SmartCloud CPAs

@SmartCloudCPAs

SAVE MONEY ON TAXES $$ We share Tax Planning Strategies, Busted Tax Myths and Tax Trivia. A Washington State CPA Firm - Ask us about your Taxes and Bookkeeping.

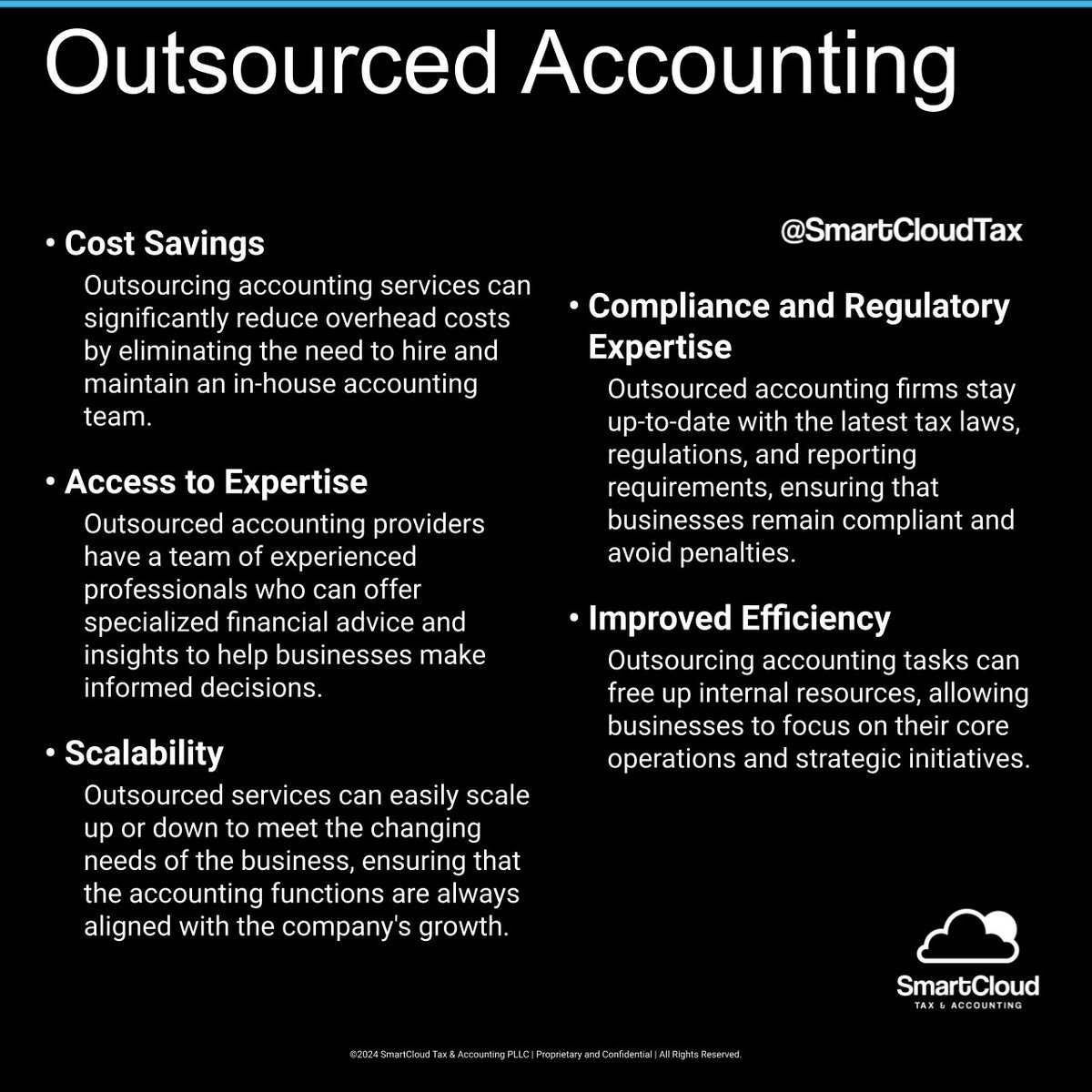

Did you know outsourced accounting services offer professional management of your financial records, ensuring accuracy and compliance? Learn the basics and benefits. Comment below to learn more! #SmallBusiness #BusinessStrategy

Did you know tax loss harvesting can help you save on taxes by offsetting capital gains with losses? It's a smart way to manage your investments. Comment below to learn how we can help! #SmartCloud #BizTips #SmallBusiness #BusinessSuccess

Earning rental income? Here are 5 key points: 1. It's taxable 2. Must be reported 3. Keep detailed records 4. Understand allowable deductions 5. File accurately Need more info? Let us know! #TaxTips #RealEstateInvesting

The Teapot Tax was a tax on the production and sale of teapots, aimed at raising funds by targeting common household items. Learn how this tax impacted daily life and society. Comment below to learn more! #Startups #BusinessStrategy

