Savar Gupta

@SmartCompounder

Engineering + Business Student, Entrepreneur & Investor.

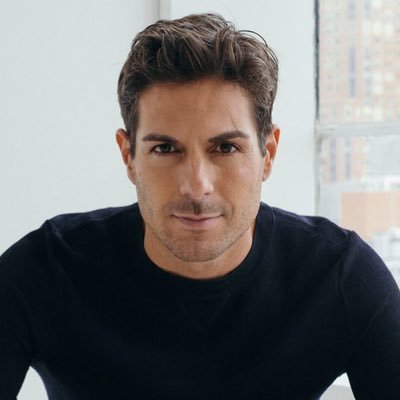

Portfolio Holdings - October 1, 2025 Started a position in $MELI with the recent sell-off, aiming to build it into a 5% position. Also want to increase sizing in $FICO and $TOI.V. New Holdings: $MELI $FICO Watchlist: $ISRG

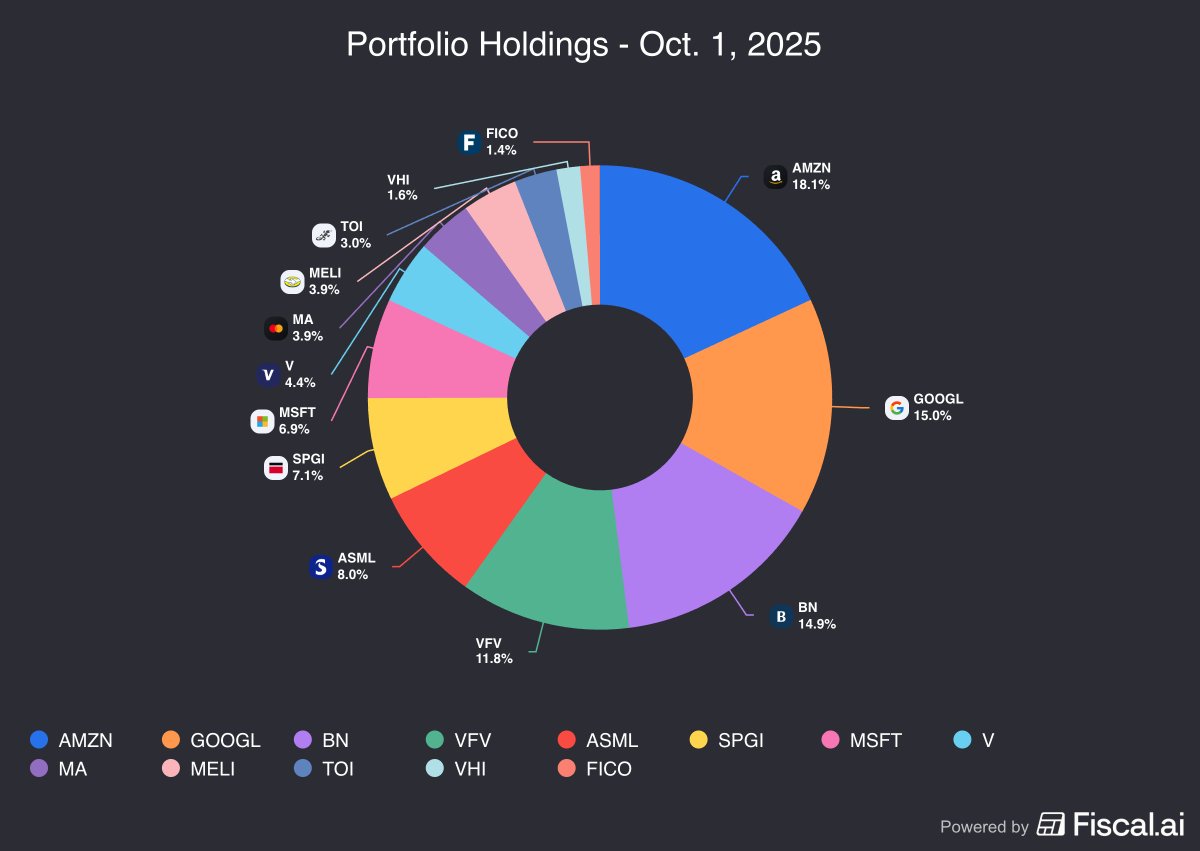

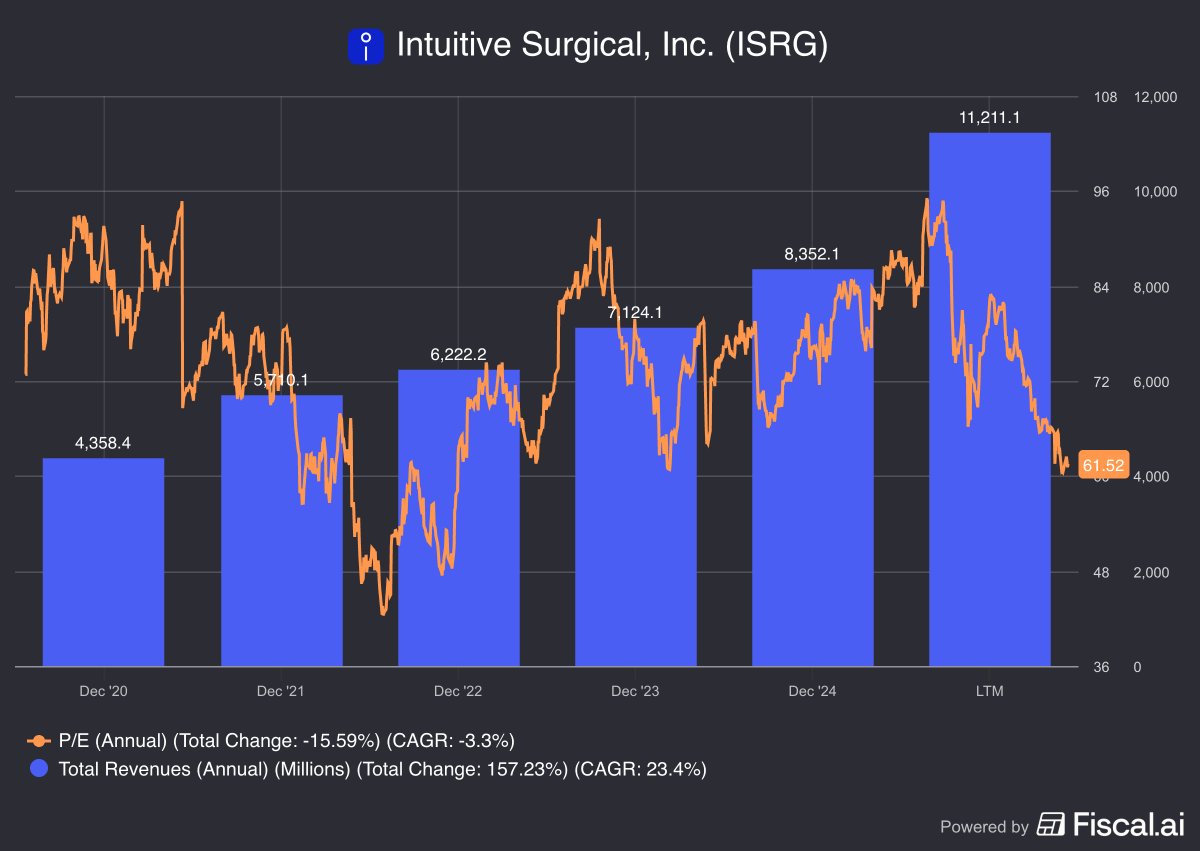

$ISRG recurring revenue grew from 71% in 2017 to 84% in 2024 --> the business is becoming increasingly subscription-like

$ISRG smashed earnings 😳 > da Vinci and Ion combined procedures grew 20% > Total installed base at 10,763 systems > Revenue +23% YoY & Net Income +30% YoY

When Michelangelo was asked how he created David he said “it’s simple, I just removed everything that is not David” — @FoundersPodcast, #399 How Elon Works

$TOI.V new acquisition > MeData is a German software company specialising in VMS for the transport & logistics industry > The acquisition is part of TSS’s strategy to expand in niche/industry-specific software and to strengthen its footprint in Germany/Europe

> If you want to keep up with AI: code, integrate an API, and build something. > Integrated @coderabbitai to review our PRs over the weekend, the level of detail is insane and we’re shipping faster than ever.

