Sigma Knight

@SigmaKnight__

An independent broker providing specialist funding solutions including short term property loans and business finance #Bridging #Finance 📞 020 4531 6500

You might like

It’s Q&A Friday… this week we answer the question ‘What factors do underwriters consider when reviewing a development finance application?’ 👇 #DevelopmentFinance #PropertyDevelopment #PropertyInvestment

If you’re a #FirstTimeDeveloper looking for #DevelopmentFinance, you may find that some lenders are reluctant to lend you the funds due to your lack of experience which can be considered higher risk. Although everyone has got to start somewhere, right? 🤔 sigmaknight.com/blog/how-to-se…

Did you know you can raise finance secured against your business’ assets such as equipment and machinery?💰 Or, if you need new equipment to help your business grow, but are short on cash, you can borrow the money now and spread the cost over time👉 sigmaknight.com/corporate-fina…

How does invoice financing work? 🤔 Head to sigmaknight.com/corporate-fina… to see our case study examples... #InvoiceFinance #InvoiceFactoring #Invoices #BusinessLoan

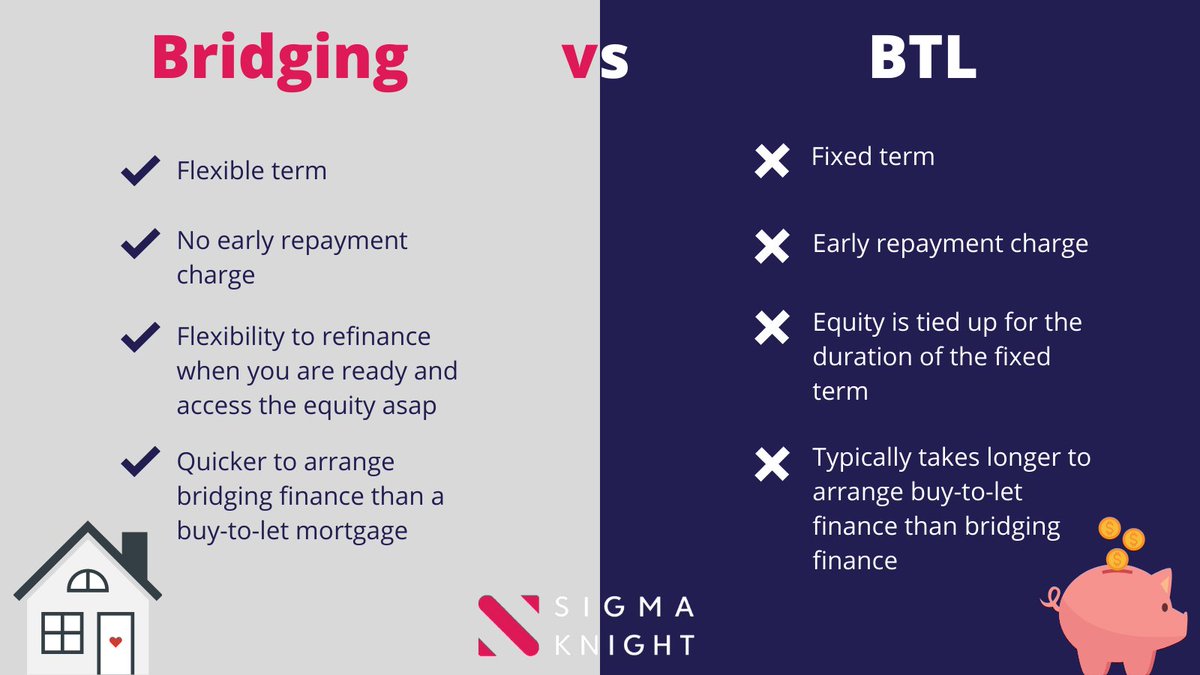

Bridging finance used to be reserved for only the most experienced #PropertyInvestors but the sector has grown rapidly and #BridgingLoans now have multiple use cases from initial purchase and funding a refurbishment, through to selling or refinancing with a BTL mortgage🏡

Our top tips for selecting the right #DevelopmentFinance Part 2👇 1. Shop around – compare quotes from multiple lenders to find the best deal 2. Put your best foot forward – you must present yourself and your case in the best way to reassure underwriters that you’re a safe bet

It’s Q&A Thursday, this week we answer the question ‘How can I finance a refurbishment project?’ To learn more, check out our blog post 👉 sigmaknight.com/blog/how-to-fi… #Refurbishment #BridgingFinance

Top tips for selecting the right #DevelopmentFinance👇 Fail to prepare, prepare to fail. Make sure you’ve got your ducks in a row before you apply for finance. Check your figures and get a full breakdown of costs so that you can share accurate calculations with lenders.

