Quant ={RhΞo}

@SizeQuant

All about big numbaz and big booty bishes @rheo_xyz IYKYK

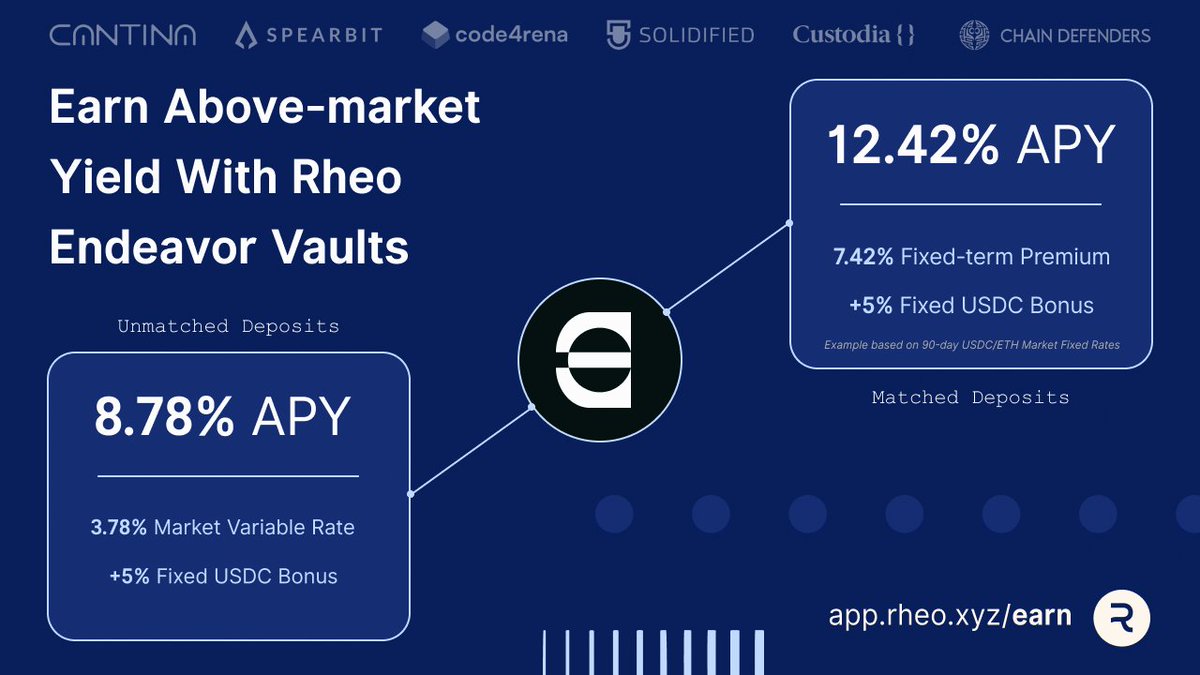

Swerve baseline yield traps 🪤 Unmatched → market variable rate + 5% USDC fixed bonus Matched → fixed-term premium + 5% USDC fixed bonus

