QuantCheck Labs

@QuantCheckLabs

Pick the winning horse in financial markets. Stocks, crypto, bonds, currencies, commodities, and ETFs. Quant platform based on cross-sectional momentum.

You might like

BREAKING: Paul Tudor Jones says to invest in the fastest horse. QCL was built to show you the fastest horse across all asset classes. Spend 5 mins a day checking our dashboard and always be positioned in the fastest horse.

Paul Tudor Jones: "Whatever is the fastest horse at this point in time, probably has a good chance of being that on Dec 31st." $BTC

"i'll continue believing in this horse until it tells me it's no longer fast" this is exactly what QCL was built to do. nobody else has this data available for retail + has a partner that's actually executing these trades with a #1 copy trading vault on Binance. @momofund

$MNT is in price discovery, meaning there are no bag holders in pain (resistance) and it is one of the fastest horses. I like holding fast horses because usually they remain fast. I'll continue believing in this horse until it tells me it's no longer fast.

You don’t fade BTC ATHs. Especially when it comes with QCL’s model signaling crypto as the strongest asset class when comparing it to all other asset classes. Our model guides a 100% allocation to crypto. If you’re not already allocated to crypto, it’s not too late to…

See the flat lines on our PnL? That’s protection. Cash Jul 18 when BTC lost cross-asset strength. Back Sep 10 when $BKCH entered our Macro matrix Top-5—easy-mode again via the @QuantCheckLabs signal.

CRYPTO TRADERS: Our quant model signaled to exit crypto on July 18th due to BTC's weakness vs other asset classes. At that time $BTC was at 119K. Today (BTC at 111K), for the first time in 55 days, the model has signaled an entry into crypto.

Where are we in the crypto cycle? 3 days ago we posted that after 55 days our model has finally signaled to re enter into the crypto markets. At that time BTC was ~111K and today it’s at ~116K. Let’s take a look at the Top 10 ranked cryptos according to our model: 1. $WLD 2.…

CRYPTO TRADERS: Our quant model signaled to exit crypto on July 18th due to BTC's weakness vs other asset classes. At that time $BTC was at 119K. Today (BTC at 111K), for the first time in 55 days, the model has signaled an entry into crypto.

