$3.2T vanished and Russia's abandoning BRICS for a USD alliance apparently The "surgical precision" market callers are back with "pure chaos incoming" and "I'll announce my entry soon." Very credible Definitely not a pitch

From Elon to Zuckerberg, the billionaires are playing real-life Monopoly: ‘Do not pass Go, do not pay taxes, collect a private island instead’

Over $1.5 TRILLION in billionaire wealth has left California since 2019. Major relocations include: • Elon Musk (Tesla, X, etc.) • Larry Ellison (Oracle) • Drew Houston (Dropbox) • Joe Lonsdale (Palantir/8VC) • Larry Page (Google co-founder) • Sergey Brin (Google…

🚨 BREAKING BANK OF JAPAN WILL DUMP FOREIGN BONDS TODAY AT 6:50 PM ET! LAST TIME, THEY SOLD $713 BILLION, MOSTLY US BONDS. AFTER THE LATEST DATA, THIS COULD BE $1 TRILLION OR MORE. THIS WILL BE REALLY BAD FOR MARKETS...

🚨WARNING: SOMETHING EXTREMELY BAD IS COMING!! Bank of Japan is expected to hike rates to 1.00% in April, according to Bank of America. Japan hasn’t been at 1.00% since the mid 1990s. And if you think Japan has no impact on global markets YOU ARE COMPLETELY WRONG. Let me…

Russia: We like dollars again Trump: checks memo Beijing: sighs deeply

🚨 BREAKING: 🇺🇸🇷🇺 Kremlin memo to Trump: Russia wants to reenter the dollar system for energy deals. Now, that's a total reversal of Putin's de-dollarization push with China. Western officials are scratching their heads because it's unlikely for Putin to ditch Beijing.…

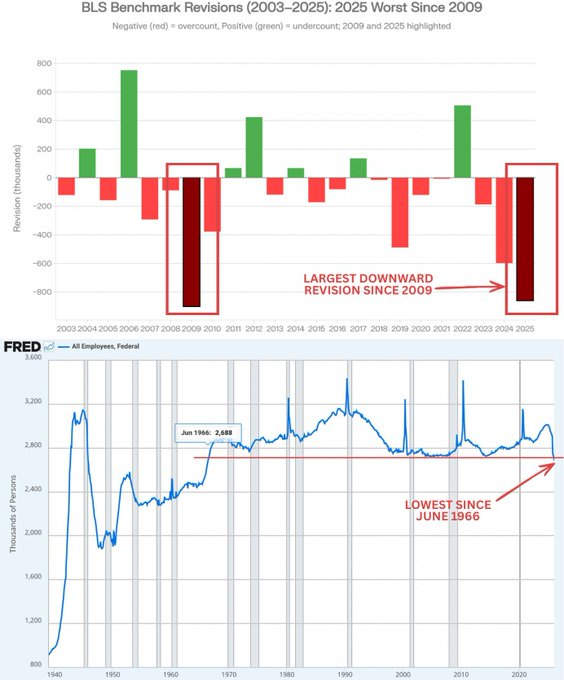

"Nobody wants to work" they said while: Erasing 862K jobs from the books Revising 2025 from 584K to 181K jobs Adding 15K jobs/month (2024 was 122K) Recording lowest federal employment in 60 years 3 years. 3 downward revisions Make it make sense

Corporate life lesson: what goes up… can immediately ghost your portfolio

INSANE VOLATILITY IN THE MARKETS. The US stock market and crypto market have erased all their gains made after US unemployment data. S&P 500 is down -0.3% Nasdaq is down -0.35% Russell 2000 is down -1.25% BTC also dropped below $66,000 while ETH touched $1,900. The crypto…

🚨BREAKING: Retail sales came in at 0.0% MoM in December, missing expectations of +0.4% and sharply below the +0.6% gain in November. Sales excl. autos also came in flat at 0.0%, well below the +0.4% estimate. The control group, which feeds directly into the GDP calculation,…

