PrecisionStockPicks

@PrecisionPicks

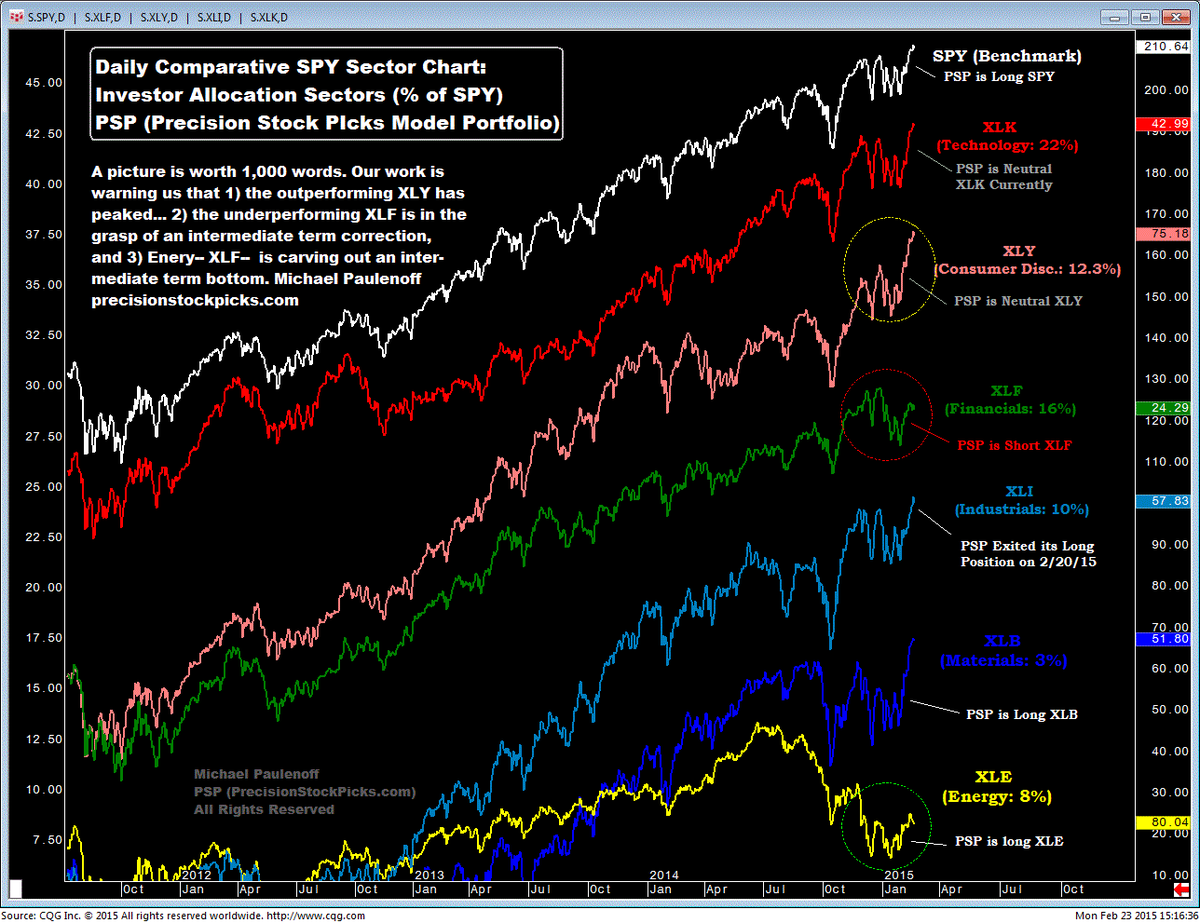

PSP is home to my 'S&P 500 At-A-Glance' Sector Summary where I rank every sector on a 1-10 Trend Strength scale. Daily updates of the SPY, XLF, XLE, and more.