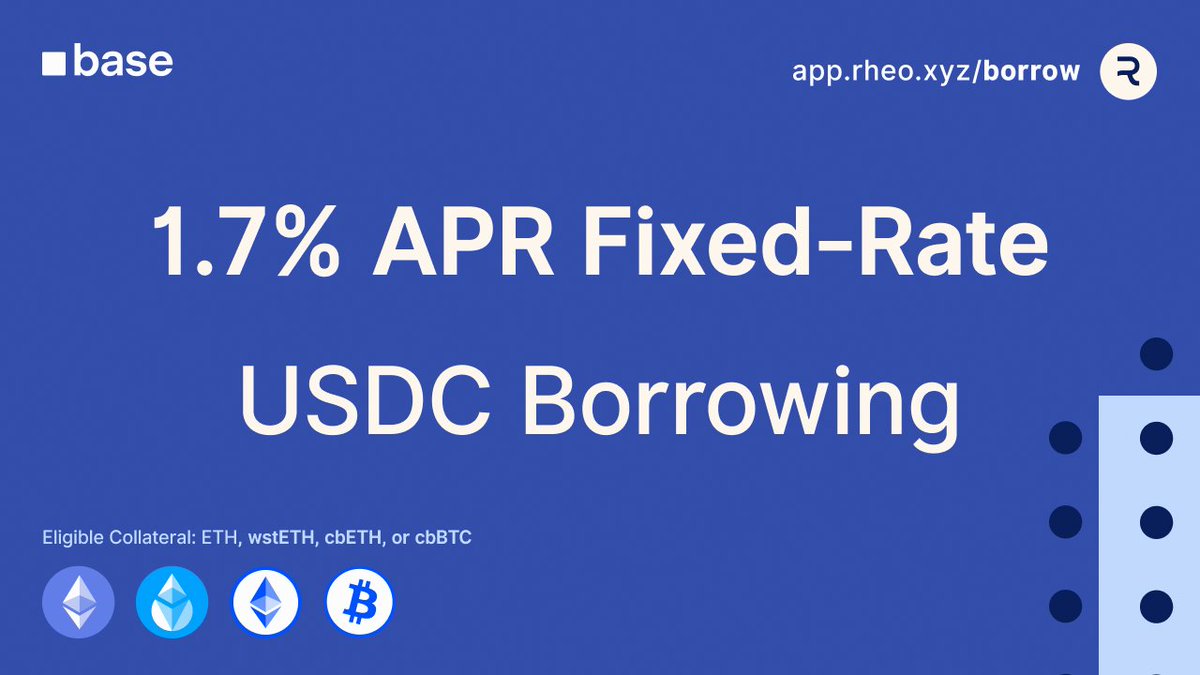

DeFi was meant to unlock credit markets 🔓 Rate volatility, co-mingled collateral risk, and utilization caps still punish borrowers Lock in a Base USDC fixed-rate position for 90 days or more → get predictable funding with a 2% rebate

Stop overpaying and cut USDC borrowing from 3.73% → 1.73% APR Fixed 📌 Reclaim 2% on leading borrow rates on Base (90d+) Check eligibility ↓