It’s Q&A Thursday… this week we answer the question ‘What security will I need to provide to obtain invoice finance?’ #InvoiceFinance #BusinessLoan #BusinessGrowth

What factors do you consider when selecting the right #bridging finance?🤔 There is currently a race to the bottom on interest rates, but the rate alone does not determine how suitable a loan is for your project. Other factors include product fees, the LTV, & repayment terms ✅

Growing rental demand and increasing #property prices mean that #refurbishment projects continue to present a good opportunity for investors📈 Although a huge increase in demand for building and construction work over the last 12mnths has driven up costs of materials 💰

When purchasing property for investment, it can make sense to buy a property that needs refurbishment as you can make a bigger ROI💰 Here we explain why a bridging loan can make more sense than a BTL mortgage to fund refurbishment costs 👇 sigmaknight.com/blog/how-to-fi…

Shariah bridging finance is, for the most part, just like a traditional bridging loan. The key difference between a traditional bridging loan and a Shariah bridging loan is the way that interest is applied...👉 sigmaknight.com/blog/shariah-b… #Shariah #BridgingLoan #ShariahFinance

The Association of Short-Term Lenders found that bridging loan completions reached £1.1bn in Q2 📈 Bridging loan books now stand at more than £4.7bn and the market is showing strong signs of recovery as we emerge from lockdown✔️ #BridgingLoans #BridgingFinance

If you’re planning to refurbish a property, it’s a good idea to consider all available finance methods to weigh up your options and pick the one that’s right for you👇 sigmaknight.com/blog/how-to-fi… #PropertyInvestment #BuyToLet #Refurbishment

It’s Q&A Thursday, this week we answer the question ‘When applying for development finance, will I have to explain how the funds will be used?’ #Development #DevelopmentFinance #PropertyDevelopment

21% of #bridging loans that were taken out in Q2 were due to a break in a #property chain, allowing borrowers to proceed with their purchase regardless and ensuring that they didn’t miss out on the opportunity to buy – as revealed by bridgingtrends.co.uk 🏡

It’s Q&A Thursday… this week we answer the question ‘If I take out a bridging loan for 24 months, can I pay it back sooner than the 24-month period?’ #Bridging #BridgingLoans #PropertyFinance #PropertyInvestor

If you’re looking to raise capital to purchase new equipment and help grow your business, could asset finance be the right finance solution for you? #AssetFinance #BusinessLoan #Business

House prices in Newham and Barking and Dagenham have soared by more than 80% since the 2012 Olympics 👀 Projects including the London Stadium and the Olympic village have contributed to the popularity of surrounding boroughs. #London #Olympics #HousePrices mylondon.news/news/east-lond…

United States Trends

- 1. Indiana 120 B posts

- 2. Mendoza 34,9 B posts

- 3. Dante Moore 14,9 B posts

- 4. #PeachBowl 4.965 posts

- 5. Dan Lanning 5.295 posts

- 6. Cignetti 11,7 B posts

- 7. 2019 LSU 2.078 posts

- 8. #DragRace 5.819 posts

- 9. #iufb 6.171 posts

- 10. Stein 7.895 posts

- 11. #OPLive 1.778 posts

- 12. #NeverDaunted 4.004 posts

- 13. Pick 6 8.796 posts

- 14. Phil Knight N/A

- 15. Grizzlies 13,5 B posts

- 16. Charlie Becker N/A

- 17. Elijah Sarratt N/A

- 18. Ponds 4.926 posts

- 19. Hamas 130 B posts

- 20. Chelsea Gray 2.268 posts

Something went wrong.

Something went wrong.