You might like

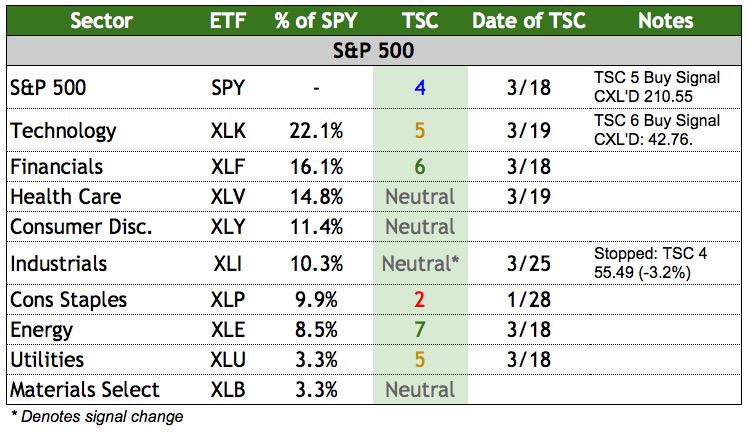

This AMs S&P Sectors Table, with my 1-10 Trend Strength Coefficient $SPY $XLK $XLF $XLV $XLY $XLI $XLP $XLE $XLU $XLB