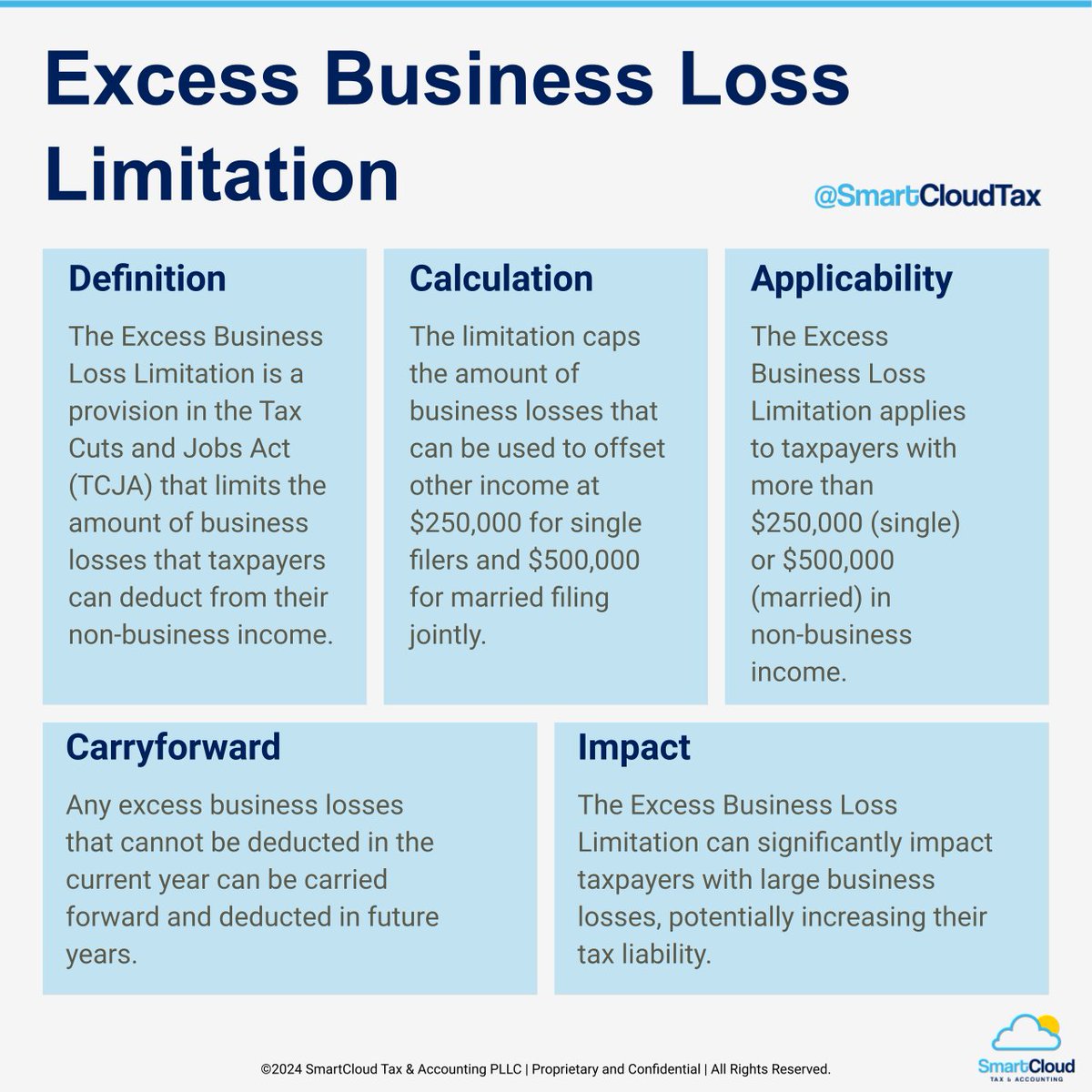

Worried about how the Excess Business Loss Limitation affects your tax filings? Learn how to navigate these rules and protect your deductions. Want to know how to maximize your benefits? Comment below for more info! #BusinessOwners #Markets

