Praize_Jr(♟,♟)

@PraizeJR

data & market intelligence | research | prev @JournalTac

You might like

A lot of teams out there are making decisions more narrative-driven rather than data-driven Products that will stand out are the ones that will learn how to convert onchain data into actionable business insights

A quiet pattern I’ve noticed in BTC yield products: The hardest part isn’t usually generating yield It’s explaining where the yield actually comes from and what risks are being transformed

A lot of founders thinking about RWA tokenization underestimate where the real work is From what I’ve seen, the tech is ~10% Legal diligence is the other ~90% that decides whether the project survives

Leon shared some profound truths here Take some time to check it out

Distribution is one of the most abused words in crypto and startups Distribution is not: “We have an X with 200k followers” “We’re partnered with X” “We’re listed on CoinGecko” “We ran an airdrop” e.t.c These are channels mainly for visibility

2025 Video Showreel. Press play and enjoy 😉

Congrats big man... well deserved

I guess people just love buying new machines

are most of these clawd bot users running local models, or simply giving a server-based model access to all of their files + passwords? if not local model, what's the point of buying clawd its own dedicated machine? is it the optics of a dedicated piece of hardware in your own…

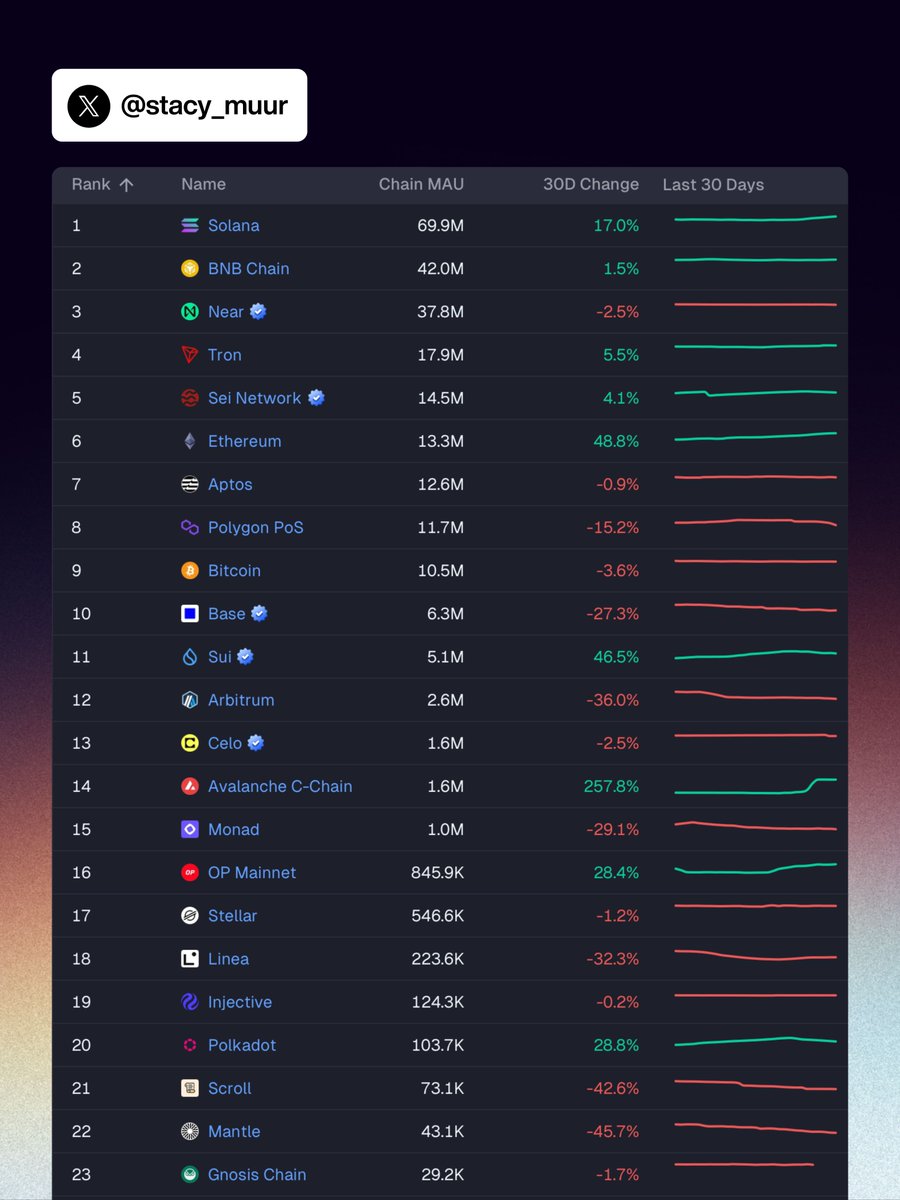

Some interesting numbers here guys!