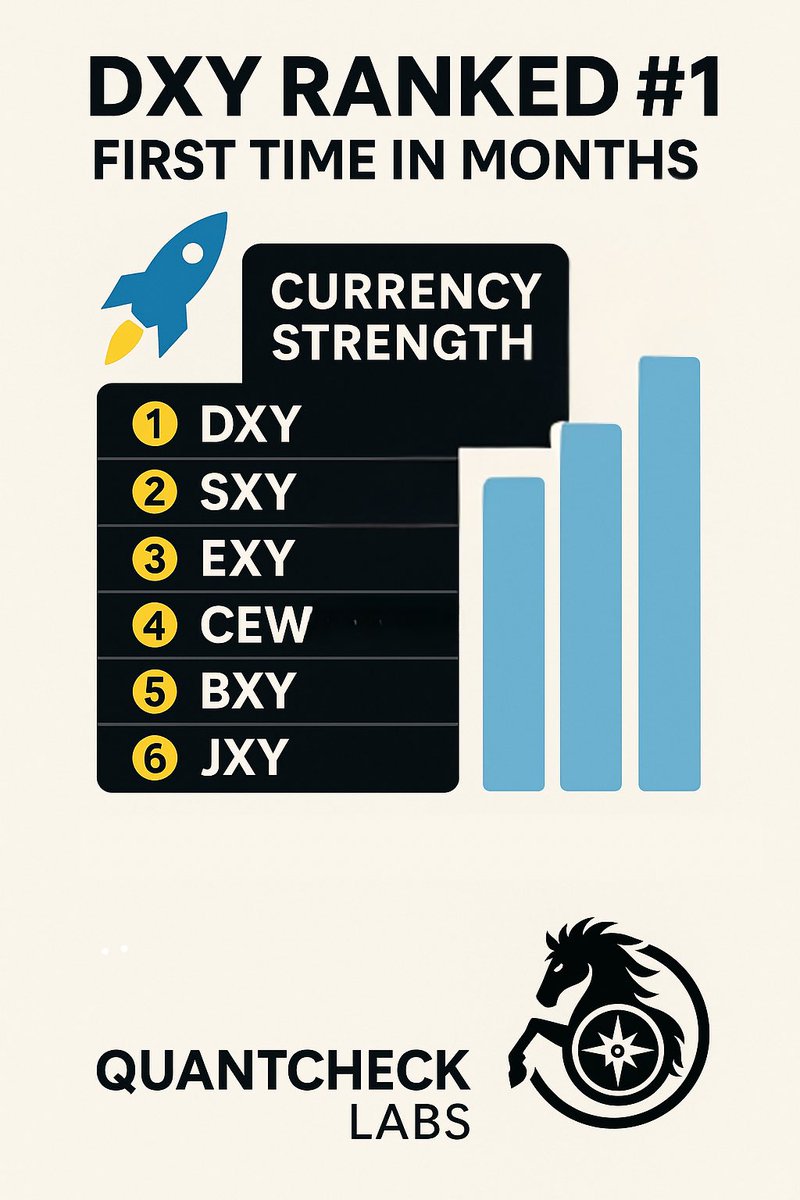

Dollar back on the throne 💵🦅 We track six major currency baskets🚦 the top spot just flipped. Our currency matrix just crowned DXY #1 — first time in months. Here’s today’s leaderboard: 1️⃣ DXY 2️⃣ SXY (Swiss) 3️⃣ EXY (Euro) 4️⃣ CEW (Emerging FX basket) 5️⃣ BXY (British) 6️⃣ JXY…

Whether it’s alt season or not, crypto’s gone K‑shaped: only a handful of coins surge. QCL Top 5 vs $BTC: $ENA +21.7%, $CFX +9.4%, $CRO +4.7%, $PENGU +3.1%, $ETH +0.6% vs $BTC –1.5%. Pick winners. Tomorrow, catch the move before it happens. All you need is 5 mins a…

Whether or not you’re long crypto at this stage is a different topic. But if you are allocated to crypto, then $ENA makes sense. It has remained part of QCL’s top 5 crypto matrix as of the open of Jul 20th. Disclaimer: the matrix gets updated daily. Remain long until rank >= 5…

