Options_Addict

@Options_Addict

Focused on trading Indices & select (highly liquid) equities using options. Identified ways to track institutional flows in options market. Ideas = suggestions

You might like

Still overseas. What was originally supposed to be a two week trip has turned into a 7 month trip already, thanks to Covid and poor health of my parents. Anyway, I'm now geared up for trading from here and will start sharing some of my insights.

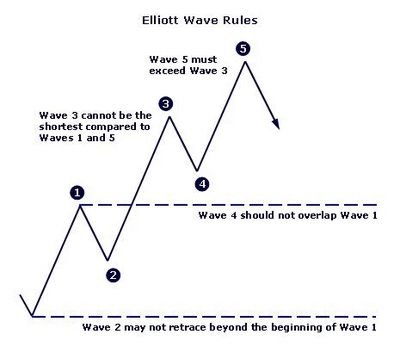

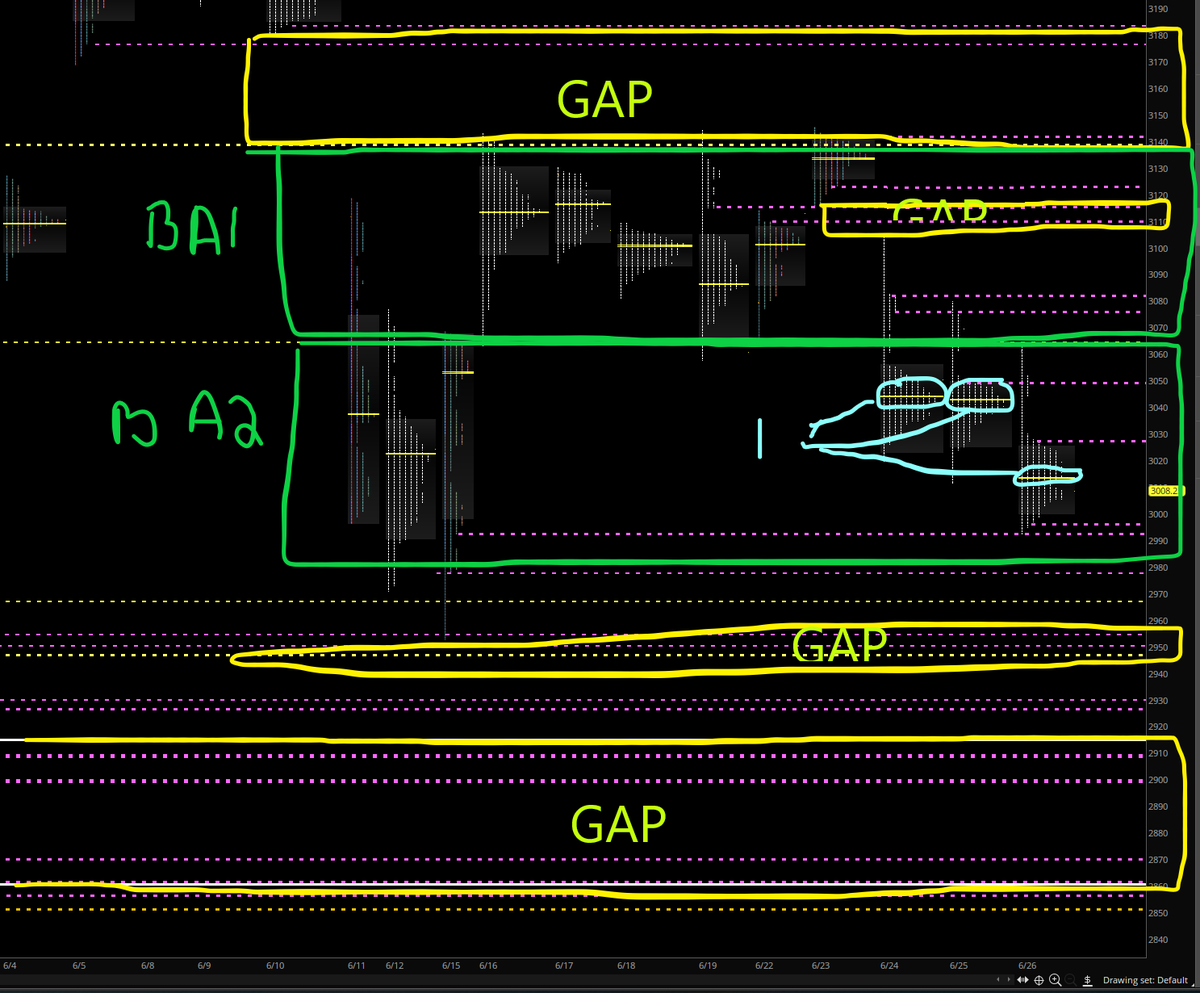

$es $spx $spy Gaps and Balance areas identified. 1. indicates even though mkt has moved down the last three days, value has not migrated lower in a meaningful way. This week, on Tuesday, Powell will be sharing his insights. On Thursday morning, we have unemployment data

Important: They bought the 310 6/29 calls doesn't mean the mkt gets there - they can take it up a little higher and for example, sell the 308 calls against it. There are all kinds of games which get played / ways to play options so don't start loading up on the 310 calls @ open.

