Monster Lab

@MonsterLab3

Futures Trading Community Since 2020 | Live Education & Strategy | Monster Lab 😈🧪

If you’re blaming headlines, you missed the framework. October isn’t just a monthly PO3 — it’s a quarterly PO3 open. The script was already in play; Trump only added velocity We mapped it live in MonsterLab. If it felt “unexpected,” you weren’t calibrated.

RR 1:52 isn’t luck. Framework, narrative & delivery. Respect to this Monster 😈🧪

How did I know today’s move 24h before it happened? 📊 RR 1:52 locked. Answer: @MonsterLab | Dexter 🔑 When you can call the market 1 day ahead… Shoutout @MonsterLab & @TraderDext3r — the real market killers.

Once you see it, you can’t unsee it. The Monster Lab Continuation Model 😈🧪

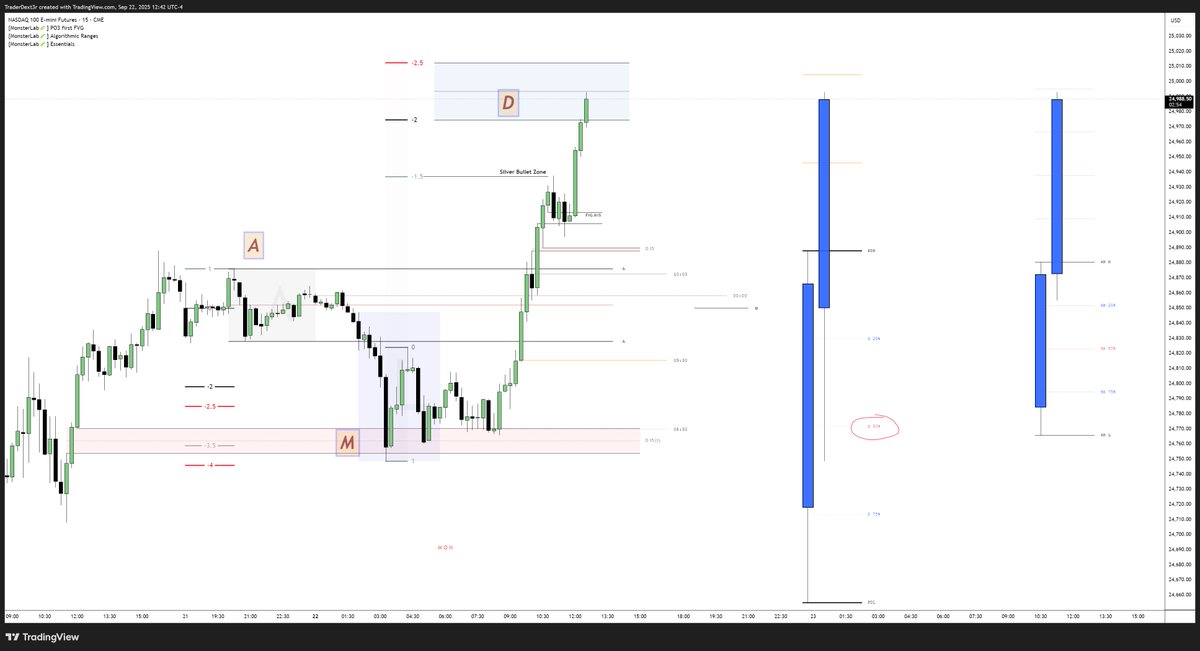

Automated until the look back...@TraderDext3r 1.0 - 1.5 SBZ continuation 4H PO3 SMT in the low mastering the model every time I reverse engineer it

IPDA DATA RANGE + STDV DOESN’T LIE Consistency in framework 💡 Today was one of those days to make money inside the Monster Lab 😈🧪

IPDA DATA RANGES Synchronization tool. It will show you where the liquidity is accumulated.

Monster Lab Model in Play Again 😈🧪 In the livestream we called the bearish move on $NQ before it happened. –3.5 / –4 STDV within the 3-Day IPDA Lookback SMT off the Previous Daily High Waited for the 10:00 AM wick print Targets: NWOG or -2.0 -2.5 STDV Session Lows

NY Session on fire 🔥 🎯 |We are again Cooking Liquidity at @MonsterLab3 with chief @TraderDext3r

4H PO3 + STDV Model Entry system breakdown. The quality of your framework determines the quality of your entries.