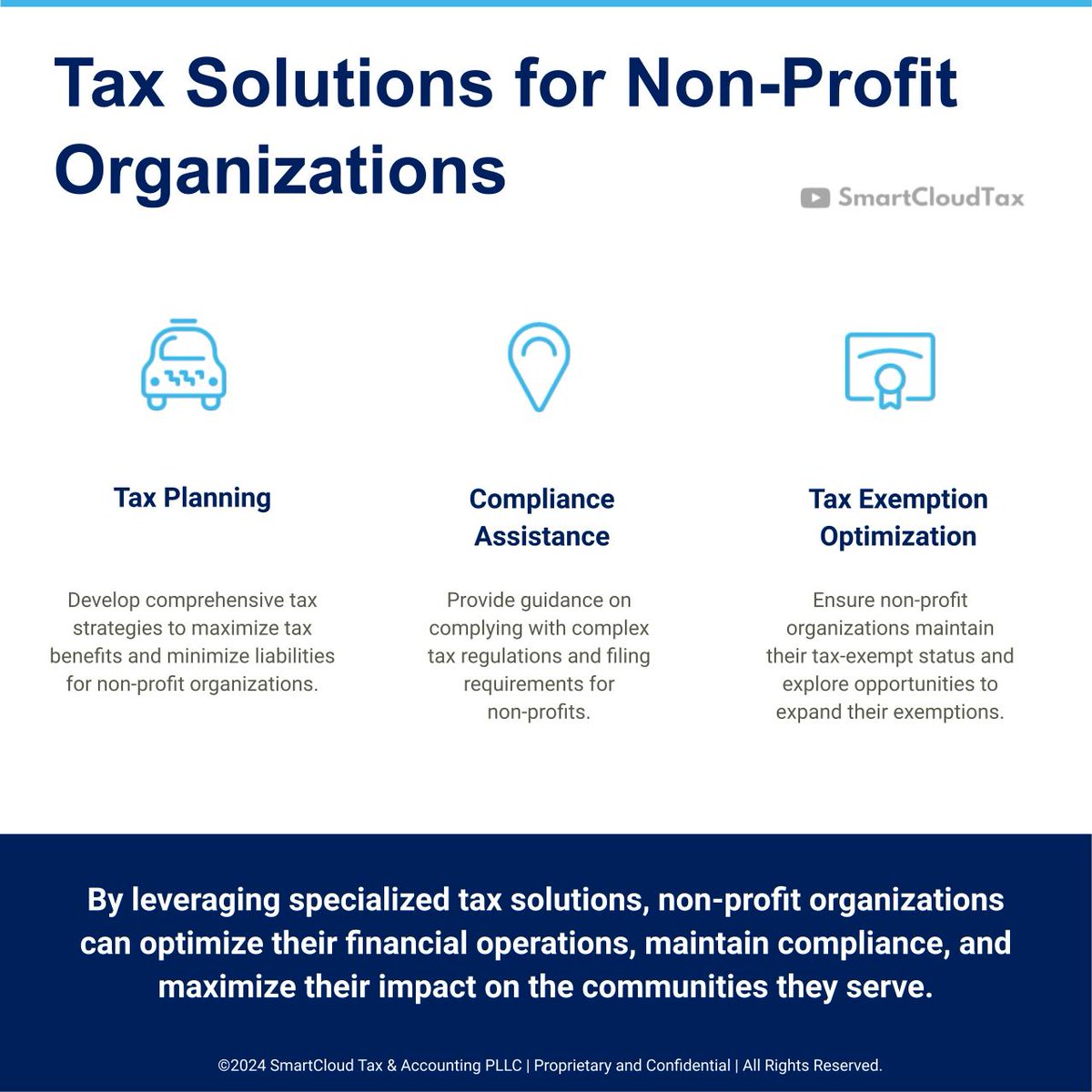

Did you know non-profit tax services can help manage deductions, credits, and compliance issues specific to your organization? Learn how these services benefit you. Comment below to learn more! #Startups #BusinessStrategy

