Shalvi Sharma

@Powerofcomodity

Forex & Commodity Technical analyst No Financial Advice!

Vous pourriez aimer

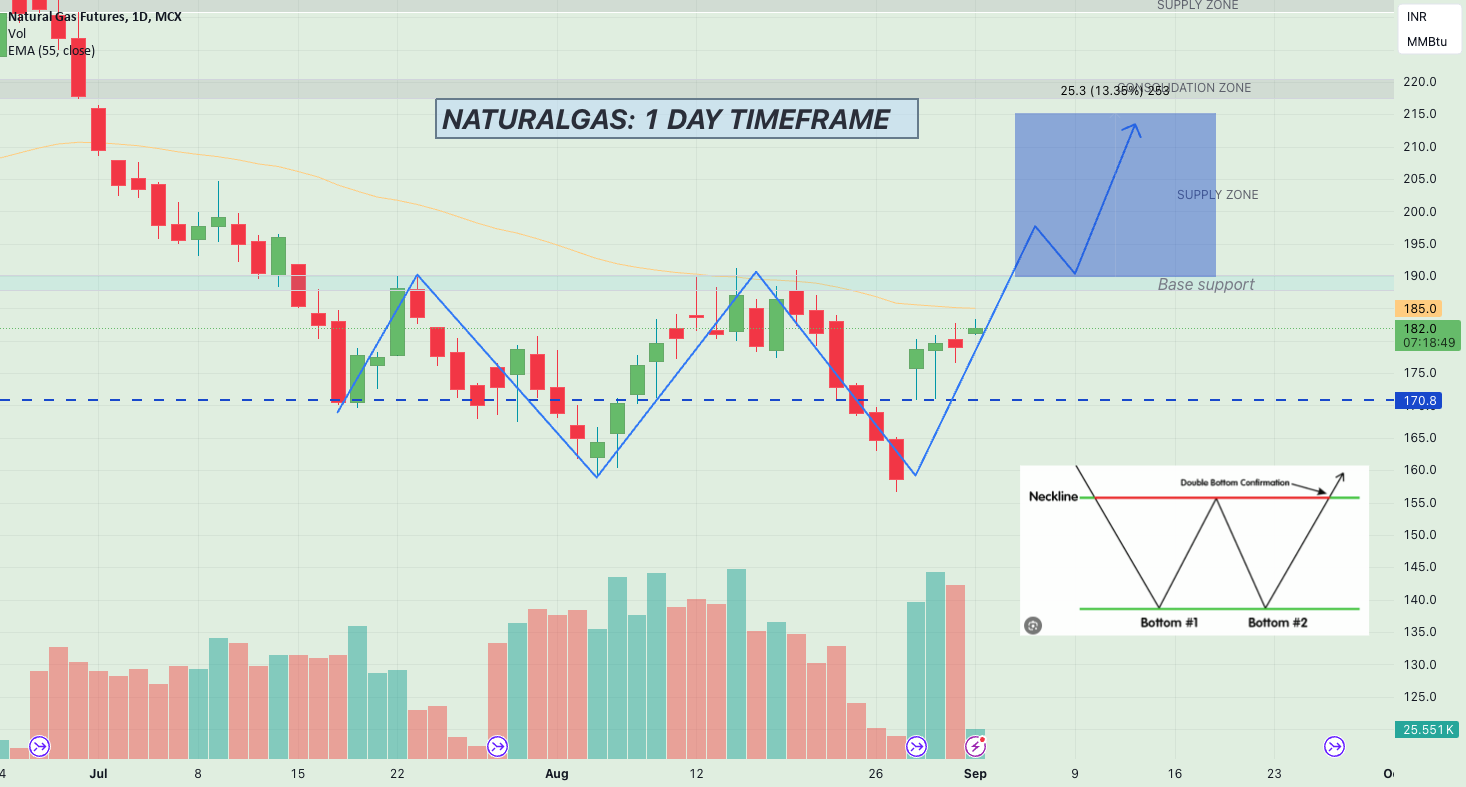

⭐️ Another chart published on editor's pick of trading view📷 📷⭐️tradingview.com/chart/NATURALG… #NG