Correction - Its important 4 the bulls to keep this above 3050 level today

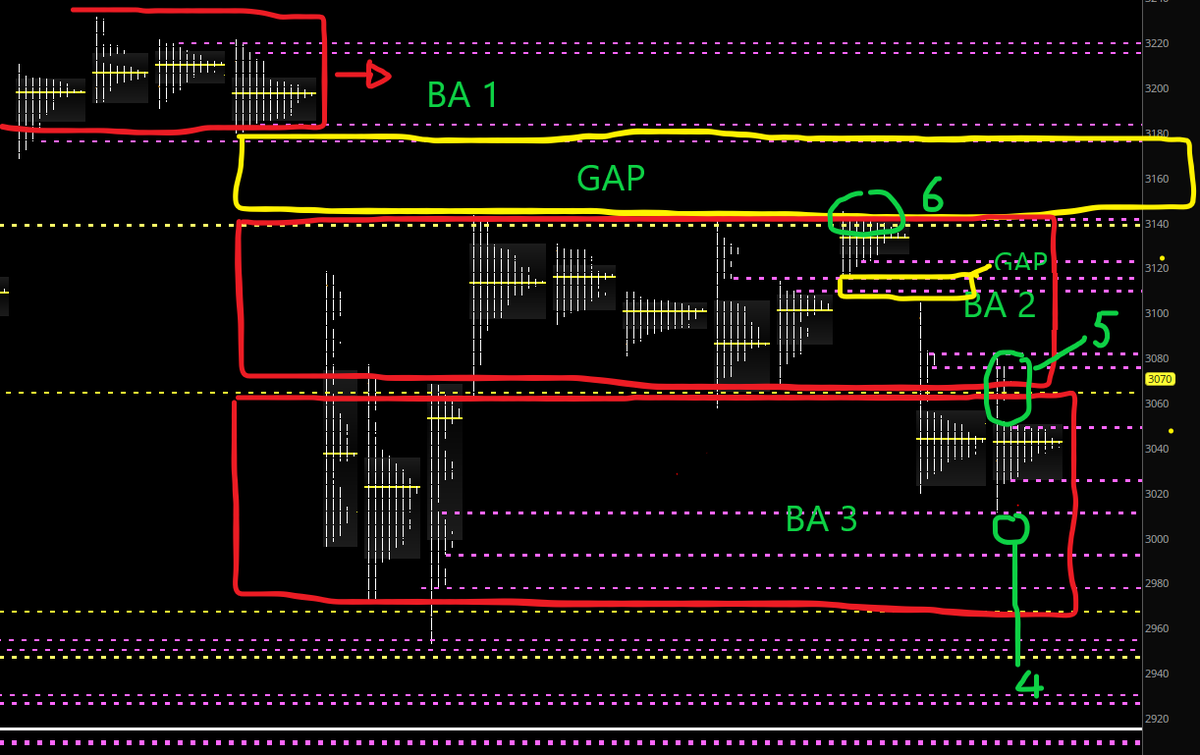

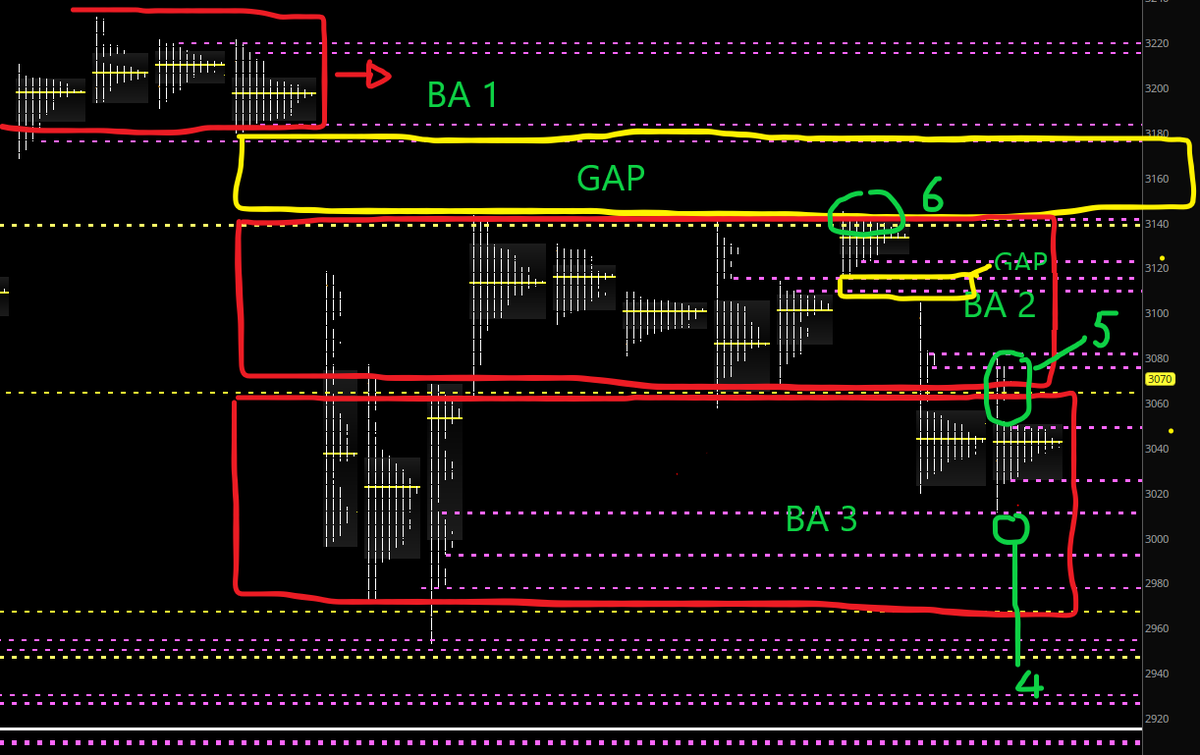

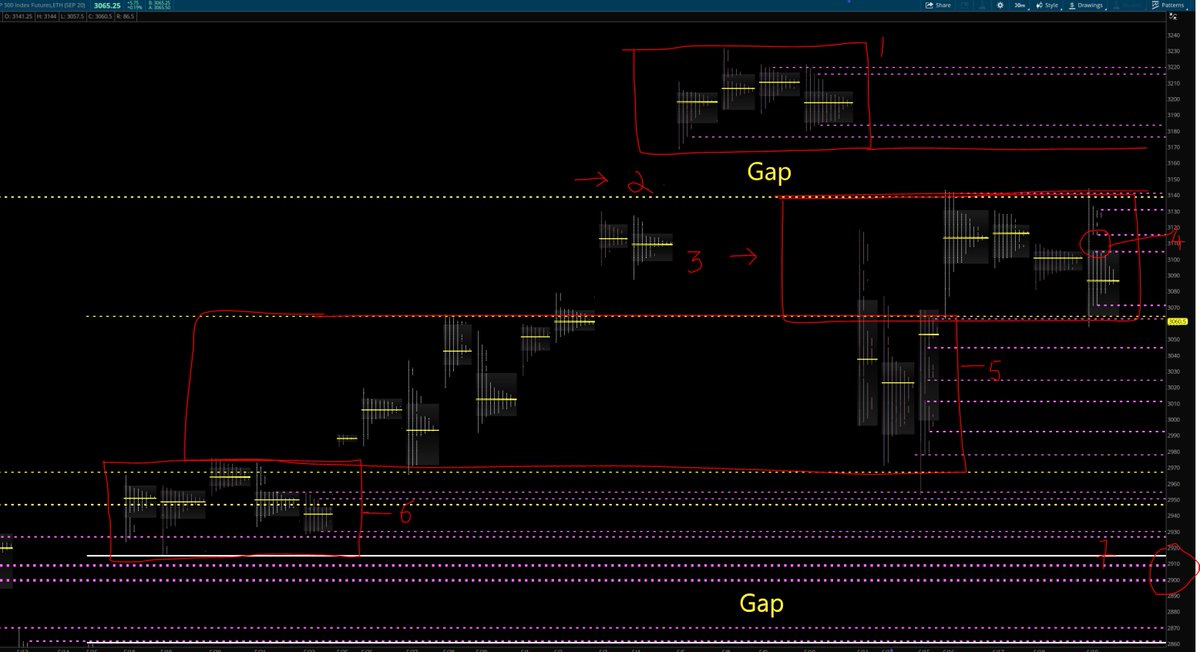

$ES $SPX $SPY BA = Balance area 4 = 200 day sma 5 = Spike 6 = Poor high Yellow dashed lines = Monthly S&R lines Its important 4 the bulls to keep this above 3055 level today There was good amount of call buying at the lows yesterday. The went aggressively after 310-6/29 calls

$ES $SPX $SPY BA = Balance area 4 = 200 day sma 5 = Spike 6 = Poor high Yellow dashed lines = Monthly S&R lines Its important 4 the bulls to keep this above 3055 level today There was good amount of call buying at the lows yesterday. The went aggressively after 310-6/29 calls

