CoinForge

@Realcoinforge

Data-Driven Insights | Follow to learn more about crypto & global economy | Get your bi-daily crypto updates here ↓

How I went from entrepreneur to $3 million in crypto at a very young age.

"I'm gonna get a Clawdbot so I can outperform all of my competitors!"

I live in a penthouse, I’ve stayed at the nicest hotels around the world, I’ve partied on yachts, I’ve done what most people consider luxury. I could spend my weekends clubbing, at beach clubs, or at expensive restaurants, but… that doesn’t bring me joy. Instead, I play video…

Most investors like to say, "There is no top because we haven't seen euphoria." I think we got a top in October, and we're now forming a bottom. Euphoria isn't part of this cycle and likely won't be part of any future cycle because of institutions. Retail no longer controls…

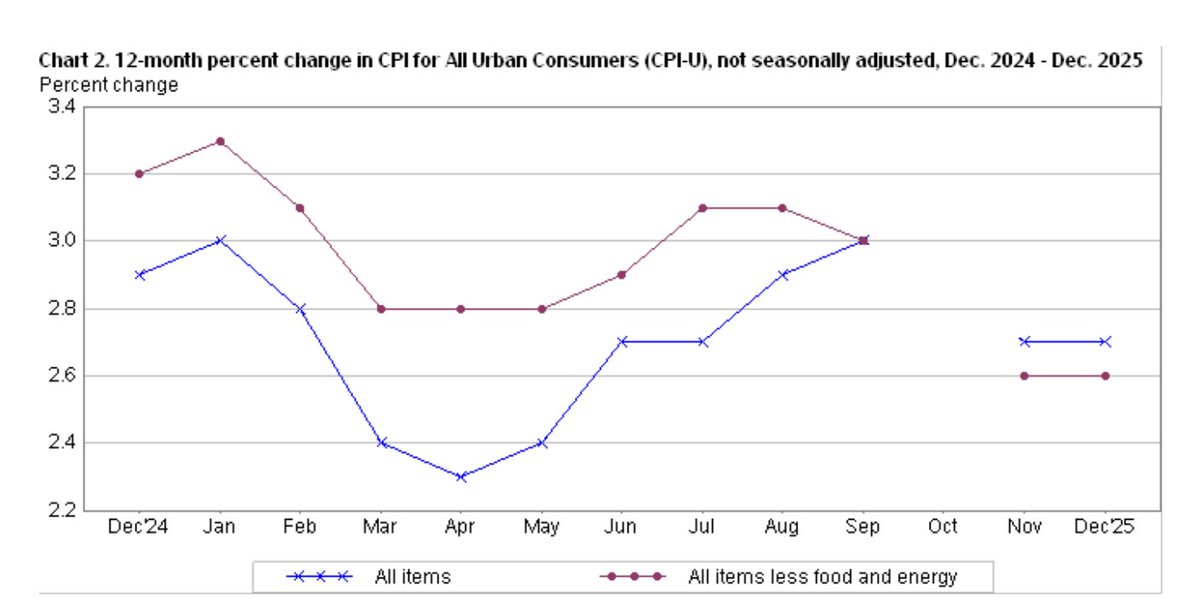

For all the perma-bears, let me put it like this: → Jobs data weakening → CPI printing lower → HUGE Treasury spending projections → ISM PMI in expansion → QT ended Dec 1 In my opinion, it’s irrational to remain bearish here. Sure, it may go down a little further, but…

This is something that most people will never be able to manage. You make the most money when fewer people agree with you. Most people simply move with the herd, finding comfort in the majority. But the majority lose in this game. For example, In this cycle, No one…

Getting paid $15/hour for manual labor.

Official CPI cooling off from 2.7% → 2.4%. I've said it before and I'll say it again: give it 4-6 months and CPI will print below 1.8%. Rate cuts are inevitable this year.

BREAKING: Official US CPI comes at 2.4% Y/Y Truflation correctly predicted the numbers would come in cooler than the market consensus of 2.5%, between 2.2% and 2.4%, when we extrapolate our rapidly cooling numbers to the BLS CPI.

I LOVE seeing bearish tweets everywhere. I LOVE people being on the opposite side of me. I LOVE being the abnormality. I LOVE making money.

It’s delusional to believe the Fed isn’t going to aggressively cut rates in 2026. Truflation has printed 0.68%, which is about 66% lower than the Fed’s baseline target of 2%. If this number accurately represents true consumer inflation, CPI YoY will drop significantly over the…

Hopefully you guys are starting to understand what I meant about a declining inflation rate. We will, almost inevitably, see aggressive rate cuts in 2026. That's when the capital will finally rotate.