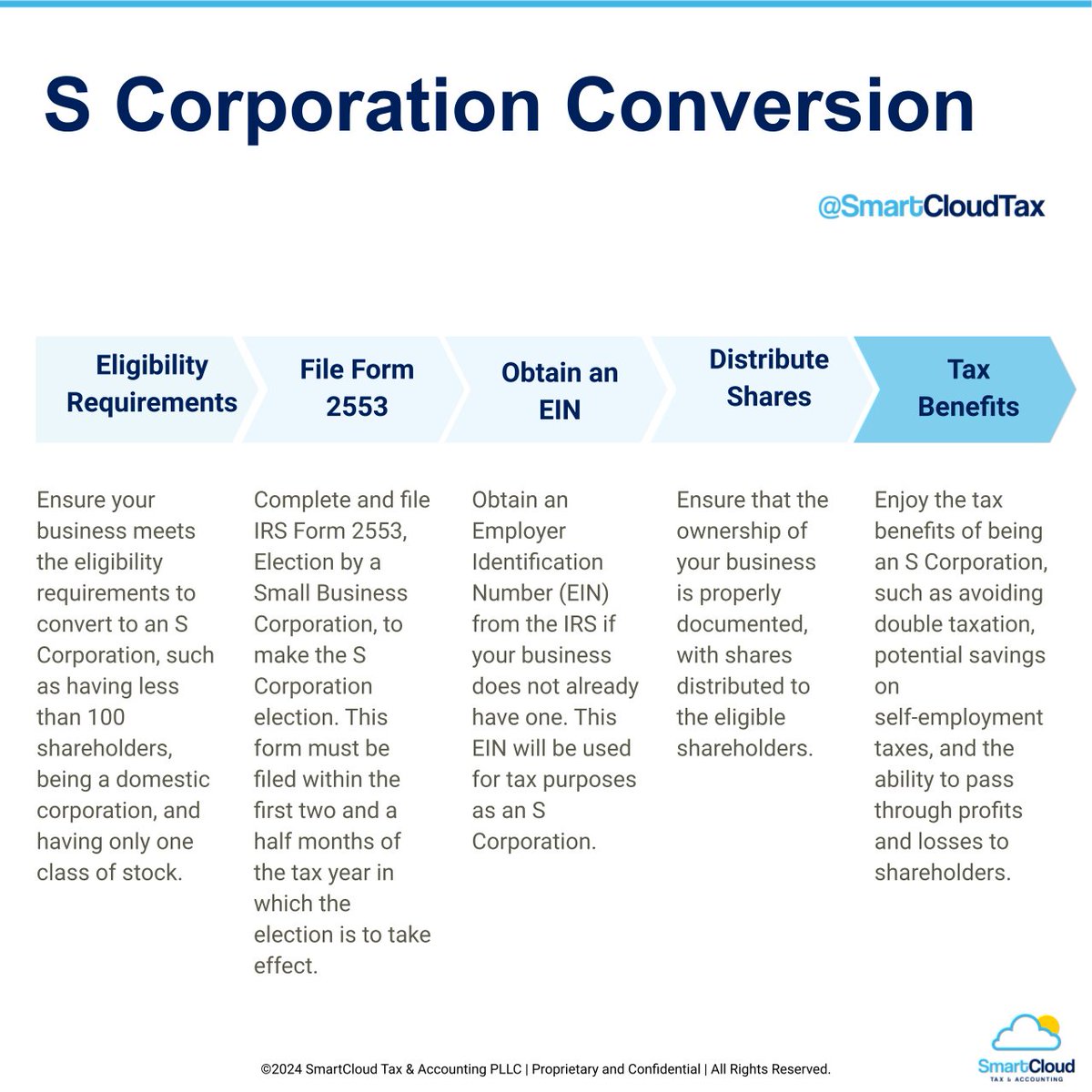

Curious about converting to an S Corporation? Learn how to make the switch and maximize the benefits with these simple steps. Comment below for a step-by-step guide! #BizTips #Investing

Earning tips? Here are 5 key points: 1. All tips are taxable 2. Must be reported as income 3. Keep detailed records 4. Understand IRS requirements 5. Plan your taxes accordingly Need more info? Let us know! #TaxTips #MoneyManagement

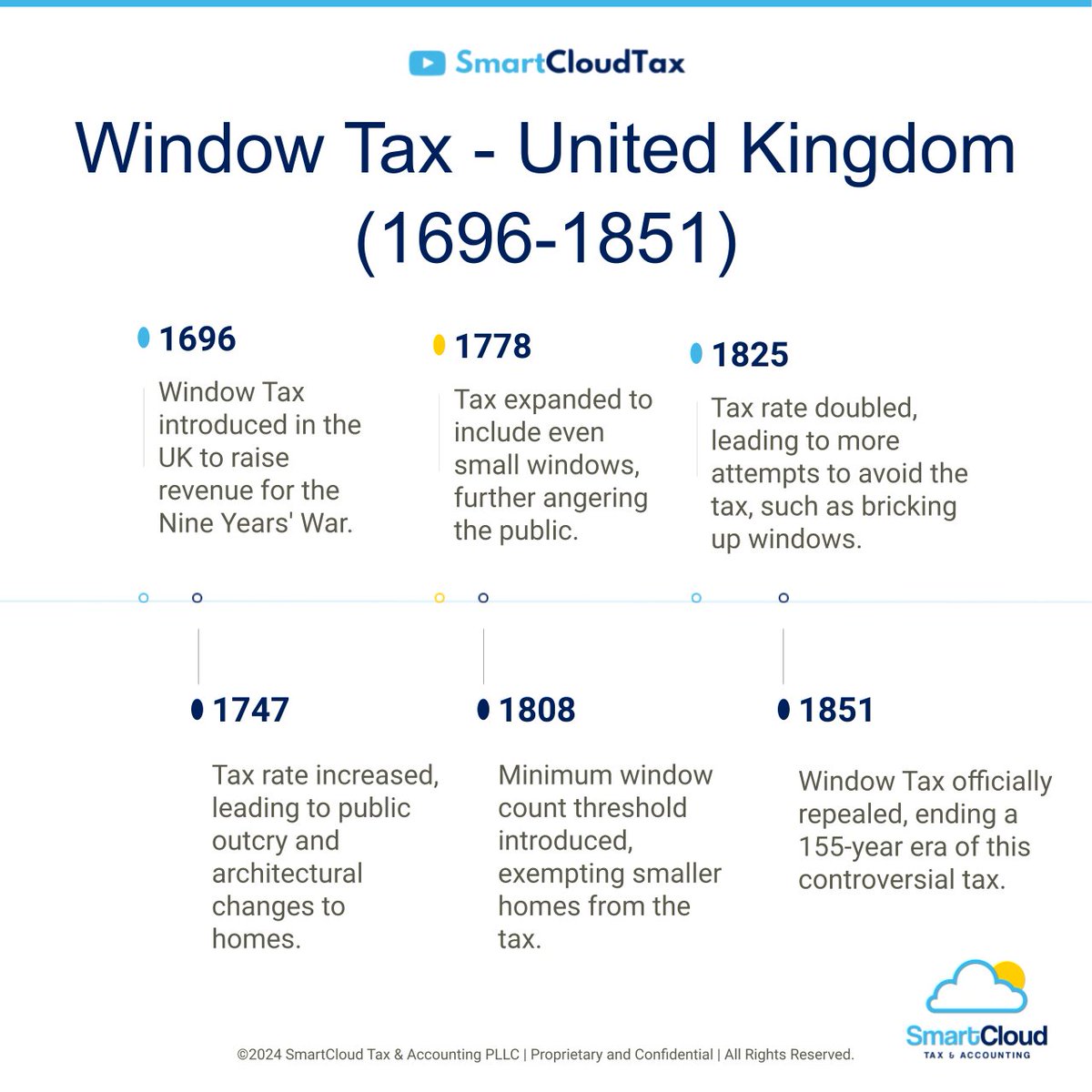

Fascinated by historical taxes? The Window Tax shows how governments have used taxes to regulate household architecture. Ready to learn more about this unique tax? Comment below! #BusinessOwners #Wealth