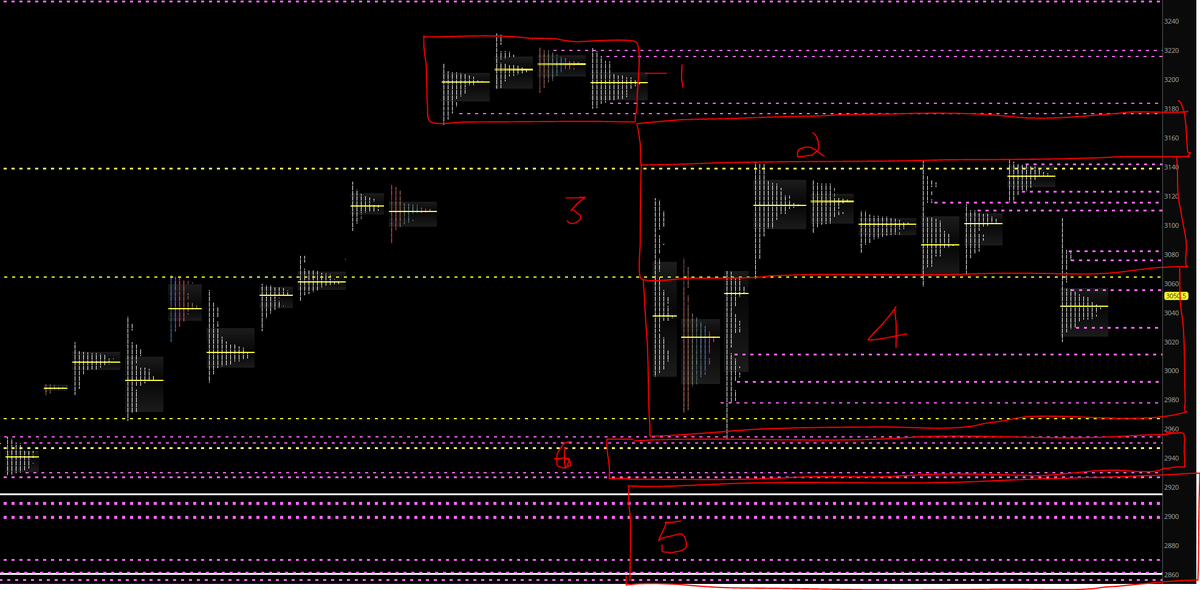

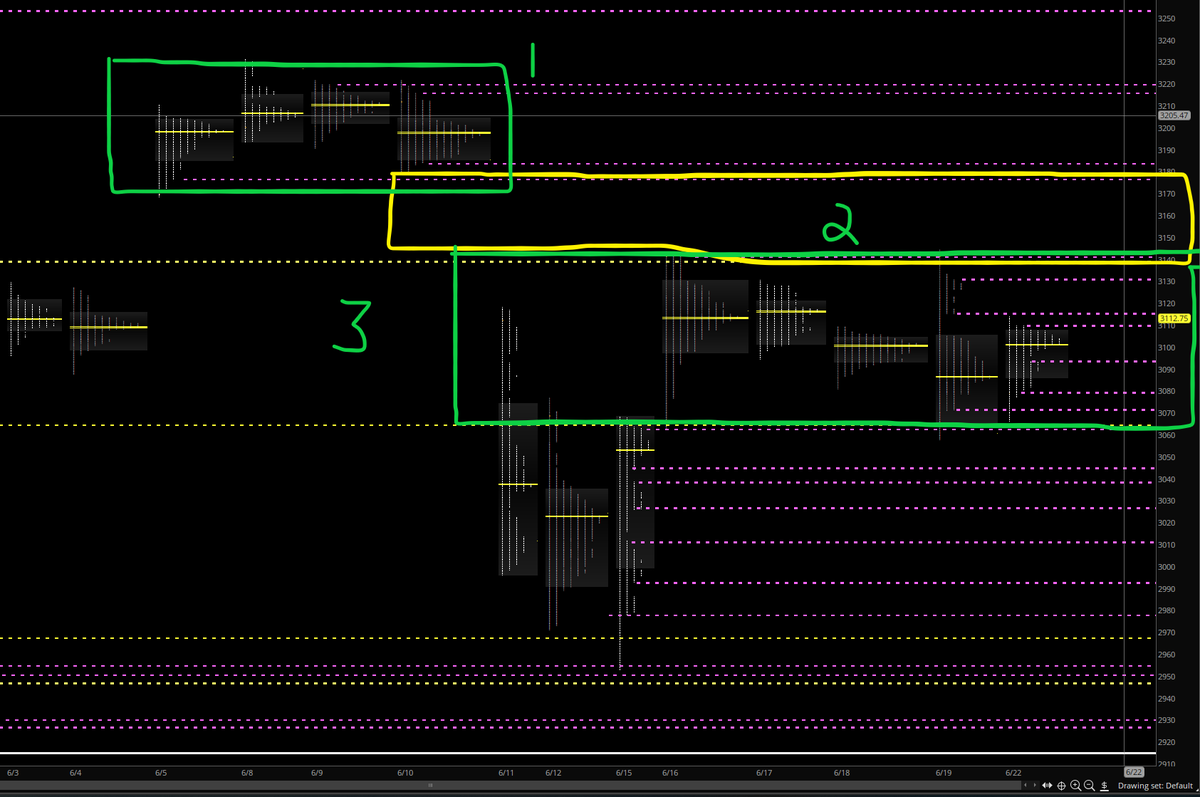

$ES $SPX $SPY 1. Balance Area (BA) 2. Gap 3. Recent BA 4. Current BA 5 Huge Gap 6. Weak area The SPX 200 day sma isn't too far below - about 30 points or so. We broke thru trend line yesterday and are sitting at it. On the $NDX and $QQQ, 20 day sma and trend line not to far below

