Pro Markets Hub

@ProMarketsHub

can't stop watching charts. posting clean market breakdowns and finance takes.

Gold pullback after the massive run makes sense, profit taking was inevitable

shell CEO says the oil major doesn't need to buy assets "anytime soon." sitting on massive cash reserves, focused on shareholder returns over growth

2026 earnings playbook: Beat estimates = stock flat Miss slightly = stock dies Guidance weak = -15% minimum Say "AI investment" = market doesn't care anymore Fundamentals are dead.

it's basically black friday for stocks

If you truly are a long-term investor Market sell-offs should excite you, not scare you.

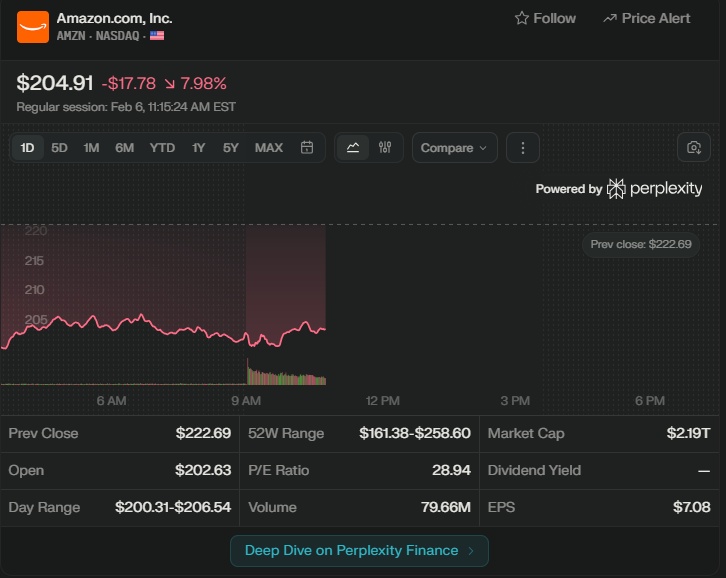

amazon announces 200 billion in capex for 2026 and the stock tanks 10% because wall street can't see past next quarter

feels like the market is pricing in the apocalypse

the market in 2026 is insane bcs wdym 9 days ago we were at all time highs and now my portfolio looks like it went through a paper shredder

the secret is to just keep it chill

everyone's a value investor after their growth stocks get cut in half funny how long term thinking only shows up after the losses

what a roller coaster we're witnessing man

BREAKING: Gold price rises back above $5,000

BREAKING: Silver prices surge back above $90/oz, now up +28% in 48 hours.

With this volatility? hard to say. Bull markets don't usually feel this fragile, but corrections happen even in strong runs

Does anyone believe now we are still at the start of a bull market?

markets closed monday, reopened tuesday. semiconductors rallied, consumer confidence dropped to 102.9 (lowest since 2021). traders pricing in slower rate cuts. first full week of feb looking volatile

software stocks entered a bear market. microsoft down 12%, servicenow down 10%, entire sector getting hammered. wall street finally asking "does AI actually increase profits or just burn cash?" about time someone asked

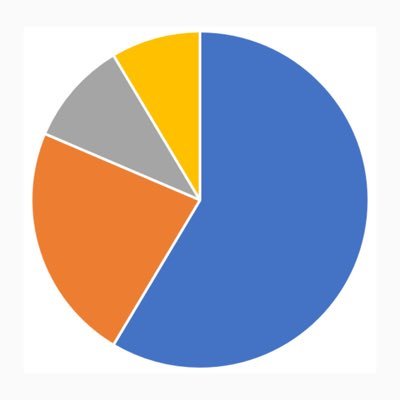

S&P 500 hit 7,000. Cool stat: 10 companies = 40% of the index Your "diversified" retirement fund is actually: 20% Magnificent 7 20% everything else that matters 60% companies nobody talks about

Software sector carnage: ServiceNow: -11% (beat estimates) SAP: -16% (missed cloud backlog) Salesforce: -7% Adobe: -4% Software ETF (IGV): -21% from peak AI disruption narrative killing everything.

ASML prints money because they're the only ones who can make the machines that make the chips, it's the ultimate monopoly moat

*ASML POSTS NEW ORDERS/BOOKINGS AT €13.16 BILLION VS. €6.85 BILLION ESTIMATE $ASML

Silver ETF volume nearly matching S&P 500 fund tells you: 1- FOMO is real 2- Safe haven demand is massive 3- Industrial use (solar, EV) driving supply crunch 4- This rally has legs or it's about to crash spectacularly

Silver breaks $100 for the first time in history. Started 2025 at $40. Hit $100 in January 2026. 150% gain in one year. Outperformed!

United States Trends

- 1. #WWENXT N/A

- 2. Purdue N/A

- 3. Nebraska N/A

- 4. Real ID N/A

- 5. SWAT N/A

- 6. Jaida Parker N/A

- 7. Courtney Love N/A

- 8. RINO N/A

- 9. Alaska N/A

- 10. Kurt Cobain N/A

- 11. Murkowski N/A

- 12. #RingRoyale N/A

- 13. Jackson Drake N/A

- 14. Cluff N/A

- 15. Baylor N/A

- 16. Collins N/A

- 17. Save America Act N/A

- 18. Nancy Guthrie N/A

- 19. Sesko N/A

- 20. Rob Wright N/A

Something went wrong.

Something went wrong.