Analyzed transaction volume & MAU data for 12 major chains throughout 2025. Industry lost 77M users while transactions went up. Transaction volume is the biggest lie in crypto ↓ Total MAU across tracked chains: • Q1: ~195M • Q4: ~118M → −77M users (−39.4%) Only 4…

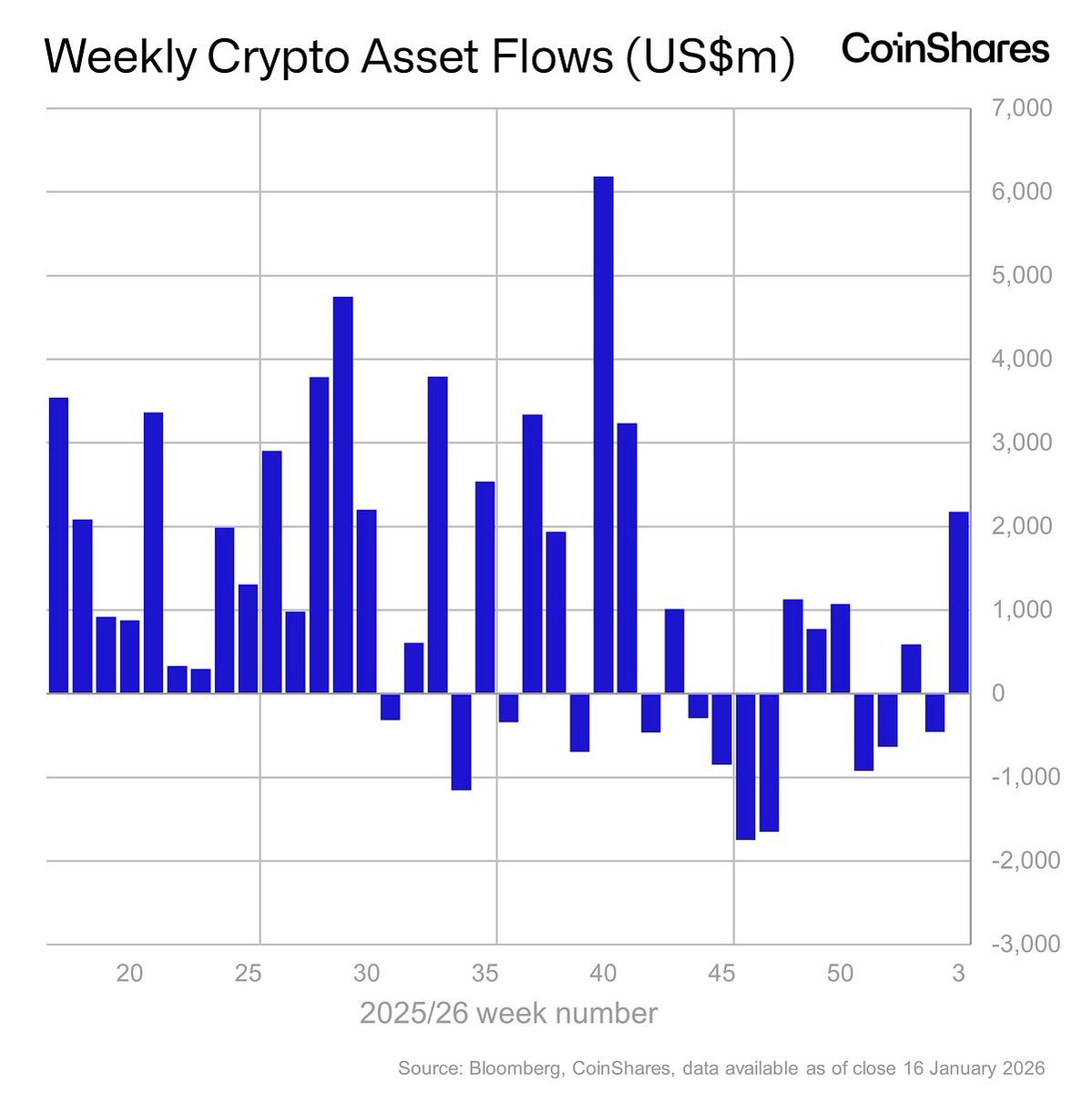

Digital asset investment products recorded $2.17bn in weekly inflows, the largest since Oct 2025. Notably, sentiment softened into Friday amid geopolitical risk, tariff threats, and policy uncertainty. Capital is allocating, but selectively.

United States Trends

- 1. AJ Lee N/A

- 2. Becky N/A

- 3. Tozawa N/A

- 4. David Njoku N/A

- 5. Otis N/A

- 6. Alpha Academy N/A

- 7. Megyn Kelly N/A

- 8. Bediako N/A

- 9. The Usos N/A

- 10. Discord N/A

- 11. #RawOnNetflix N/A

- 12. Mikel Brown N/A

- 13. iTunes N/A

- 14. Stanley Cup N/A

- 15. Elimination Chamber N/A

- 16. Neal Shipley N/A

- 17. Sion James N/A

- 18. Fannin N/A

- 19. Maryse N/A

- 20. Fess Parker N/A

Something went wrong.

Something went wrong.