Paul Fox

@PFoxFin

Brussels-based Senior Research & Advocacy Officer at @forfinancewatch, tweeting on EU finance services legislation. RT/follow ≠ endorsement

You might like

🚨 Report Alert: "The Debt We Need. Reinforcing Debt Sustainability with Future-Oriented Fiscal Rules” explores debt management amidst today's challenges. finance-watch.org/publication/re…

Job alert, please share! Research & Advocacy Officer - Insurance. The ideal candidate would👇 ▶️ Have exp. in the insurance sector ▶️ Know the (re-)insurance regulatory framework ▶️ Understand fin. regulation and supervision - closes 8 May. More👇 finance-watch.org/job/job-offer-…

[📊New Report] Over 97 million people in the EU are at risk of poverty or social exclusion. That’s the equivalent of all inhabitants of DE🇩🇪, BE🇧🇪 and LT🇱🇹 combined. 1 in 3 EU households are unable to take a hit in their income equal to one monthly salary. What’s missing? 1/3

![forfinancewatch's tweet image. [📊New Report] Over 97 million people in the EU are at risk of poverty or social exclusion. That’s the equivalent of all inhabitants of DE🇩🇪, BE🇧🇪 and LT🇱🇹 combined.

1 in 3 EU households are unable to take a hit in their income equal to one monthly salary.

What’s missing? 1/3](https://pbs.twimg.com/media/FJiWNAeXsAAeJWx.jpg)

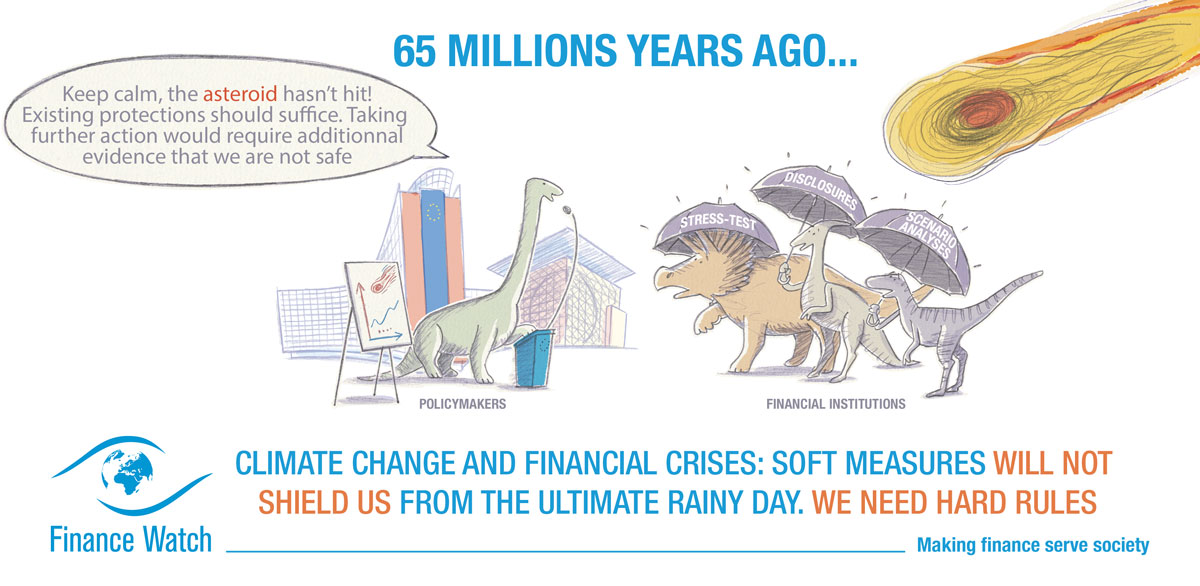

In @JuliaSymon_‘s #GreenSwan report, we discuss the best solutions among different prudential tools to tackle climate-related financial risks (#CRFR). More here 👇 #ClimateRisk #OneForOne finance-watch.org/press-release/…

Capital requirements: a “silver bullet” against the looming climate-induced financial crises👉finance-watch.org/capital-requir… #OneForOne #ClimateRisk

Join us this Wednesday for a round table "Can #sustainablefinance break the tragedy of horizons?" exploring how to tackle the “Tragedy of Horizons” by private and public means, 👉obsfin.ch/2021-buildingb…

ICYMI - our response to the Federal Insurance Office consultation on Insurance and #ClimateRisks. There is an urgent need to address capital requirements for #FossilFuel assets in US prudential rules for insurers finance-watch.org/publication/in… via @PFoxFin #OneForOne

[📊New Report] Minimum capital requirements are the cornerstone to tackling #ClimateRisk. Read our press release 1/9👉 finance-watch.org/press-release/…

![forfinancewatch's tweet image. [📊New Report] Minimum capital requirements are the cornerstone to tackling #ClimateRisk. Read our press release 1/9👉 finance-watch.org/press-release/…](https://pbs.twimg.com/media/FE8U7WwXMAoF6A0.jpg)

