Real Assets App

@RealAssetsFund

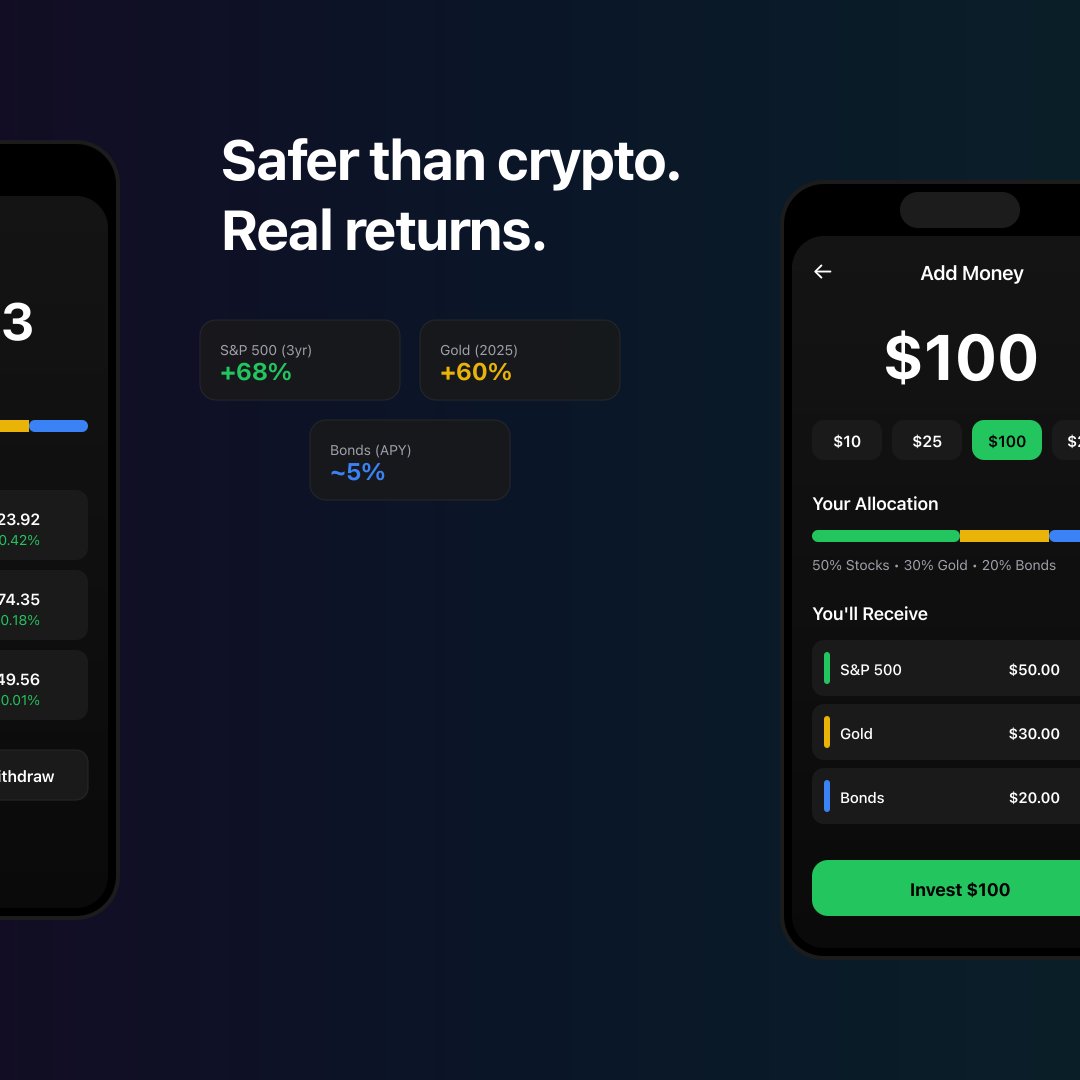

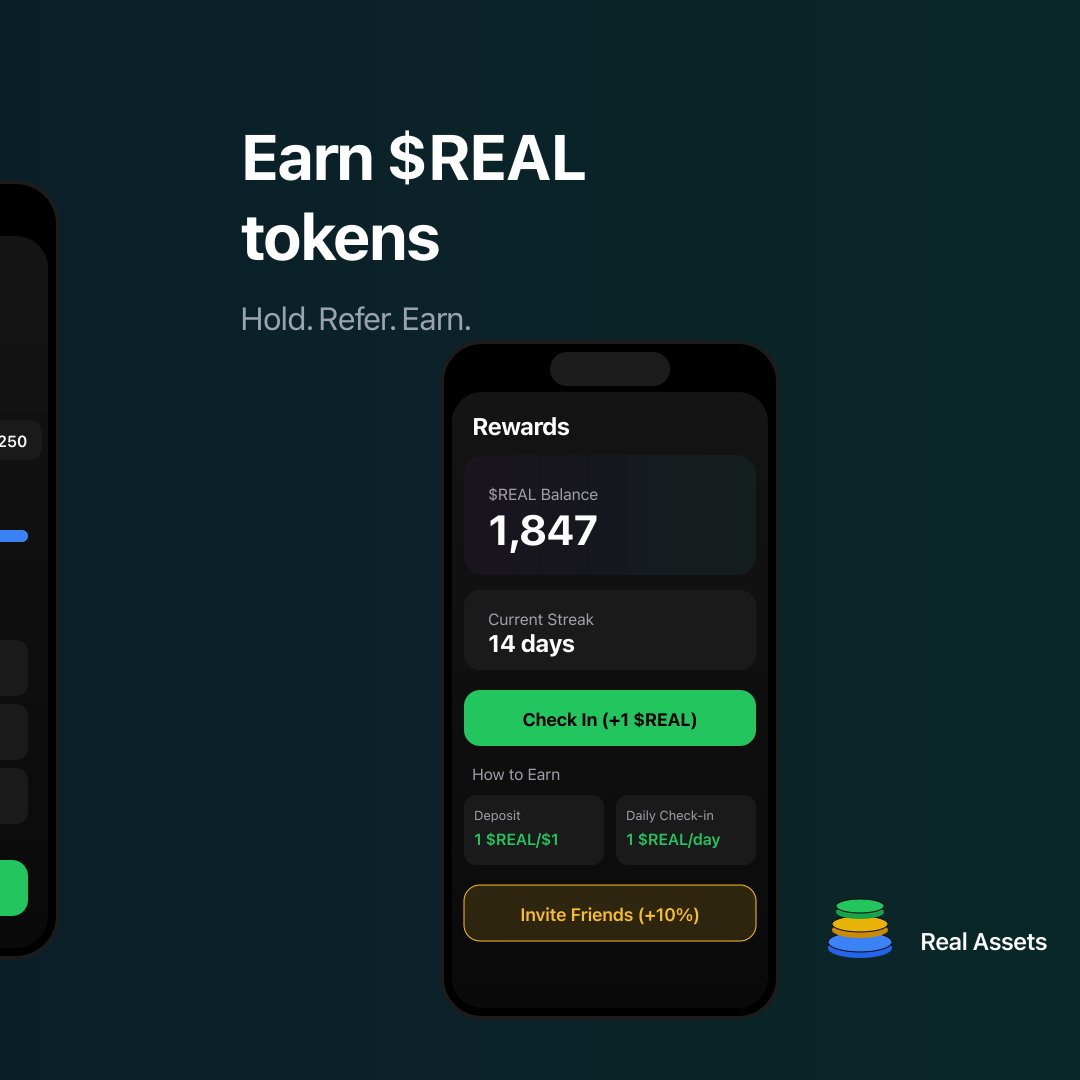

Invest in Stocks, Bonds & Gold on @Worldcoin. Real assets, real returns. Inspired by Bogleheads.

Gold had its best year since 1979 (+65%) The S&P 500 gained ~17% Treasuries paid steady 5% yields A simple 3-fund portfolio inspired by Bogleheads would have crushed it in 2025 We're bringing this strategy to @useworldapp users No brokerage. No minimums. Just real assets.

Crypto communities are the new digital tribes, with meme lords leading the charge and vibes stronger than any whitepaper.

Memecoins: the wild ride where chaos meets culture and sometimes a Lambo pulls up, if you're lucky.

Just vibing through the chop—market keeps playing games, but I'm here for the long haul. Stay sharp, don't get wrecked.

Memecoins: where chaos meets culture, and sometimes a Lambo pulls up—just don't bet the farm on it.

Why work for your money when it can work for you? Staking's the lazy genius move—let your crypto chill and earn passive income while you catch up on life.

Market's vibing like we're in a lo-fi playlist—just waiting for the beat to drop or the bass to kick in.

DAO governance: where voting feels like a team meeting, but instead of donuts, you get token incentives and the occasional rug pull.

Cross-chain bridges: the teleporters of crypto, but remember, even in sci-fi, teleporters sometimes lead to duplicates or disasters. Stay savvy.