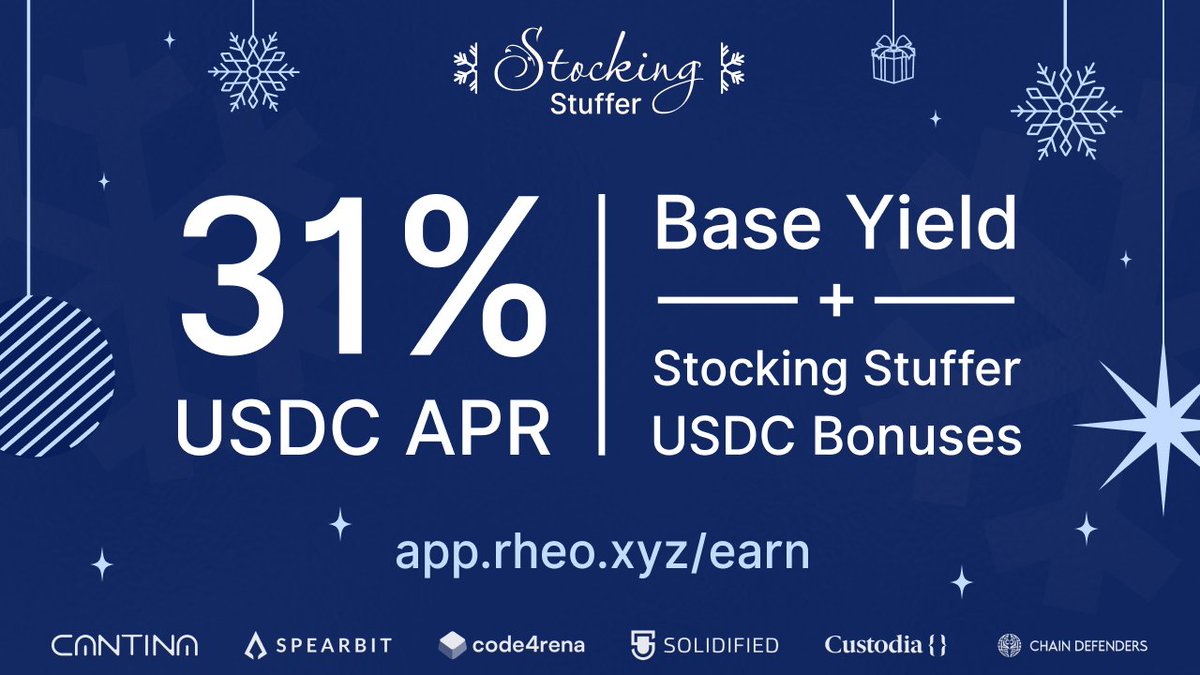

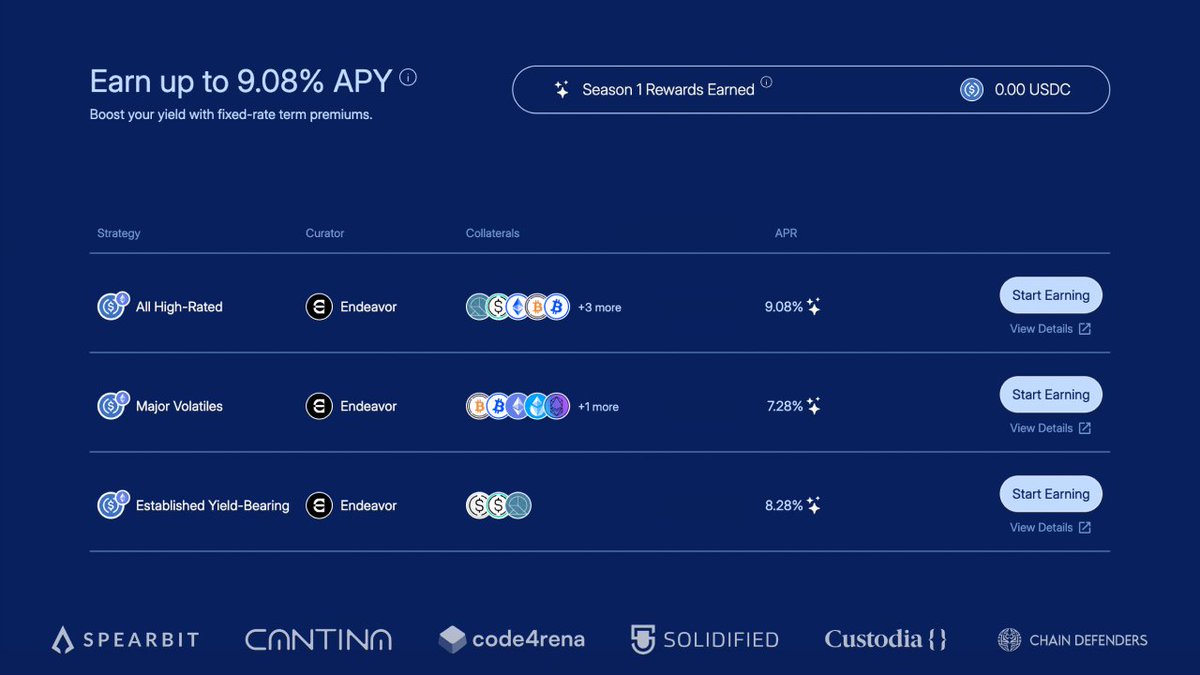

31% APR, all in USDC 🎁 Deposit to Endeavor vaults → get premium yield + festive USDC rewards

A must-watch for a reality check on market vals

NEW Crypto Yield Curve podcast! 🎙️ How Should We Value Crypto? (~17 mins) A recent debate between @hosseeb and @santiagoroel exposed industry pricing doubts Rheo core explains why spreadsheets misprice crypto, exponentials overreach – and which onchain signals truly matter

Sliding yields don’t have to freeze your profits 🥶 Endeavor vaults use term premiums to outpace variable rates – with festive USDC rewards now layered on top

Double yields. Double-digit APR. Earn up to 35% USDC yield on Endeavor vault deposits now!