⭐️ Another article published on editor's pick of trading view📷 ⭐️ Link --in.tradingview.com/chart/XNGUSD/i…… #TradingView #XNGUSD

#NG closes the day strong, but right at a critical resistance band. Price continues to ride the rising channel, yet upside is getting stretched. above 456 Bullish Weakness begins below 444 tomorrow’s first breakout/retest will set the tone. #NaturalGas

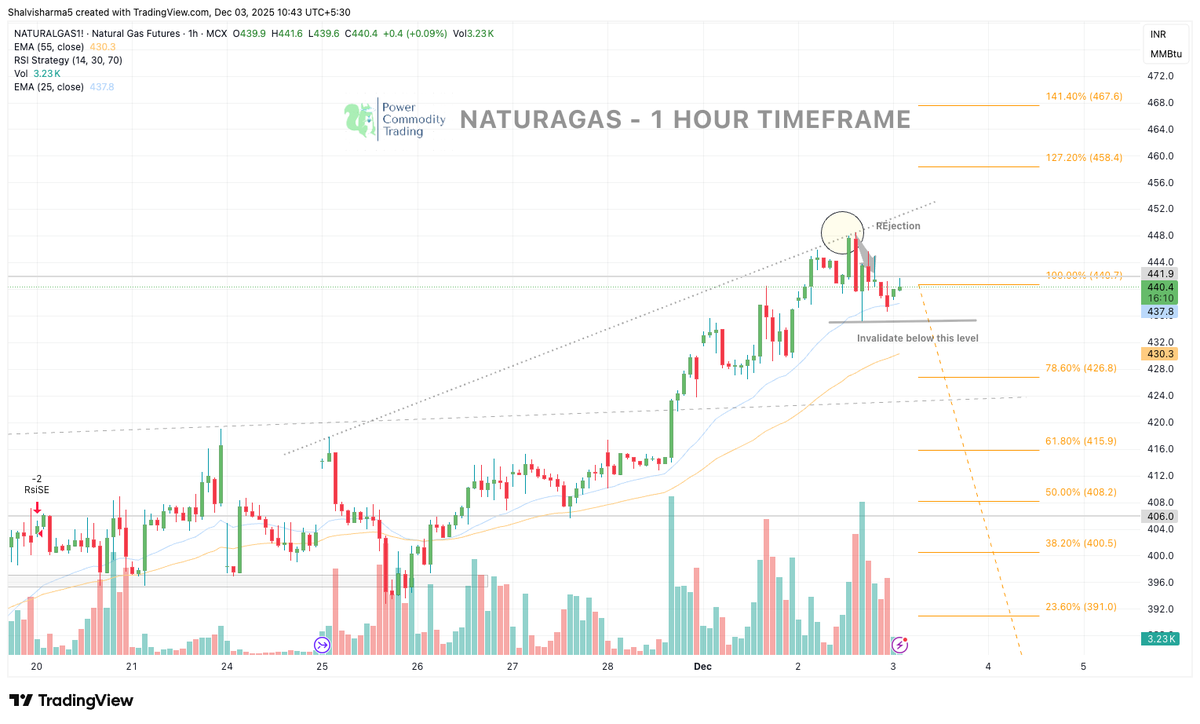

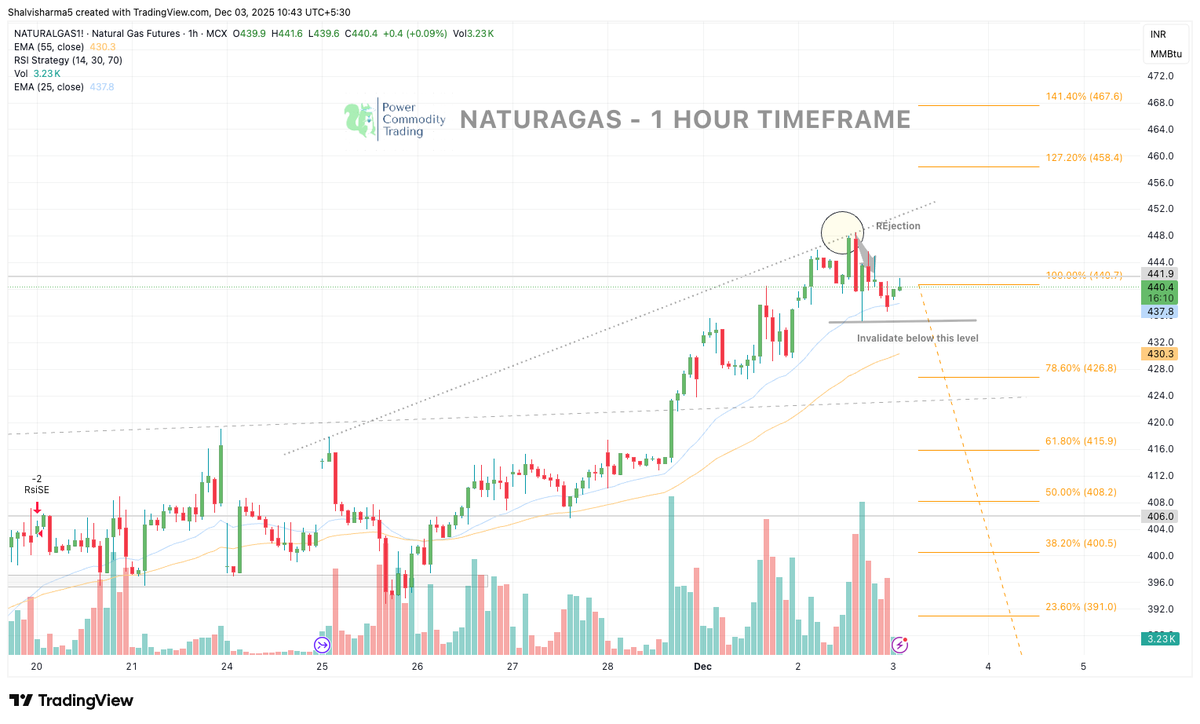

$NG: Rejected from 448–450. Bias steady only above 437–439. #MCX #CrudeOil #NaturalGas #Silver #Gold #CommodityTrading

$NG: Rejected from 448–450. Bias steady only above 437–439. #MCX #CrudeOil #NaturalGas #Silver #Gold #CommodityTrading

