내가 좋아할 만한 콘텐츠

« Between being happy and being successful, what do you choose? » Thay asked a business man. « - both! - If everything is important then nothing is important » Here is @thichnhathanh answer. « You can be victim of your success, but you can never be victim of your happiness.»

The current bull market turns 3 today. "Since WWII, there have been 11 other bull markets and only once did a bull market make it this far and not get it it's fourth birthday. The '62-'66 bull market died at 44 months. but the other seven times it always made it another yr."…

Potentially the 60th time China has announced export controls on rare earths in the past 5 years is going to play out just like the 59th time?

CHINA’S COMMERCE MINISTRY CLARIFIES THAT RARE EARTH EXPORT CONTROLS DO NOT AMOUNT TO AN EXPORT BAN — ELIGIBLE APPLICATIONS WILL CONTINUE TO RECEIVE LICENSES.

The one issue with Trump’s 100% tariff threat is he’s running the same playbook that he did back in April. The # doesn’t necessarily mean anything & China exports have actually gone UP rather than down following tariffs having been implemented since Liberation Day. This is while…

A rule I apply to myself: never use margin. So yes it limits my upside but I sleep well and no risk of being liquidated.

At some point every trader learns that using excess margin is the act that guarantees future liquidation. Like applying a match to a string of fireworks. #CryptoCrash

*TRUMP: HAVEN'T CANCELED MEETING W/ XI *TRUMP: MIGHT STILL HAVE XI MEETING

Imagine you want to short this. 😂

S&P Info Tech Stocks Above 5-Day Average approaching April low levels.

Already in fear after one big red day.

Spooz down less than 2% CNN Fear & Greed Index ~ 33 Fear

$TEM and $NBIS holding well after the initial dump. Not surprised as they are not or not much impacted by China. My 2 biggest convictions LT.

My process for a day like today: - I have trimmed some into strength the days before - Watching what holds well and what doesn’t - If something i really dont like I cut. - sell some calls for premium is high - add some more on my biggest conviction plays - let my stops do the…

Stop looking for “news” after every algo sell-off. Start following the flow and you’ll be ahead of the news. Distribution is healthy. A little risk-off resets the board shakes out leveraged bulls, and gives bears false confidence. All it really does is create opportunity 🧠

$QQQ sweepers have had enough Big ITM calls being sold, adding negative delta pressure on Nasdaq and markets

This account made a short report about $TEM last May. See what it did since. 🤡

Short Red Cat $RCAT -FOIAs revealed Key Army SRR LRIP contract is significantly smaller than mgmt claimed -FANG drone exposed as another company's drone built with key CHINESE parts. FANG is just a "marketing concept" Guidance & Estimate misses will de-FANG the hype

If you disagree with this or hate it, feel free to let me know. There will be corrections. But comparing both is lazy

This Is Not 1999: Stop Calling It a Bubble The dot-com era was tiny revenue and big stories. Today is trillions in revenue, real capex, and physical constraints. AI is infrastructure, not hype Big tech generates over $1.7 trillion in annual revenue

Robots, more robots.

$SERV ... Serve Robotics said on Thursday it is partnering with DoorDash to deploy its sidewalk robots to fulfill orders on the food delivery platform, in a move to capture more customers and expand its reach beyond Uber Eats. The San Francisco-based robotics firm said customers…