Watching on-chain metrics is like reading the blockchain's diary—it's all about who's doing what and where the money's flowing. Want to know if the party's hot or not? That's your backstage pass.

Diversifying your crypto portfolio is like dating around—don't put all your love into one coin.

Cross-chain bridges: where your dreams of seamless swaps meet the reality of weak links. Tread lightly, or your bags might just find new destinations.

Why hustle when you can stake and let your crypto do the heavy lifting? It's like earning rent for your digital assets while you chill.

On-chain metrics are like the blockchain's receipts, showing you who's actually using the network and who's just flexing with charts.

Layer 2s: where the real magic happens. Scaling isn't just a buzzword, it's survival in this wild west.

Layer 2s are like the secret sauce—everyone talks about the main course, but without them, we're stuck in the slow lane.

Mix up your crypto like your dating life—don't put all your love into one token. Keep it interesting and spread the risk.

The crypto market's like that ex you keep going back to: always dramatic, never boring, and somehow you love the chaos.

United States Trends

- 1. Dodgers N/A

- 2. #TNAiMPACT N/A

- 3. Mets N/A

- 4. #TheTraitorsUS N/A

- 5. Baseball N/A

- 6. Colton N/A

- 7. World Series N/A

- 8. Yankees N/A

- 9. Bellinger N/A

- 10. #TNAonAMC N/A

- 11. Lockout N/A

- 12. Nobel Peace Prize N/A

- 13. Cohen N/A

- 14. Skubal N/A

- 15. #thepitt N/A

- 16. Ohtani N/A

- 17. Dixie Carter N/A

- 18. #911onABC N/A

- 19. The MLB N/A

- 20. Anfernee Simons N/A

Something went wrong.

Something went wrong.