Real Money Moves

@Real_Money_Blog

Personal finance writer. ETF nerd. Building wealth should be simple, transparent, and accessible. Not Financial Advice, Education Only.

Leveraged ETF Strategy: Amplified Returns & Hidden Risks 👉 realmoneymoves.com/leveraged-etf-… Leveraged ETFs can make you rich faster (or broke sooner). They’re typically tools for traders, not long-term investors. $TQQQ $UPRO $SPXL $QLD $SSO $SOXL $TECL $TNA $SQQQ $SPXU

How many different Stocks/ETFs do you have in your portfolio?

Optionality isn’t the same thing as diversification. A focused theme at five percent gives you upside if it hits and protects you if it doesn’t. Small enough to survive, large enough to matter. That’s how optionality should work.

How many different Stocks/ETFs do you have in your portfolio?

“The best thing a human being can do is to help another human being know more.” — Charlie Munger

Me purging my one-way followers:

Vanguard Group 13F (as of 9/30/25) Top Buys: 🟢 $TSLA ↑ 0.39% 🟢 $APP ↑ 0.17% Top Sells: 🔴 $MSFT ↓ 0.23% 🔴 $V ↓ 0.12% Top 5 Holdings: $NVDA 6.21% $MSFT 5.44% $AAPL 5.33% $AMZN 2.79% $AVGO 2.36%

Copart Inc $CPRT 🚗 runs the digital salvage-auction rails: asset-light yards, dominant network effects, and steady free cash flow. They turn totaled cars into a recurring business. Here’s where it sits in quality-tilted ETFs: $QUAL 0% $SPHQ 0% $SMOT ~0.60% $TOLL ~1.94%

Ratios keep you honest. An 80 to 20 split gives you a core position plus a tilt that shows up in performance. The ratio matters more than the decimals. Simple rules you can stick to will always beat precision that looks smart on paper and falls apart in real life.

“There’s nothing scary about a balance sheet. It can tell you if a company has the cash and the strength to survive tough times.” — Peter Lynch