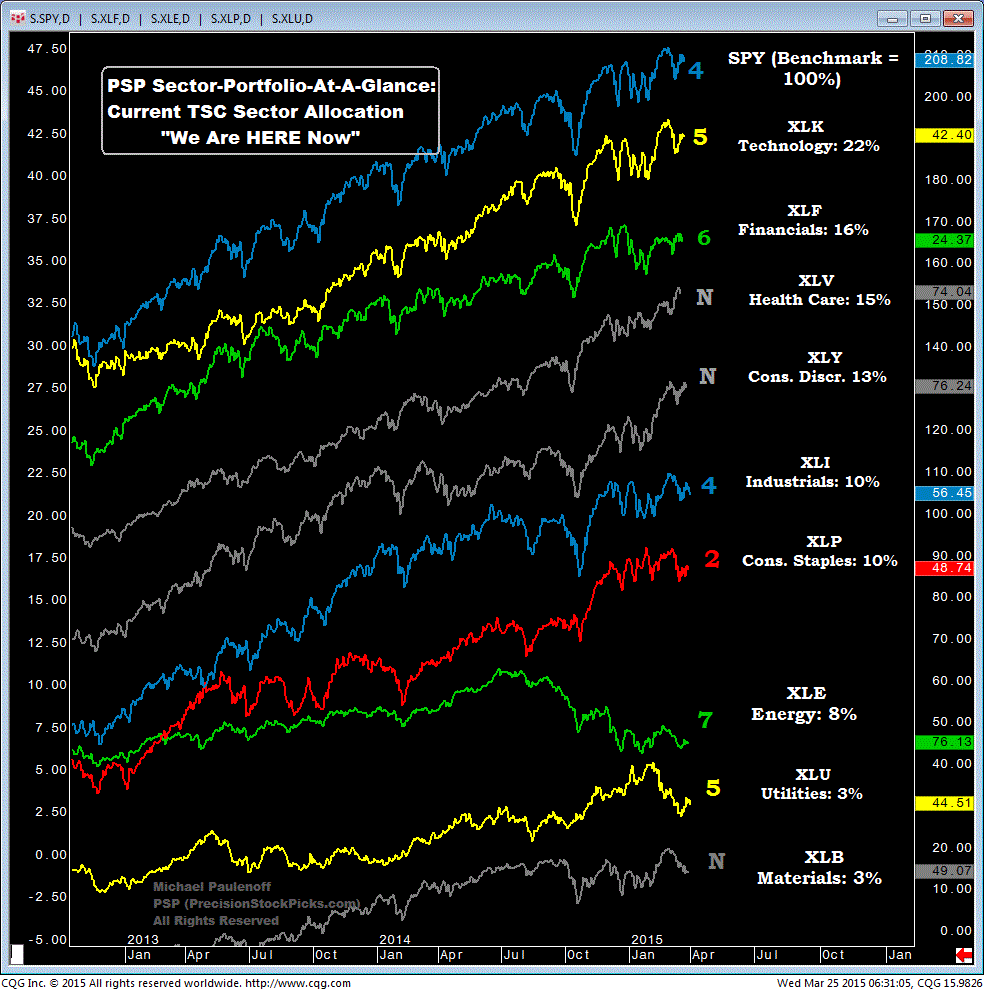

S&P Sectors-At-A-Glance, with my 1-10 Trend Strength Coefficient $SPY $XLK $XLF $XLV $XLY $XLI $XLP $XLE $XLU $XLB