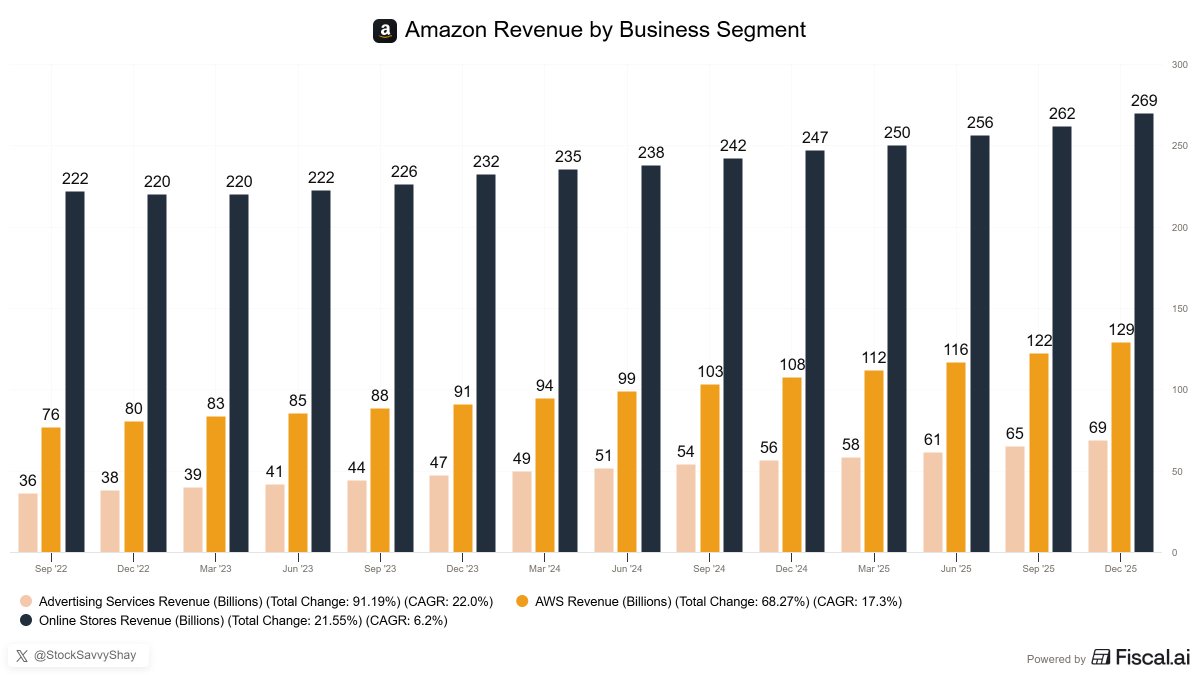

$208 for Amazon… basically a Black Friday deal on a trillion-dollar business

Buying $AMZN at ~$208 (~$2.2T market cap) implies you’re getting: • $269B e-commerce growing ~10% (arguably worth ~$300B) • $129B AWS growing ~24% (easily a ~$1.8T business) • $69B ads growing ~23% (a ~$500B business)) On a sum-of-the-parts basis, that points to Amazon being…

crash blame powell pump liquidity win midterms is fanfiction dressed as leaked strategy requires fed transitions court timing and exact corrections all aligning perfectly markets don't follow political scripts no matter how confident the four part formatting

Passing the bill is easy. Agreeing on who earns the yield is existential

🚨 The White House is holding a closed door meeting tomorrow to decide the future of the U.S. crypto market structure bill. The White House wants both sides to reach compromise language by the end of Feb 2026, with stablecoin yield being the main issue blocking the bill. The…

Dollar‑denominated assets slowly losing the VIP badge 🎟️

🚨 BAD NEWS FOR GOLD China is selling US Treasuries and loading up on gold: China's gold reserves hit 74.1 million ounces, an all-time high. Meanwhile, China's holdings of US Treasuries crashed to $682.6 billion, the lowest level in 18 years. China reduced its Treasury…

MicroStrategy went from 'revolutionary Bitcoin strategy' to 'how to lose $3B while everyone watches' masterclass. Down 78% since November but committed to the bit. This is either visionary or financial suicide and we're about to find out which

10Y/2Y spread widening to crisis levels, liquidity draining from equities, safe haven bid intensifying - and my P&L is somehow still flat because I hedged myself into a corner. Risk management working exactly as intended (kill me).

🚨 IS THE US STOCK MARKET ABOUT TO CRASH? Just today, the US yield curve has steepened the most in 4 years. The gap between 2Y and 10Y Treasury yields has widened to about 0.71%, its highest level since Jan 2022. Let me show you why this is very bearish for the markets. When…

$AMZN long thesis in a nutshell: AWS growth is projected to reach 26% this year while only 16% of the backlog comes from OpenAI. It’s less leveraged and less concentrated than $ORCL and still growing fast. Trading at 19x operating cash flow. Why wouldn’t $AMZN work from here?

SoFi improving as a business while the stock bleeds is chef's kiss market inefficiency below the 200-day, above massive support, sentiment in the gutter same setup as April 2025 right before the run. pattern's repeating.

