Strond Capital

@StrondCapital

Part hedge fund, part private equity firm, Strond Capital is a hybrid investment company committed to building customized portfolios of public/private equity.

You might like

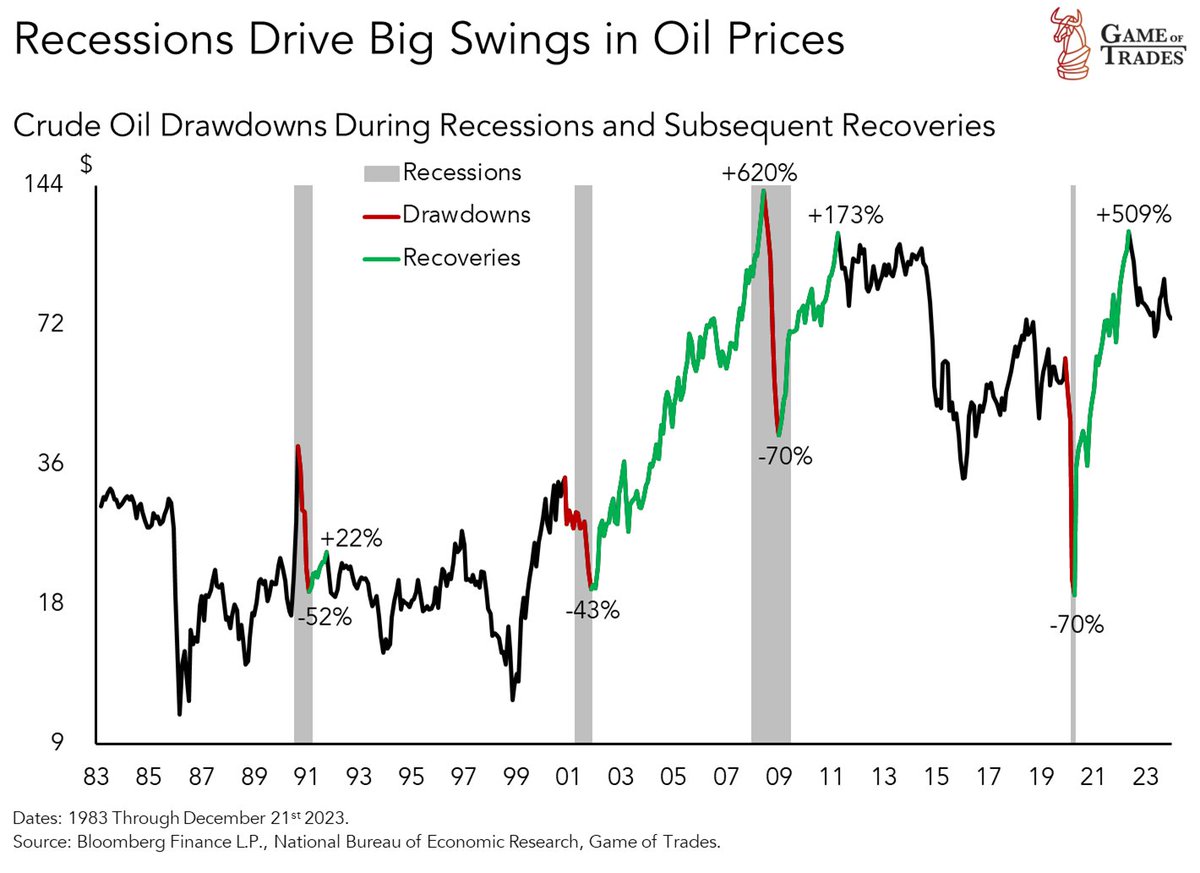

Oil gets extremely volatile around recessions In recession = oil plummets After recession = oil spikes

What do bonds know?

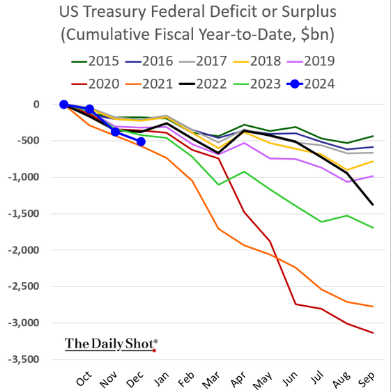

Pretty incredible to see covid-period like deficits being run at a time when unemployment is at secular lows and the economy is growing above potential. In the short-term this helps delay any recession incoming. Long-term it will make managing an eventual recession difficult.

