No More Parties

@NMPCap

signal-to-noise

Może Ci się spodobać

BJ’s Wholesale Club $BJ bull thesis via @LuisVSanchez777 $COST clone for middle-class income demo. Should thrive in a tough economic environment. Trading at 17.5x P/E vs Costco at 32x P/E. Has 226 stores vs Costco's 847 stores. What's the bear thesis?

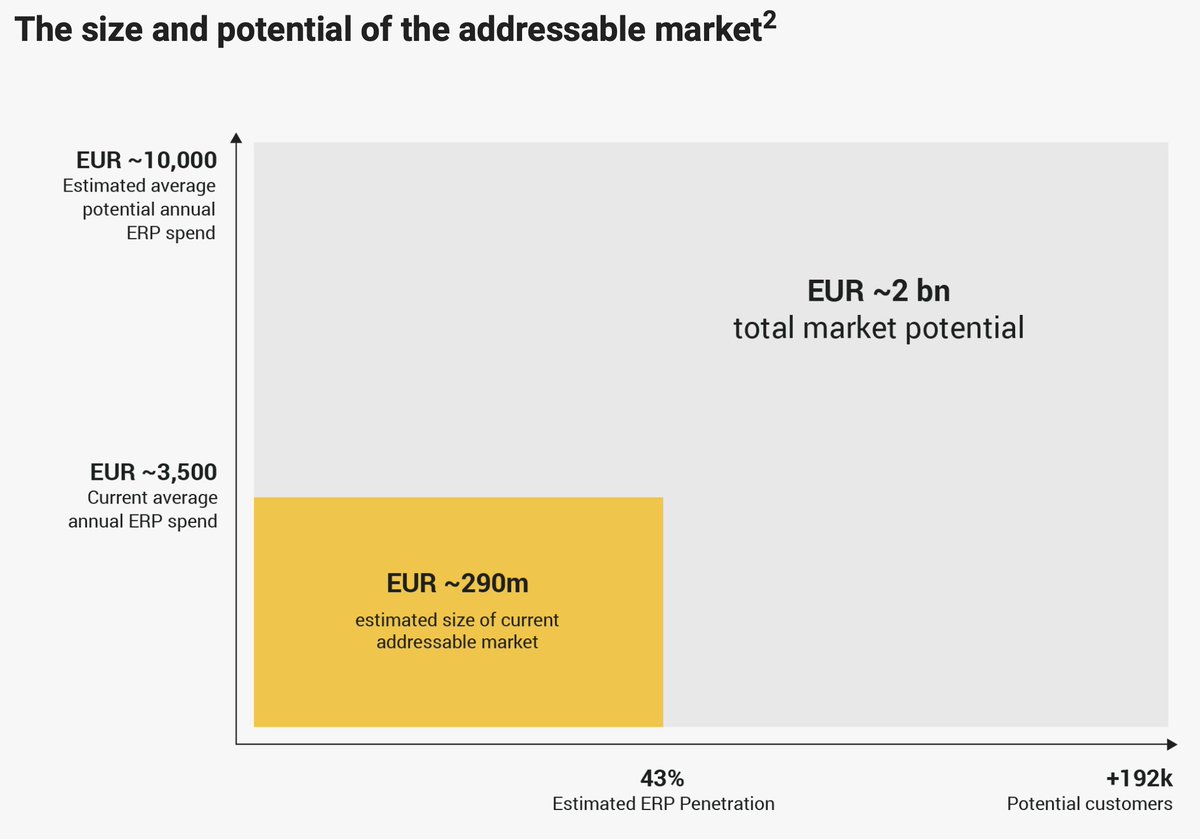

Lemonsoft $LEMON.HE -- a leading Finnish ERP for SMBs is selling at 8x '25 EBIT based on mgmt's targets. CEO owns 26% of shares. Co is s exposed to industrial manufacturing customers (no signs of demand slowdown yet), but have started cutting costs. Underpenetrated TAM.

Fidelity National Financial $FNF is trading at 6x FCF vs 10yr mean of 13x FCF and vs $FAF at 9x FCF. I get that this year is going to be tough. But if we ever see housing rebound $FNF will deliver a very strong CAGR. Large shareholders: Brave Warrior, Bill Foley, WindAcre.

Arch Capital Group $ACGL is one of the best insurance cos out there, but more than 2x P/TBV vs 10yr mean of 1.5x is a bit too much. Enstar Group $ESGR at 1x P/TBV seems fine.

Converge $CTS.TO is down 65%. Trading at 18% FCF yield vs $CDW at 4% FCF yield. 6% org growth in Q3 '22. Don't seem to have overearned in '20-'21. Paused M&A. Initiated a buyback. Started a strategic review, e.g. have downside protection. Mgmt are owner operators. Any bear case?

Hotel brands by Quality & Value cc: $WTB.L, $HLT, $MAR, $IHG

Burford $BUR earning will accelerate in '23. They underearned in '20-'22 b/c COVID slowed the judicial system and cases have stuck. Bonus points: - no correlation w/ the economy - two Argentine cases can earn more than the entire MC in '23 Current normalized P/E = 8x. Warranted?

Interpump Group - niche industrial decentralized rollup from Italy. 22% share price CAGR last 10y. 13% EPS CAGR since '96 IPO. Trading at 17x P/E. ROIC 15%. CEO owns 24%. Recession = M&A tailwind. Mgmt expects org growth in '23 b/c of backlog. Co sells to 25+ application markets.

Clarivate $CLVT is down 75%, trading at 11x P/E & 19x EV/FCF. 92% retention rate. 80% predictable subscription/reoccurring revs, growing organically at 4%. With 70-80% incremental margins should grow LT FCF @ 10%+. CEO from IHS Markit. Information Services comps trade @ 27x P/E.

United States Trendy

- 1. Saudi 197K posts

- 2. #UNBarbie 6,557 posts

- 3. Gemini 3 40.7K posts

- 4. Khashoggi 28.7K posts

- 5. #UnitedNationsBarbie 7,291 posts

- 6. Cloudflare 250K posts

- 7. Salman 60.1K posts

- 8. #NXXT2Run N/A

- 9. Piggy 99K posts

- 10. Robinhood 5,018 posts

- 11. Mary Bruce 1,153 posts

- 12. Shanice N/A

- 13. Merch 67.3K posts

- 14. Pat Bev 1,687 posts

- 15. Olivia Dean 4,598 posts

- 16. #LaSayoSeQuedóGuindando 3,052 posts

- 17. Nicki Minaj 42.3K posts

- 18. Luis Guerrero N/A

- 19. CAIR 34.5K posts

- 20. Antigravity 5,828 posts

Może Ci się spodobać

-

Analog Capital

Analog Capital

@analogcap -

Newmoon Capital

Newmoon Capital

@NewmoonCap -

11 KM/s

11 KM/s

@escvel0city11 -

Westpine Capital

Westpine Capital

@buckbid -

Andy 🍕🏔️

Andy 🍕🏔️

@bizalmanac -

Ray

Ray

@heartof_thesea -

MJH📈📉

MJH📈📉

@hedgie007 -

TBall Coach Black Sails

TBall Coach Black Sails

@BlackSailsRsch -

FLinvestor

FLinvestor

@FLinvestor_ -

SC

SC

@soonercapital -

BCap21

BCap21

@b_cap21 -

CrosscheckC

CrosscheckC

@CrosscheckC -

3:10 Value

3:10 Value

@310Value -

Compounder$Bro

Compounder$Bro

@CompounderB -

komrade

komrade

@komrade_kapital

Something went wrong.

Something went wrong.