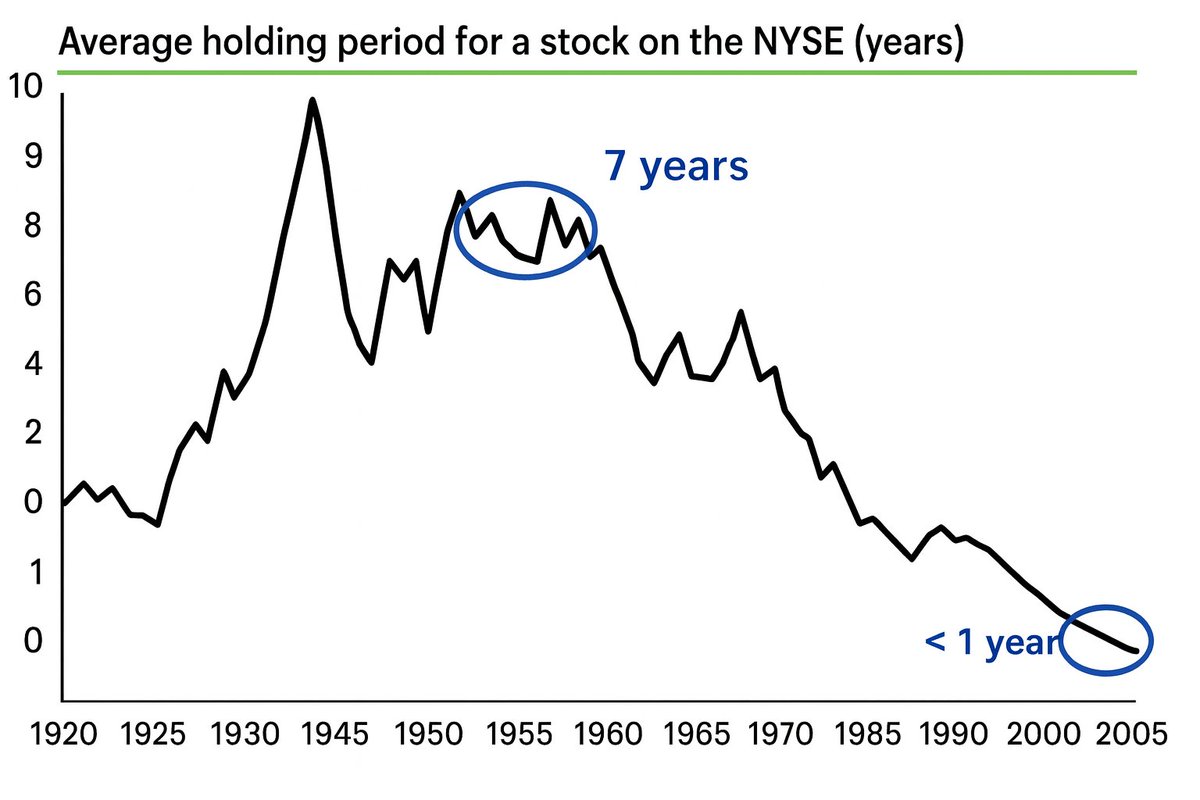

Recent NYSE data shows the average US stock is now held for about 6 months, down from over 8 years in the 1970s. That isn’t investing, it’s churn. Zero-commission apps make rapid bets easy, but brokers profit from your activity, not your long-term returns.

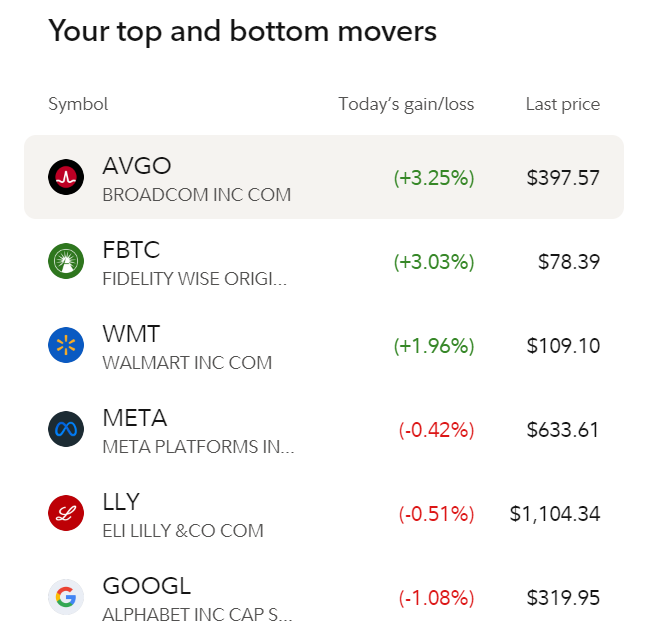

My “Top Movers” ↑↓ Today: $AVGO, $FBTC, and $WMT leading while $META, $LLY, and $GOOGL ease off shows capital rotating toward companies with clear cash flows, tech-infrastructure leverage, and liquidity strength. Nice to see Bitcoin price moving green🧐

“Know what you own, and know why you own it.” - Peter Lynch

Baker Bros. Advisors 13F (as of 9/30/25) Top Buys: 🟢 $CELC ↑ 2.12% 🟢 $MDGL ↑ 1.30% Top Sells: 🔴 $INSM ↓ 0.55% 🔴 $VRNA ↓ 0.21% Top 5 Holdings: $ONC 21.66% $INCY 18.84% $MDGL 7.10% $INSM 6.98% $ACAD 6.61%

AirBNB $ABNB 🏡 turned the travel rebound into a durable platform: asset-light model, rising free cash flow, and brand power. Pricing and host tools scale without heavy capital expenditure Here’s where it sits in quality-tilted ETFs: $QUAL 0% $SPHQ ~0.62% $SMOT ~0.70% $TOLL 0%

Unchecked lifestyle inflation is dangerous. Just like how flying first class makes economy feel inferior, if you live an expensive lifestyle then go back down, it’ll feel worse. If you don’t experience first class, you don’t know how “bad” economy really is after all.

United States Trends

- 1. Lamar 25.8K posts

- 2. Thanksgiving 1.79M posts

- 3. Ravens 32.8K posts

- 4. Chiefs 95.9K posts

- 5. Zac Taylor 2,046 posts

- 6. Cam Boozer N/A

- 7. Mahomes 30.2K posts

- 8. Tanner Hudson N/A

- 9. Joe Burrow 10.1K posts

- 10. Pickens 30.4K posts

- 11. Sarah Beckstrom 158K posts

- 12. Derrick Henry 3,061 posts

- 13. Tinsley 1,162 posts

- 14. #AEWCollision 8,394 posts

- 15. Duke 18.4K posts

- 16. Jason Garrett N/A

- 17. Caleb Foster N/A

- 18. Kyle Hamilton N/A

- 19. Chase Brown 2,086 posts

- 20. #CINvsBAL 1,242 posts

Something went wrong.

Something went wrong.