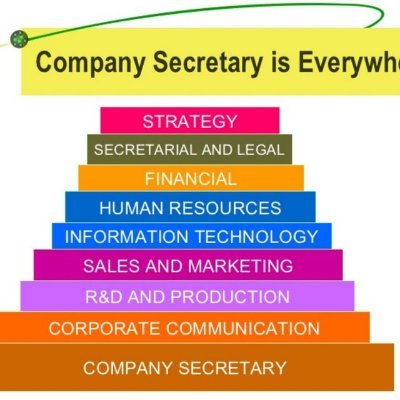

Practising Company Secretaries

@PractisingCS

Page open to all Practising Company Secretaries. Follow to receive regular updates on Corporate Affairs. Page run by a Proud Practising Company Secretary.

You might like

Dear @IncomeTaxIndia Aadhar OTP not getting Generated Portal not working fine After Getting Non Filing Message from Department too many ITR pending PAN India Please Extend Due Dates of Filing ITR for AY 22.23 upto 31.3.23 #extend_due_dates #ExtendDueDate @rambajajbikaner #ITR

इनकम टैक्स और जीएसटी दोनों की रिटर्न टैक्स प्रोफेशनल द्वारा ज्यादातर फाइल की जाती है इसलिए दोनों की अंतिम तारीख एक साथ कभी नहीं होनी चाहिए। आपसे निवेदन है कि दोनों की तारीख को आगे इस तरह बढ़ाएं ताकि दोनों की तारीख फिर एक साथ नहीं हो । @FinMinIndia @cbic_india @IncomeTaxIndia

Dear @IncomeTaxIndia Majority of income tax returns are filled in between the months of Jan and Feb. So, please be humble and extend the date of ITR filling till 31 march. #extend_due_date @PMOIndia @nsitharaman @FinMinIndia

Kindly extend the due date for #GSTR9 & #GSTR9C & Belated ITR for the financial year 2021-22 from 31.12.2022 to 31.03.2023. @GST_Council @Infosys_GSTN @FinMinIndia @cbic_india @narendramodi @nsitharaman @nsitharamanoffc @cbic_india @mpfinancedep @IncomeTaxIndia

ITD portal is not working properly. Extend the due date of ITR filing for the FY 2021-22 from 31.12.2022 to 31.03 2023. #ITD_PORTAL_DOWN #extend_due_dates #ITR @nsitharamanoffc @nsitharaman @IncomeTaxIndia @FinMinIndia

#incometax #GSTR9 #GSTR9C Timely extension will be a big relief and need of times as well... Let's do happy ending of 2022 @FinMinIndia @cbic_india @GST_Council @IncomeTaxIndia @PMOIndia

#Incometax trending Extend the date of filing belated return to 31.03.2023 @nsitharaman @IncomeTaxIndia #ITR @FinMinIndia

Kindly extend the due date for #GSTR9 & #GSTR9C & Belated ITR for the financial year 2021-22 from 31.12.2022 to 31.03.2023. @GST_Council @Infosys_GSTN @FinMinIndia @cbic_india @narendramodi @nsitharaman @nsitharamanoffc @cbic_india @mpfinancedep @IncomeTaxIndia

It is humbly request you that the date of Gstr 9 , Gstr 9c & Income Tax Return will be Extend to 31st March 2023. @FinMinIndia @nsitharaman @narendramodi @PMOIndia @cbic_india @GST_Council @nsitharamanoffc @IncomeTaxIndia @ianuragthakur @cbdt

Respected Finance Minister Smt. @nsitharaman Ji, Chairman @GST_Council @FinMinIndia, @IncomeTaxIndia plz extend the last date from 31/12/22 to 31/03/2023 of GSTR 9, 9C and Income Tax Returns.

Sending messages like these for ITR's filed months ago. Just 4 days before the last date of filing revised ITR. Please tell me if this is not making mockery of Tax Payers. At least send messages like this 15-20 days prior. Logo ko aapko Tax dene ke alawa bhi kaam hote h.

