OpenVC.app

@OpenVC_

Founders: raise funds from 5,000+ investors at http://OpenVC.app Investors: access top 1% deals before they close at http://OpenVC.app/flow

Może Ci się spodobać

Liz Christo shares her insights on industries ripe for disruption: - Construction and manufacturing, where legacy technology creates openings for AI-driven solutions - Vertical software, where smaller, focused markets can lead to massive wins like Procore

Should founders ask investors for a NDA before sharing their decks? The answer is no. Here are the 6 reasons why, and how you can actually protect your startup without a NDA. openvc.app/blog/nda 🔒

🚀 On this episode of The OpenVC podcast, we speak with Joakim Achren, one of Europe’s most accomplished gaming investors. He founded Next Games, which grew to 160 employees, went public, and ultimately was acquired by Netflix. youtube.com/watch?v=LC2oRP…

youtube.com

YouTube

F4 Fund General Partner: Joakim Achren, co-founder of Next Games...

This playbook is our home-made, battle-tested process to prepare a killer startup pitch deck. 2 hours of work that will save you 10x more time down the road. Read now at openvc.app/blog/startup-p… ⚡️

openvc.app

How to build a startup pitch deck

This playbook is my home-made, battle-tested process to prepare the structure, content, and design of a typical early-stage startup pitch deck. These 2 hours of prep work will save you 10x more time...

Liz Christo, General Partner at Stage 2 Capital, shares a key insight: a strong seller with great fundamentals and work ethic can excel across industries—as long as they understand the right sales motion. Her advice? Don’t overvalue industry experience. Focus instead on finding…

Here are the top pitch deck designers for startups, including their prices & past works: pitchdeckexperts.app 🫡

Liz Christo, General Partner at Stage 2 Capital, highlights two key pitfalls founders face after raising a big Series A: 1️⃣ Ramping spend too quickly under pressure to hit aggressive growth targets 2️⃣ Overvaluing industry experience in sales hiring

"Your project sounds cool, but I'm not sure it's VC fundable". If you're raising funds, you need to understand what VC fundability is and how you can improve it. Read now at openvc.app/blog/vc-fundab… 🥲

Here are some not-so-obvious insights about VCs, their incentives, their goals... ...that will help you get better deals with the investors you choose to work with! Read now at openvc.app/blog/how-to-ne… ♟️

Liz Christo on how AI and automation has led to really high volume of really bad emails getting sent

OpenVC pro tip ⚡️ Take our Fundability test for free and find out how to boost your chances with investors: fundability.app 💯

What Makes Stage 2 Capital Different? 1️⃣ Pod model: Every deal has two partners—one with a go-to-market background and one with a finance/VC background 2️⃣ Operator-powered LPs: With over 800 CROs, CMOs, and GTM leaders as LPs, Stage 2 offers founders direct access to talent…

Advisory shares are a double-edged sword. Let's venture into the realm of startup advisory shares, addressing the whys, whos... and the how muchs. Read now at openvc.app/blog/advisory-… 🫢

We have compiled and summarized 16 research papers every VC should know. Being an investor shouldn't be just about Twitter and pitch decks, here's some actual science for VC & angels. Read now at openvc.app/blog/venture-c… 🎓