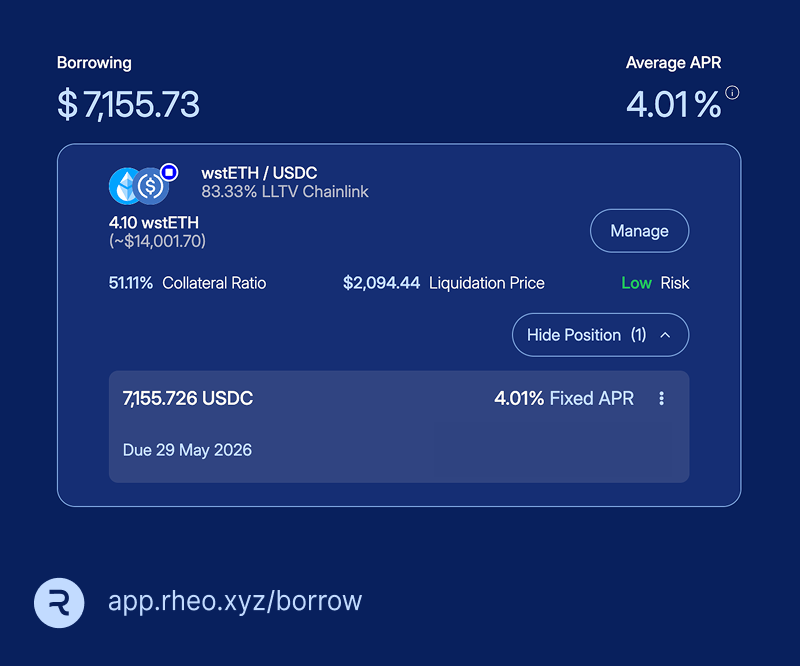

90d+ fixed rates from 6.12% APR – with a 2% rebate back ⏪ ✓ Predictable costs ✓ Prime collateral ✓ Market-proof funding 🔗 app.rheo.xyz/borrow

A new Rheo borrower just locked 180d @ 4.01% APR vs. wstETH on Base. Why? First off, @LidoFinance staking yield is only 2.6% APY. So this wasn’t a carry trade. With @Aave’s variable rates sliding to 3.54% borrow / 3.23% lend, this was a pure bid for funding certainty. They…

Rheo has top-tier security down to a tee 🔗

We’re excited to announce that Rheo has adopted the @_SEAL_Org Whitehat Safe Harbor! Further boosting our security stack, Safe Harbor provides legal protection for ethical hackers during active incidents - letting them intervene without hesitation. Glad to be on board 🫡

Trade your random variable returns for certain cashflows Our Endeavor vaults continuously optimize for the highest fixed-income yields Deposit USDC today and also collect a weekly 5% fixed-APR bonus 💸

Typical DeFi borrowers are forced into a fee free-for-all. Even a whisper of volatility can drain AMM liquidity, spike utilization, and pump rates. Whether you borrow for one day or one year, Rheo locks costs upfront. Fix a rate today for a 2% rebate on eligible positions ↓

Variable borrow rates swing almost at random. Utilization spikes can strike any time. Fixed-rate, fixed-tenor lenders provide much-needed DeFi rate security. In return, they typically get predictable cash flows with higher yields over time. Start earning 9.26% APY on your USDC…

NEW Crypto Yield Curve ep! 🎙️ Cypherpunk Consumerism (~17 mins) Following big @aave and @gnosisdotio updates, Rheo core asks whether it’s still TradFi converging into DeFi - or the opposite ➤ Ideology → UX shift ➤ USDC as a global savings account ➤ zk tech privacy revival

NEW Crypto Yield Curve podcast! 🎙️ Next-Generation Curation (~30 mins) DeFi’s risk layer is broken. Rheo core sits down to map how it must evolve to rebuild trust: ✓ Leveling up vault risk frameworks ✓ Enforcing on-chain guardrails ✓ Making skin-in-the-game the default