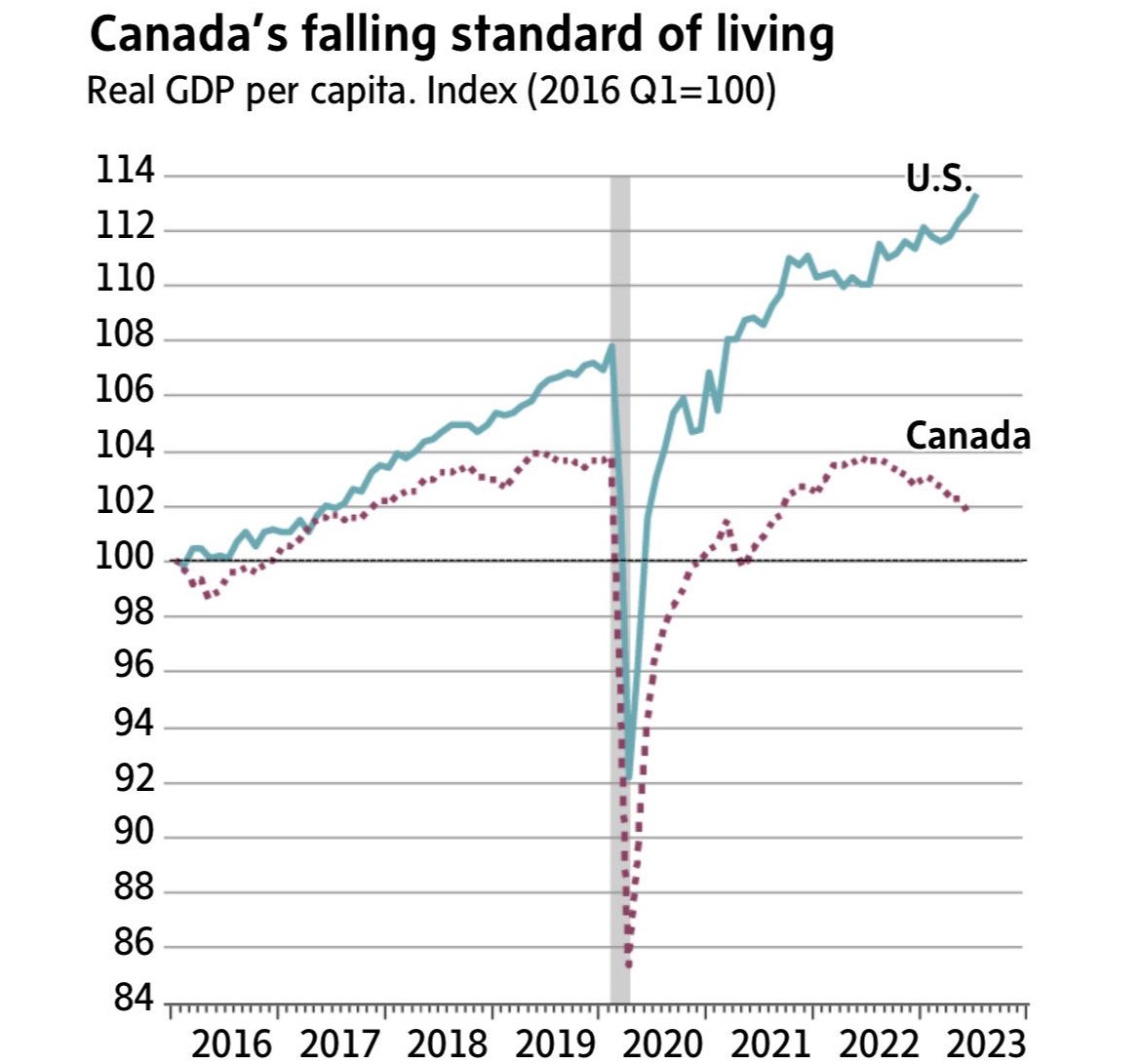

Has Canada joined the European Union?

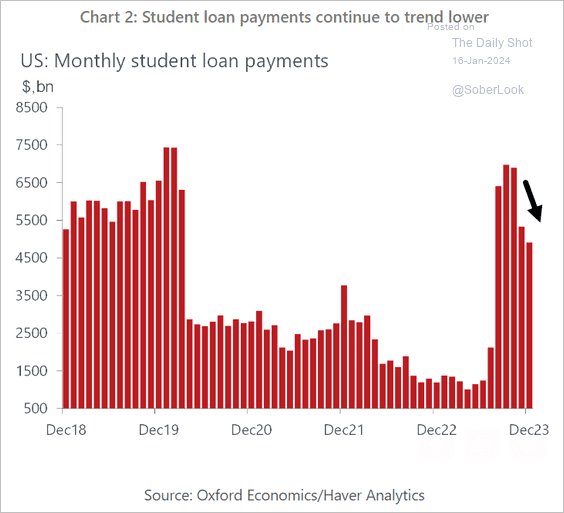

After a spike in #studentloan payments following the end of the payment holiday, they are now on the decline as #incomes fall short.