Hot take : Side project teaches you more than any college or degree.

Sentiment around Jassy is terrible right now. If only people look at all the things he’s done at $AMZN instead of looking at the stock price 🤦♂️

A lot of people in the future, probably: “Hey Andy, sorry for doubting you & $AMZN despite the cloud backlog swelling, mountains of Anthropic capacity coming online, ads proliferating, Kuiper maturing & the marketplace continuing to dominate.“

The recent stock market “decline” makes you realize how many “investors” are really just traders in it for the short-term.

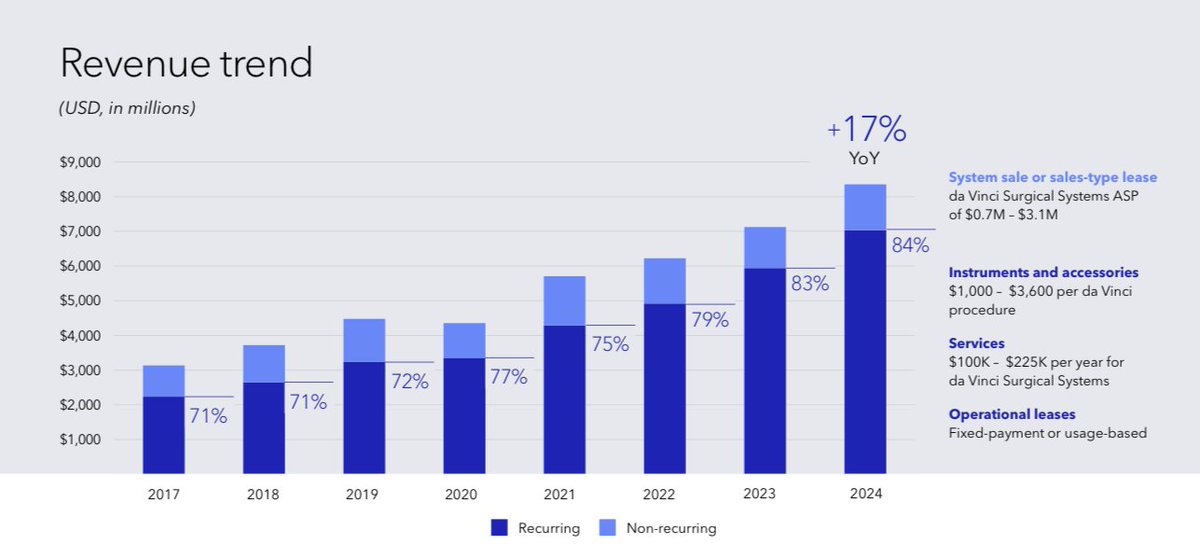

$FICO has steadily grown revenue while expanding operating margins from 16% to nearly 46%. A great example of pricing power, operational efficiency, and the strength of their data.

$BN Investment Thesis (~15% of my portfolio): - 73% owner of $BAM’s $1T AUM and building the AI capex stack: data centres, power (10.5GW deal w/ Microsoft), and semis - $549B in fee bearing capital - 20% of insider ownership - Expanding wealth and retirement solutions

$AMZN vs $MELI: two of the best e-commerce businesses on earth.

Agreed, built out a full 5% position during this drop.

$MELI is looking very cheap here. Political noise and competition aren't new.

$FICO direct licensing move explained simply: Old model: Lenders get FICO scores via credit bureaus, which bundle scoring with their credit report products, applying markups. New model: Lenders/resellers can get FICO scores directly and choose among pricing models.

