the EU and UK, as Italy tops the percentage share of exports in four broad commodities. Italy could therefore be most exposed to any tariffs imposed on European exports. #tariffs #GlobalTrade

The return to the Red Sea route by all shipping lines has the potential to shake up the global shipping market: the move could release over 70 vessels and as much as one million TEU of capacity back into circulation, which would put downward pressure on freight rates #shipping

Capacity scheduled to be deployed on deepsea services calling at Red Sea ports drops below 1 mn TEU in 2024Q4. As the largest shipping lines increase their offers via the Cape of Good Hope, the Red Sea market has seen a notable diversification.

In 2024, the global shipping industry saw a significant increase in fleet capacity: in Nov 2024, over 4 mn TEU of capacity was added on deepsea services, outpacing capacity removed. This is over double the capacity change in the same month last year and nearly 4x that in Nov 2020

United States Trends

- 1. Columbus 72.3K posts

- 2. #SwiftDay 8,571 posts

- 3. #WWERaw 24.8K posts

- 4. #IDontWantToOverreactBUT N/A

- 5. #IndigenousPeoplesDay 3,101 posts

- 6. #TSTheErasTour 2,229 posts

- 7. Marc 36.4K posts

- 8. Knesset 124K posts

- 9. Good Monday 40.8K posts

- 10. Thanksgiving 43.8K posts

- 11. Victory Monday 1,733 posts

- 12. Flip 48.9K posts

- 13. Branch 48.6K posts

- 14. Broadcom 2,011 posts

- 15. Kairi 10.3K posts

- 16. Happy 250th 2,237 posts

- 17. Rod Wave 3,209 posts

- 18. Egypt 158K posts

- 19. GOD BLESS THE PEACEMAKER 4,708 posts

- 20. Penta 4,778 posts

You might like

-

Jan Hoffmann

Jan Hoffmann

@JanHoffmann_gva -

Drewry

Drewry

@DrewryShipping -

Kenworth Truck Co.

Kenworth Truck Co.

@KenworthTruckCo -

Poten & Partners

Poten & Partners

@PotenPartners -

ESPO Secretariat

ESPO Secretariat

@ESPOSecretariat -

Air Cargo News

Air Cargo News

@Air_Cargo_News -

Kpler

Kpler

@Kpler -

Tankers International

Tankers International

@TankersInt -

BreakWave

BreakWave

@DryBulkETF -

Peter Sand

Peter Sand

@XenetaSand -

PortEconomics

PortEconomics

@PortEconomics -

Costas Paris

Costas Paris

@CostasParis -

MABUX.com

MABUX.com

@MabuxAB -

Shipping Corporation of India (SCI)

Shipping Corporation of India (SCI)

@shippingcorp -

NatWest Business

NatWest Business

@NatWestBusiness

Something went wrong.

Something went wrong.