Software Equity Group

@SoftwareEquityG

Sell-side M&A advisory services for B2B software companies #SaaS #Tech #MergersAndAcquisitions

You might like

Our 2024 Annual SaaS M&A and Public Market Report is now available for download! softwareequity.com/research/annua… #SaaS #Software

SEG client, ClearPathGPS, has been acquired by GPS Insight, an Accel-KKR portfolio company. For more details on this acquisition, click here: softwareequity.com/transactions/c…

SEG is pleased to announce the promotions of two outstanding individuals to the role of SEG Principal: Diamond Innabi and Austin Hammer. Whether it's their outstanding work on deals, their dedication to mentoring others, or their pivotal roles in driving sales initiatives.

We are thrilled to announce the launch of our new SEG SaaS Index tool (stemming from our SEG SaaS Index created in 2006). This is real-time resource offers the latest stock and financial performance data for 121 publicly traded SaaS companies. softwareequity.com/saas-index

Sellers often find themselves immersed in the day-to-day of their businesses, leaving little room for dealmaking. Recognizing this, Austin Hammer SEG Principal, shares his two cents on why SaaS founders struggle in the latest M&A Magazine. themiddlemarket.com/magazine/the-s…

Our Monthly M&A Deal Database™ is UPDATED for the month of October. See the deals here: softwareequity.com/saas-ma-deal-d…

For a more in-depth look at Chris Atkinson's experience working with SEG, you can find the full 3-minute interview here: softwareequity.com/resources/clie…"

Improving unit economics in your SaaS business boils down to enhancing both lifetime value (LTV) and reducing customer acquisition costs (CAC). Explore more insights in our latest blog post. softwareequity.com/blog/saas-unit…

In this post, we offer insights to help executives use ARR to better understand their businesses, growth trajectories, and improve positioning for a possible liquidity event... softwareequity.com/blog/arr/

SEG is pleased to announce the promotions of two individuals to SEG Principal: Diamond Innabi and Austin Hammer. Their consistent track record of exceptional performance, unwavering commitment, and exemplary contributions to SEG have led to this well-deserved recognition.

SEG takes over Disneyland! Our deal teams had the chance to take a much-deserved break and spend the afternoon at the happiest place on earth.

Everything you need to know about EBITDA can be found here. Swipe through the images to gain a comprehensive understanding of what EBITDA is and why it holds significant importance for your company. softwareequity.com/blog/ebitda-ca…

softwareequity.com

EBITDA Calculations and Adjustments that Improve Financial Readiness

Many SaaS operators overlook EBITDA adjustments that can add millions to valuation. Learn how proper EBITDA preparation can protect value and avoid costly surprises in M&A.

See how our M&A Deal Database can help give you the competitive edge your business needs. Leverage these five steps to maximize the tool's potential. Explore the latest SaaS deals by vertical or date right here. softwareequity.com/saas-ma-deal-d…

softwareequity.com

Explore Our SaaS M&A Deal Database

The SEG SaaS M&A Deal Database™ provides visibility into who is buying, what sectors are in demand, and the profiles of target companies.

Based on the data from the previous quarters, the SaaS industry is on track to achieve a record-breaking year! To further explore the latest data and insights, click here to download your copy of the report: softwareequity.com/research/quart…

In 2020 and 2021, the high-burn / growth-at-all-cost SaaS business was highly attractive to PE investors and strategic buyers. Yet, in 2023, the narrative has changed. The demand for top-tier SaaS companies in M&A has surged. See more insights here: softwareequity.com/research/saas-…

Sales efficiency is an important metric providing valuable insights into a company's financial health and growth potential for potential investors and buyers. By analyzing this metric, they can better understand a company's ability to generate revenue. softwareequity.com/blog/sales-eff…

softwareequity.com

The Importance of Sales Efficiency to SaaS M&A (And How to Calculate It Properly)

Sales efficiency is an important indicator of how effective your sales and marketing efforts are and how quickly your organization can grow.

