قد يعجبك

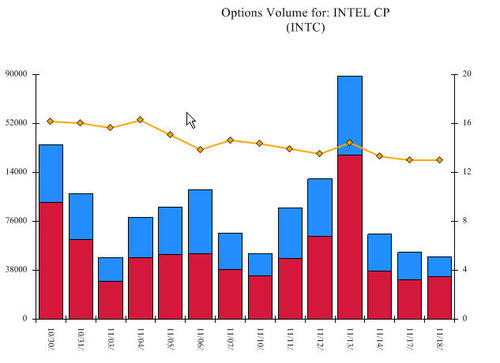

$IP Jan 2010 ratio put spread 10/12.50 traded yesterday (2:1)

Just added myself to the http://wefollow.com twitter directory under: #options #financial #trading

$VMW High put volume (spread) in May contract. Over 40,000 puts traded.

$XLE Interesting spread -May contract. Over 10,000 calls and 20,000 puts traded.

$BARE Active calls vol (Jun 5.00 5,317 contracts traded). Puts vol only 151.

$BARE Active calls vol (Jun 5.00 5,317 contracts traded). Puts vol only 151. http://www.crimsonmind.com/options/optionsSummary.aspx?s=bare

$IDCC interesting calls volume ( 9,347 Apr 30.0 traded). http://www.crimsonmind.com/options/optionsSummary.aspx?s=IDCC

$AMLN Heavy call volume today - over 20,000 calls traded. http://www.crimsonmind.com/options/ActivityWatch.aspx

$CREE Unusually high call volume (over 22,000)http://www.crimsonmind.com/options/QuoteOptionsAll.aspx?s=CREE

$ZUMZ High call volume - May contract http://www.crimsonmind.com/options/ActivityWatch.aspx

$EWZ Butterfly call spread - April contract http://tinyurl.com/cwaguq

$ZUMZ High call volume May contract. http://www.crimsonmind.com/options/ActivityWatch.aspx

$EEM High volume call ratio spread- May contract. http://www.crimsonmind.com/options/VASpreads.aspx

$BNI High volume (10,000X) call spread - July contract http://www.crimsonmind.com/options/ActivityWatch.aspx

$AMZN High volume call spread July contract http://www.crimsonmind.com/options/VASpreads.aspx

$AAPL High volume put spread May contract. http://www.crimsonmind.com/options/VASpreads.aspx

United States الاتجاهات

- 1. Eagles 95.7K posts

- 2. Jalen 23.7K posts

- 3. Caleb 43.7K posts

- 4. Ben Johnson 5,694 posts

- 5. AJ Brown 3,808 posts

- 6. Patullo 7,115 posts

- 7. Black Friday 496K posts

- 8. Sirianni 4,047 posts

- 9. Swift 56.8K posts

- 10. Swift 56.8K posts

- 11. #CHIvsPHI 2,065 posts

- 12. Lane 51.3K posts

- 13. Tush Push 4,717 posts

- 14. Nebraska 13.7K posts

- 15. Saquon 6,256 posts

- 16. #BearDown 1,240 posts

- 17. Philly 19.1K posts

- 18. Nahshon Wright 1,932 posts

- 19. Al Michaels N/A

- 20. Going for 2 9,641 posts

قد يعجبك

-

gundog

gundog

@gundogtrader -

OrangePillSky

OrangePillSky

@orangepillsky -

Trading Time Machine

Trading Time Machine

@thetrading -

Steven Burrell

Steven Burrell

@StevenBurrell16 -

Gary Compton

Gary Compton

@GaryCompton -

Catalyst Pit

Catalyst Pit

@CatlystTrading -

Stairs Up, Elevator Down

Stairs Up, Elevator Down

@YahooFinePants -

Carl Galletti

Carl Galletti

@CarlGalletti -

TradingBlock

TradingBlock

@TradingBlock -

Brian Johnson

Brian Johnson

@johnsontrading -

David Halsey

David Halsey

@EminiAddict -

Joe Black

Joe Black

@ShiftCTRL -

Charly

Charly

@buildinginai

Something went wrong.

Something went wrong.