You might like

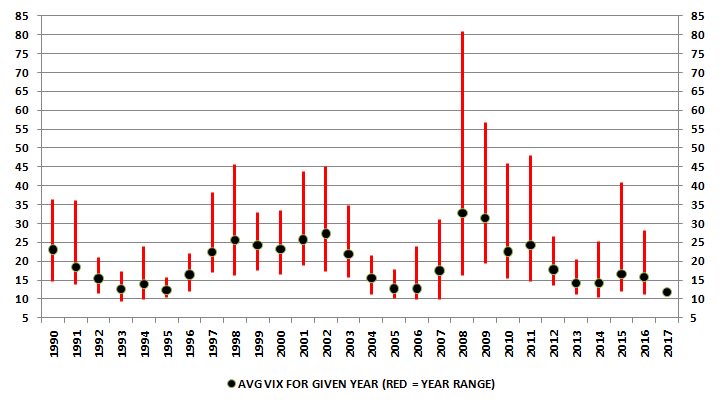

Caution to the wind. The min-max of the $VIX over last 10 years is 20.69 in 2013 (79% above current levels). $SPX $SPY $DIA $DJIA $QQQ $IWM

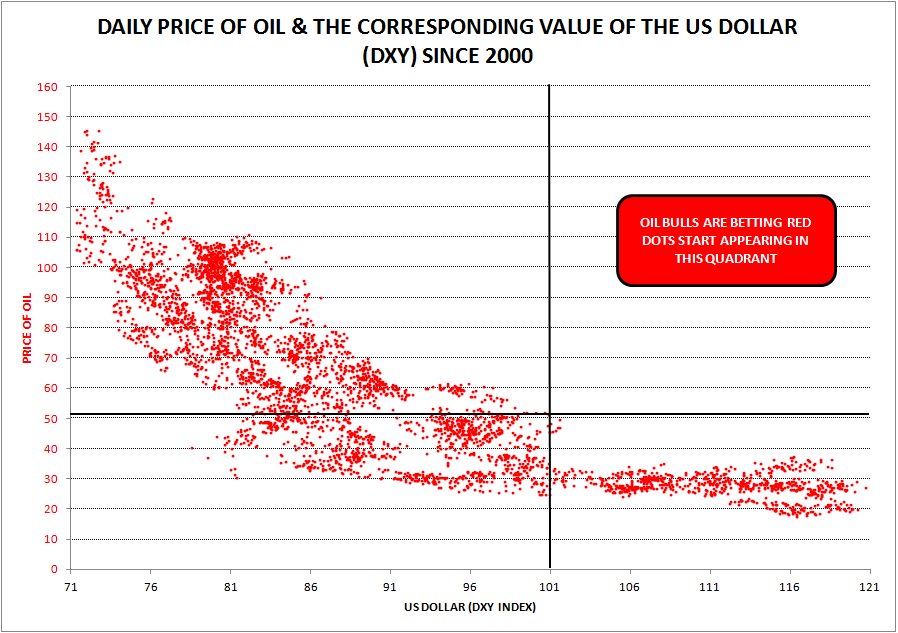

OIL BULLS ARE BETTING ON RED DOTS APPEARING IN THE FIRST QUADRANT $OIL #OIL #OPEC #OOTT $USO $CL $XLE $WTI #WTI $SPX $SPY

It appears that Icahn may have capitulated at the turn.

Remember when you buy or sell #crude #oil, you are competing with people who have devoted a good portion of their lives to the same endeavor

A first-rate #crude #oil model predicts; a second-rate model forbids & a third-rate model explains after the fact

#OPEC has very little to lose by freezing #crude #oil production when they are already close to maxing out capacity

#crude #oil market my remain imbalanced longer but ultimately end users will pay the piper for producers not replenishing depleting reserves

Two traders, one long $twtr and the other short #oil, go to happy hour this evening....who pays?

Have any $oil company secondaries hit the market yet?