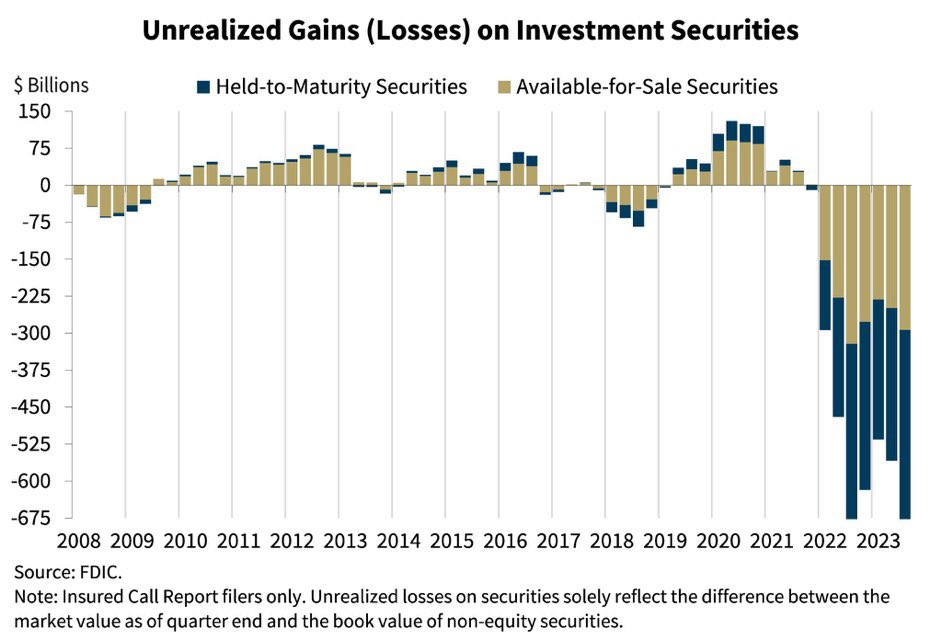

U.S. Banks are facing unrealized losses of roughly $685 billion. They are desperately hoping the Federal Reserve will cut rates sooner rather than later.

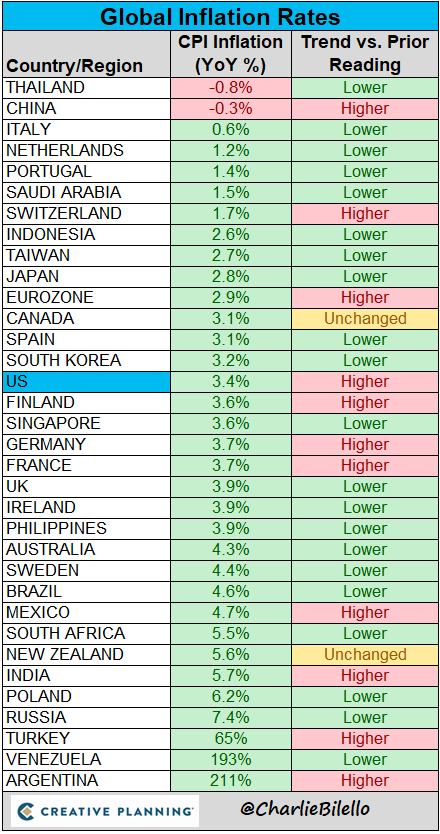

Global Inflation Rates...

