Chris™

@ProbableChris

I trade $NQ using statistical models, probabilistic frameworks, and custom tools built on my market perspective. Owner of @NQStats

You might like

I've been trading since 2007. I do not sell products or services, nor am I affiliated with any groups. I do not offer public mentorship or share my specific strategies or entry criteria. I post my trades with context, focusing on the statistics and data they involve. I also…

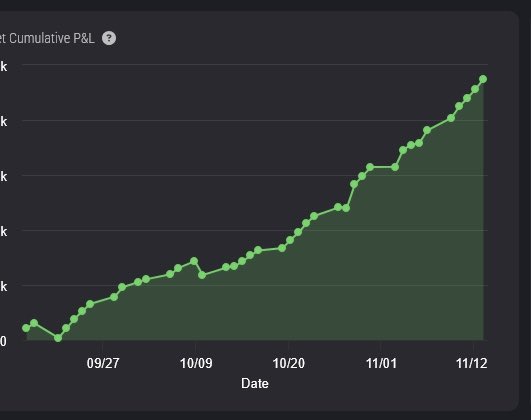

Getting DMs like this is awesome. Will let the individual chime in if they choose to, otherwise congrats!

Friday going into low of week after making a OHLC from the mean/median weekly high of a down week, to the mean/median low of a down week. The week is at 138% of the 60 week average range. The week is at a -1.5 sdev weekly distribution. This week is showing signs of being "maxed"…

The market has been extra volatile lately. While the stats I trade around are playing out to the expectancy they historically gave, live price is not providing clean entries or its defining risk larger than I want. Have made less trades than normal this week, but have been…

The fundamentals of trading are important. I see too often in this space skewed expectations, oversizing, lack of self control, etc. Traders love to attribute their lack of success to poor strategy, which is why so many strategy bounce from mentor to mentor or paid group to paid…

Awesome to see people killing it like this!

I’ve had a solid last 3 months. Base hits at key spots. Trading and working full time is challenging but I like the NQ stats for the IB and noon curve setups with other confluence

How did everyone do this week? Let’s see some equity curves, good or bad. What went good? What went bad?

Trades today. "ALN Sessions" data gave a pattern 3, so was looking for a long, but did not get the follow through and took a break even. Second trade was an "IB Breaks" short for a win. Third trade was a "Noon Curve" short for a win taking it off at the pivot low.