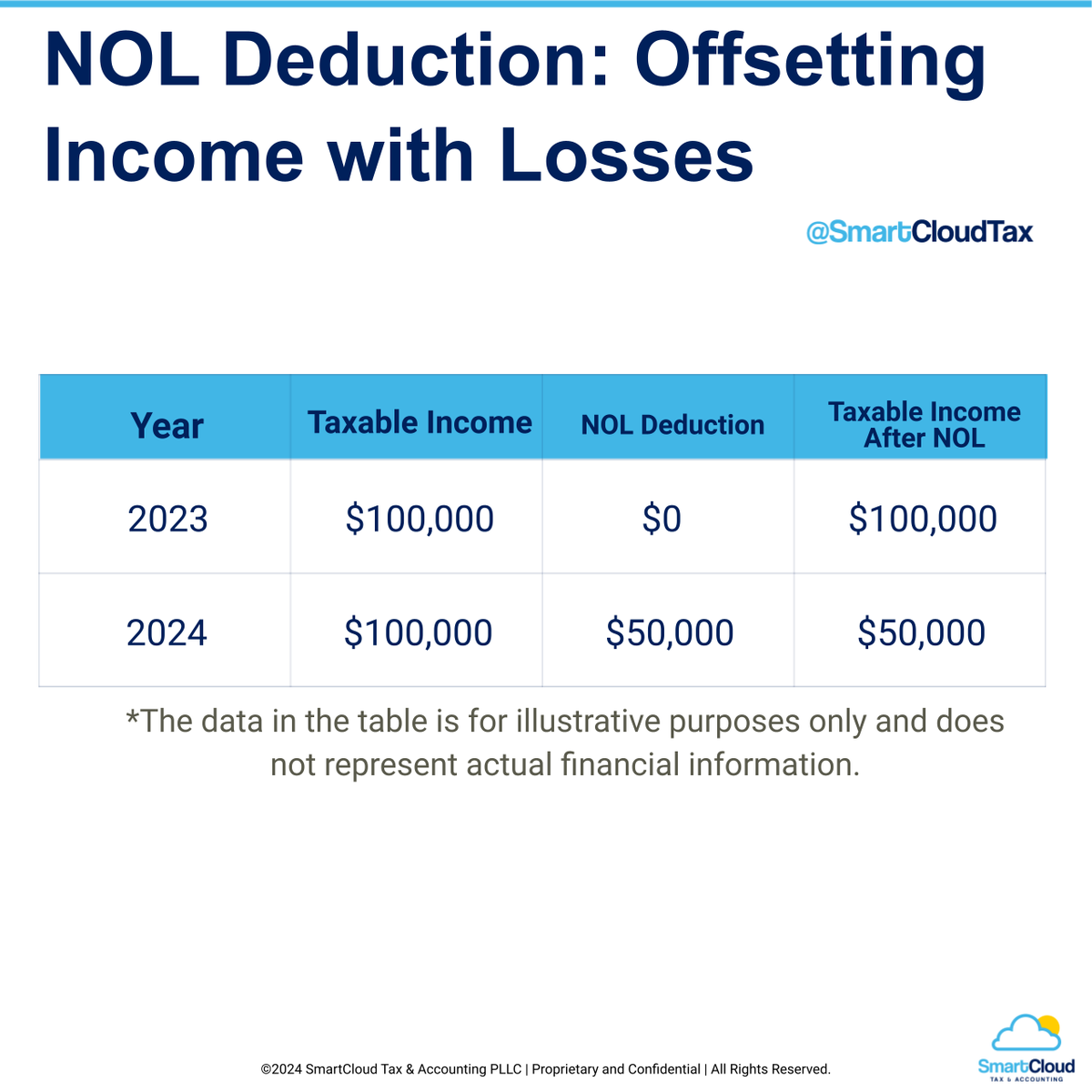

Facing a tough year? The Net Operating Loss (NOL) deduction allows you to carry over losses to future years, reducing taxable income. Curious about how it works? Comment below for a link to more info! #BusinessOwners #SmallBiz

Want to maximize your tax savings in the scientific industry? Professional tax services can help you claim all deductions and credits. Ready to learn how? Comment below! #BusinessOwners #Wealth