There is an urgent need to address capital requirements for #FossilFuel assets in US prudential rules for insurers. More details in our response to the Federal Insurance Office consultation on Insurance and #ClimateRisks 👇 finance-watch.org/publication/in… via @PFoxFin #OneForOne

Yesterday's announcement at #COP26 that the #GFANZ has up to $130tn of private capital committed to hitting #NetZero emissions targets by 2050 ignores the elephant in the room that requires urgent tackling to ensure the financial system is resilient to #climaterisks... 1/6

This weekend, @g20org and @cop26 are set to convene world leaders. Bring their attention to the role of banks' and insurers' capital rules to prevent a climate related financial crash #OneforOne @AlokSharma_RDG finance-watch.org/campaign/clima…

[📢PressRelease] @EU_Commission's review of EU banking rules sets the right objectives but is dangerously weak on climate change-related financial stability risks and implementation dates. Read👉finance-watch.org/press-release/… 1/8

![forfinancewatch's tweet image. [📢PressRelease] @EU_Commission's review of EU banking rules sets the right objectives but is dangerously weak on climate change-related financial stability risks and implementation dates. Read👉finance-watch.org/press-release/… 1/8](https://pbs.twimg.com/media/FCtaxELXsAYDM3H.jpg)

[JobAlert] Do you know an expert in #insurance regulation files? Please share and help us make EU financial regulation serve society 👇#ClimateRisk #SolvencyII #IRRD finance-watch.org/job/job-vacanc…

Big news: @algore seems to endorse our proposal to #BreakTheDoomLoop: "Gore believes that banks’ regulatory capital requirements should be changed to incorporate #climatechange" ft.com/content/a8884d…

⚠️Important for the review of the #EUfiscalRules ⚠️ "The main political parties in the Netherlands are discussing a new approach to climate-related investments that would mean they don’t count toward the country’s headline budget deficit." 👉 bloomberg.com/news/articles/… 1/3

bloomberg.com

Dutch Consider Budget Loophole to Boost Green Investments

The main political parties in the Netherlands are discussing a new approach to climate-related investments that would mean they don’t count toward the country’s headline budget deficit.

🤔Sustainable investments are not necessarily less risky investments. @eiopa_europa_eu & @EBA_News's work on the prudential treatment of such exposures should NOT become a backdoor for an unjustified relaxation of capital requirements 1/6 eiopa.europa.eu/media/news/eio…

“If the capital requirements do not take into account climate change risks, banks will sooner or later need public bailouts again,” @BenLallemand told @EURACTIV #FossilSubprimes #BreakTheDoomLoop #CRR4climate #Solvency4climate euractiv.com/section/econom…

euractiv.com

Hedge fund billionaire calls for higher capital requirements for fossil fuel financing | Euractiv

Days before the Commission is expected to publish its proposal to change capital requirements rules, billionaire hedge fund manager Chris Hohn called for a stricter treatment of fossil fuel investm...

Today´s @NGFS_ report demonstrates clear limits to supervisory actions on climate-related risks to the financial sector. It is time for regulators to step in and amend prudential capital requirements – first of all for fossil fuel exposures – to reflect climate risks 1/6

Today, the NGFS published the report "Scenarios in Action: a progress report on global supervisory and central bank climate scenario exercises". ▶ Read more: ngfs.net/en/communique-… The report is part of the NGFS’ contribution to #COP26. More coming soon!

[Press Release] Finance Watch calls for EU policymakers to remove fiscal rules handcuffs to build a resilient future: securing long-term sustainability is our duty vis-à-vis today’s youth. No #DebtSustainability in an unsustainable world... #FiscalMatters finance-watch.org/press-release/…

After last year's shock, Europe's economy is recovering strongly. But the crisis has made some challenges more visible, such as higher deficits and debt, and investment needs. To tackle them, we are relaunching a debate on the review of the #EUEconomicGovernance.

United States Trends

- 1. Indiana 153 B posts

- 2. Indiana 153 B posts

- 3. Mendoza 49,5 B posts

- 4. Giannis 9.648 posts

- 5. Dante Moore 17,3 B posts

- 6. Jabari 3.122 posts

- 7. Cignetti 24,1 B posts

- 8. Dan Lanning 8.372 posts

- 9. 2019 LSU 3.728 posts

- 10. #PeachBowl 5.678 posts

- 11. #iufb 7.777 posts

- 12. #TheLastDriveIn 3.380 posts

- 13. #NeverDaunted 5.420 posts

- 14. #DragRace 8.448 posts

- 15. Stein 8.235 posts

- 16. Blazers 3.401 posts

- 17. Konvy 3.257 posts

- 18. Grayson Allen N/A

- 19. Phil Knight 1.111 posts

- 20. Hamas 132 B posts

Something went wrong.

Something went wrong.