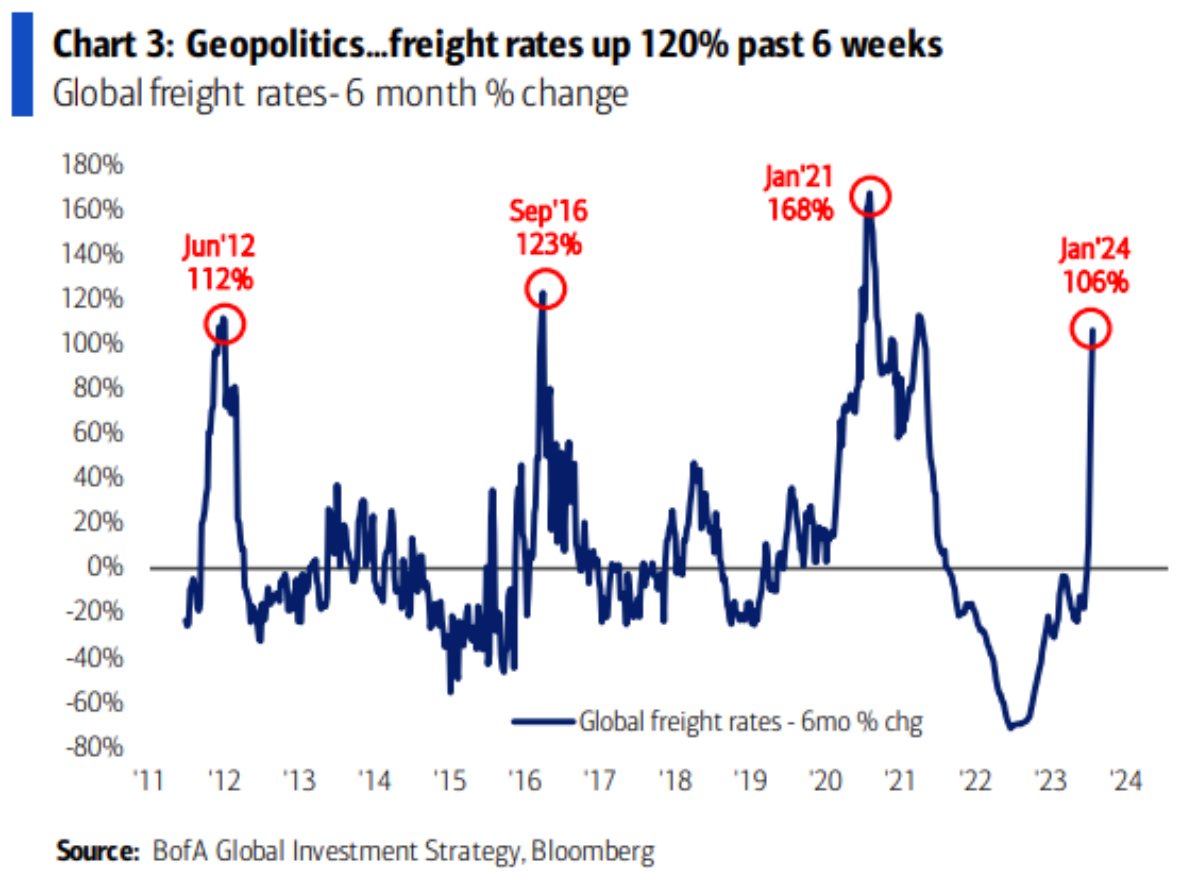

Shipping costs are skyrocketing as a result of geopolitical tensions. Over the past 6 weeks, global freight rates are up ~120%. Much of this has to do with recent attacks on commercial vessels in the Red Sea. The last time we saw such a quick surge in freight rates was during…