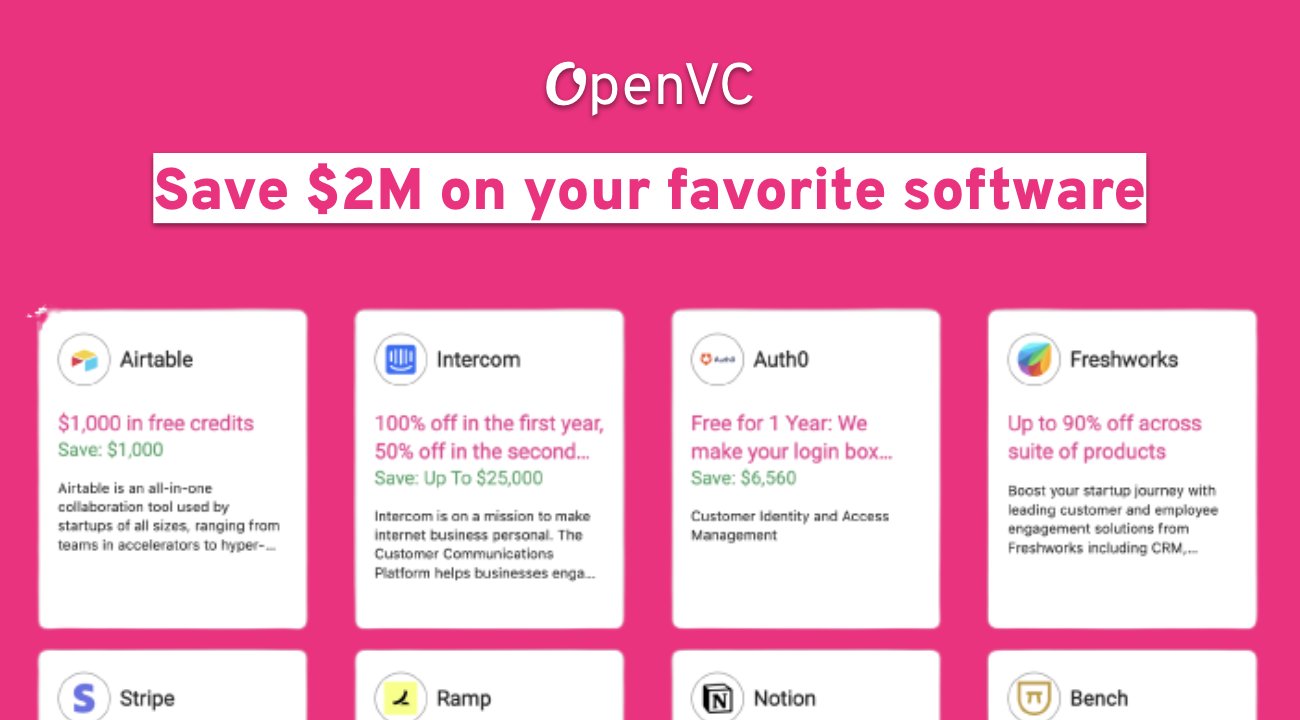

OpenVC pro tip ⚡️ Premium members get unlimited access to $250k+ in software perks: Airtable, Hubspot, Stripe, Notion... Best deal in town: openvc.app/perks 🤑

United States Trendy

- 1. Josh Allen 17.2K posts

- 2. Texans 33.4K posts

- 3. Bills 128K posts

- 4. #MissUniverse 189K posts

- 5. Maxey 7,406 posts

- 6. Will Anderson 4,577 posts

- 7. Ray Davis 2,138 posts

- 8. #TNFonPrime 2,269 posts

- 9. Costa de Marfil 14K posts

- 10. Shakir 4,519 posts

- 11. Achilles 3,816 posts

- 12. Christian Kirk 3,178 posts

- 13. James Cook 5,139 posts

- 14. Taron Johnson N/A

- 15. Woody Marks 2,764 posts

- 16. Ryan Rollins 1,250 posts

- 17. Nico Collins 1,779 posts

- 18. Adrian Hill N/A

- 19. Sedition 263K posts

- 20. #BUFvsHOU 2,491 posts

Może Ci się spodobać

-

Marge Ntambi

Marge Ntambi

@margentambi -

Everywhere Ventures

Everywhere Ventures

@EverywhereVC -

Brett Calhoun

Brett Calhoun

@brettcalhounn -

Meagan Loyst 🧚♀️

Meagan Loyst 🧚♀️

@meaganloyst -

Mike MacCombie 💬

Mike MacCombie 💬

@MikeMacCombie -

Ganas Ventures

Ganas Ventures

@ganasvc -

VITALIZE Venture Capital

VITALIZE Venture Capital

@VitalizeVC -

Sara Ledterman

Sara Ledterman

@saraledterman -

Steph from OpenVC

Steph from OpenVC

@StephNass -

Conviction

Conviction

@conviction -

Unshackled Ventures

Unshackled Ventures

@UnshackledVC -

Responsibly Ventures

Responsibly Ventures

@ResponsiblyVC -

The Fintech Fund

The Fintech Fund

@thefintechfund -

Martin Tobias (Pre-Seed VC)

Martin Tobias (Pre-Seed VC)

@MartinGTobias -

Afore Capital

Afore Capital

@AforeVC

Something went wrong.

Something went wrong.