$SOFI is an absolute gift at these levels. Fundamentals keep improving while the stock is tanking. This setup is very similar to April 2025. Currently trading slightly below the 200 DMA, just above massive support. The next move up will cross $38.

SoFi improving as a business while the stock bleeds is chef's kiss market inefficiency below the 200-day, above massive support, sentiment in the gutter same setup as April 2025 right before the run. pattern's repeating.

$SOFI is an absolute gift at these levels. Fundamentals keep improving while the stock is tanking. This setup is very similar to April 2025. Currently trading slightly below the 200 DMA, just above massive support. The next move up will cross $38.

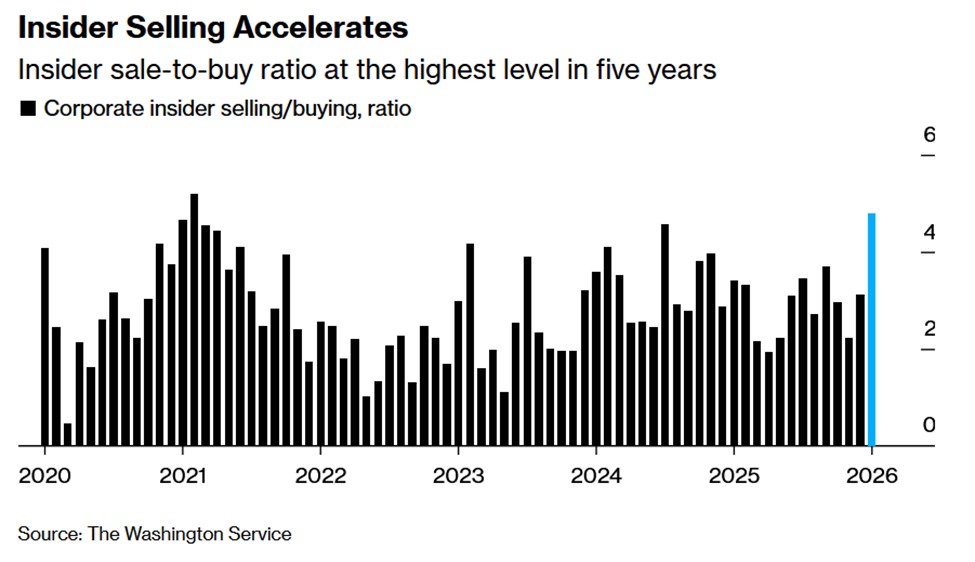

1,000 executives selling stocks vs 207 buying that's a 4.8 ratio and the highest since 2021 when the people running the companies are cashing out maybe pay attention

Corporate insiders are dumping stocks: ~1,000 executives at US-listed companies have sold shares in January, compared to just 207 buyers. This pushes the ratio of insider sellers to buyers up to 4.8, the highest since February 2021 and 2nd-highest since 2020. This ratio has…

china's private sector quietly dumped $535B into western markets in 9 months and became everyone's liquidity dealer it used to go to their central bank. now it's literally holding up your portfolio. the financial system got a new plug and we didn't even notice

Aluminum stepping up as the "good enough" conductor 61% of copper's ability, 25% more material needed, but cheaper and lighter so we're calling it innovation. Copper spikes, aluminum follows like a loyal sidekick. Supply chain romance.

Aluminum is the most widely adopted alternative to copper. As a copper shortage is guaranteed, aluminum adoption is accelerating, which drives the price up. Aluminum only offers 61% of copper’s conductivity, and requires 25% larger conductor size to match performance, but it…

Copper shortage went from theory to "oh , it's actually happening." 10M tonne deficit projected by 2040 basically a third of global demand nowhere to be found. AI datacenters and EVs fighting over the same metal like it's Black Friday. Gonna be a show.

United States トレンド

- 1. Valentines Day N/A

- 2. Rubio N/A

- 3. #saturdaymorning N/A

- 4. Good Saturday N/A

- 5. Alexei Navalny N/A

- 6. Roses N/A

- 7. Padres N/A

- 8. Senior Day N/A

- 9. #ด้วงกับเธอEP3 N/A

- 10. Happy Love N/A

- 11. #วิวาห์ปฐพีตอนที่4 N/A

- 12. #Caturday N/A

- 13. #RISERCONCERTD2 N/A

- 14. DUANG WITH YOU EP3 N/A

- 15. Carbon Monoxide N/A

- 16. Munich N/A

- 17. Range Rover N/A

- 18. Love Day N/A

- 19. GAMEDAY N/A

- 20. Travis Hunter N/A

Something went wrong.

Something went wrong.