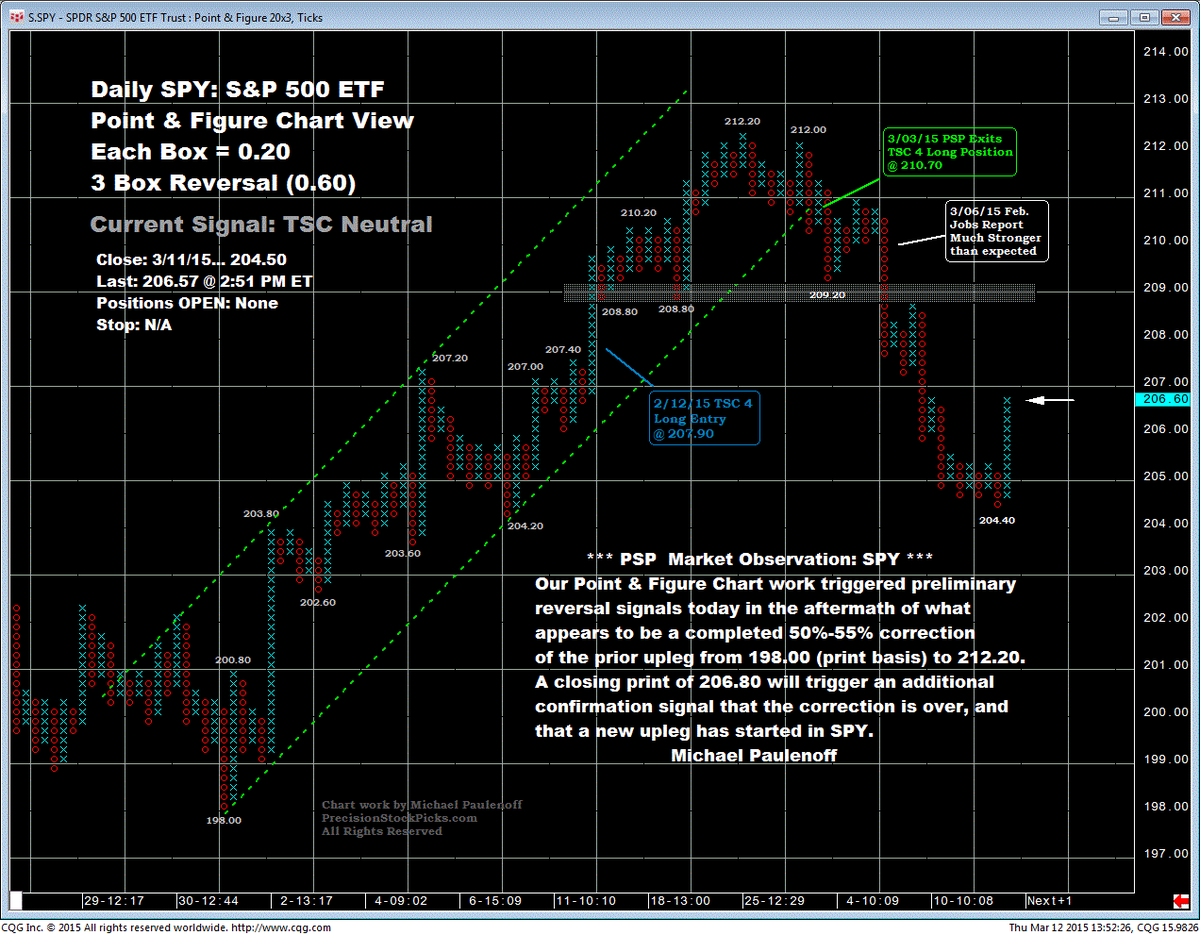

$SPY Point & Figure Triggers Preliminary Upside Reversal Signal

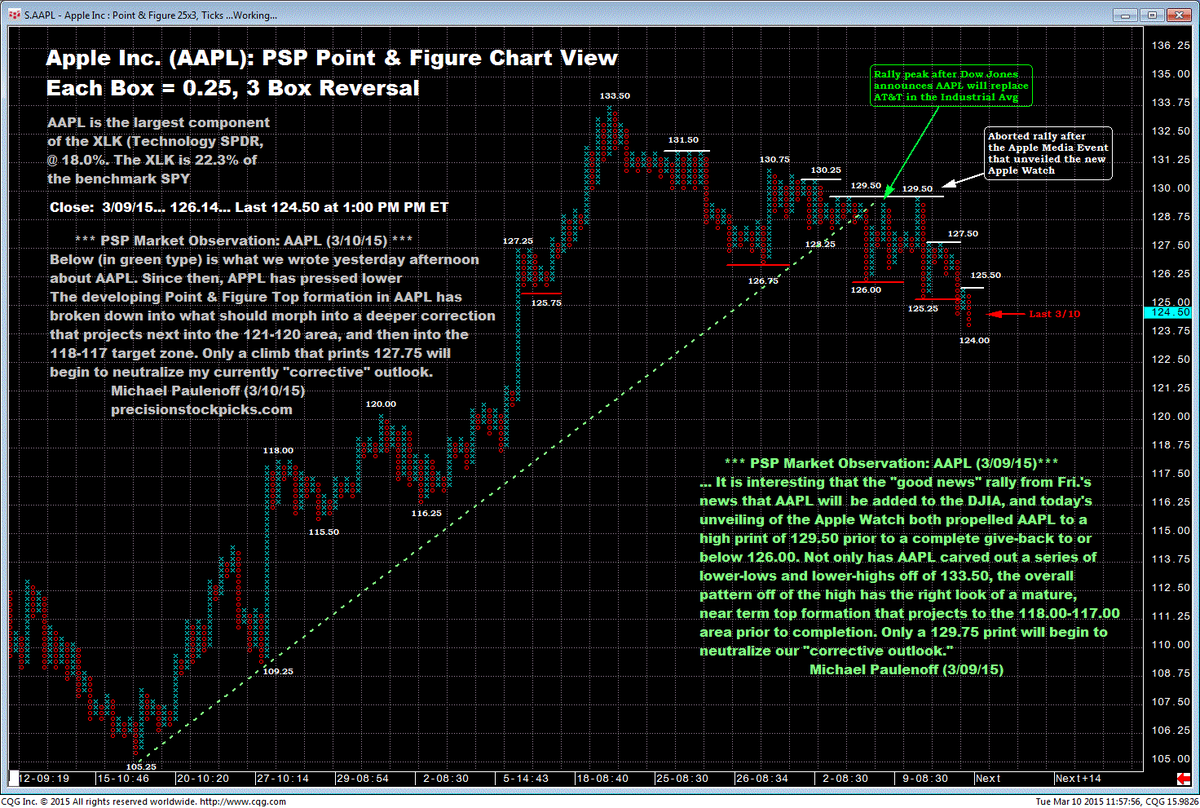

$AAPL Continues to Follow Our Pt & Fig. Chart Script

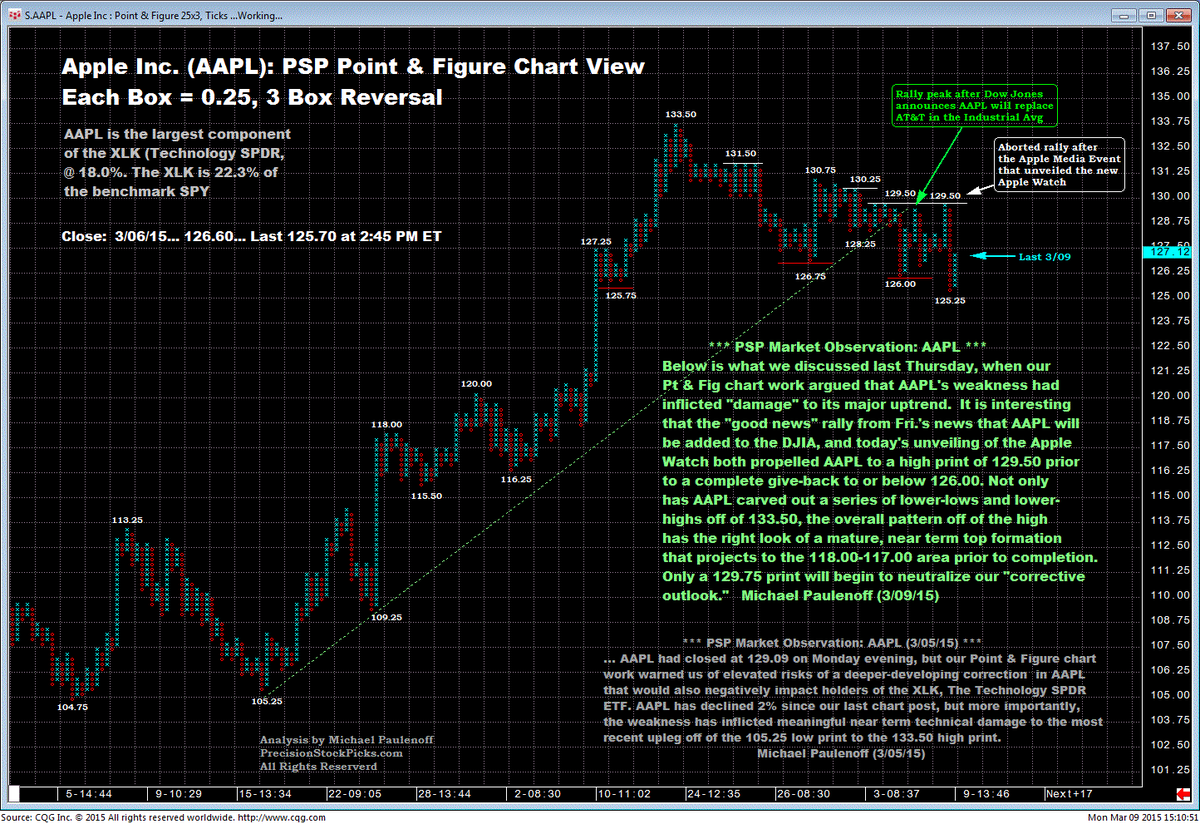

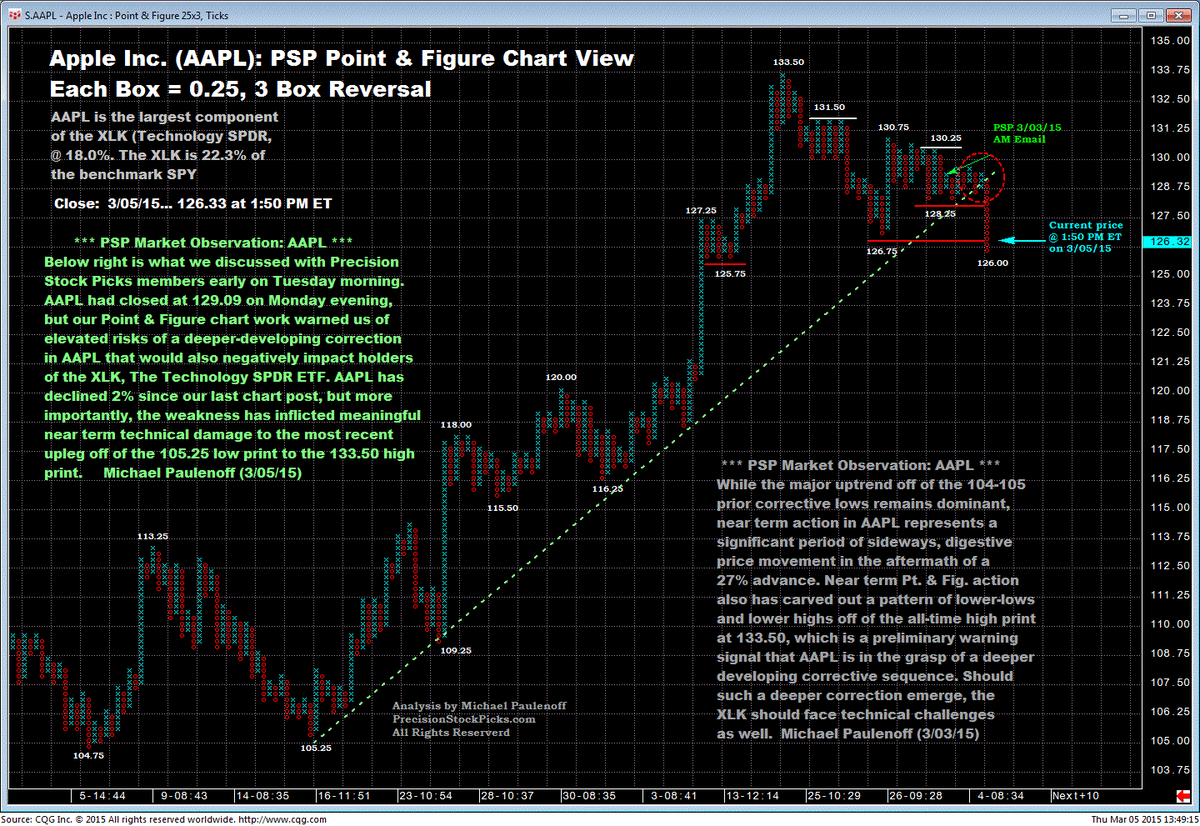

Another "Good News" Stall Within the $AAPL Uptrend

$AAPL's Weakness Follows Our Near Term Technical Script