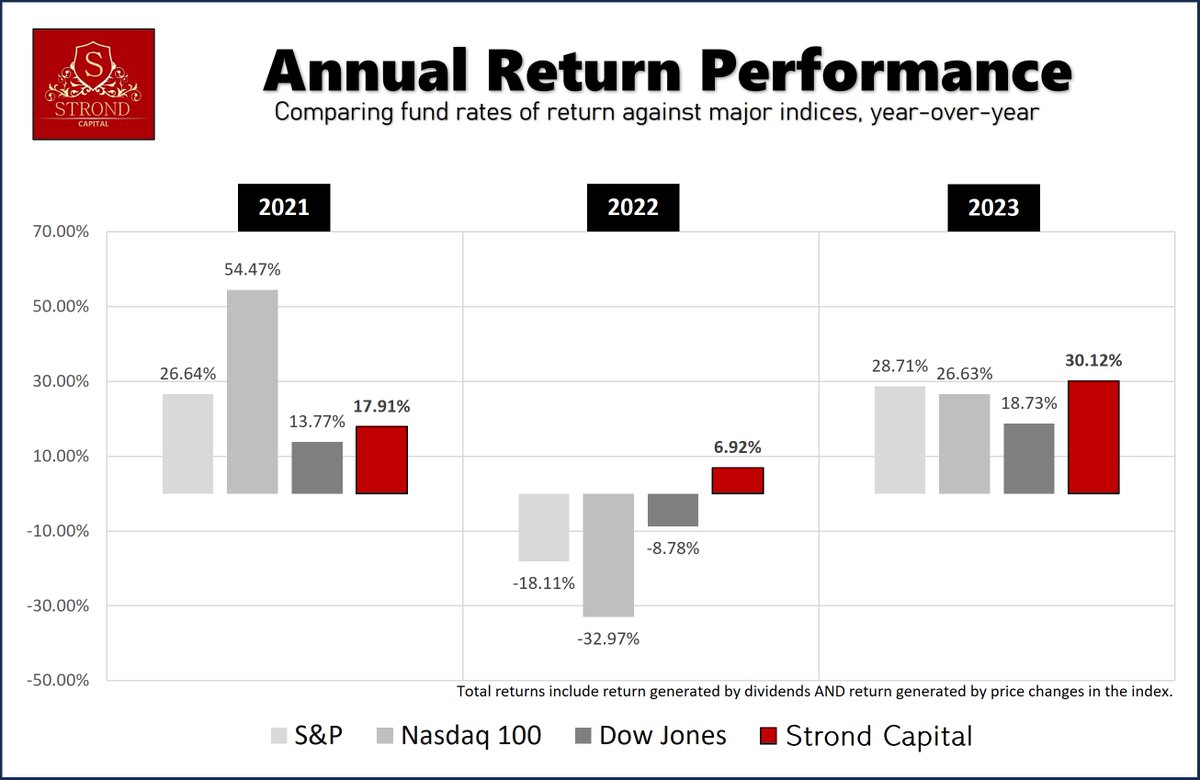

For the second year in a row, Strond Capital’s fund performance rate of return has surpassed the Dow Jones, the Nasdaq 100, and the S&P 500 indices!

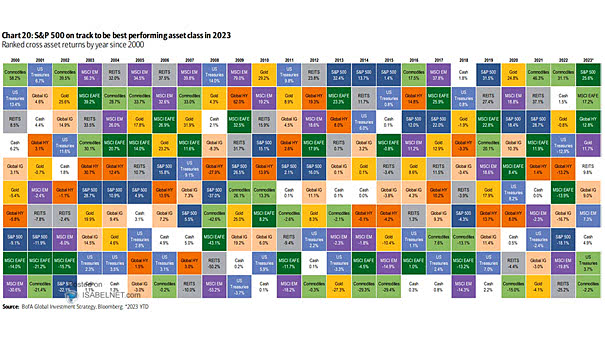

This is one of my favorite charts which shows that most of the time whatever was last year's winner tends to lag the following year. h/t @ISABELNET_SA

Global Money Supply... Hardly a monetary contraction. via Bloomberg

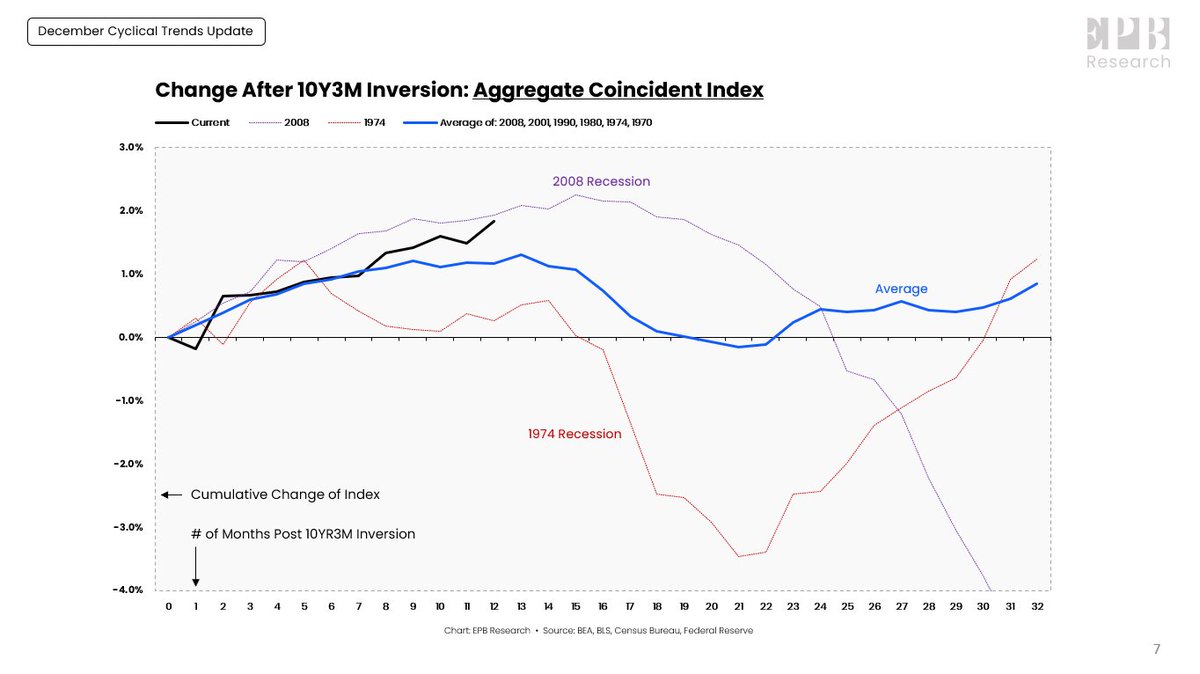

It's still too early, and almost irresponsible, to confidently declare that "this time is different."