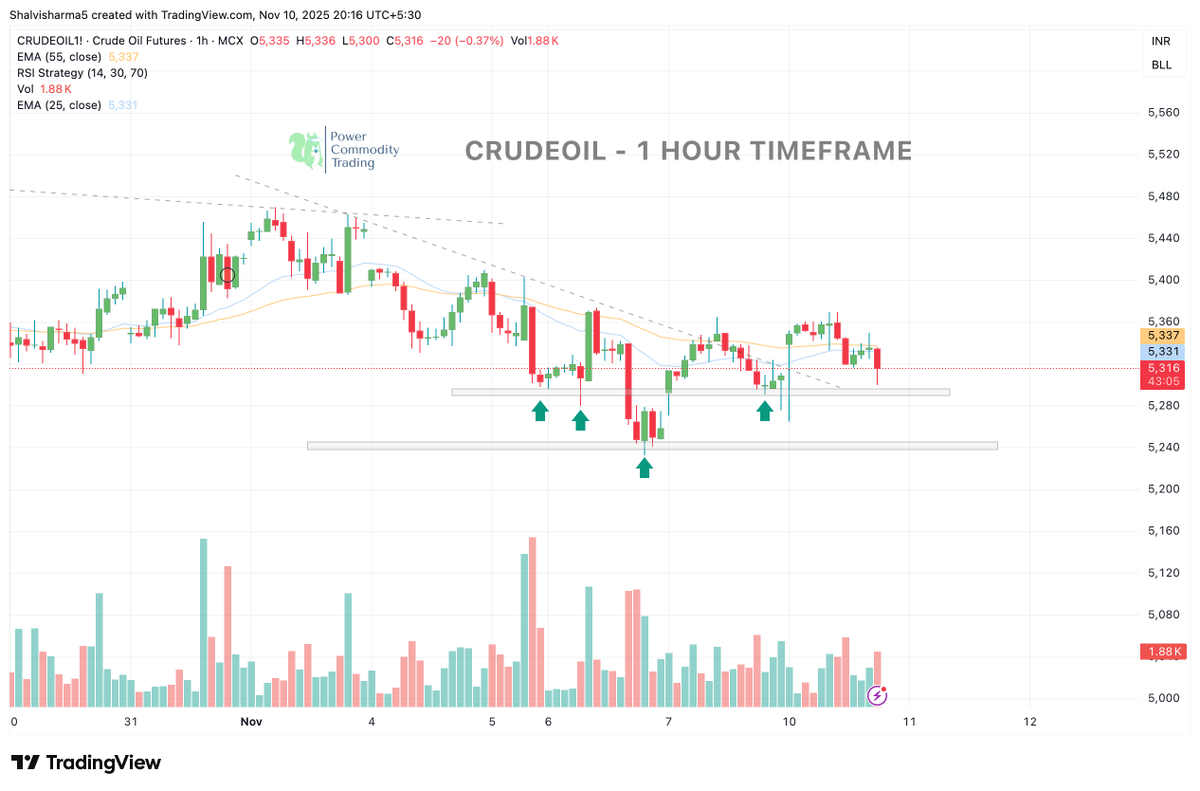

#CRUDE Stuck below 5370–5400 supply. Needs breakout. Support holds at 5300–5320. #MCX #CrudeOil #NaturalGas #Silver #Gold #CommodityTrading

Natural Gas (1H) Price hovering near trendline resistance. Bias stays bullish above 434–436. Long above 442 - Targets 448 / 452 / 458 Breakout structure forming. Momentum favors upside. #NaturalGas #MCX #CommodityTrading #PriceAction

$Crude is compressing inside a symmetrical triangle with demand holding at 5280–5300 and supply capping price around 5360–5380. EMAs are flat and volume is thinning, indicating indecision ahead of a likely volatility expansion. Breakout soon. #CrudeOil #MCX

Silver 1H: Price stuck below trendline and EMAs. Bullish only above 154400. Weak below 152800. Compression building — breakout likely. #Silver #MCX #CommodityTrading

🚨 Gold 1H Holding 123,219 (38.2% Fib) Bullish above 124,000 Below 122600 turns weak. Trendline support intact. #Gold #MCX #Trading

🚨 Silver 1H Update Price holding at 155430 (50% Fib) Bullish above 157000 Weakness below 154900 Trendline still intact. #Silver #MCX #CommodityTrading