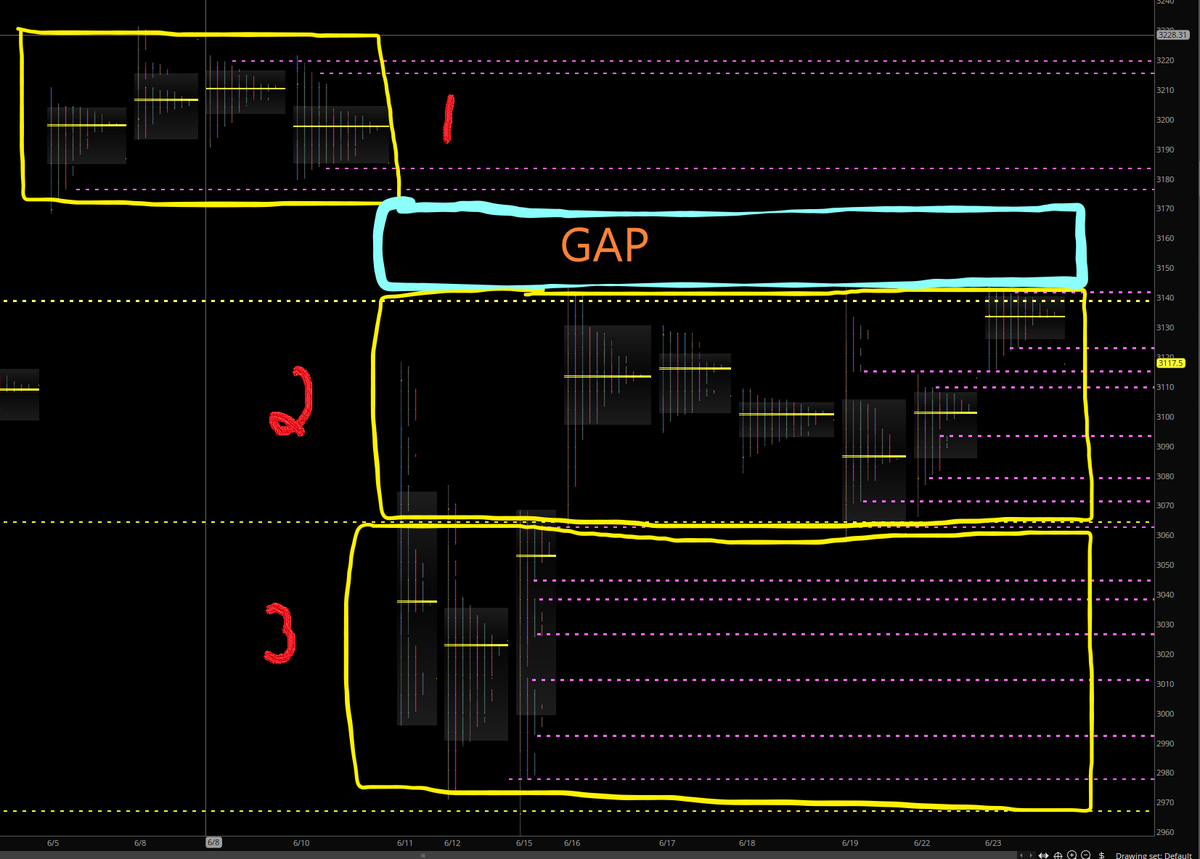

$ES $SPY $SPX 1 2& 3 All represent balance areas & mkt is stuck in zone 2. We have ATHs in the QQQs / NDX. So a fair bit of divergence coming into play between QQQ/SPY. This can't continue and something has to give. Expiration of SPY & SPX today Mkt will move a fair bit

$ES $SPY $SPX Mkt trying to work its way thru the gap today. Its overextended in the very short term but should move higher between today & tomm and into the 3180+ ish area. Wait for a liquidation break before getting long. 1. Balance area up above 2. Gap 3. Current balance area

$ES $SPY $SPX 1. Balance area 2. Gap 3. Current balance area 4. Double Distribution 5. Balance area 6. Balance area 7. Gap On the SPX/ES, the 20 day SMA @ 3087/3077 which on ES Trend line is at 3050/3040. 50 day SMA @3018/3008. Next balance area low @2970.