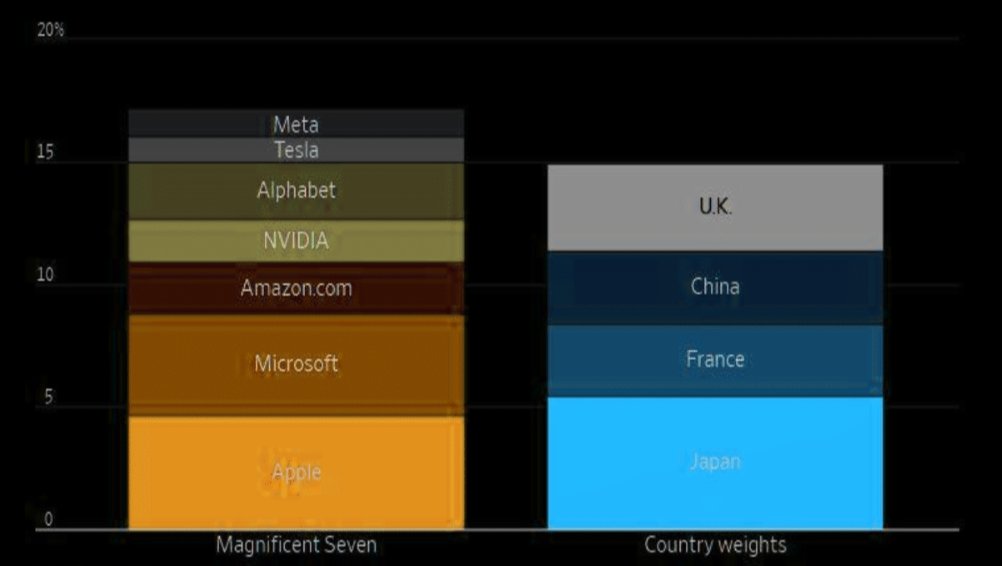

The Magnificent 7 have a higher weighting in the MSCI World index than all of the stocks in the UK, China, France and Japan combined.

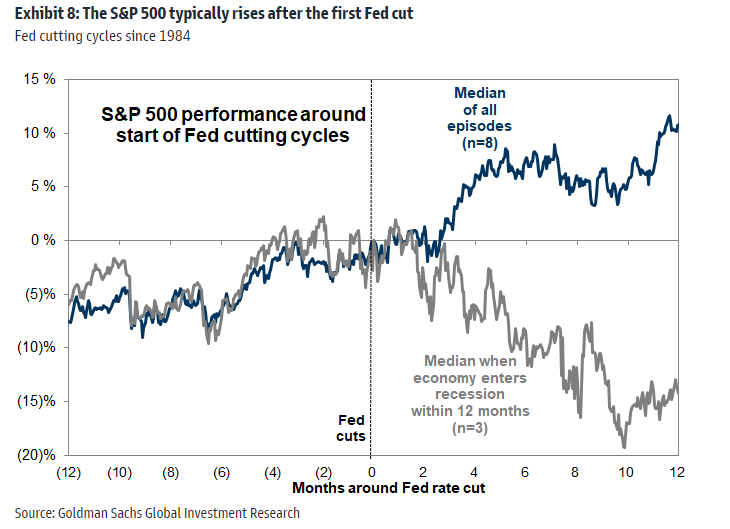

The S&P 500 typically rises after the first Fed cut

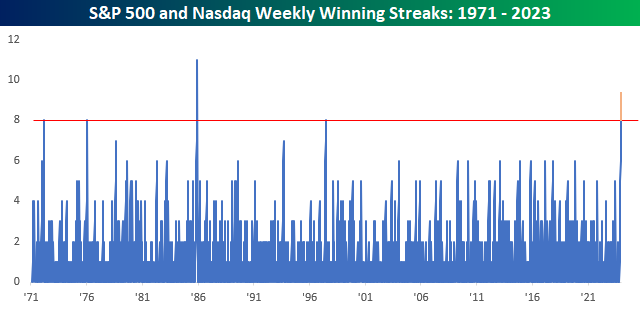

There's still a full trading day left in the week, but both the S&P 500 and Nasdaq are on pace for their ninth straight positive week, something they haven't done in unison since late 1985.