Why are SaaS founders hesitating to bring their businesses to market despite the incredible appetite from investors? Our 2023 State of SaaS M&A Survey Report answers this question, offering insights that shed light on the dynamics at play. softwareequity.com/research/saas-…

We are driven by a passion to excel and a commitment to deliver outcomes that consistently surpass expectations. Our relentless pursuit of excellence truly sets us apart, and we believe our team members are the best testament to this philosophy. softwareequity.com/strategic-asse…

softwareequity.com

Zero-Obligation Software and SaaS Strategic Assessment

Discover hidden growth levers and strengthen your business with our complimentary Software and SaaS Strategic Assessment.

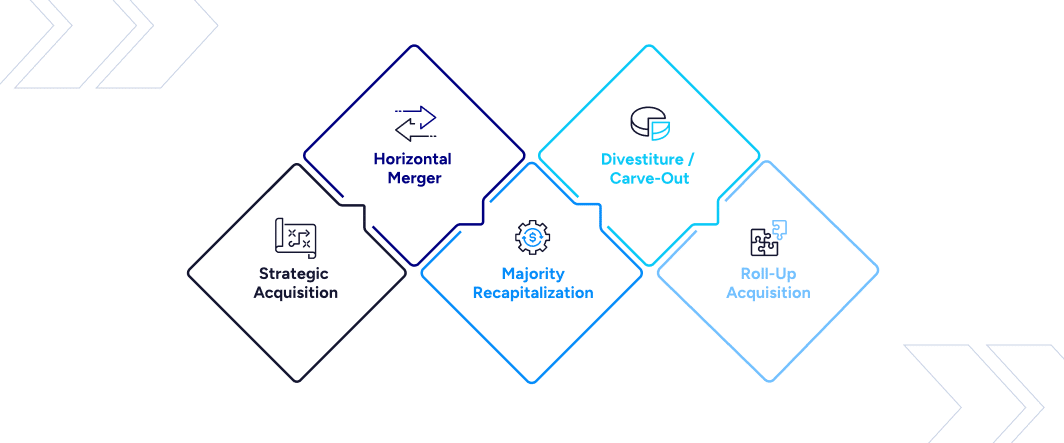

If you are a software entrepreneur, you are probably aware that merging with or being acquired by another company could present an attractive exit opportunity for you, your stakeholders, and the business itself. KEEP IN MIND: Not all M&A deals are equal... softwareequity.com/blog/types-of-…

United States Trends

- 1. Good Sunday 70.9K posts

- 2. Klay 31.2K posts

- 3. #sundayvibes 5,674 posts

- 4. #AskBetr N/A

- 5. McLaren 132K posts

- 6. Full PPR N/A

- 7. Beirut 7,492 posts

- 8. Sunday Funday 2,351 posts

- 9. Ja Morant 14.6K posts

- 10. Blessed Sunday 19.4K posts

- 11. Who Dey 8,912 posts

- 12. Florentino 35.9K posts

- 13. #FelizCumpleañosNico 5,125 posts

- 14. #FG3Dライブ 122K posts

- 15. #sundaymotivation 3,623 posts

- 16. NFL Sunday 5,369 posts

- 17. King of the Universe 2,309 posts

- 18. For the Lord 31K posts

- 19. Lando 148K posts

- 20. Christ the King 11.8K posts

You might like

-

Benchmarkit

Benchmarkit

@Benchmarkitai -

Faire

Faire

@faire_wholesale -

turja🕺

turja🕺

@tchowd_ -

Blossom Street Ventures

Blossom Street Ventures

@yourfaveVC -

Creative Strategies, Inc

Creative Strategies, Inc

@creativestrat -

Ben ✈️🇰🇷🇻🇳🇸🇬🇯🇵

Ben ✈️🇰🇷🇻🇳🇸🇬🇯🇵

@benohanlon -

rayrike

rayrike

@rayrike -

Prismatic

Prismatic

@prismatic_io -

Coffee

Coffee

@Capital2Coffee -

Victor Young

Victor Young

@VictorYoungMe -

Sinclair Day Acct

Sinclair Day Acct

@SinclairDayAcct -

Cloudify

Cloudify

@Cloudify_biz -

OPEXEngine by Bain & Company

OPEXEngine by Bain & Company

@OPEXEngineSaaS -

Bowmar

Bowmar

@PdqJones -

Cathe Collins

Cathe Collins

@CollinsCathe

Something went wrong.

Something went wrong.