For some reason, my comments related to profile never went thru. My take prior 2 mkt opening, was mkt would not be able to move into the gap area & fill it...lets see what happens...will do a better job of ensuring comments get posted going fwd.. rusty after months of no activity

$VIX $SPY $SPX $QQQ $AAPL $MSFT $AMZN Although the presidential elections are still 5 months away, a VIX Call spread 65/100 strikes being initiated in 11/18 expiration! 40K/40K It appears (based on trade structure) this is a form of buying cheap protection

$SPY $SPX $QQQ $AAPL $MSFT $AMZN This Friday is triple witching expiration and the day tends to be relatively choppy. Consider closing your options positions which expire on Friday by thursday evening. Also, SPY pays dividend and the value of your calls will drop Friday AM

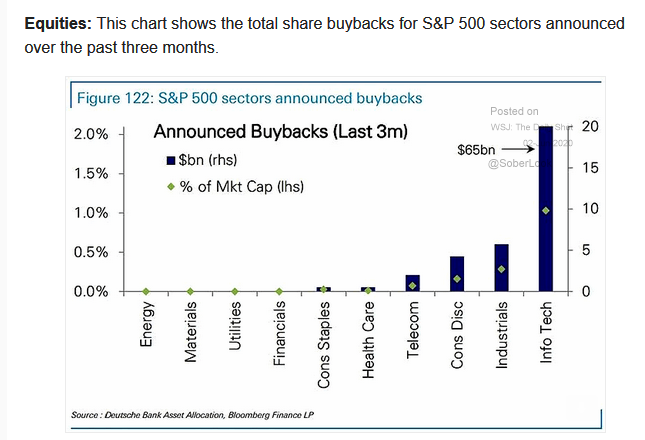

Buybacks! Low interest rates = increased debt offerings = more buybacks. This play book has been deployed very effectively since 2008-2009.

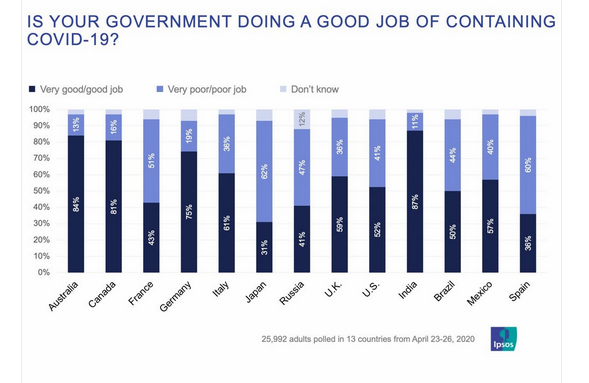

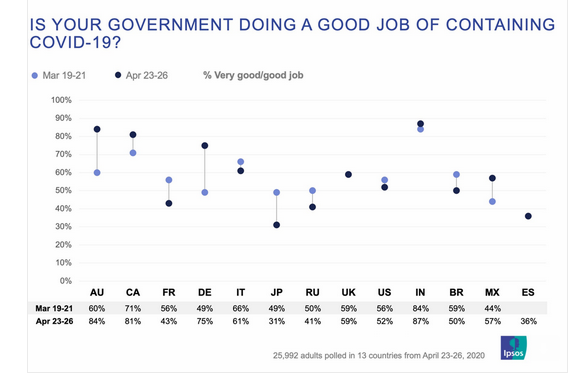

Covid and Govt responses as perceived by citizens.