The taxpayer filed returns on 31 July. @IncomeTaxIndia is sending such messages and notices via email 4 days before the 31 Dec deadline Many are about purchasing of property, in ITR no one discloses that. Further, give taxpayers 15 days most are on holiday

Kindly extend the due date for #GSTR9 & #GSTR9C for the financial year 2021-22 from 31.12.2022 to 31.03.2023. @GST_Council @Infosys_GSTN @FinMinIndia @cbic_india @narendramodi @nsitharaman @nsitharamanoffc @cbic_india @mpfinancedep @JagdishDevdaBJP @cgstbhopalzone @CgstBhopalComm

I humbly request you that the date of #Gstr9 and #Gstr9c be Extend to 31st March2023, it will be in the public interest. Please #extend the date of #GSTR9 and #Gstr9c Till 31March 2023. @FinMinIndia @nsitharaman @narendramodi @PMOIndia @cbic_india @GST_Council

Kindly Extend Belated/Revised Income Tax Return due date to 31/03/2023 and Kindly also extend GSTR 9/9C due date @IncomeTaxIndia @cbic_india @FinMinIndia @nsitharamanoffc @PMOIndia

Dear @FinMinIndia @cbic_india We request you to kindly #ExtendDueDate of #GSTR9 & 9C by reasonable time. With parallel work of fixing errors in hurriedly filed ITR due to preponmt. of dates, revision of which cannot happen beyond 31.12.22, difficult to manage GST AR. @PMOIndia

Dear @IncomeTaxIndia Please Extend Due Dates of Filing ITR for the AY 22.23 till 31.3.23 Many People Receiving This Msg Attention XXXX (PAN XXXXX5675X) Based on available information with Income Tax department, it appears that you were required to file ITR for AY 22-23 @theicai

Dear @IncomeTaxIndia Please Extend Due Dates of filing Income Tax Return (ITR) for AY 2022.23 till 31st March 2023. In Jan Feb March Many Returns will get filed. #extendduedate #itrduedate #ay2223 @theicai @CAChirag @abhishekrajaram @rambajajbikaner @nsitharaman #ITR

United States Trends

- 1. #SmackDown 25.8K posts

- 2. Zack Ryder 4,855 posts

- 3. Matt Cardona 1,311 posts

- 4. #OPLive N/A

- 5. Clemson 5,289 posts

- 6. LA Knight 5,370 posts

- 7. Landry Shamet N/A

- 8. Bubba 45.2K posts

- 9. Bill Clinton 150K posts

- 10. Mitchell Robinson N/A

- 11. Jey Uso 3,771 posts

- 12. #TNATurningPoint 4,103 posts

- 13. Drummond 1,276 posts

- 14. Nikes 1,356 posts

- 15. #OPNation N/A

- 16. Cam Boozer N/A

- 17. Ersson N/A

- 18. #Dateline N/A

- 19. End 1Q N/A

- 20. Kevin James 8,686 posts

You might like

-

CA Anupam Sharma

CA Anupam Sharma

@caanupam7 -

CS Jigar Shah

CS Jigar Shah

@FCSJigarShah -

Aniket Talati

Aniket Talati

@AniketTalati -

DHIRAJ KHANDELWAL

DHIRAJ KHANDELWAL

@kdhiraj123 -

CA Chirag Chauhan

CA Chirag Chauhan

@CAChirag -

Institute of Company Secretaries of India (ICSI)

Institute of Company Secretaries of India (ICSI)

@icsi_cs -

CS Kishan Thoriya

CS Kishan Thoriya

@cskishan09 -

CS Santosh Pandey 🇮🇳

CS Santosh Pandey 🇮🇳

@SantoshPandeyCS -

CS Abhishek Singh

CS Abhishek Singh

@csabhisheksingh -

AshishGarg आशीष

AshishGarg आशीष

@ashishgargcs -

All about CS😎 @Job4CS

All about CS😎 @Job4CS

@Job4CS -

CA. Rajesh Sharma

CA. Rajesh Sharma

@RajeshSharmaBJP -

Dr. Shyam Agrawal

Dr. Shyam Agrawal

@shyamagrawalcs -

CS Thulasi Raman T

CS Thulasi Raman T

@CSThulasiRamanT -

CS Manish Yogendra Singh

CS Manish Yogendra Singh

@Manishsinghcs

Something went wrong.

Something went wrong.