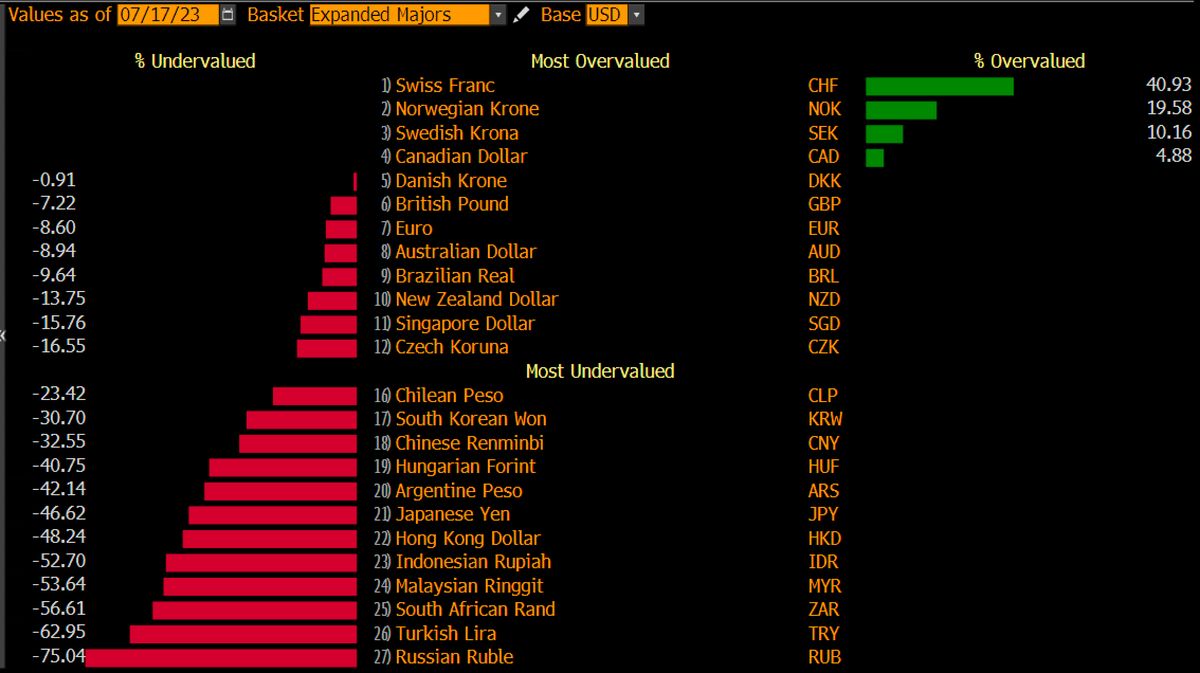

Dollar’s worst slump since Nov has some strategists saying a turning point is finally at hand for the greenback. Standard Bank expects ‘multi-year downtrend.’ Dollar bears can also lean on valuation measures. Dollar is overvalued in terms of purchasing power (Big Mac Index)…

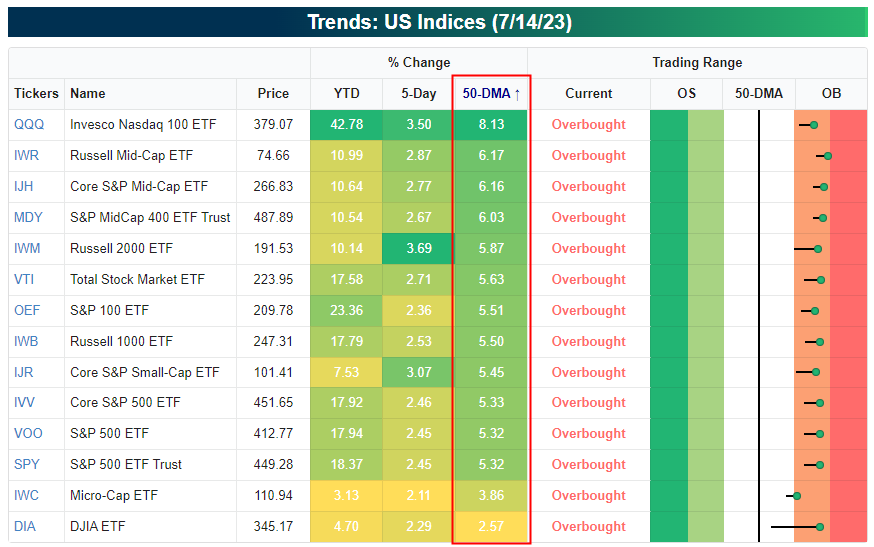

Heading into the new trading week with all of the major US index ETFs in overbought territory (yet again). Most are more than 5% above their 50-DMAs:

