Simply Compounding

@SimplyCompound

I analyze businesses and like to buy things for cheaper then they are worth.

You might like

Haven't been on X since last year. You should be proud of me.

If someone ever mentions "Berkshire Hathaway" and "P/E ratio" in the same sentence you should just immediately run

$BRK.B ~ Berkshire Hathaway Has had a 14% price increase YTD and is trading at a low P/E ratio Do you think the stock is undervalued?

Wait what! Credit Suisse is still a thing?

CREDIT SUISSE INCREASES S&P 500 YEAR-END 2023 TARGET TO 4,700 FROM 4,050

From my understanding of $HIFS, I believe that when they report earnings tomorrow that it will be quite a significant drop from the previous quarter. My educated guess is that core eps comes in at $1.50. Just a guess based off what I think they payed on deposits for the quarter.

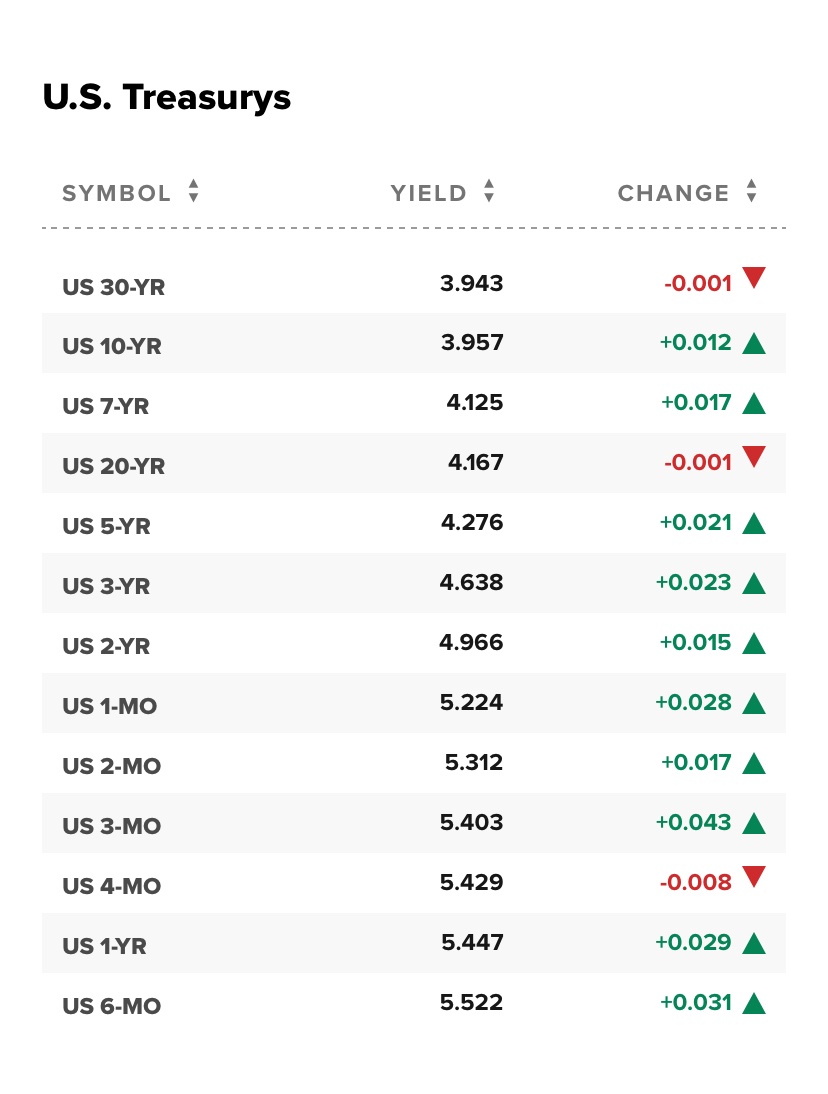

There haven't been many times in History when 30 year treasuries have had lower rates than all other kinds of treasuries. Quite odd

Titanic Survivor Interviews from 1956 and 1970 youtu.be/-p3D7rQdhxw

youtube.com

YouTube

Titanic Original Survivors Interviews from 1956 & 1970 *Must See*

The problem with cyclicals is that most tend to buy back shares right at the wrong time. They do this right when profits are highest and usually when valuations are the highest too.