My portfolio principles: - Great opportunities rarely arrive, lump sum > DCA - Own 8–12 of the best businesses, avoid over diversification - Look for monopoly-like moats, pricing power, operating leverage, capital-light models, products embedded in society & long growth runways

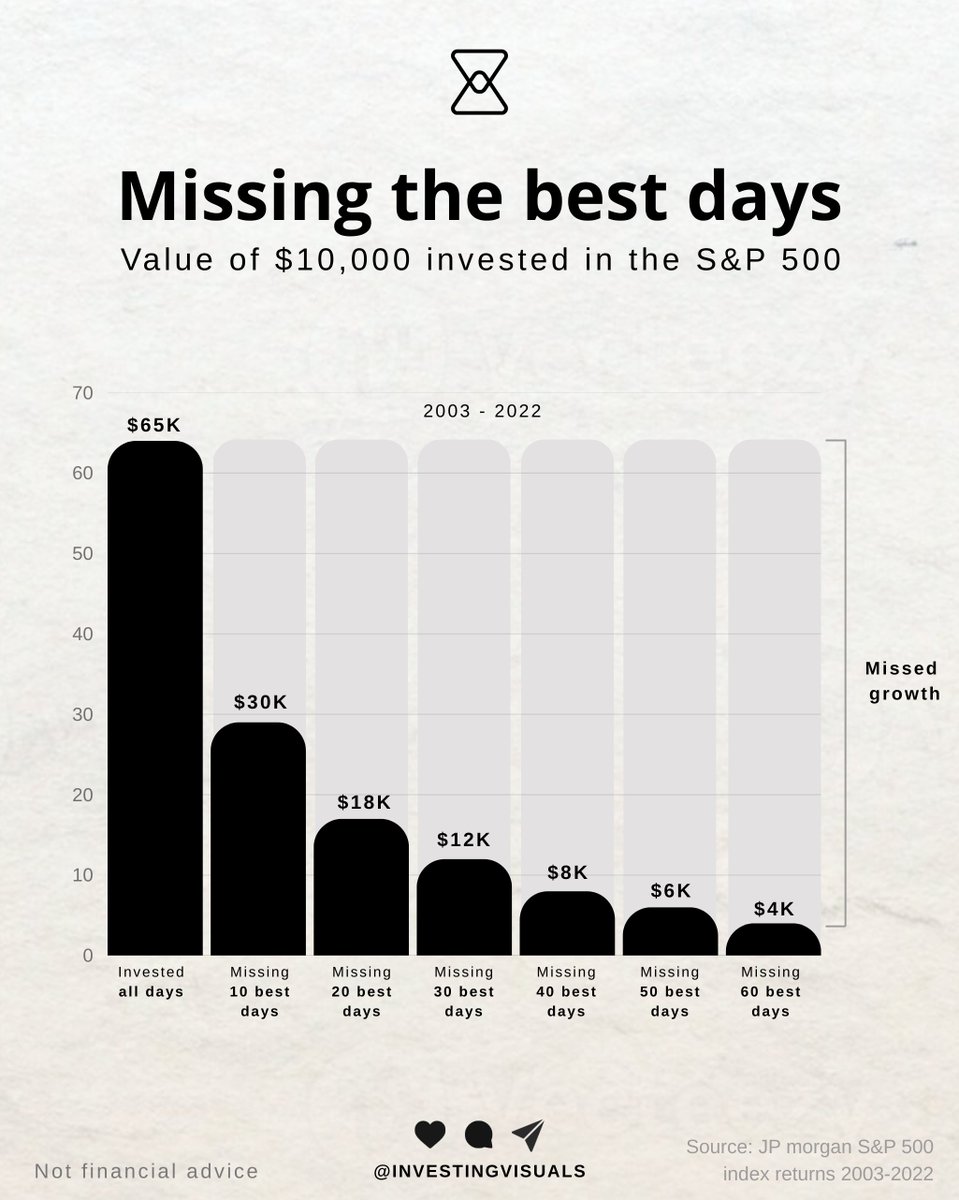

Staying fully invested is important, but I also like to build a 5% cash position when the market seems potentially frothy.

