Origin Protocol

@OriginProtocol

Creators of $OETH, $OS, and $OUSD. Governed by $OGN. Made in America 🇺🇸

قد يعجبك

We swap, they moo. Everyone wins. Udderly efficient buybacks, powered by @CoWSwap 🐮

Alpha Access: DeFi Lending, $OGN updates, and $USDC Loans ft. @yearnfi $YFI - $ETH x.com/i/broadcasts/1…

🎙️Tune into our Alpha Access Livestream tomorrow at 12 pm EDT! We'll give updates on $OGN, walk through new integrations, and chat with @yearnfi about our Borrow Booster Markets:

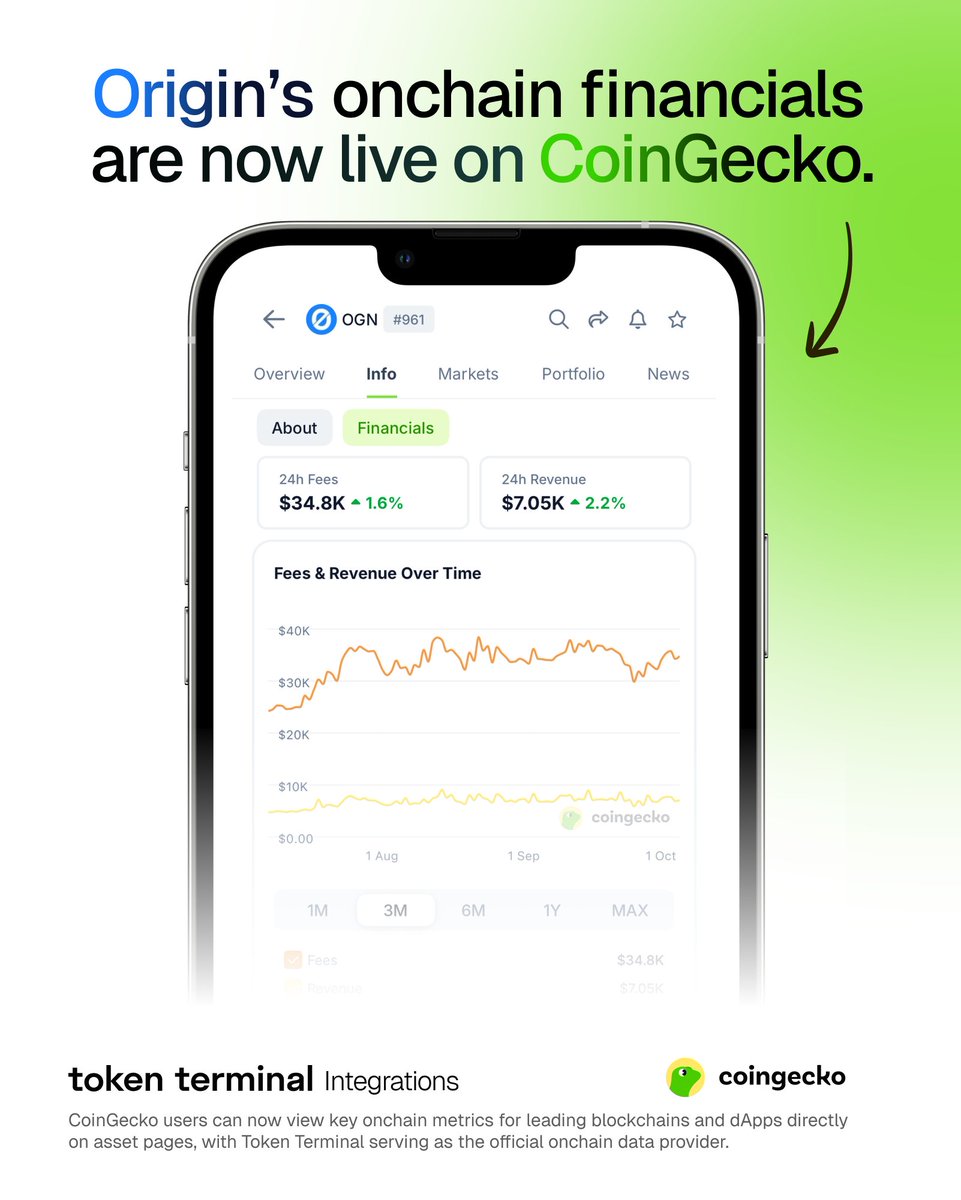

🚨🆕 @OriginProtocol's onchain financials are now live on @coingecko. Fundamentals are growing in importance.