This is exactly what a competitive advantage looks like.

Warren Buffett in 1991: “Every year for 19 years, I’ve raised the price of [See’s Candies] … and everyone keeps buying the candy. Every ten years, I tried to raise the price of [textile] linings a fraction of a cent — and they’d throw the linings back at me.” $BRK.A $BRK.B

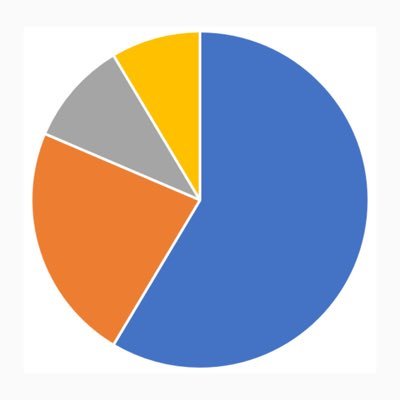

An interesting fact about Berkshire Hathaway $BRK.B is that, for its stock portfolio, 60% of its investment selections are held for less than a year while only 4% are held for more than a decade. Even more interesting, it is the 4% that creates the bulk of Berkshire's wealth.

"no research, no thinking" 🤦♂️

Investing solely into ETFs/index funds is not exciting. BUT it requires no research, no thinking, & it's a strategy that works & difficult to beat. This is the most effective route for many.

If you use CAGR for increases in book value you're making a *Dangerous* mistake. 1/X

Great Thread

Removing Working Capital from FCF calculations Why should a whole business also be adjusted by any movements in working capital? Isn’t it useful to take into account movements in working capital to observe cash flow generating capacity? “Cashflow > Earnings”? Let me explain why…

United States Trends

- 1. Klay 21.2K posts

- 2. McLaren 69.7K posts

- 3. #AEWFullGear 70.9K posts

- 4. Lando 116K posts

- 5. #LasVegasGP 204K posts

- 6. Ja Morant 9,396 posts

- 7. Oscar 108K posts

- 8. Max Verstappen 57.4K posts

- 9. Piastri 47.9K posts

- 10. Hangman 10.2K posts

- 11. Samoa Joe 4,984 posts

- 12. Gambino 2,645 posts

- 13. LAFC 15.8K posts

- 14. Swerve 6,469 posts

- 15. #Toonami 2,843 posts

- 16. Kimi 44.7K posts

- 17. Utah 23.9K posts

- 18. Fresno State 1,016 posts

- 19. South Asia 34.6K posts

- 20. Rose Bowl 1,674 posts

You might like

-

Investment Wisdom

Investment Wisdom

@InvestingCanons -

Sidecar Investor

Sidecar Investor

@sidecarcap -

William Green

William Green

@WilliamGreen72 -

Roundhill Investments

Roundhill Investments

@roundhill -

The Conservative Income Investor

The Conservative Income Investor

@TCII_Blog -

Fortescue

Fortescue

@FortescueNews -

Rahul Sharma

Rahul Sharma

@Retail_Guru -

Maxfield on Banks

Maxfield on Banks

@MaxfieldOnBanks -

Spencer Jakab

Spencer Jakab

@Spencerjakab -

joshua rosner

joshua rosner

@JoshRosner -

Benif

Benif

@Benif_ch -

Mimmo Nobile

Mimmo Nobile

@nobilefunds -

Jody Hirschi

Jody Hirschi

@thehirschibar -

Brent Humason

Brent Humason

@BrentHumason -

Cameron Russell

Cameron Russell

@Cam_Russell_

Something went wrong.

Something went wrong.