Peter Stern

@Sternpeter9

Financial Services & Crypto | Head of Americas @cfbenchmarks/@krakenfx | Former MSU Spartan & Athlete

Was dir gefallen könnte

Brown University’s $4.9M allocation to BlackRock’s IBIT ETF isn’t just a headline—it’s a signal. When Ivy League endowments and state pensions like Wisconsin’s start stacking sats, it’s clear: Bitcoin is no longer fringe. The institutional era of crypto isn’t coming—it’s here.…

“Markets are jittery, headlines are chaotic, and yet… institutions are quietly stacking sats. 🧠 With the U.S. establishing a Strategic Bitcoin Reserve and endowments entering the space, the smart money sees beyond the noise. Short-term volatility? Just background music to a…

Building a Bitcoin strategic reserve isn’t just a hedge—it’s a forward-thinking monetary strategy. With states exploring Bitcoin reserves and endowments gaining access, we’re seeing real institutional adoption, regardless of short-term price moves. The infrastructure is…

Having lived in San Francisco for a year and Chicago for eight, I thought I had seen the worst of urban decline. But after a recent trip back to SF, I have to admit—Chicago has it worse. Yes, SF has its challenges, but at least it has world-class food, stunning landscapes, and a…

In the following clip, Roger Bayston explains why diversification in digital asset portfolios will take the spotlight in 2025. Listen to the full episode here: open.spotify.com/episode/6iC6Bs… @FTI_US @MarkPilipczuk @TheSquareMile @gxselby

Exciting to see my former employer, @BitwiseInvest , secure a $70M investment—including from MIT’s endowment fund! Institutional confidence in crypto keeps growing, and it’s incredible to see Bitwise leading the charge. Big moment for the space. #Crypto #InstitutionalAdoption…

Attending the @blockworksDAS in New York next week? Then be sure to visit our stand and connect with @Sternpeter9, @AlexButler222 and @XWangXin to learn how CFB’s indices power digital asset funds for some of the world’s most respected financial services firms. Book a catch-up…

There’s so much happening, luckily it’s been too cold to go outside lately

🚨BREAKING: Franklin Templeton, a $1.46T asset manager, has officially filed an S-1 with the SEC for a spot Solana $SOL ETF.

Traditional portfolios aren’t cutting it anymore. Institutional investors are shifting into alternative assets—crypto, private credit, infrastructure, and real assets—to hedge against inflation & volatility. Diversification isn’t just a buzzword anymore. It’s a necessity.…

Sunday nights rewatching the Disney movies I grew up with just hit different now—because the best part is sharing them with my 2-year-old daughter. ✨ Seeing the magic through her eyes makes them even better. Some things never get old. 🎥🍿 #Disney #DadLife #WeekendVibes

Every cycle, people rediscover that self-custody matters—usually the hard way. Exchanges freeze withdrawals, protocols get exploited, and suddenly ‘not your keys, not your coins’ isn’t just a meme. Some lessons don’t need to be learned twice. 🔑 #Bitcoin #Crypto #SelfCustody…