Last week, @LidoGrants allocated $3M from its treasury to Origin's $stETH Automated Redemption Manager (ARM). Dive into how this partnership reinforces stETH’s peg while generating sustainable onchain yield: originprotocol.com/blog/lido-arm-…

More liquidity is available on the Super OETH Borrow Booster market. Borrowers are now earning 4.6% APR to take $USDC loans backed by Super OETH ⬇️

Negative Borrow Rates Now Available on Morpho for superOETHb / USDC 🦋 Origin’s new Borrow Booster forwards Super OETH yield to reduce borrow rates — creating more attractive markets for both borrowers and lenders. Now live on @MorphoLabs (1/5)

📅 It’s time for the $OGN Weekly Recap Let’s walk through the numbers and see how fees, buybacks, and staking all connect 🧵👇

🎙️ Join us at 12 pm EDT for Origin's Community Call! We'll give $OGN updates, talk product development, and highlight new integrations and yield opportunities. Tune in 👇

.@OriginProtocol, the team behind yield products like OETH and OUSD, has been pushing growth with OGN buybacks, new product launches, and integrations. Their TVL sits at $339M today. Will it exceed $345M on or before Oct 10, 2025? Place your conviction ❌⭕️

Origin’s ARM just gained a major backer. Pursuant to @LidoFinance’s grant, Lido Ecosystem Foundation is now a primary liquidity provider for the stETH ARM, allocating $3M of its treasury assets to the vault. This reinforces $stETH stability while earning yield for Lido…

Origin’s ARM is now integrated into @yield ⚙️ The yoETH vault now allocates to the stETH ARM, turning $stETH volatility into yield. ~1,000 ETH has been allocated to the ARM from the $yoETH vault, representing 10% of the vault’s assets 👇

Super OETH 🤝 Goo Money @GooMoneyfi is making a treasury allocation to Super OETH to make its ETH holdings productive. As part of our collaboration, select $OGN and #superOETHb holders will be whitelisted for their Genesis Event:

United States الاتجاهات

- 1. Bears 71.7K posts

- 2. Bills 132K posts

- 3. Falcons 45.3K posts

- 4. Snell 17.9K posts

- 5. Josh Allen 22.8K posts

- 6. #Dodgers 12.9K posts

- 7. Jake Moody 8,218 posts

- 8. Caleb 40.3K posts

- 9. Bijan 28.1K posts

- 10. Turang 3,356 posts

- 11. phil 147K posts

- 12. #NLCS 11.4K posts

- 13. Swift 285K posts

- 14. Roki 5,511 posts

- 15. Jayden Daniels 8,595 posts

- 16. AFC East 7,684 posts

- 17. Brewers 43.1K posts

- 18. Joe Brady 4,314 posts

- 19. Commanders 44.5K posts

- 20. McDermott 6,535 posts

قد يعجبك

-

THORChain

THORChain

@THORChain -

Zilliqa

Zilliqa

@zilliqa -

AirSwap

AirSwap

@airswap -

ARPA Network

ARPA Network

@arpaofficial -

Uniswap Labs 🦄

Uniswap Labs 🦄

@Uniswap -

Flamingo Finance

Flamingo Finance

@FlamingoFinance -

Polkadot

Polkadot

@Polkadot -

Contentos

Contentos

@contentosio -

Kyber Network

Kyber Network

@KyberNetwork -

Horizen

Horizen

@horizenglobal -

Qtum

Qtum

@qtum -

Waves 🌊

Waves 🌊

@wavesprotocol -

Viction

Viction

@BuildOnViction -

Synthetix ⚔️

Synthetix ⚔️

@synthetix_io -

StaFi Protocol

StaFi Protocol

@StaFi_Protocol

Something went wrong.

Something went wrong.