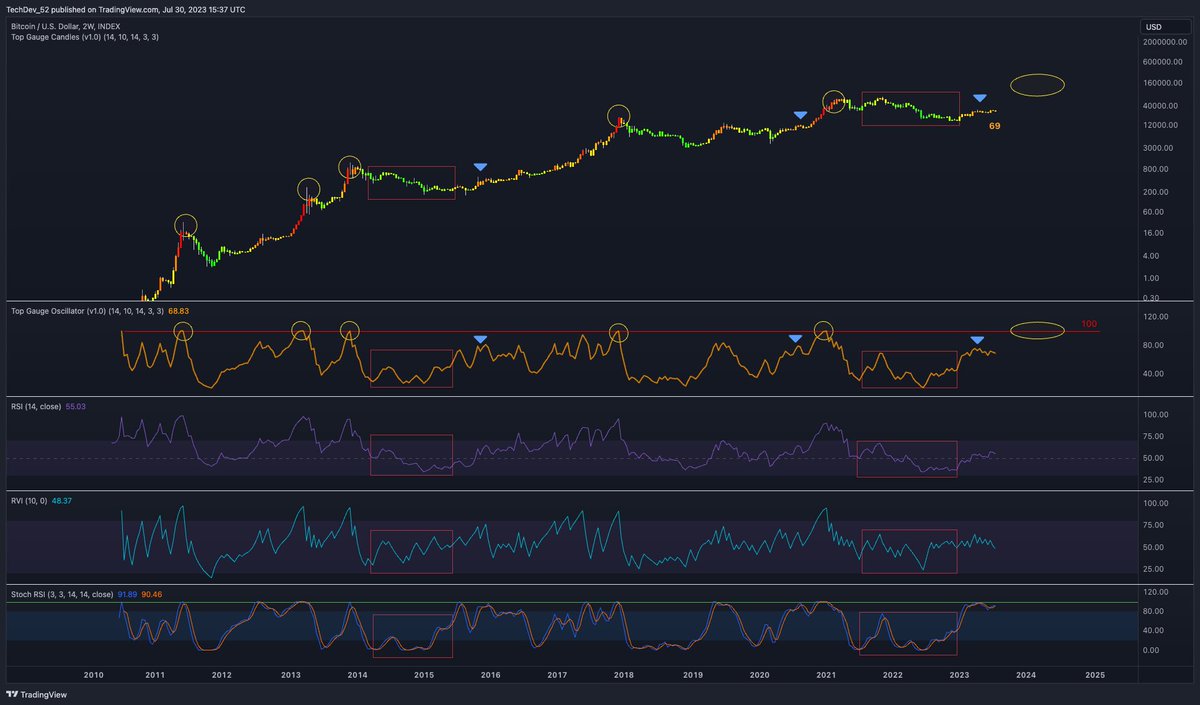

TechDev

@Real_TechDev52

Entrepreneur | #Bitcoin and crypto analysis

Few signals have correlated with #Bitcoin's macro inflections as tightly as China's 10-year yield. Local tops at major $BTC impulse tops. Local CN10Y downtrend breaking with 3W RSI exceeding 50... Began each of #Bitcoin's last 3 largest moves.

Either the months ahead surprise the market yet again, or this time is truly different. $BTC

Want to see a move up to 2M supertrend + retest to complete 2M compression. $BTC

Saylor, Capo, cryptocrash all trending. Never change CT.

It won't be boring forever. $BTC

Liquidity cycle MACD crosses and trendline breaks at tight #Bitcoin compressions. Monthly.

Last #Bitcoin issue featured: ✓ Expanded liquidity cycle analysis ✓ 3 topping signals to watch (1 with custom TV indicator, 2 with live chart links) Free trial now available. Sub link in bio.

#Bitcoin approaching historic 3W compression levels above 20 MA. Tick tock.

#SP500 already showed what happens after a low volatility 6-month compression against the 20M MA with steady MACD convergence approaching a cross. #Crypto lagging and looking to follow.

Global Liquidity = "Cycles" CB Balance Sheets = "Up-to-the-right" Multiply them together. #Bitcoin

Indicators put in so you can notice the cycle pattern and see structure more clearly. The purple scribbles I put in so everyone can follow along. Most have been thrown off with the Sept Top imo. Close on the bimonthly in 1 month and 5 days from now.

Doesn't look like it's ever been the halving. Clever if Satoshi tried to line it up though. It's a liquidity cycle world. #Bitcoin lives in it.

#Crypto market cap is beginning to expand with price above 20MA, after the tightest 3W compression in history. Only twice before did it even come close. Neither was 2019, and both began a major parabolic move.

I heard some landmark ruling with bullish #altcoin implications just happened to come in near a potential major top in #Bitcoin dominance. And yes, #Bitcoin can go parabolic at the same time.

#Bitcoin sure looks to be building a macro parabola. Question is whether this one will be steeper like late 2020, or shallower like early 2016. Not a bad position for macro investors.

United States Trends

- 1. Blue Origin 8,382 posts

- 2. Megyn Kelly 31.2K posts

- 3. New Glenn 9,254 posts

- 4. Vine 34.6K posts

- 5. Senator Fetterman 19K posts

- 6. Brainiac 6,091 posts

- 7. CarPlay 4,454 posts

- 8. #NXXT_JPMorgan N/A

- 9. World Cup 103K posts

- 10. Portugal 64.1K posts

- 11. Matt Gaetz 14.8K posts

- 12. GeForce Season 1,090 posts

- 13. Eric Swalwell 27.5K posts

- 14. Padres 29K posts

- 15. Man of Tomorrow 6,578 posts

- 16. Grade 1 26.5K posts

- 17. Black Mirror 5,297 posts

- 18. Katie Couric 9,931 posts

- 19. Judge 131K posts

- 20. Apple TV 10.5K posts

Something went wrong.

Something went wrong.