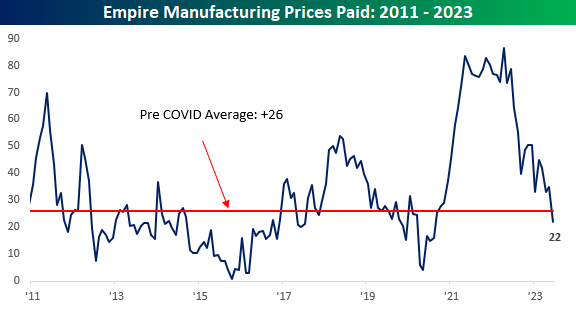

The Price Paid component of the Empire Manufacturing report is now below its pre-COVID average.

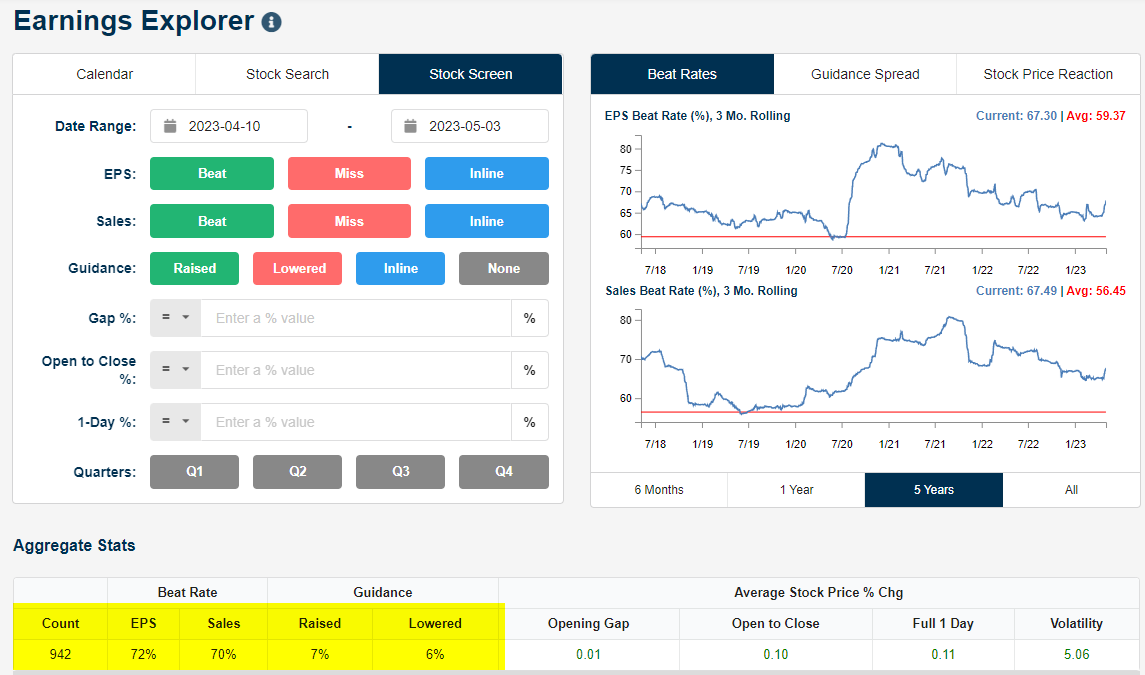

Nearly 1,000 earnings reports so far this season, 72% EPS beat rate, 70% sales beat rate, and more companies have raised than lowered guidance. 130 companies are set to report after the close today (the biggest day of the season).

United States Trends

- 1. Zverev N/A

- 2. #AusOpen N/A

- 3. #AO26 N/A

- 4. #TheTraitorsUS N/A

- 5. #AustralianOpen N/A

- 6. Sinner N/A

- 7. Don Toliver N/A

- 8. Carlitos N/A

- 9. Warsh N/A

- 10. Djokovic N/A

- 11. Colton N/A

- 12. #River N/A

- 13. OpenClaw N/A

- 14. Cooper Flagg N/A

- 15. Candiace N/A

- 16. Lisa N/A

- 17. Iron Lung N/A

- 18. Hasan N/A

- 19. Jannik N/A

- 20. Sascha N/A

Something went wrong.

Something went wrong.