TPS Group, Inc.

@TPSGROUPINC

Expert Guidance and Customized Solutions since 1964

You might like

HRA’s are Health Reimbursement Accounts, and they work combined with your current health insurance coverage. They can be designed to cover specific health care costs or even copays towards a high deductible. Learn more at: bit.ly/3AXhmXp

The pre-tax advantages of a 401(k) plan make it a very effective way for employees to save for retirement and lower their tax burden. bit.ly/3HjUXqq

From all of us here at TPS Group - Happy Thanksgiving to you and your families!

Plan Design Strategies to Attract and Retain Talent in a Competitive Job Market bit.ly/4k7YmZx

The mission of a Third Party Administrator (TPA) is simple: to act as an “Independent set of eyes,” protecting the client’s best interest and ensuring compliance for their retirement plan. bit.ly/3zIZeCw

Today we honor the brave men and women who have served and sacrificed for our freedom. Thank you for your courage, commitment, and service. Happy Veterans Day!

It’s surprisingly easy to lose track of a 401(k) when you change jobs. In fact, millions of Americans have “orphan” accounts, which are small retirement balances left behind at former employers. Read more: bit.ly/3LNFZ03

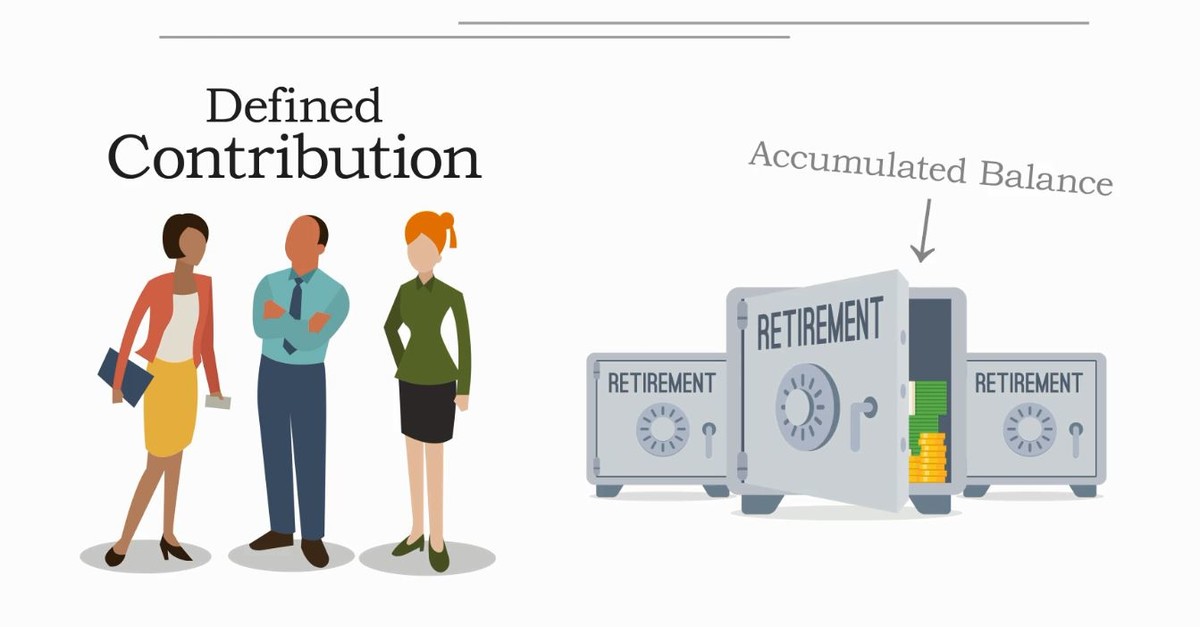

Many private companies have switched from defined benefit plans to defined contribution plans (such as 401(k) plans). It’s worth considering whether a defined benefit plan would benefit you as a business owner and help you meet your tax and savings goals. bit.ly/3F5ezgd

Compliance with federal regulations like ERISA, ACA, and COBRA is critical for employers offering benefits programs.Noncompliance, whether due to oversight or misunderstanding, can lead to hefty fines, damaged employee trust, and reputational harm. bit.ly/4gYRpc6

HSAs offer a triple tax advantage for retirement savings—contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free. bit.ly/3T25bRW

It’s easy to set up a 401(k) and then forget about it, especially when life gets busy. But the “set it and forget it” approach can cost you over the long term. Checking your 401(k) at least once a year ensures your retirement savings stay on track. bit.ly/4ngPv9n

Each generation has its unique approach to savings, shaped by their specific economic, political, and societal contexts. bit.ly/41x6H0J

Investment Professionals & CPA’s, Partner With Us and expand your offerings with TPS Group! More info at this link 👉 bit.ly/4eFAvNR

ERISA's stringent requirements for Plan Sponsors have made the administration of retirement plans even more complex and subject to legal challenges. Now more than ever, outsourcing these responsibilities makes sound business sense. bit.ly/3wae9Au

At TPS Group, we guarantee to our clients that their Tax Deposits, Quarterly, and year-end tax forms are made on time. Let Payright Payroll Affiliates create a customized payroll experience based on your companies exact needs.

Please note our Lunch and Learn event on on September 25th has been cancelled. Stay tuned as we announce further events!

Effective retirement planning requires a holistic approach. The “Four L’s” framework—Longevity, Lifestyle, Legacy, and Liquidity—offers a structured way for employers and employees to evaluate retirement readiness and design sustainable strategies. bit.ly/4nnfegu

📢 Join us Sept 25 for a Lunch & Learn on the latest 401(k) trends! ✅ Plan sponsor best practices & participant readiness ✅ Key legislative & regulatory updates ✅ Class-action lawsuits & action steps ✅ Plan design tips to optimize outcomes bit.ly/4g8pHKq

eventbrite.com

Staying Ahead of the Curve: 401(k) Best Practices & Updates

Learn the latest 401(k) trends, laws, and best practices to strengthen plan governance, boost outcomes, and reduce fiduciary risk.

United States Trends

- 1. Derrick Henry 32,1 B posts

- 2. Packers 62,5 B posts

- 3. #AEWWorldsEnd 59,6 B posts

- 4. Malik Willis 23,2 B posts

- 5. Ravens 54,4 B posts

- 6. #GoAvsGo 1.037 posts

- 7. NFC North 19,7 B posts

- 8. Green Bay 12 B posts

- 9. Josh Jacobs 3.292 posts

- 10. Houston 48,4 B posts

- 11. Huntley 10,6 B posts

- 12. Chicago Bears 12,6 B posts

- 13. Moxley 11,9 B posts

- 14. Giannis 14,4 B posts

- 15. #netflixreleasethevolume2files 122 B posts

- 16. Frank Wilson N/A

- 17. Clayton Tune 1.371 posts

- 18. Jordan Love 6.712 posts

- 19. Okada 16,7 B posts

- 20. Nate Wiggins 1.213 posts

Something went wrong.

Something went wrong.