Scuba Steve

@StackItScuba

Full time options trader as of March 2018.

You might like

You’ve placed every trade. You’ve done every review. So if you were coaching you, right now - what would you tell yourself to do? What’s crazy about this mental cue is half the time, the advice is not what you’re currently doing. Take your own advice. You’ll make more $.

One bad trade does not make you a bad trader. Keep that perspective, always.

take advantage of the best trading group out there. Can't recommend highly enough

The clock is ticking on our only sale of the year. If you have yet to experience our community or educational offerings, now is the time to lock in a reduced price. If you are a member, now is the time to secure reduced annual pricing or coaching. opinicusholdings.com/black-friday-s…

yeah dont sleep on this

Black Friday is here, and so is our annual sale. Massive discounts for our only sale of the year 👇 opinicusholdings.com/black-friday-s…

Trading can be as simple or as hard as you want to make it.

P A Y D A Y $$$$$

Post unlocked 🔓 - $NFLX +25% since our write-up featuring the bullish setup in the stock. Profits are being secured in the swing. opinicusholdings.com/research/strea…

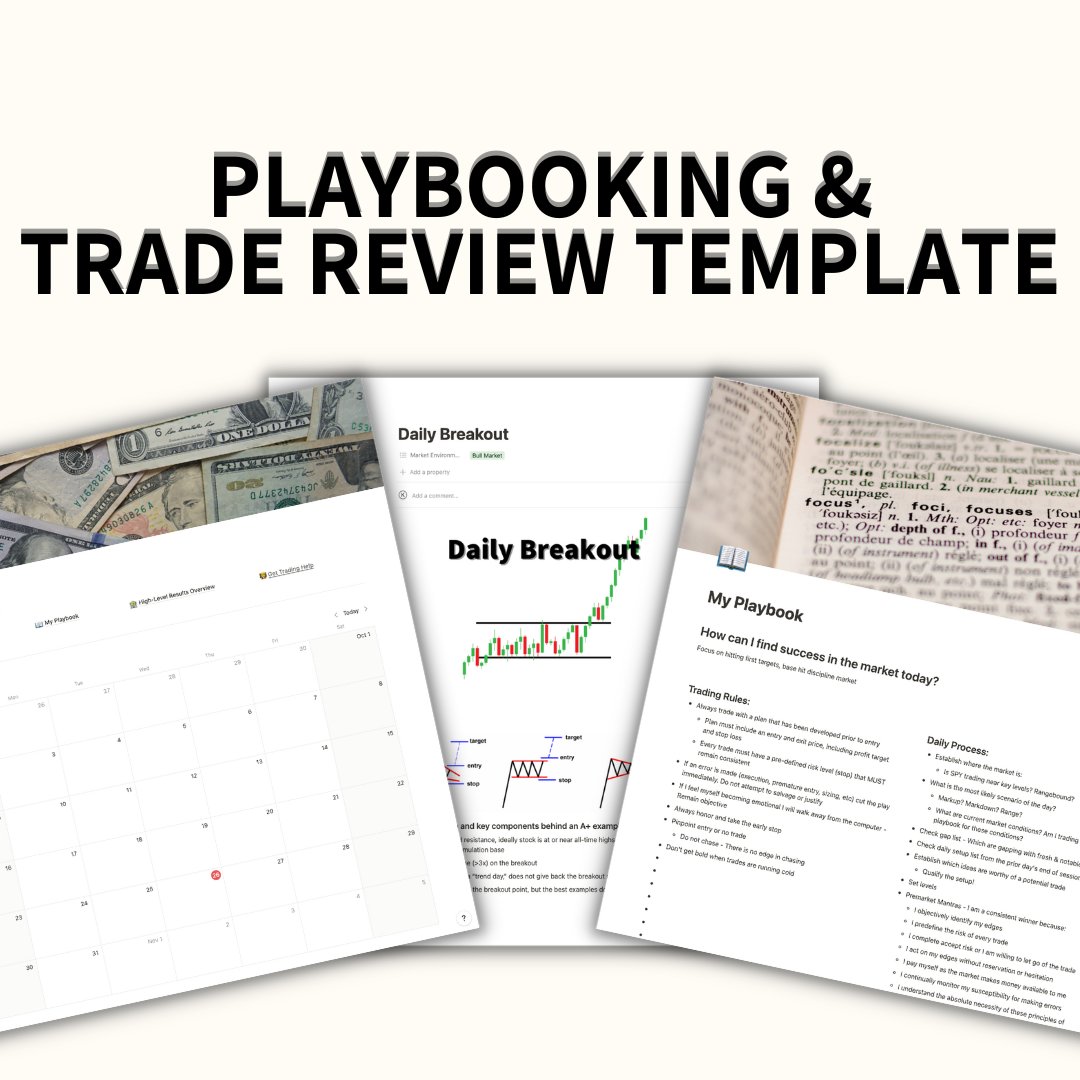

THE PURPOSE OF A TRADING PLAYBOOK To deepen neural networks.

The trader habit of being asked what you do for work and being incredibly vague about it

How to buy the dip as a trader. Avoid catching the falling knife 🔪

Meta employees to be offered real estate in the Metaverse as part of severance package.

MINDSET FRAMING AT MARKET OPEN ⁃ Today is a new day. Whatever happened yesterday is irrelevant ⁃ If I follow my process, the market will guide me ⁃ I will control my environment to optimize for patience ⁃ Personal check-in: how am I feeling mentally? Physically?

If you want to survive as a trader, you MUST learn to sit and wait for the opportunities and conditions that you perform best in.

Playbooking & Review is >80% of a trader's success But most are doing it wrong I put together the playbook & trade review template that helps our clients TURN PROFITABLE You can get it for FREE (24hr only) Retweet and like this post & I'll DM it to you

Stop thinking about exercise as purely a means of caloric expenditure and start thinking about it as a way to make your life better. Particularly your physical capabilities and mental health. There is no single habit with a higher ROI than regular exercise.

HOW TO CUT A BAG YOU ARE HOLDING 🧵 Are you holding a bag and down big on a stock or options play and not sure how/ when to sell for a loss? Here is how to deal with this position 👇

Trading the Breakaway Gap An important strategy to know for earnings season.

The greatest threat to results is boredom and impatience. This applies to trading, weight lifting, and broadly across many facets of life. The only way to become good at something is to practice the ordinary basics for an uncommon length of time.

THE TRUTH ABOUT WINNING AND LOSING STREAKS 🧵 How luck plays a role in your trading 🎲👇

Some bear market thoughts 🐻 - <10% of breakouts work - Most strength comes in one move, forms a range and uses the range to sell shares higher before failing - Deep pullbacks require longer bases before up-trending - Corrections grind lower than you think they will

United States Trends

- 1. Good Friday N/A

- 2. #KawasakiHeavenlyWord N/A

- 3. RED Friday N/A

- 4. #23Ene N/A

- 5. Hire Americans N/A

- 6. Lakers N/A

- 7. Luka N/A

- 8. Ari Lennox N/A

- 9. Clippers N/A

- 10. Autopilot N/A

- 11. #TheTraitorsUS N/A

- 12. Jim Jones N/A

- 13. Maki N/A

- 14. Kawhi N/A

- 15. #VolunteerLife N/A

- 16. Uncle Ted N/A

- 17. Colton N/A

- 18. Ted Nugent N/A

- 19. Hanoi Jane N/A

- 20. #CommunityLove N/A

Something went wrong.

Something went wrong.