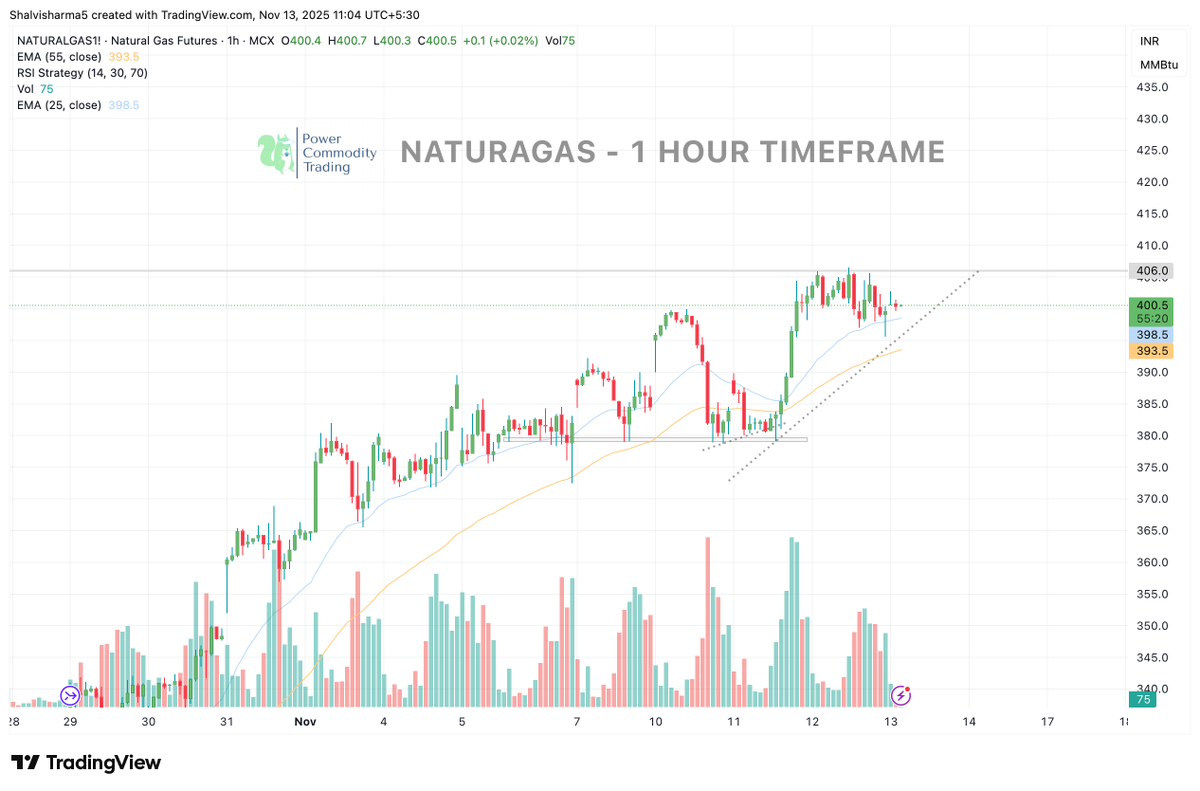

🚨 NATURAL GAS – 1H Setup NG is compressing under a falling trendline while holding the rising micro-structure. Breakout zone: 404–406 Invalidation: Below 394 Expect volatility in 398–404 before a clean move. Bias turns positive only above 406. #NaturalGas #MCX #TradingView

MARKET OUTLOOK – 13 Nov 2025 📍 #Commodity: #Natural Gas (#NG) Price consolidating near resistance with EMAs acting as dynamic support, a breakout above 406 may trigger fresh momentum. Levels to Watch: Resistance: 406 Support: 393 / 398

