Pattern Hawk

@PatternHawk

Part Time Trader. 14+ yrs experience. Focused on Technical Analysis, Momentum & Swing Trader. Posts are for educational purposes and NOT financial advice.

You might like

$COST bears about to bring the boom? 💥

Time to put up or shut up. ✔️ $NKE

A $SPY seller's dream scenario for next week would look something like this:

Watching today for signs of rotation into different sectors OR more selloff pressure.

WHAT A MOVE. 🩸 $SPY Highest one-day volume since the August 5th bottom.

$SPY erased over two months of gains today.

BREAKING 🚨: China Chinese ETFs on track for largest monthly outflow in history

$LMND Textbook selloff here on hourly chart. Nice 0dte option trade +100%!

From IBD this weekend.

JUST IN 🚨: New York Stock Exchange to extend trading to 22 hours a day. Opening at 1:30 am and closing at 11:30 pm EST.

The lack of confirmation for new record highs for the S&P 500 is still a major divergence that should not be ignored. Historically, this has preceded corrective volatility in markets seen in 2007, 2018, 2020, and 2022.

$SPY bulls need to invert the chart and ask themselves a serious question... Would you fade this chart right now? 🤔

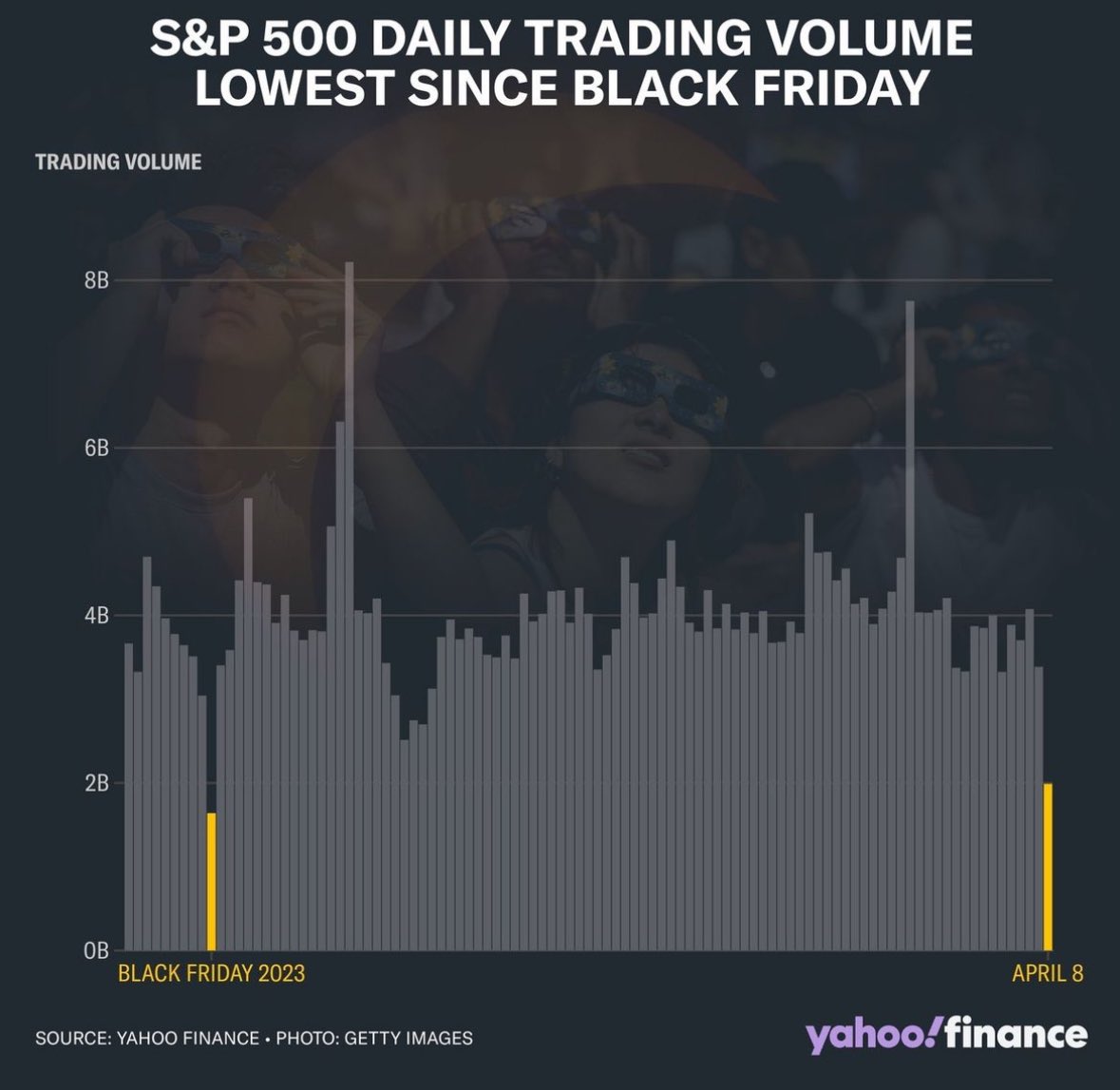

Today was the lowest trading volume for the S&P 500 since Black Friday 👀

Stay level-headed through this week's chaos. $SPY $SPX thesandboxdaily.com/?utm_campaign=…

Markets still range bound for last 2 weeks. $SPY closest to retesting highs (vs $DIA, $QQQ, $IWM). Volume has been lower at market opens vs higher near EOD. Currently, not much signal coming from sectors. Still keeping close eye on precious metals $GLD $SLV

Today & tomorrow are going to be important for next direction on overall market. I could be wrong, but don't believe we just however sideways. Things on watch for me. ▪︎ Strength of different indexes ▪︎ Sector strength and rotation ▪︎ Volume ▪︎ Leaders vs Losers

A little impressed $AAPL held up these last 2 days and didn't completely break down at key levels.

United States Trends

- 1. Cowboys 28.4K posts

- 2. Colts 36.8K posts

- 3. Chiefs 74.7K posts

- 4. Giants 82K posts

- 5. Gibbs 16.2K posts

- 6. Jameis 40.6K posts

- 7. Jerry Jeudy 2,624 posts

- 8. Turpin 2,392 posts

- 9. Lions 59.6K posts

- 10. #FlyEaglesFly 8,747 posts

- 11. Steelers 51.8K posts

- 12. Bears 68.6K posts

- 13. JJ McCarthy 7,756 posts

- 14. Shedeur 38.9K posts

- 15. Smitty 3,402 posts

- 16. Mahomes 18.7K posts

- 17. Vikings 30.7K posts

- 18. Shane Bowen 2,711 posts

- 19. Tomlin 7,653 posts

- 20. Ceedee 3,228 posts

You might like

-

Tomikazi

Tomikazi

@Tomikazi1 -

RJTrades

RJTrades

@RJTtrades -

Avery

Avery

@ATMSnipes -

Sean trades

Sean trades

@SRxTrades -

July

July

@JulyPeppers -

Rambo

Rambo

@mohankonuru -

SundayStockTalk

SundayStockTalk

@SundayStockTalk -

Thanos

Thanos

@Dougie_dee -

stockhunter84

stockhunter84

@stockhunter841 -

mash

mash

@mash_trades -

Nikko

Nikko

@soalokkiN -

Melody Rei

Melody Rei

@MelodyRei1 -

Preston

Preston

@Somepreston -

Warren

Warren

@Warren_Bruh -

fug

fug

@fugstocks

Something went wrong.

Something went wrong.