ProBenefits - The benefit of trust

@ProBenefits

Simplify benefits admin with a team of caring experts who believe in doing things right. (Specializing in FSA, HRA, HSA, COBRA, & Compliance.)

You might like

For 2022, the HSA maximum contribution limits are $3,650 for self-only coverage and $7,300 for family coverage. Individuals age 55 and up can contribute an additional $1,000/year.

February is Heart Month! Did you know that you can help track your heart health by purchasing a home blood pressure monitor with your Health FSA or HSA funds?

Can you use your FSA or HSA to pay for home COVID tests? Yes - but should you? Check out our latest blog post for some clarification on this question: probenefits.com/otc-covid-test…

probenefits.com

Over-the-Counter COVID Tests – Are they a good use of your FSA, HRA, or HSA dollars? - ProBenefits

COVID-19 Expenses Eligible for FSA, HRA, and HSA Payment or Reimbursement As you may recall, in March of 2021, the IRS issued an announcement notifying taxpayers that amounts paid for ... Read More

If you're a ProBenefits HSA participant, your 2021 HSA tax documents are available now on the web portal. See our blog post for more info: probenefits.com/hsas-and-taxes…

probenefits.com

HSAs and Taxes: What account holders should know - ProBenefits

It’s tax time again! If you have an HSA, you are required to report any contributions made to your HSA and any distributions received from your HSA during the 2022 ... Read More

Happy holidays from the ProBenefits team! Our offices will be closed on December 23rd, 24th, and 31st. Wishing you a wonderful holiday season and a healthy 2022!

If you are a ProBenefits plan participant, but you’re not accessing your account on our web portal or mobile app, you’re missing out on some great features! Use “New User?” on the web portal (my.probenefits.com) or mobile app to get started. #benefitoftrust

Did you know you can choose to invest your HSA dollars, and that those investments grow tax-free, earning interest to pay for future medical expenses or to save toward retirement? On the ProBenefits participant web portal, click Manage Investments to get started. #benefitoftrust

Happy Thanksgiving from the ProBenefits team!

A Dependent Care FSA is used to set aside pre-tax funds to pay for eligible daycare or childcare expenses for your dependents so you and your spouse can work, look for work, or attend school full-time. Learn more: probenefits.com/faq/what-type-… #benefitoftrust

You can't contribute to both an HSA and a full Health FSA, but you can have an HSA with a Limited Dental/Vision FSA, which can be used to pay for eligible dental and vision expenses for yourself, your spouse, and dependents. Have an HSA? See if your employer offers a Limited FSA.

A dependent care FSA is a great way to save money on child care expenses. Watch our video for a quick introduction, and let us know if you have questions! youtu.be/cvrAjqOCcJE #benefitoftrust

youtube.com

YouTube

What is a Dependent Care FSA?

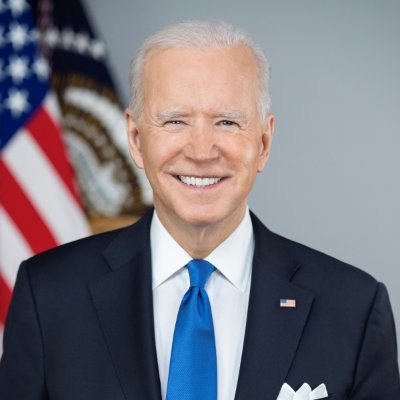

As Vice President of Benefits Administration, Julie guides us all in working together to provide our partners and participants with the seamless support you've come to expect from us. We can give you the #benefitoftrust because we have Julie on our side — and yours.

For many people, it’s time to start thinking about enrolling in employee benefits for 2022. Have you wondered if a Flexible Spending Account is a good option for you? Watch our quick video to learn more about them: youtu.be/vBrYjP4vCRk #benefitoftrust

Happy #HSADay! We received a lot of great questions in response to our HSA Survey, so we’ll be sharing more information on those topics soon. Thanks to all who participated! And congratulations to Kathleen, the winner of our gift card drawing!

#HSADay is a week away! Take our quick HSA survey for a chance to win a $50 Amazon gift card: ow.ly/bA2250GoubO We’ll draw and notify the winner on HSA Day, October 15th, so be sure to enter by Thursday, October 14th.

We know that keeping our participants and partners well-informed is vital. From sharing info on new regulations to helping with questions on eligibility, our Account Managers like Jane are here for you whenever you find yourself in need of benefits education. #benefitoftrust

Many plans allow reimbursement by direct deposit – it’s the fastest and most secure way to receive your claim payments! Setting it up is quick and easy on our web portal or mobile app. #benefitoftrust

Have you ever wondered how an HSA can help you save money on health expenses now, or even save toward retirement? Try our new planning tool to see how you can benefit. Access it here: myhsaplanner.com/PBF

Sidelined by an injury? Your Health FSA or HSA can help. Bandages, crutches, wheelchairs, and orthopedic doctor visits are all eligible expenses. #benefitoftrust

Is hand sanitizer on your back-to-school shopping list? This year you can use your Health FSA or HSA to buy it for your dependents.

United States Trends

- 1. Clemson 10,9 B posts

- 2. Texans 14,5 B posts

- 3. #PopTartsBowl 1.773 posts

- 4. Penn State 8.347 posts

- 5. Dabo 2.505 posts

- 6. Terry Smith 1.599 posts

- 7. Chelsea 153 B posts

- 8. Jayden Higgins N/A

- 9. Lookman 11,1 B posts

- 10. harry styles 98,7 B posts

- 11. #WeAre 1.869 posts

- 12. Villa 119 B posts

- 13. Georgia Tech 3.391 posts

- 14. #HTownMade N/A

- 15. Maresca 31,1 B posts

- 16. Minnesota 790 B posts

- 17. CJ Stroud N/A

- 18. Narduzzi 1.208 posts

- 19. Rich Eisen N/A

- 20. Cade Klubnik N/A

You might like

Something went wrong.

Something went wrong.