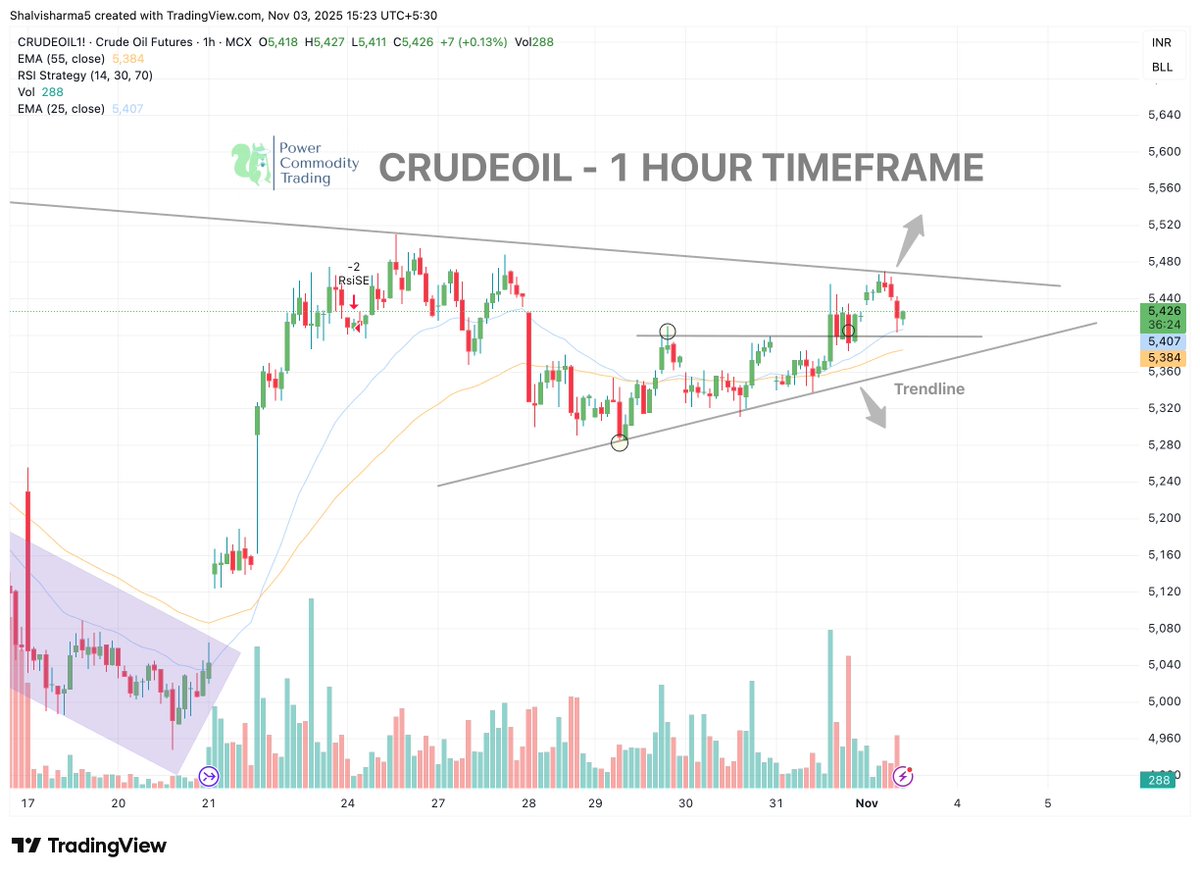

⚡ QUICK UPDATE – 7:30 PM CRUDEOIL reacting near 5375–5380 after steady higher-low formations on the 1H chart. Pattern spotted: Ascending trendline breakout attempt Next zone: 5420–5450 if momentum sustains ⚖️ Bias: Bullish 📉 Confirmation above: 5390 for a potential rally…

CRUDE OIL – 1H TIMEFRAME 📊 Price Action: Crude is retesting the key demand zone around 5280–5300, repeatedly defended by buyers. However, rejection from EMA (25 & 55) near 5340 signals sellers still in control Bullish: Only above 5340 Bearish: Breakdown below 5280 opens…

Silver trades steady amid global rate-cut optimism and softer dollar. 📈 Price holding near 148,400 — breakout above 149,800 may trigger fresh upside, while breakdown below trendline can invite weakness. #Silver #MCX #Commodities

Natural Gas opened gap-up on strong global LNG demand & bullish breakout above EMA-25. Buyers active above 378; momentum to continue if price sustains. #NaturalGas #MCX

CRUDEOIL UPDATE (1H Timeframe) 📰 Market News: Crude prices remain steady as traders await U.S. inventory data and OPEC+ commentary. Weak demand cues from China and strong USD continue to limit upside momentum. WTI hovering near $60 zone, keeping pressure on MCX prices. 📊…

CrudeOil continues to coil inside a symmetrical triangle. Trendline support & overhead resistance intact. Expect momentum once 5450 / 5350 breaks decisively. #MCX #CrudeOil #MarketUpdate

