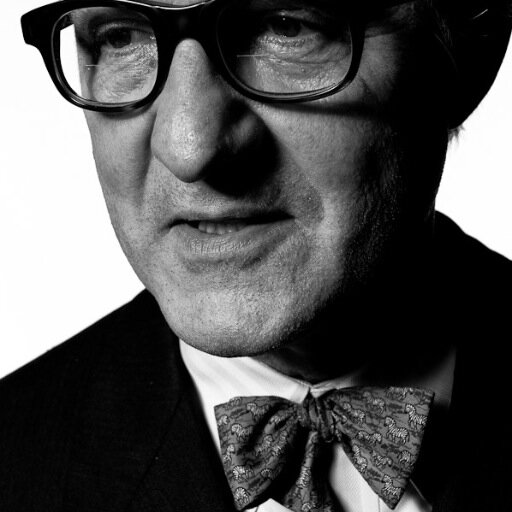

Porter Collins

@Seawolfcap

Value investor, short seller and 2 time Olympian. Always looking for the next Big Short. https://substack.com/@whatarewedoingonthedesk

قد يعجبك

Interesting to me that an activist fund is going after a company with the same EBITDA margins as NVDA...

$NEM | Activist hedge fund Elliott Management has built a multi hundred million dollar stake in $B Barrick Mining, per FT. Reports say Elliott now ranks among Barrick’s top 10 holders with a stake over $700M and is pushing to separate its North American and higher risk assets.

I don't think anyone argues that the average insider sale correlates with negative forward stock performance (the research certainly doesn't back this claim). But claiming there is no signal in insider selling is equally as incorrect. Let's just look at the companies in the last…

I don’t blame them asking again for the bailout but something is very wrong here.

OpenAI has asked the US to expand the CHIPS Act Tax credit for data centers

Seems like we are back to “Not QE, QE”

FED'S WILLIAMS: FED MAY SOON NEED TO EXPAND BALANCE SHEET FOR LIQUIDITY NEEDS

History shows us that having too much debt during an economic downturn leads to a classic, self-reinforcing cycle where: 1) The empire can no longer borrow the money to repay its debts 2) It prints a lot of new money, which devalues the currency and raises inflation 3) Living…

“NVIDIA’s biggest competitor is Google….I think you could argue they are the leading AI company” @GavinSBaker

Sports are amazing at teaching so many lessons, even if your team is 1-7. Today felt like we won the Super Bowl…..

“Consider it pure joy, my brothers and sisters, whenever you face trials of many kinds, because you know that the testing of your faith produces perseverance. Let perseverance finish its work so that you may be mature and complete, not lacking anything.” James 1:2-4 JETS WIN 🙌🏽

All that talk about wage garnishment lasted only a few weeks...Anybody see the pattern here?

The Trump administration has agreed to forgive student debt under income-driven repayment programs it had partially blocked, per CNBC.

I called this 18 months ago.....

Powell: The Fed could end QT in the coming months

Near record quarter and the #1 Wall Street firm is cutting jobs. At the same time investors are clamoring to fund all these AI companies that are about to destroy their jobs. Interesting times.

GOLDMAN SACHS IS PLANNING A ROUND OF LAYOFFS, SOURCES SAY -- WSJ

Looks like we can finally buy $GLASF on @RobinhoodApp . Thank you for acting faster than the NYSE and Nasdaq!

One thing we haven't see from Google is the intricate web of ponzi type deals unlike all the other AI players.

$GOOGL just launched Gemini Enterprise, its new agentic AI platform built to compete with Microsoft and OpenAI. The platform unifies Google’s latest Gemini models, a no-code workbench, customizable business agents, and a secure data layer, all managed under one governance…

Lots of people laughed at @LukeGromen when he mentioned this shift could occur post USD sanctions. The preferred reserve asset of central banks will be gold soon enough.

When geopolitical & socio-economic tensions rise, both people & nations turn to hard assets. One big buyer in particular has been Beijing. China has been swapping Treasuries for gold for years, lifting reserves to over 74m ounces. This is a reflection of both state policy and…

Good to see some things don't change.

An example of what many central banks have been doing, as China sheds itself of US Treasuries (though still owns more than $700b worth), they continue to buy more gold. China's gold holdings value (so tonnage + appreciation)

Since nobody is saying it I will: We're witnessing the largest and most concentrated instant market cap expansions in history with no proven future revenue/cost/earnings models to back up the investments or the valuations. This market is running on an incredible amount of blind…

$AMD - *AMD SOARS 38% ON OPENAI DEAL, ADDING $101 BILLION IN VALUE

$PCT: a lot of bears have been asking me recently "are you nervous we have haven't seen any press releases about orders"? Looks fairly promising to me but no big change in my opinion. The pic is from today's presentation.

U.S. Stocks are underperforming the rest of the world by the largest margin since 2009

Over 15 years since the book & almost 10 years since the movie & feels like we’re back on our trading desk talking about the GFC; Michael Lewis joins @Seawolfcap @VD718 & myself to talk about what has & hasn’t changed since 2008 & we take some questions! whatarewedoingonthedesk.substack.com/p/michael-lewi…

Yeah most SOC shareholders want the pipeline but at this point the environmentalists deserve the tankers all year long for 50 years and the $10b lawsuit. The definition of overplaying a hand. See 19m in.

United States الاتجاهات

- 1. Thanksgiving 2.28M posts

- 2. Lions 92.7K posts

- 3. Dan Campbell 6,241 posts

- 4. #GoPackGo 10K posts

- 5. Wicks 10.2K posts

- 6. Jordan Love 13.5K posts

- 7. Micah Parsons 8,527 posts

- 8. Goff 10.8K posts

- 9. Jack White 8,621 posts

- 10. Watson 15.1K posts

- 11. #GBvsDET 4,594 posts

- 12. #OnePride 6,797 posts

- 13. Jamo 5,000 posts

- 14. Gibbs 8,805 posts

- 15. Caleb Wilson N/A

- 16. Jameson Williams 2,628 posts

- 17. LaFleur 4,430 posts

- 18. Thankful 465K posts

- 19. Turkey 295K posts

- 20. Hutch 1,928 posts

قد يعجبك

-

Vincent Daniel

Vincent Daniel

@VD718 -

CrossBorder Capital/ GLIndexes

CrossBorder Capital/ GLIndexes

@crossbordercap -

George Noble

George Noble

@gnoble79 -

Kantro

Kantro

@MichaelKantro -

Michael Green

Michael Green

@profplum99 -

Kuppy's Korner

Kuppy's Korner

@kuppyskorner -

Christopher Bloomstran

Christopher Bloomstran

@ChrisBloomstran -

Danny Moses

Danny Moses

@dmoses34 -

Laughing Water Capital

Laughing Water Capital

@LaughingH20Cap -

Marc Cohodes

Marc Cohodes

@AlderLaneEggs -

AV

AV

@AureliusValue -

bill fleckenstein

bill fleckenstein

@fleckcap -

Lake Cornelia Research Management

Lake Cornelia Research Management

@CorneliaLake -

Paulo Macro

Paulo Macro

@PauloMacro -

Jesse Felder

Jesse Felder

@jessefelder

Something went wrong.

Something went wrong.