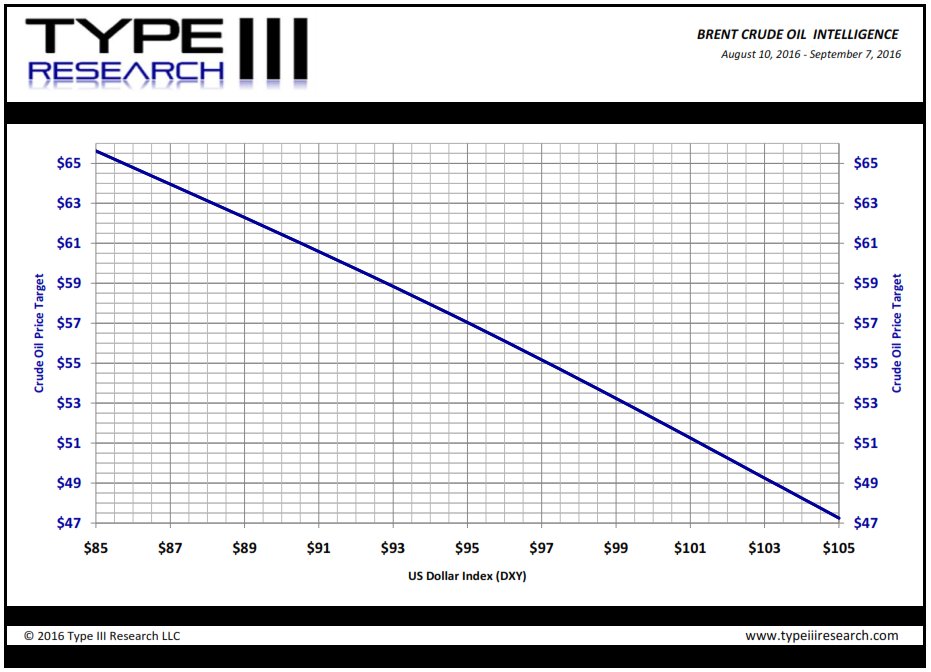

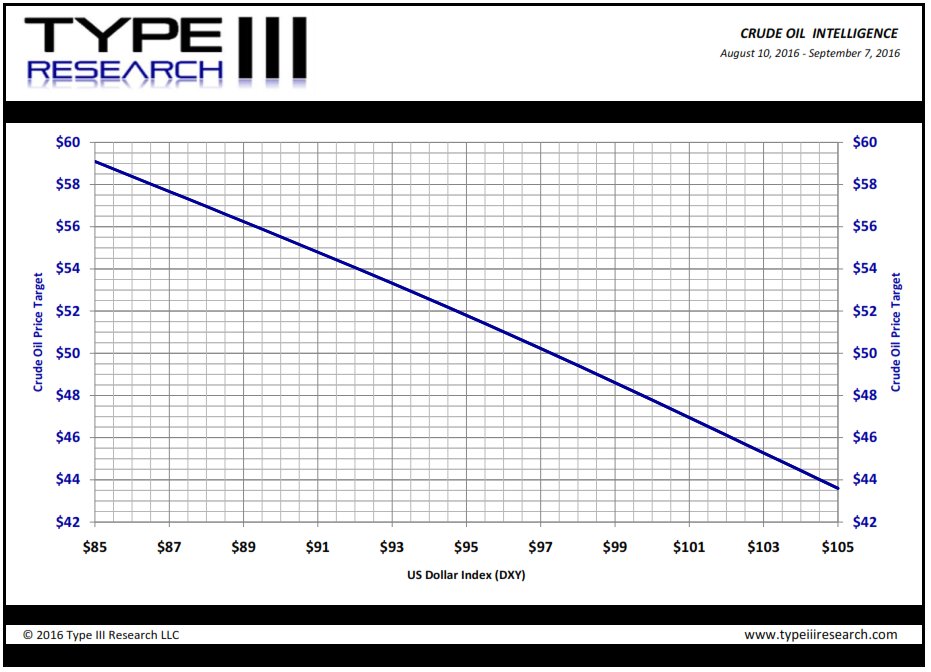

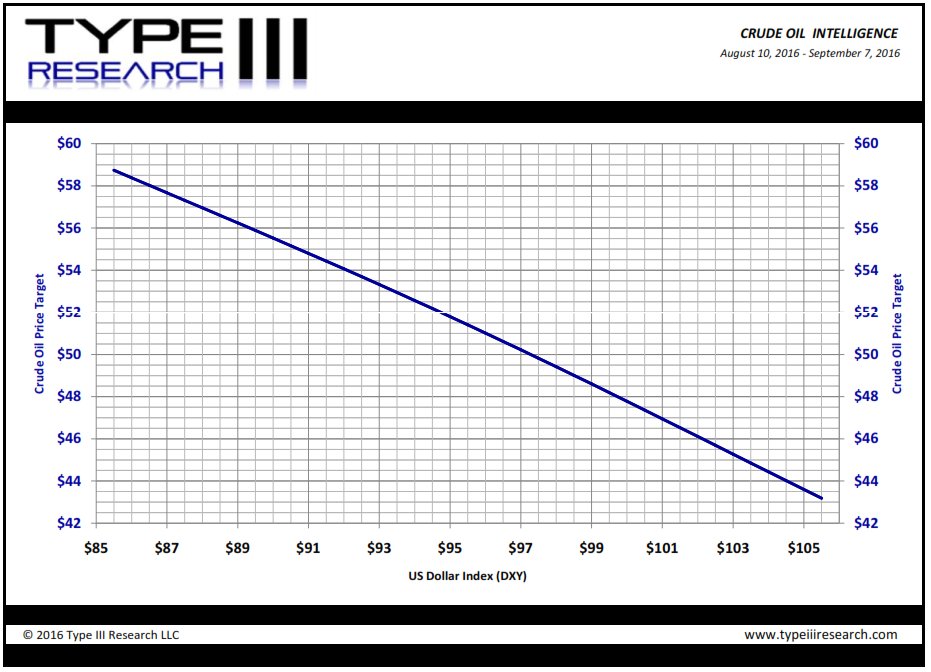

$Oil Price Target Update: -$55/bbl (assumes $DXY around $95) $xle $uso #oott #OPEC #wti #brent $CL_F #CL_F #crudeoil

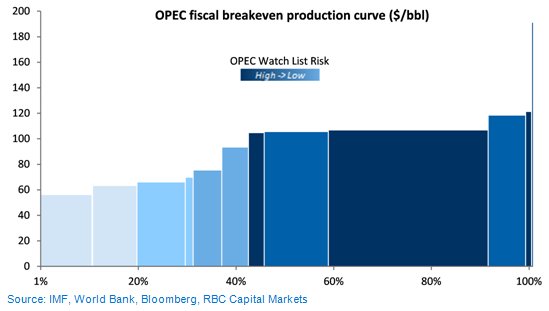

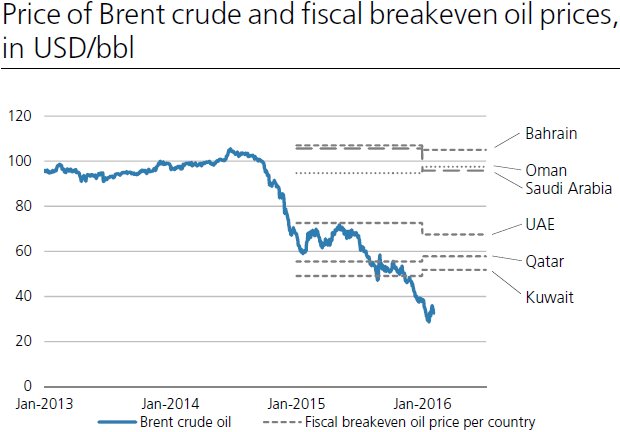

Ways of seeing, and assessing, #oil breakeven costs #Brent #WTI #OPEC #OOTT @RBS @MerrillLynch @natixis #EOG

United States Trends

- 1. McBride N/A

- 2. taemin N/A

- 3. #OrmBlossominShanghaiEvent N/A

- 4. Chase N/A

- 5. ORMKORN BA BLOSSOMIN N/A

- 6. #DragRace N/A

- 7. Gibbs N/A

- 8. #OPLive N/A

- 9. #FreenFanSignInTIANJIN N/A

- 10. SAROCHA AT TIANJIN EVENT N/A

- 11. Gobert N/A

- 12. The Rip N/A

- 13. #JustinStrong N/A

- 14. Jaylon Tyson N/A

- 15. Sengun N/A

- 16. Mandy N/A

- 17. Julius Randle N/A

- 18. Rockets N/A

- 19. Michael Cohen N/A

- 20. Dylan Cardwell N/A

Something went wrong.

Something went wrong.