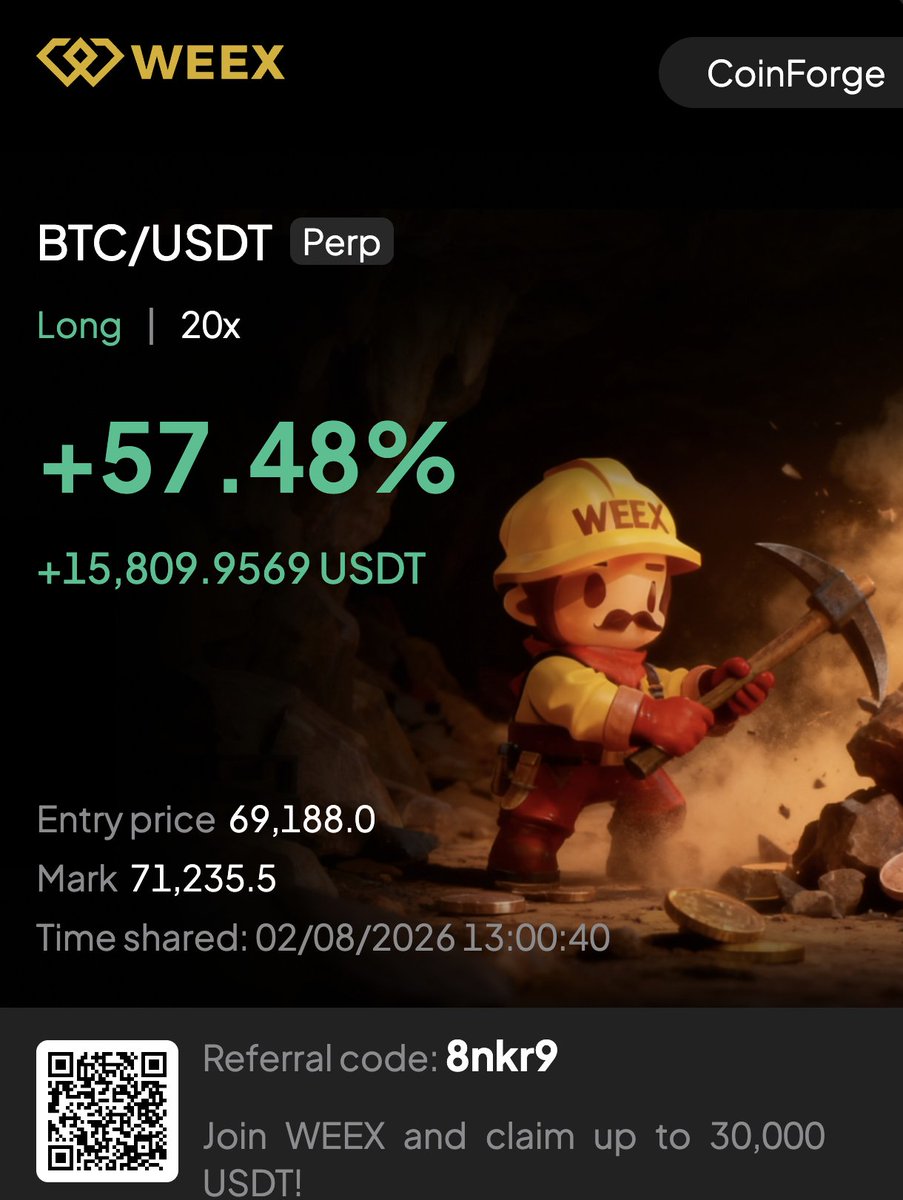

Weekend longs paying off pretty well so far. Everyone on CT said "Do NOT long this up-move", "Easiest weekend shorts", "easy shorts here." So I did the opposite. These trades are often the easiest money you can possibly make.

recently discovered an interesting pattern while observing the Bitcoin Relative Volatility Index. Throughout history, it has found a bottom below 30, formed a higher low, and then Bitcoin has taken off. It’s forming a higher low as we speak.

Here are two unpopular opinions: 1. Even if Epstein created Bitcoin, it wouldn't matter. 2. Even if Satoshi sold, Bitcoin wouldn't go to zero. Simple.

I honestly believe we could see the largest pump season in the history of crypto in 2026–2027. There are so many catalysts being held back by uncertainty and negative expectations. Once this eases, it’s almost inevitable.

I haven’t seen a better buy opportunity on Bitcoin since 2019. Even though they may not appear the same, what we’re seeing right now is very similar to 2020. → The RSI is below 30 → The 200d EMA has been hit → The ISM PMI has started expanding Even if I end up being wrong,…

United States Trends

- 1. Jesse Jackson N/A

- 2. Happy Lunar New Year N/A

- 3. Colbert N/A

- 4. Good Tuesday N/A

- 5. Fat Tuesday N/A

- 6. Tony Clark N/A

- 7. Rev. Jackson N/A

- 8. Rest in Power N/A

- 9. Gina Carano N/A

- 10. Ronda Rousey N/A

- 11. Embo N/A

- 12. I AM SOMEBODY N/A

- 13. Keep Hope Alive N/A

- 14. James Talarico N/A

- 15. Mardi Gras N/A

- 16. MLBPA N/A

- 17. Taco Tuesday N/A

- 18. #tuesdayvibe N/A

- 19. The Mandalorian and Grogu N/A

- 20. The Rev N/A

Something went wrong.

Something went wrong.