Quant Support

@QuantSupport01

The infrastructure of money. Building on #Overledger? Follow @OverledgerDev. E Financial Services © London @ http://quant.network # Joined October 2016

Kindly get in touch with us via DM 💬📥 by clicking on the below button, and we will be able to help. 1950378712609779712

How does the Multi-Ledger Rollup work? ⚙️ The MLR's power comes from its unique design: - Sequencer: Orders transactions from various chains. - Consensus Nodes: Leverage connected networks to validate transactions. - Virtual Machine (VM) Node: Tracks the state of the entire…

The #tokeniseddeposit revolution faces a critical challenge that could determine its success or failure: the absence of universal standards for how #banks and #wallets communicate and operate. Achieving scale requires the industry to prioritise narrow, specific standards in…

📣 Attention UK @Xero users! This #BlackFriday, we’re giving you a one-day-only offer you won’t want to miss. Still processing #payments by hand, moving #taxfunds manually, or juggling multiple bank accounts? There’s a smarter way. Quant Flow connects directly with #Xero to…

As #tokenisedassets scale, #posttrade infrastructure remains fragmented. QuantNet orchestrates assets & money across #distributedledgers + traditional systems, no infrastructure replacement, no custody risk. The future of post-trade is programmable: eu1.hubs.ly/H0pLklM0

Did you know over a third of businesses face potential closure without access to vital funding? Yet traditional #credit forces rigid monthly repayments, regardless of #cashflow reality. With #QuantFlow, businesses can automate #repayments based on actual performance. Example:…

#Programmablemoney has the potential to revolutionise how individuals, businesses, and banks interact with value. We developed #QuantFlow to make this vision real. Not only does it give money a language, but it's also creating the infrastructure for a smarter, more connected…

The financial system is undergoing a major shift - toward #programmable, #sovereign, and real-time #digitalmoney. At @Sibos 2025, we’re diving into what this transformation means for the industry, during our session delivered by our Founder and CEO, @gverdian. 🎤 Title:…

Global #capitalmarkets handle roughly £50 trillion worth of securities, yet the infrastructure powering these transactions would be recognisable to traders from the 1980s. #Settlement still takes two days, #liquidity sits trapped in silos, and operational complexity drives costs.…

Are you ready for @Sibos 2025 in Frankfurt? Don't miss our Welcome event on the Tuesday evening, where delegates can connect with #fintech innovators, #banking leaders, software providers, speakers and corporate partners. You can also find us at Stand DISM13 to learn how…

History shows that monetary revolutions require robust infrastructure. #Programmablemoney demands equally sophisticated infrastructure – secure networks, regulatory #compliance frameworks, and #interoperability protocols that connect existing systems with emerging technologies.…

#Regulatedstablecoins give banks a powerful tool to compete in a world where money is becoming #programmable, fast, and borderless. But to make this a reality, banks need secure, compliant infrastructure that connects seamlessly with both legacy systems and #blockchain…

#Cashflowmanagement remains the cornerstone of business survival and growth, yet 37 percent of UK #CFOs operating mid-sized companies struggle with erratic cash flow patterns that cost their businesses an average of £660,000 annually. Learn why smarter #cashflow management can…

#Credit can fuel growth - but only if it’s managed well. Yet many businesses find themselves hamstrung by rigid loan terms, facing barriers to accessing cash and unexpected repayment stress. #Programmableworkflows, underpinned by our #digitalfinance platform #QuantFlow, can…

The #banking industry stands at the precipice of a digital revolution, with #tokeniseddeposits emerging as an alternative to central bank digital currencies (#CBDCs) and #stablecoins, by building on the very foundation of money we already use and trust. Discover how they work…

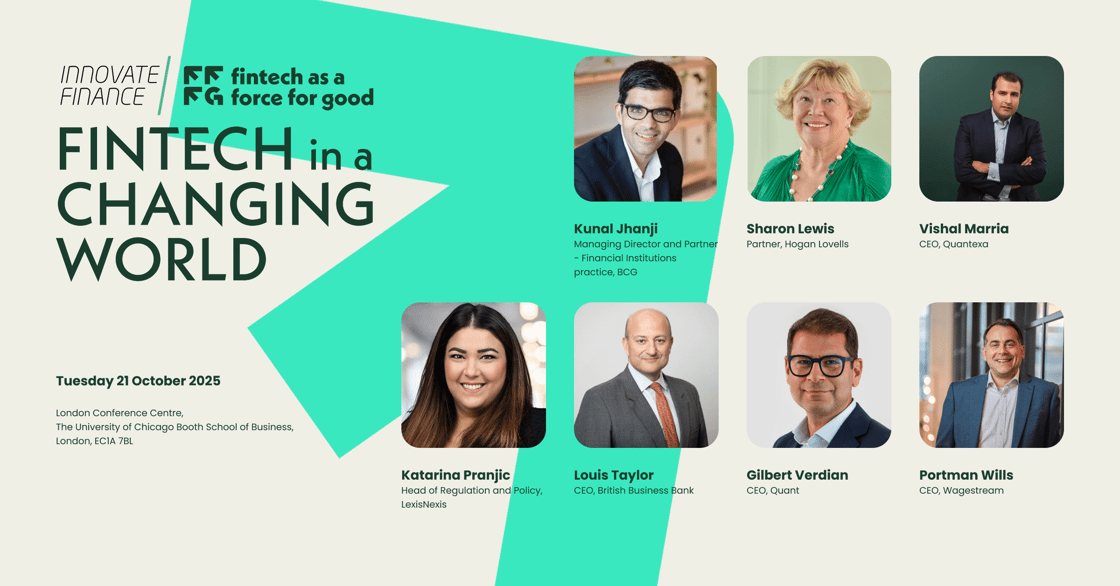

Next month, our Founder and CEO, @gverdian, will be attending @InnFin's 'FinTech as a Force for Good Forum' to share his insights into how we can build a safer, more transparent and inclusive #financialsystem. Learn more and register here: innovatefinance.com/fintechasaforc… #FinTech…

Programmable money will reshape #financialinfrastructure as we currently know it. By removing manual intervention and reducing operational complexity, businesses can cut costs, save time, and focus on growth. Consumers gain more control and confidence in managing their…

DLT in #capitalmarkets is set to be operationalised – the technology is proven, regulatory frameworks are being established, and the economic benefits are quantifiable. The question is whether your institution will lead this transformation or spend the next decade playing…

Exploring the possibilities of digital, #programmablemoney is no easy feat. Join us at @Sibos 2025 on 29 September – 2 October and book a meeting with our team to see how we can support your transition from traditional rails to #tokenisedmoneymarkets and #digitalassets:…

The #financialservices sector is experiencing a paradigm shift, as traditional institutions increasingly recognise the value of #publicblockchain infrastructure. What once seemed like a contradiction, highly regulated #banks operating on open, #decentralisednetworks, has…

United States الاتجاهات

- 1. Rockets N/A

- 2. Wemby N/A

- 3. #AEWDynamite N/A

- 4. Spurs N/A

- 5. Amen Thompson N/A

- 6. Benedict N/A

- 7. Sengun N/A

- 8. Ciampa N/A

- 9. #Bridgerton N/A

- 10. Fulton County N/A

- 11. Andrade N/A

- 12. Mikey N/A

- 13. Dylan Harper N/A

- 14. Model S N/A

- 15. Jaylon Tyson N/A

- 16. Chris O'Leary N/A

- 17. Castle N/A

- 18. Optimus N/A

- 19. #ChicagoPD N/A

- 20. Cavs N/A

Something went wrong.

Something went wrong.