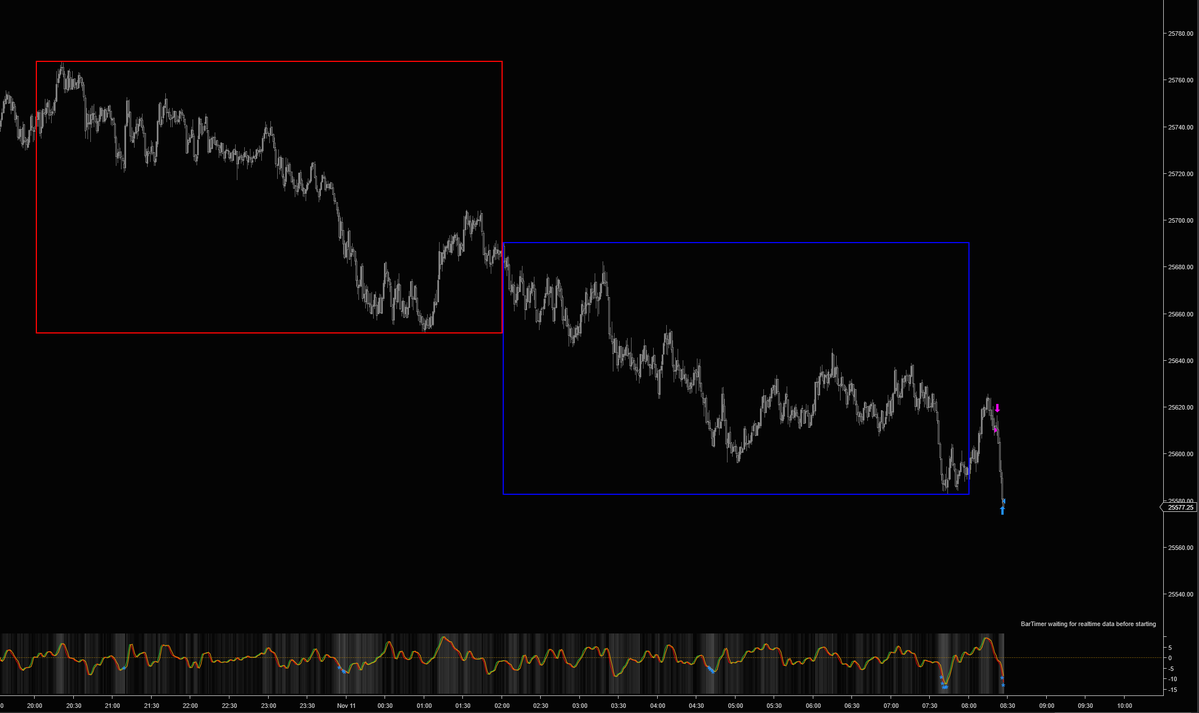

"ALN Sessions" pattern 4. High expectancy break to the blue box low (London Session Low). Next up will be "IB Breaks" to see what setup that gives. You can learn more about these stats at @NQStats and its free.

This week is an example. I will not be trading today. This week has expanded down, setting its weekly high at the 60 week average high, shown with the upper red region. Its also set its low in the average 60 week low shown by lower red region. If you look in top left, this week…

I don't trade Fridays. Fridays typically close the week out near the weeks high or low, think OHLC/OLHC for a weekly bar. Thus Fridays often end up consolidating with choppy price action during the NY session, like it did for todays NY session. The only time I consider trading…

youtu.be/UPsSQP4yAO0 I get the same questions on Initial Balanced based trades almost daily, to which I reply almost daily, so here is a video that should answer these questions and give some pointers.

youtube.com

YouTube

Tips For IB Trades

Rinse, Repeat....again, just different direction.

Rinse, repeat. Even had the same ES divergence scale out as yesterday. Deja Vu moment.

Just curious, who else made $ today using anything @NQStats related or related to the content I post? I do not share my personal strategies, only the data, concepts, stats and the broader context around my own executions. So it is always cool to see people taking the baseline…

@ProbableChris The Noon Curve showed a PM high was statically possible given the AM moves - thank you @NQStats Captured solid profit!

Rinse, repeat. Even had the same ES divergence scale out as yesterday. Deja Vu moment.

Todays IB trade. I'm just looking for the same pattern every day and for my entry criteria/conditions to be present. If it doesn't happen that day, I wait until the next day. Back testing the strategy over multi market conditions, across various years lets me know it has…

Todays IB trade. I'm just looking for the same pattern every day and for my entry criteria/conditions to be present. If it doesn't happen that day, I wait until the next day. Back testing the strategy over multi market conditions, across various years lets me know it has…

ALN Session stats gave a pattern 4 today going into 8am, so expectancy wise, the London low of 25645 would be the target....HOWEVER.....At the time of the New Your range opening at 8am ET, price was at a daily -1.0 distribution. Asking price to go lower down to that London low…

Lets talk expectations..... This was a +1% account gain trade in less than an hour this morning using the "ALN Sessions" stat data and some basic price action principles. The US Equity markets average annual return is roughly +10% annually. This is a base hit trade, taking the…

Stop loss always goes where the trade idea becomes null/negated. You enter a trade because of a reason, where does that reason become invalid? Thats where your stop goes. A stop loss also doesn’t have to be binary as in “all or none”. You can close the trade early if price…

Doing lots of backtesting on IB setups and trying to find what works for me. Can you help me understand where you are placing your stop loss on a trade like this bro?

I don't trade Fridays. Fridays typically close the week out near the weeks high or low, think OHLC/OLHC for a weekly bar. Thus Fridays often end up consolidating with choppy price action during the NY session, like it did for todays NY session. The only time I consider trading…

United States Trends

- 1. Good Monday 32.3K posts

- 2. #MondayMotivation 8,513 posts

- 3. TOP CALL 3,917 posts

- 4. AI Alert 1,630 posts

- 5. Check Analyze N/A

- 6. Token Signal 2,131 posts

- 7. Market Focus 2,705 posts

- 8. Victory Monday 1,571 posts

- 9. #centralwOrldXmasXFreenBecky 630K posts

- 10. SAROCHA REBECCA DISNEY AT CTW 647K posts

- 11. #LingOrmDiorAmbassador 322K posts

- 12. NAMJOON 63.5K posts

- 13. DOGE 189K posts

- 14. #BaddiesUSA 67.6K posts

- 15. Chip Kelly 9,667 posts

- 16. Happy Thanksgiving 10.3K posts

- 17. Monad 123K posts

- 18. Stacey 23.6K posts

- 19. Stefanski 9,870 posts

- 20. Scotty 10.7K posts

Something went wrong.

Something went wrong.