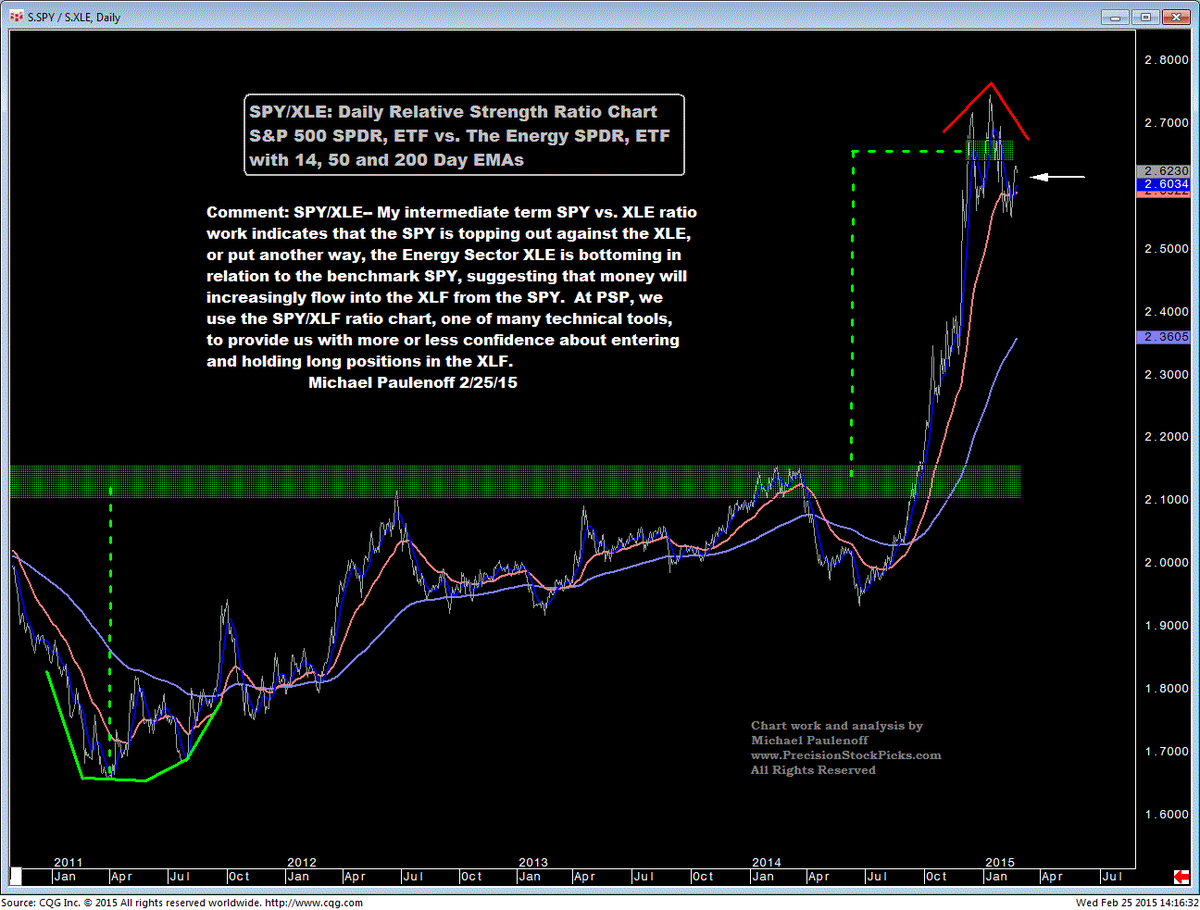

Is Ratio Chart Telling Us Anythig Abt The Expected Relative Performance of Benchmark $SPY vs the Energy Sector $XLE?

A birdseye view of the $SPY and its major "offensive" sub-sectors has a story to tell...$XLK $XLF $XLY $XLI $XLB $XLE

Is the $SPY vs. $XLY Relationship Telling Us Something Important About The Real Economy? stks.co/p14H3

Is the $SPY/$XLE Ratio Whispering Anything Important About The Underperforming Energy Sector? stks.co/c1F4K

$XLI experienced the longest and deepest correction (-12.5%) and has led the upside charge. What now? stks.co/d1ElN

$GLD has triggered its 1st bullish strength of trend coefficient 6 signal since Aug '12 $PHYS $NUGT stks.co/h0HMf

United States Trends

- 1. Epstein N/A

- 2. Jay Z N/A

- 3. Pusha N/A

- 4. Mariah N/A

- 5. Iron Lung N/A

- 6. SANTA FROST WARM SIGN N/A

- 7. Billy Porter N/A

- 8. Bill Gates N/A

- 9. #OPLive N/A

- 10. #Santa1stFSinShanghai N/A

- 11. #questpit N/A

- 12. Hanoi Jane N/A

- 13. Watts N/A

- 14. Marina N/A

- 15. Izzo N/A

- 16. Girls FTW N/A

- 17. Moltbook N/A

- 18. Podz N/A

- 19. $Accelerando N/A

- 20. #DragRace N/A

Something went wrong.

Something went wrong.