MonsterLab Model 🧪 4H PO3 + Standard Deviations.

$NQ $MNQ - Market Maker Sell Model // Breakdown 🚩NFP postponed 🚩10:00 a.m ISM Services PMI -SMT with ES -MMSM Internal Dynamics -STDV -Daily Profile @MonsterLab3 Model - 4H PO3 Executed with PATIENCE! @TraderDext3r ending the week in the best way

11am (1h) open to low to measure manipulation 10am (4h) open to high to measure distribution 1pm (1h) open in expansion = no manipulation needed Multiple breakevens, stop-losses, and re-aligning Trading accumulation is death. Trading distribution is easy.

We are Building Monsters in Monster Lab 🧪 Today’s livestream proved it — while everyone was buying, we monsters had already anticipated the move.

#us100 #nq #nasdaq TGIF in play ▶️ All credits to @MonsterLab3 and especially to @TraderDext3r 🤝

New month = New PO3 New PO3 = New 1st PFVG 💡

PO3 Time frame → 1ST PFVG Time frame 💡 1. You must be able to visualize what you’re trying to find. 2. Simplify your approach — and find a way to make money with it.

Sep 30th, 2025 - PM Session 15:00 (1h) po3 Retracement into upper 25% of previous candle dealing range (1h) Expansion to upper 25% of previous candle dealing range (daily) Using projections within 15:00 (1h) po3 candle Targeting September 29th FVG + Balanced Price Range (30m)

Monster Lab Model 🧪 4H PO3 + STDV Focus on the 10:00 AM wick. Confirm with SMT + ≥4H PD Array.

@MonsterLab3 learn PO3 mastering from this guy 👉 @TraderDext3r #us100 #nq #nasdaq NY SESSION MMXM + PO3 RR 1:24 🔥🔥🔥

PO3 Time frame → 1ST PFVG Time frame 💡 1. You must be able to visualize what you’re trying to find. 2. Simplify your approach — and find a way to make money with it.

Scalping Model #1 ✍️ 1H PO3 → 1 Minute 1ST PFVG Friday 26 sep example: 11:00 A.M PO3 in play (1H) 11:10 A.M 1st presentation FVG

PO3 Time frame → 1ST PFVG Time frame 💡 1. You must be able to visualize what you’re trying to find. 2. Simplify your approach — and find a way to make money with it.

Not every range is a Standard Deviation projection. Objective: Identify a TIME event with upcoming expansion, preceded by manipulation. 💡5 manipulation types exist: Large Wick is #3 Wed Sep 17 FOMC type was LARGE WICK—our range to project via STDV.

Daily PO3 IN PLAY, I am grateful to @MonsterLab3 and especially to @TraderDext3r for deeply exploring this concept 🤝👍

PO3 (AMD) → wicks first, body next. Outside this framework = noise

Day trading truth✍️: intraday will whip both ways, but the session closes in its underlying direction. Take profits, be nimble, stop hunting home runs. No move is eternal—Execute, Liquidity 2.5 / 4.0 STDV, Pay the trader. Go home.

United States Tendencias

- 1. Jets 67K posts

- 2. Aaron Glenn 2,720 posts

- 3. Justin Fields 4,627 posts

- 4. Garrett Wilson 1,601 posts

- 5. HAPPY BIRTHDAY JIMIN 57K posts

- 6. #JetUp 1,434 posts

- 7. Peart 1,570 posts

- 8. #BroncosCountry 2,228 posts

- 9. Tyrod N/A

- 10. #DENvsNYJ 1,573 posts

- 11. #OurMuseJimin 93.1K posts

- 12. Sherwood 1,162 posts

- 13. Kurt Warner N/A

- 14. Good Sunday 65.9K posts

- 15. Bam Knight N/A

- 16. Hail Mary 2,352 posts

- 17. #30YearsofLove 86.9K posts

- 18. Rich Eisen N/A

- 19. Brownlee N/A

- 20. Troy Franklin N/A

Something went wrong.

Something went wrong.