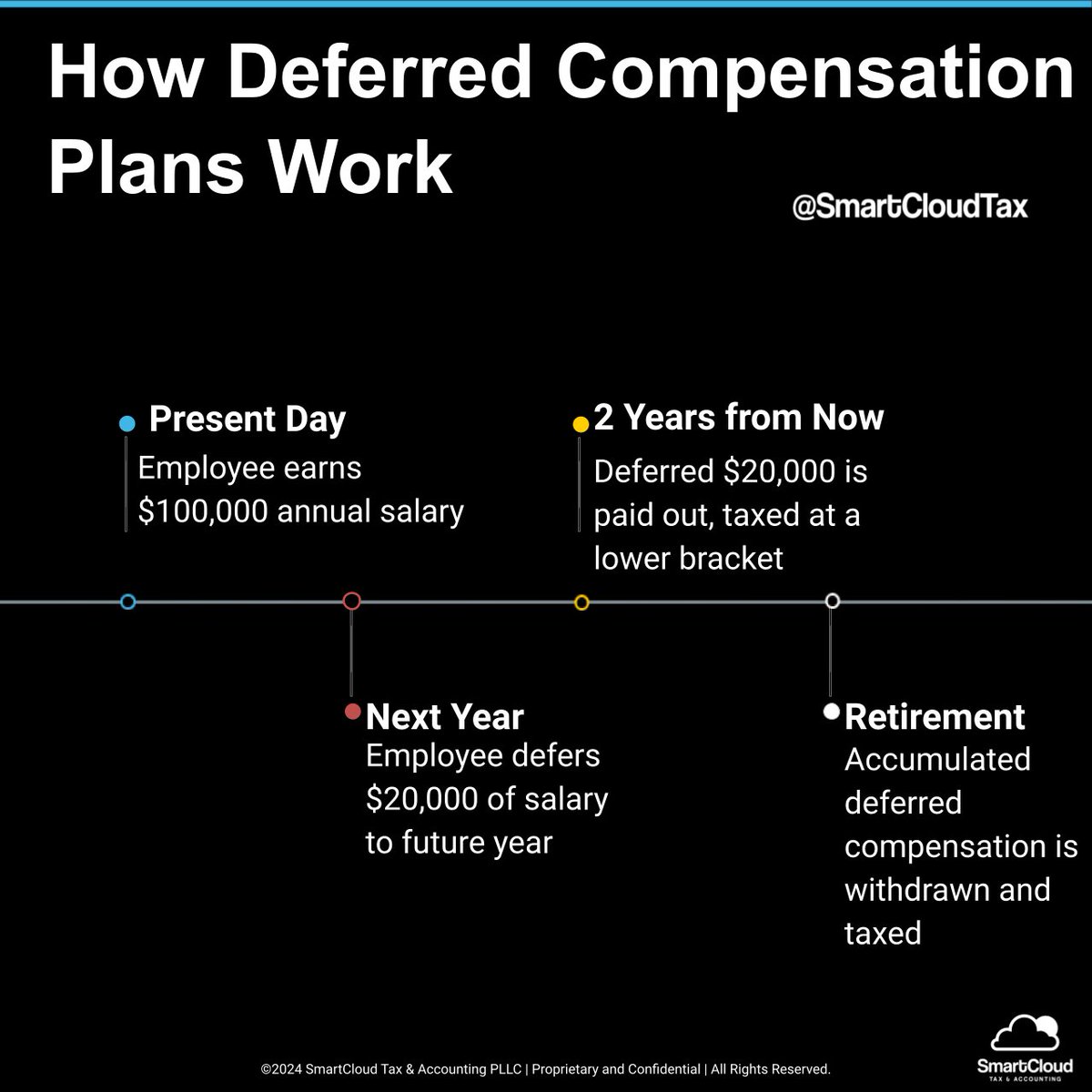

Want to maximize your future earnings? Deferred compensation plans can help you save on taxes and build wealth for the future. Curious about how it works? Comment below for a link to more info! #SmartCloud #SmallBiz #BusinessOwners #SmallBusiness

Confused about interest deductions? Here are 5 key points: 1. Only certain types qualify 2. Mortgage interest is deductible 3. Student loan interest is deductible 4. Keep detailed records 5. Maximize deductions Need more info? Let us know! #TaxTips #Finance