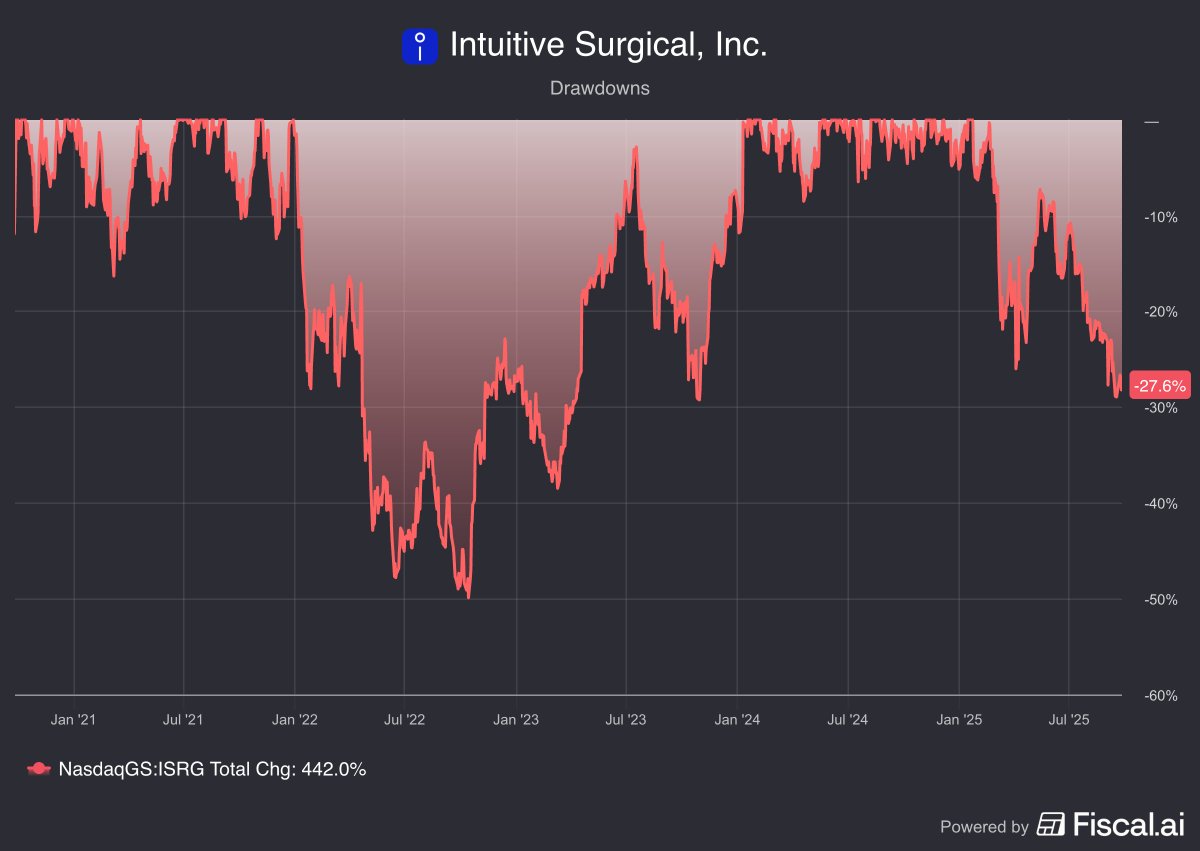

$ISRG is now in a 27% drawdown, however still trades at very high premium. @DavidGFool recently mentioned this high-quality compounder. On the sidelines for now, will wait for a better entry opportunity.

United States الاتجاهات

- 1. Wemby 77.3K posts

- 2. Spurs 49.8K posts

- 3. #QueenRadio 19.9K posts

- 4. Cooper Flagg 13.5K posts

- 5. Clippers 11.6K posts

- 6. Mavs 18.1K posts

- 7. Victor Wembanyama 23.7K posts

- 8. Anthony Edwards 6,279 posts

- 9. Dillon Brooks 1,200 posts

- 10. Maxey 11.4K posts

- 11. Anthony Davis 6,364 posts

- 12. VJ Edgecombe 25.4K posts

- 13. #PorVida 2,625 posts

- 14. Suns 16.1K posts

- 15. Embiid 14.2K posts

- 16. Sixers 24.5K posts

- 17. Blazers 3,955 posts

- 18. Lavine 1,418 posts

- 19. #AEWDynamite 24.6K posts

- 20. Klay 8,040 posts

Something went wrong.

Something went wrong.