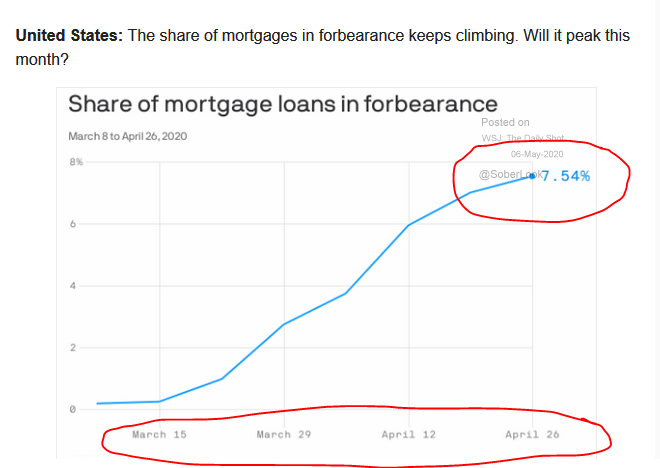

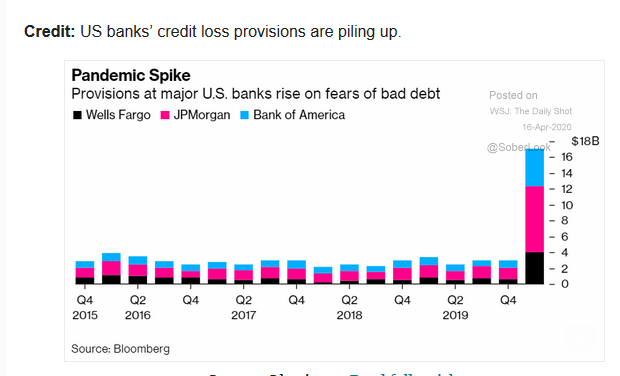

Just some general info in the next few tweets This one gives a glimpse of what is happening and how it will impact the broad economy .

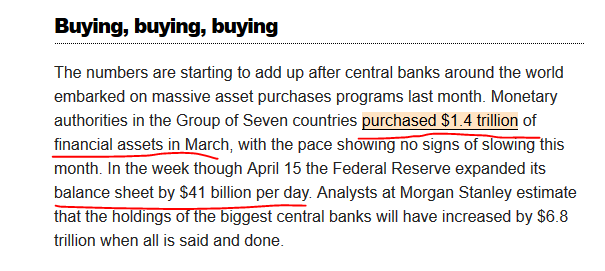

If you were wondering, what moved the markets over the last 3-4 weeks - here is your answer. I've posted on the topic multiple times since the crisis began

$BAC $JPM $C It's a good thing they are being so cautious already. They seem to have learnt their lessons well from 2008. US banking sector is much healthier this time and in a good position to weather this storm as compared to 2008/2009

United States Trends

- 1. Happy Thanksgiving Eve 1,422 posts

- 2. Good Wednesday 21.4K posts

- 3. Luka 65.2K posts

- 4. #DWTS 97.4K posts

- 5. Lakers 51K posts

- 6. Clippers 18.9K posts

- 7. Robert 141K posts

- 8. Kris Dunn 2,890 posts

- 9. Collar 46.1K posts

- 10. Jim Mora 1,046 posts

- 11. #LakeShow 3,594 posts

- 12. Kawhi 6,531 posts

- 13. Karoline Leavitt 24.8K posts

- 14. Reaves 13.6K posts

- 15. Alix 15.3K posts

- 16. Jaxson Hayes 2,633 posts

- 17. Colorado State 2,638 posts

- 18. TOP CALL 14.7K posts

- 19. Elaine 46.6K posts

- 20. Ty Lue 1,667 posts

You might like

-

Blake

Blake

@TradeTracer -

Marc-André Fongern

Marc-André Fongern

@Fongern_FX -

Margin Call

Margin Call

@margincall3825 -

Chicago Chart Guy

Chicago Chart Guy

@ChicagoChartGuy -

Henry-trades

Henry-trades

@Henry_trades -

RTN

RTN

@RTNRTN -

O'B

O'B

@Oblique369 -

DeltaTDR

DeltaTDR

@Nirav777 -

Anthony

Anthony

@NASDboy -

0range Crush, CMT

0range Crush, CMT

@0rangeCru5h -

NotZerohedge

NotZerohedge

@German_investor -

Damon Race, CMT

Damon Race, CMT

@damonrace1 -

Option Alpha

Option Alpha

@OptionAlpha3 -

mollytime ᒪᓕᑕᐃᒻ

mollytime ᒪᓕᑕᐃᒻ

@mollytime777

Something went wrong.

Something went wrong.