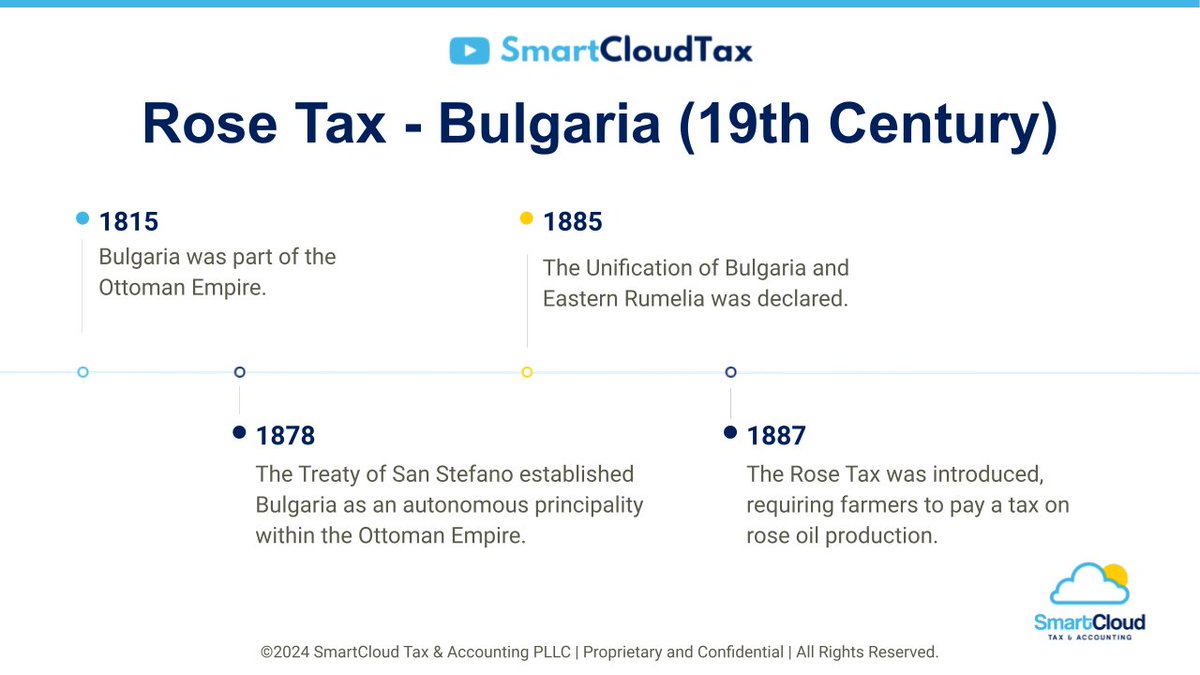

Did you know roses were once taxed? The Rose Tax was introduced to generate revenue from luxury flowers. Curious about this unusual tax? Comment below for a link to more info! #BusinessOwners #Entrepreneurship

Think distillery tax services are unnecessary? Not so fast! They can save you money and hassle by ensuring you claim all eligible deductions. Want to learn more? Comment below! #Entrepreneurship #BusinessSuccess

Did you know the Energy-Efficient Commercial Building Deduction can save you money on taxes while promoting sustainability? Learn how it can benefit your business. Comment below to learn more! #BizTips #BusinessSuccess

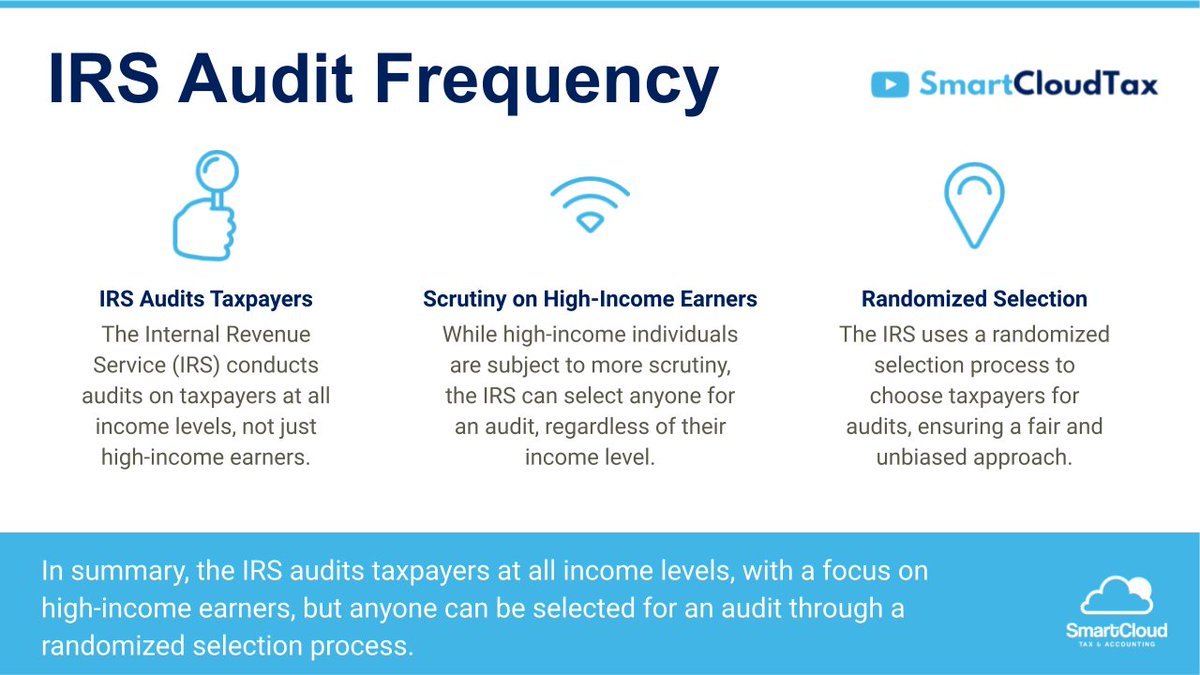

Did you know the IRS audits taxpayers at all income levels? While high-income earners face more scrutiny, anyone can be selected for an audit. Have questions? Ask us below! #BusinessOwners #Entrepreneurship