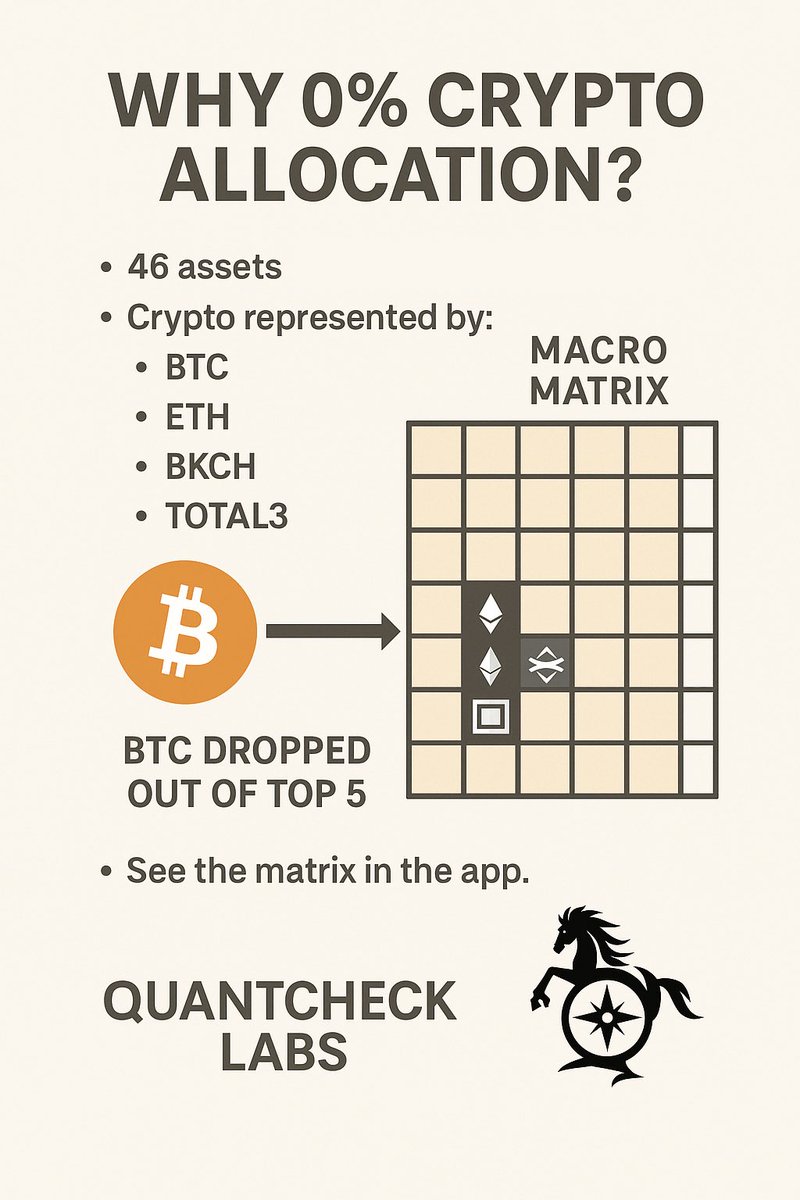

Context for why we called for a 0% crypto allocation 5 days ago: We use our 'macro' matrix to determine allocation and there are 4 representative assets for crypto in the macro matrix (there are 46 assets total in the macro matrix): 1) $btc 2) $eth 3) $bkch 4) total3 btc…

22 days ago (27 Jun) the QCL model went 100 % crypto—huge run. Today the signal flips: 0 % crypto, funds rotating into two stronger asset classes. Not a crypto-doom call, just relative-strength math: first cracks are showing. We could get a last pop, but odds now favor chop or…

United States Trends

- 1. Cheney 42.2K posts

- 2. Nano Banana Pro 14.9K posts

- 3. First Take 43.5K posts

- 4. #AcousticPianoSnowGlobe 1,957 posts

- 5. Cam Newton 2,220 posts

- 6. Stephen A 36.8K posts

- 7. SEDITIOUS BEHAVIOR 12.2K posts

- 8. FINAL DRAFT FINAL LOVE 362K posts

- 9. Trump and Vance 29.4K posts

- 10. #LoveDesignFinalEP 328K posts

- 11. #TSTheErasTour 1,606 posts

- 12. #XboxPartnerPreview 1,407 posts

- 13. Bush 51.9K posts

- 14. Sedition 86.3K posts

- 15. Husqvarna 1,077 posts

- 16. Treason 56.1K posts

- 17. Godzilla 21.9K posts

- 18. Stuart Scott 1,942 posts

- 19. Nnamdi Kanu 176K posts

- 20. #WeekndTourLeaks 1,097 posts

You might like

-

LeCryptoGF

LeCryptoGF

@iamelizbennet -

Mav 🛜

Mav 🛜

@dpbmaverick98 -

IA

IA

@ImaginaryAlpha -

cryptokaiguy

cryptokaiguy

@cryptokaiguy -

testosterone

testosterone

@tETHtosterone -

Bumzy 🪽

Bumzy 🪽

@0xBumzy -

the raven

the raven

@RavenofMind -

Jonny Fiat

Jonny Fiat

@JonnyFiat -

Jason Brannigan 🪴

Jason Brannigan 🪴

@Ja_Brann -

Matt

Matt

@dot_venv -

Pablitin 😵💫

Pablitin 😵💫

@0xPBL -

R

R

@neverabear -

harvey milk

harvey milk

@harveymizzle -

zqaby

zqaby

@zqaby1 -

eigenfxn🛡️🪨

eigenfxn🛡️🪨

@eigenfxn

Something went wrong.

Something went wrong.