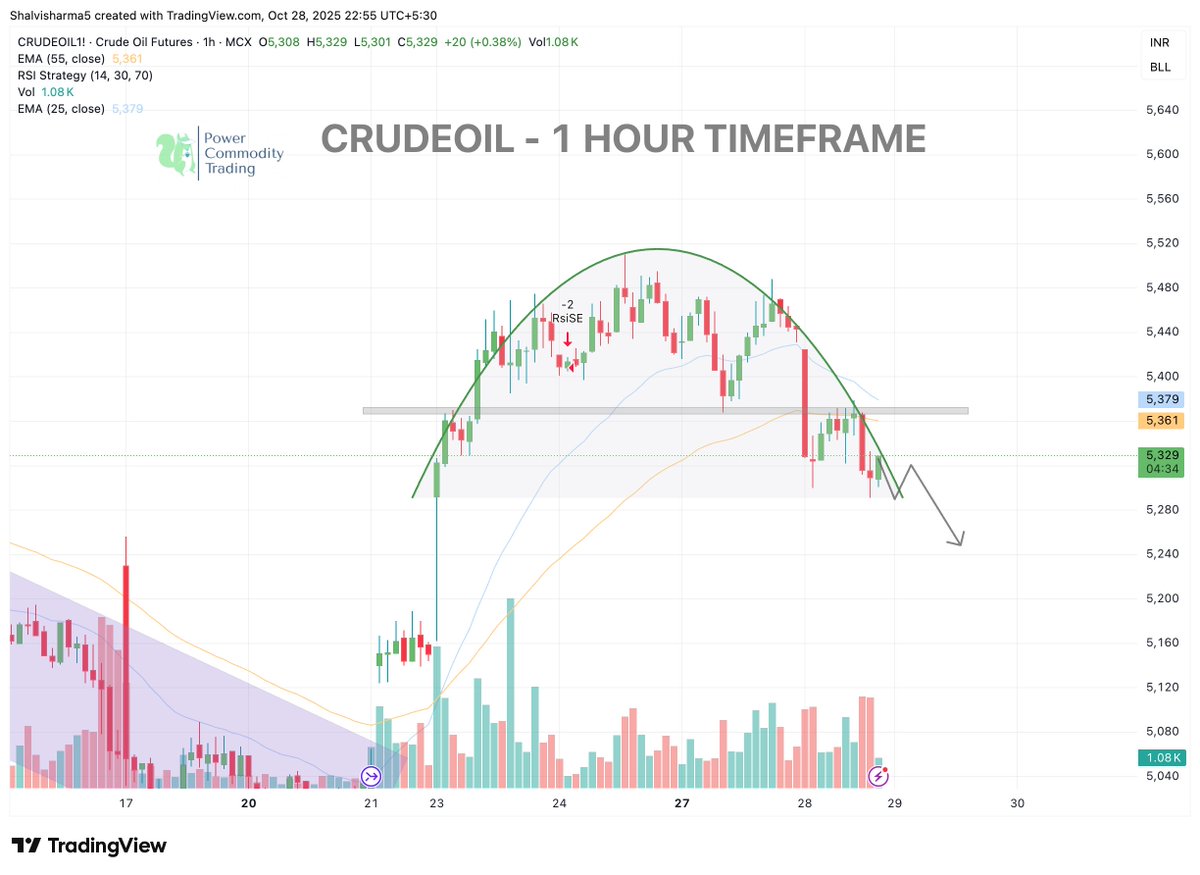

Crude Oil Update (1H Timeframe) Crude is showing a round-top formation, followed by a lower high rejection near EMA zones (5380–5400) — indicating weakness in momentum. If price sustains below 5280, expect a slide toward DOWNSIDE. This view invalidate above 5350…

#Crudeoil is currently testing key support near 5320, forming a round-top pattern — signaling potential short-term weakness unless buyers step in. #MCX #CommodityTrading #PowerOfCommodity

United States Tendances

- 1. Spotify 1.14M posts

- 2. Chris Paul 32.2K posts

- 3. Clippers 45.5K posts

- 4. Hartline 11.3K posts

- 5. Ty Lue 2,653 posts

- 6. Henry Cuellar 7,160 posts

- 7. #HappyBirthdayJin 108K posts

- 8. ethan hawke 4,839 posts

- 9. David Corenswet 8,092 posts

- 10. Jonathan Bailey 9,274 posts

- 11. GreetEat Corp 1,173 posts

- 12. Apple Music 252K posts

- 13. South Florida 6,686 posts

- 14. #NSD26 26.5K posts

- 15. SNAP 172K posts

- 16. Chris Henry 2,594 posts

- 17. Klein 17K posts

- 18. Adam Sandler 5,172 posts

- 19. #JINDAY 84.3K posts

- 20. Duncan 7,939 posts

Vous pourriez aimer

-

Rohit saraswat

Rohit saraswat

@TraderR_25 -

Fx Troupe

Fx Troupe

@FxTroupe -

Trading Destiny

Trading Destiny

@trading_destiny -

Stock Market Explorer

Stock Market Explorer

@EquityPlaya -

trendingcommodities

trendingcommodities

@trendingcrude -

🎯Martin

🎯Martin

@mpauls -

Aman Gupta

Aman Gupta

@g_aman7375 -

fyxn

fyxn

@fyxncrypto -

The Trashant Waghela

The Trashant Waghela

@TrashantN -

Kirtan Sheth

Kirtan Sheth

@kirtan1812 -

visionary tracks

visionary tracks

@visionarytracks -

Praveen kumar,😄

Praveen kumar,😄

@Praveen46717213 -

Sekhar Sahoo

Sekhar Sahoo

@sibanisekhar -

Zorochild

Zorochild

@ZDaruwala -

📈

📈

@LavanGoyal1

Something went wrong.

Something went wrong.