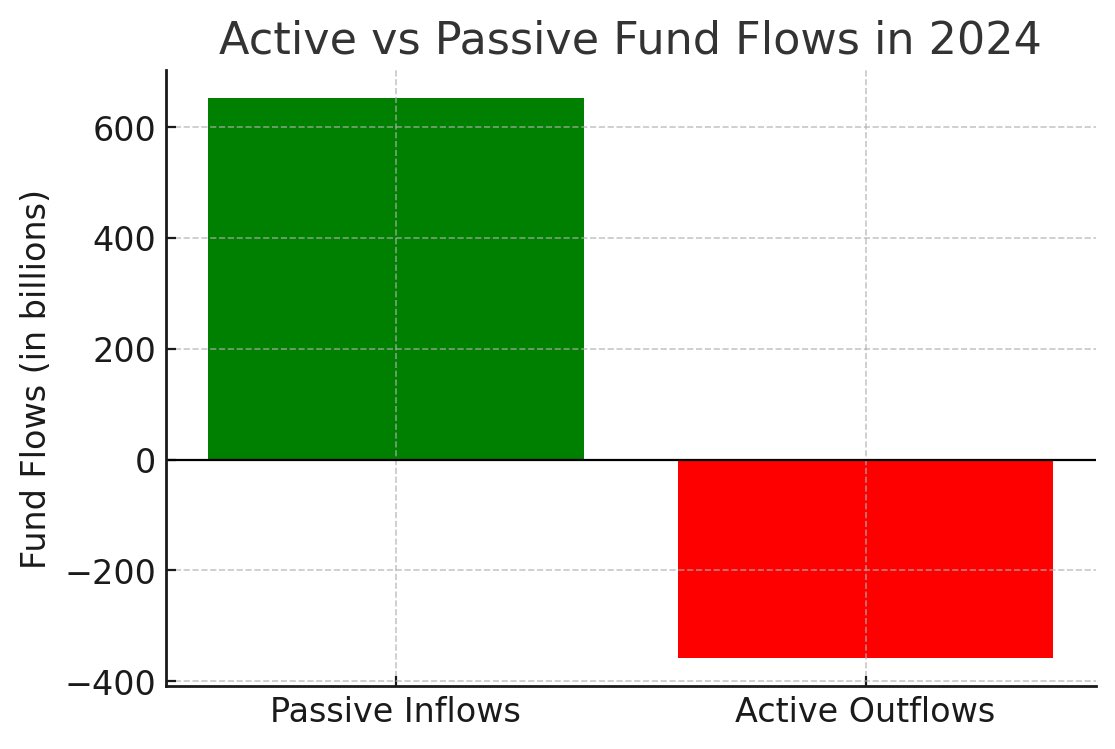

Passive investing keeps eating active managers’ lunch. 🍽️ In 2024, passive funds pulled in $652B, while active funds bled -$358B in outflows. The trend is clear: investors want low fees, broad exposure, and market efficiency over high-cost active bets. Adapt or fade. 👀…

Crypto companies are walking in the front door at the SEC to have constructive conversations about what good policy should look like. For the first time ever. Literally. We've barely begun to unlock crypto's potential in the USA. The next couple years are going to be massive.

Dogecoin just got the institutional treatment! Grayscale launching a $DOGE Trust is another sign that meme coins aren’t just for the internet degenerates anymore. Love it or hate it, liquidity flows where the attention is. 👀 More here: investopedia.com/grayscale-laun… #Crypto…

Kraken doubled revenue in 2024, surpassing $1B in spot trading fees alone. With record signups, deep liquidity, and institutional demand surging, the momentum is only getting stronger. Regulatory clarity + crypto adoption = 🚀 Read more: blog.kraken.com/news/kraken-20… #Kraken #Crypto…

The Czech National Bank is considering allocating up to 5% of its €140bn reserves into Bitcoin, aiming to diversify assets. If approved, it would be the first Western central bank to hold crypto assets. #CryptoNews #Bitcoin #Finance #Banking

🔥 Honored to share that CF Benchmarks has been nominated for Index Provider of the Year! From powering the first US spot Bitcoin ETFs to setting the standard for crypto benchmarks, we’re just getting started. Big thanks to our partners & clients for trusting us. Let’s win…

Earlier this year @CFBenchmarks, authorized and Regulated by the UK FCA, announced it would be adding the market data of LMAX Digital to some of its most liquid and referenced benchmarks. Together they have over $5 bn in assets referenced. Discover more cfbenchmarks.com/blog/cf-benchm…

Understand why @BlackRock's #Bitcoin Private Trust is a watershed for institutional crypto - with one 4-minute read👇 blog.cfbenchmarks.com/blackrocks-bit…

State of the Union Address! Shout out to @Gemini @FTSERussell @WisdomTreeETFs @JeremyDSchwartz @altruistcorp @fpassociation @CFBenchmarks @michael_venuto @APompliano and more!

United States Trends

- 1. Saudi 198K posts

- 2. #UNBarbie 6,780 posts

- 3. Gemini 3 41.2K posts

- 4. Khashoggi 28.7K posts

- 5. #UnitedNationsBarbie 7,496 posts

- 6. Salman 60.5K posts

- 7. Cloudflare 250K posts

- 8. #NXXT2Run N/A

- 9. Piggy 99.9K posts

- 10. Robinhood 5,052 posts

- 11. Mary Bruce 1,184 posts

- 12. Shanice N/A

- 13. Pat Bev 1,709 posts

- 14. Merch 67.5K posts

- 15. Olivia Dean 4,634 posts

- 16. #LaSayoSeQuedóGuindando 3,080 posts

- 17. Nicki Minaj 43.1K posts

- 18. Luis Guerrero N/A

- 19. Antigravity 5,828 posts

- 20. CAIR 35K posts

Was dir gefallen könnte

-

CF Benchmarks

CF Benchmarks

@CFBenchmarks -

Raze

Raze

@razefinance -

Jason Guthrie

Jason Guthrie

@GuthrieFi -

Dylan

Dylan

@dylangans -

Samir Kerbage

Samir Kerbage

@SamirKerbage -

The Old Man Who Lost His Horse

The Old Man Who Lost His Horse

@Sickjoke -

Jane Edmondson

Jane Edmondson

@EQMIndexes -

Christopher Grilhault des Fontaines

Christopher Grilhault des Fontaines

@christophergdf -

Three Crowns Marketing

Three Crowns Marketing

@ThreeCrownsLLC -

Anika Raghuvanshi

Anika Raghuvanshi

@AnikaRaghu -

LizaJane 🟪👑🟪

LizaJane 🟪👑🟪

@LizaJan75270182 -

Anchal Tandon

Anchal Tandon

@AnchalTandon88 -

Jack

Jack

@jackswizz7 -

Channing Griffin

Channing Griffin

@chaygriff -

たっちん

たっちん

@watashinouen

Something went wrong.

Something went wrong.