ParallelWealth

@Parallel_Wealth

Retirement Planning Specialists - Helping Canadians Coast to Coast.

You might like

1/6 Retirement on your mind? Here are the 5 things you need to look at when you are planning out your retirement. #FinancialPlanning #RetirementTips

Most people wait to pass down wealth — but often, giving earlier makes more sense. Lower taxes. Less OAS clawback. More impact.

This week we’re talking RRSP taxes, TFSA estate traps, OAS clawbacks — and yes, whether AI can really build your retirement plan. 🎙️ Head over to your favourite podcast platform for today’s episode of Retirement Unpacked!

Planning to retire around your birthday? The right month could make a bigger financial impact. Dive deeper on this week's podcast episode...out now! Check it out 👉 linktr.ee/retirement_unp…

TFSA overcontributions are on the rise (and CRA’s no longer giving passes). We cover that and plenty more in Episode 7 of Retirement Unpacked — out now!

The best “sleep at night” strategy in retirement? Have a cash wedge...Keep 1–3 years of cash aside for spending needs. It protects you from market dips and panic moves.

Wishing everyone a restful and happy Thanksgiving weekend! 🍁 Looking for something to do? Catch the latest episode of Retirement Unpacked or dive into more retirement topics on our YouTube channel. linktr.ee/parallelwealth

linktr.ee

Parallel Wealth | Instagram, Facebook | Linktree

View parallelwealth’s Linktree to discover and stream music from top platforms like YouTube, Spotify here. Your next favorite track is just a click away!

Retiring with an RRSP? How you draw it down matters. Waiting and only taking the minimum can leave a huge RRIF balance taxed at nearly 50% when you pass away. Start planning earlier, melt it down wisely, and keep more of your money.

Episode 4 of Retirement Unpacked is live! Head over to YouTube or another podcast platform to listen! linktr.ee/retirement_unp…

Should you set up a line of credit before heading into retirement?

🚨OUT NOW! Retirement Unpacked Ep. 3 | Too Much RRSP? RRIF Withdrawals, CPP Rumours, and Retirement Tax Strategies Check it out here: linktr.ee/retirement_unp…

Gifting kids money for a home? Without legal protection, half could vanish in a divorce. Full convo on Ep. 2 of Retirement Unpacked👉 linktr.ee/retirement_unp…

Retirement Unpacked Ep. 2 is out tomorrow at 6AM PST! Adam and Brett are diving into popular topics from care costs to CPP timing. 👉 Don’t miss it – follow & listen on your favorite podcast app! linktr.ee/admin

Retirement planning isn’t just about investments. It’s about big spending decisions. Cars, boats, cottages – can you afford them without derailing your plan?

Episode 1 of Retirement Unpacked is live! Adam and Brett dig into CPP survivor myths, TFSA rules, cash wedge strategies, and more. Listen now on Spotify, Apple, or YouTube. Watch it here: youtu.be/D0wZdQiY3co

Big news! Our new podcast, Retirement Unpacked, launches Sept 6! We’ll answer YOUR Canadian retirement questions – CPP, TFSA, taxes, lifestyle and more. Available soon on YouTube, Spotify & Apple Podcasts.

Retirement has phases. Your go-go years are the time to check off the bucket list. Don’t wait until you can’t do the big adventures. ✈️ Spend intentionally, plan wisely, and live fully while you can.

United States Trends

- 1. Seahawks 19.8K posts

- 2. Giants 65.7K posts

- 3. Bills 135K posts

- 4. Bears 58.5K posts

- 5. Caleb 47.8K posts

- 6. Dart 25.5K posts

- 7. Daboll 11.2K posts

- 8. Dolphins 32.1K posts

- 9. Jags 6,632 posts

- 10. Rams 15.9K posts

- 11. Josh Allen 15.5K posts

- 12. Texans 37.4K posts

- 13. Russell Wilson 3,906 posts

- 14. Browns 37K posts

- 15. Patriots 104K posts

- 16. Ravens 37K posts

- 17. Henderson 17K posts

- 18. Trevor Lawrence 2,452 posts

- 19. Bryce 15.4K posts

- 20. Drake Maye 15.6K posts

You might like

-

⚫️⚫️⚫️

⚫️⚫️⚫️

@wayt0dark -

🌸 Carye Nymph 💖 Vartist ES/EN 🌙

🌸 Carye Nymph 💖 Vartist ES/EN 🌙

@CaryeNymph -

JF Desmarais

JF Desmarais

@rjfdesmarais -

Music To Fight Evil

Music To Fight Evil

@musicfightevil -

shadow

shadow

@sansjr12 -

Kent_Trades

Kent_Trades

@daperss -

The Collector - Stock Collector

The Collector - Stock Collector

@StockCollector_ -

J0nyboy

J0nyboy

@j0nyboy7 -

Delta, do canal akaDeltaBR

Delta, do canal akaDeltaBR

@codinomedelta -

Clint Dunham

Clint Dunham

@ClintDunham -

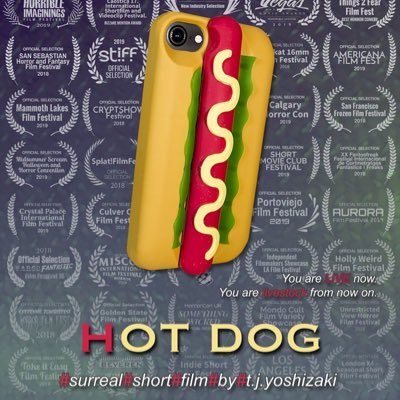

Hot Dog - surreal movie

Hot Dog - surreal movie

@DogSurreal -

Dom Peri ☧

Dom Peri ☧

@dom_peri_ordo -

M A 𝕏

M A 𝕏

@Mackslann -

Robert P. Newman, MBA, Esq.

Robert P. Newman, MBA, Esq.

@rpnewmanlaw -

Braden McMillan

Braden McMillan

@Mr_McMill

Something went wrong.

Something went wrong.