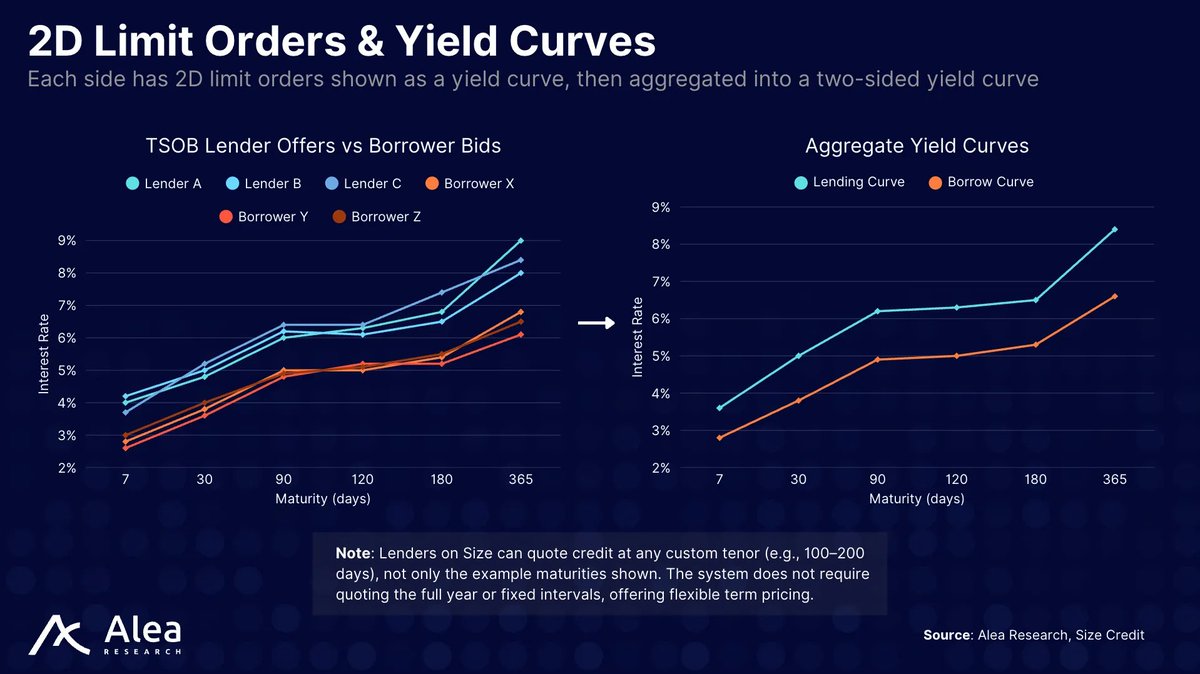

Sophisticated capital operates with precision. This means mapping cash flows, costs, and maturities ahead of time. DeFi’s variable rates sacrifice cost certainty, while existing fixed-rate AMM models constrict duration. Rheo’s Term Structure Order Book is the first protocol to…

Helter-skelter borrow fees squeeze profits Get a 2% borrow rebate on eligible positions when you lock in cost certainty on Rheo - Mainnet positions - 90d+ duration - ETH, WBTC, cbBTC, cbETH, wstETH, or weETH collateral

Flow over market waves 🌊 Earn a competitive variable yield plus a fixed 5% USDC reward Available anytime over the next four months app.rheo.xyz/earn

We’re excited to announce that Size Credit is now Rheo! DeFi has dissolved geographical borders, but not yet overcome its own divisions. Capital remains frenetic - pooled to largely stagnate, or evaporate without warning. We built Size on the thesis that as sophisticated…

United States Tren

- 1. CJ Stroud 7.220 posts

- 2. Texans 51,1 B posts

- 3. #HereWeGo 17,6 B posts

- 4. #HOUvsPIT 1.960 posts

- 5. Woody Marks 1.308 posts

- 6. Jack Sawyer 1.173 posts

- 7. Arthur Smith 1.107 posts

- 8. Aaron Rodgers 17,1 B posts

- 9. Druski 42,2 B posts

- 10. Metcalf 3.723 posts

- 11. Christian Kirk 1.670 posts

- 12. Jonnu 1.180 posts

- 13. #HTownMade 3.133 posts

- 14. Muth N/A

- 15. Nick Caley N/A

- 16. Nick Chubb N/A

- 17. Nico Collins 1.455 posts

- 18. Payton Wilson N/A

- 19. #LaCasaDeLosFamososCol3 19,8 B posts

- 20. Chuck Clark N/A

Something went wrong.

Something went wrong.