Be prepared for rip or pullback. But if this materializes…

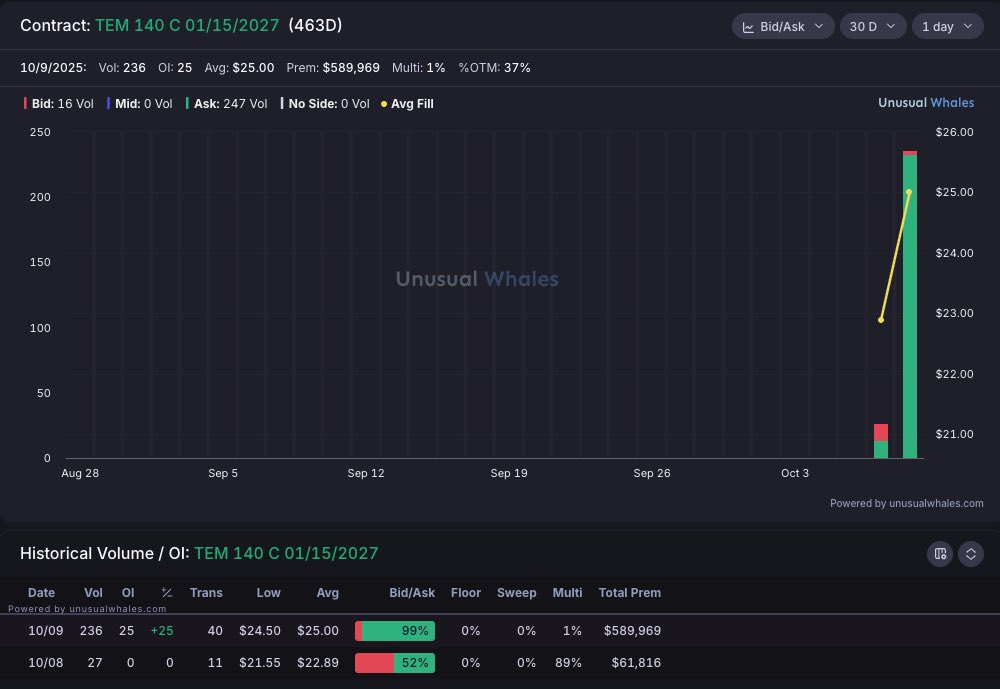

TEEEEEEEEEEEEEEEEEEEEEEM My boy. PT: moon 🌕

$TEM Character Change - Following through on the breakout from a big stage 1/IPO base - Recent strength in many medical/biotech stocks - 27% Short Float - Strong revenue growth

Look at that, dear bubble callers.

Possible for the AI frenzy to get even more crazy? Nasdaq now compared to 1999. Source: LSEG Workspace

Many people trade $TEM insane moves, not so many hold it. Its potential is huge but if you dont do proper research, you don’t see it. @JKeynesAlpha and @ZaStocks are among the few I saw tweets on this.

United States 트렌드

- 1. Good Sunday 54K posts

- 2. #sundayvibes 4,763 posts

- 3. #AskBetr N/A

- 4. Muhammad Qasim 8,841 posts

- 5. Discussing Web3 N/A

- 6. Wordle 1,576 X N/A

- 7. #HealingFromMozambique 20.5K posts

- 8. Miary Zo 1,234 posts

- 9. Trump's FBI 12.2K posts

- 10. KenPom N/A

- 11. Biden FBI 18.9K posts

- 12. Blessed Sunday 17.7K posts

- 13. Coco 48.7K posts

- 14. #ChicagoMarathon N/A

- 15. Mason Taylor N/A

- 16. The CDC 33K posts

- 17. Lord's Day 1,688 posts

- 18. Gilligan 7,205 posts

- 19. Macrohard 9,799 posts

- 20. Go Broncos 1,327 posts

내가 좋아할 만한 콘텐츠

-

Options selling with Christian

Options selling with Christian

@optionscjp -

rj

rj

@rjjoptions -

Iron Sharpens Iron Trading

Iron Sharpens Iron Trading

@ISITrading2717 -

Selling For Premium

Selling For Premium

@Selling4Premium -

Tim | Retire with Options

Tim | Retire with Options

@Options2Retire -

LEAPTRADER

LEAPTRADER

@LEAPTRADER_ -

Abundantly Erica - Stock Options + Investing

Abundantly Erica - Stock Options + Investing

@womenoptionswin -

DarkMiner

DarkMiner

@Darkminer71 -

Sleep Money Maker

Sleep Money Maker

@SleepMoneyMaker -

Sam Trades

Sam Trades

@SamTrades_ -

Options Seller

Options Seller

@options_seller7 -

Joe Yurillo

Joe Yurillo

@JoeYurillo -

Spazzin

Spazzin

@Spazzin_Trades -

Coach Mak | Know Your Money

Coach Mak | Know Your Money

@WealthCoachMak -

investafter40

investafter40

@investafter40

Something went wrong.

Something went wrong.