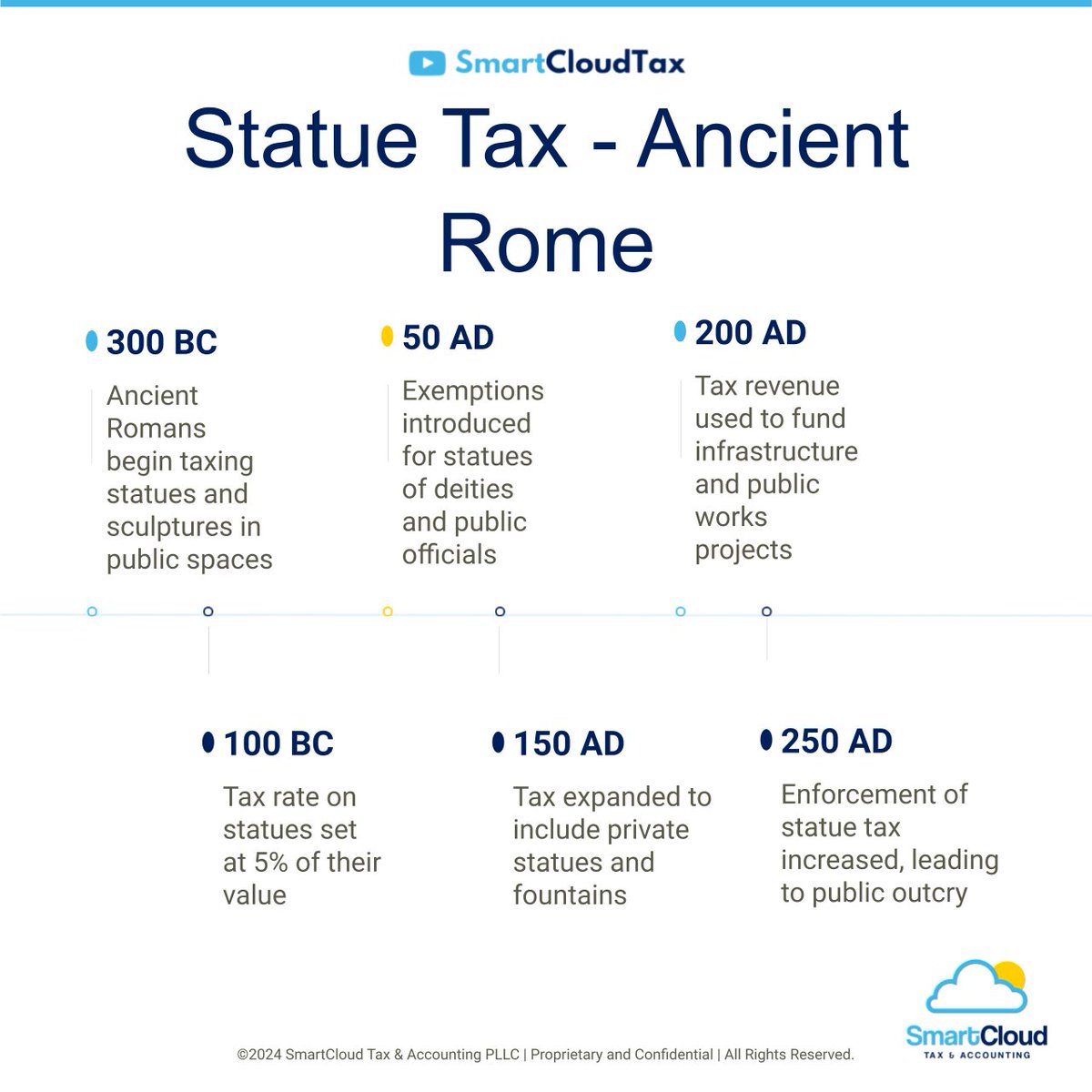

Fascinated by historical taxes? The Statue Tax shows how governments have used taxes to regulate public art. Ready to learn more about this unique tax? Comment below! #BusinessOwners #Wealth

Want to keep more of your earnings and boost your retirement savings? Use the Retirement Savings Contributions Credit to lower your tax burden and save more. Ready to learn how? Comment below! #SmallBusiness #BusinessSuccess

Curious about utilizing wholesale tax services? Learn how to find and work with a professional to maximize your industry-specific tax savings with these simple steps. Comment below for a step-by-step guide! #BusinessGrowth #Entrepreneurship

United States トレンド

- 1. Thanksgiving 2.19M posts

- 2. Chiefs 61.6K posts

- 3. George Pickens 8,605 posts

- 4. Post Malone 4,505 posts

- 5. Mahomes 18.5K posts

- 6. Tony Romo 2,069 posts

- 7. Sarah Beckstrom 78.3K posts

- 8. McDuffie 4,234 posts

- 9. Lions 98.9K posts

- 10. #KCvsDAL 5,575 posts

- 11. Packers 72.4K posts

- 12. Rashee Rice 3,516 posts

- 13. Dan Campbell 8,166 posts

- 14. Kelce 13.4K posts

- 15. Malik Davis 2,134 posts

- 16. #GoPackGo 11.6K posts

- 17. Paddy 10.8K posts

- 18. Andy Reid 1,346 posts

- 19. Josh Simmons 1,525 posts

- 20. Kenneth Murray N/A

Something went wrong.

Something went wrong.