Tax Explained.NG🇳🇬

@Taxexplainedng

Simplifying the Nigerian Tax Acts section by section | The gazetted Acts 👇🏾 https://drive.google.com/drive/folders/1msz2OXFvQOfnhhJqtTu8-cXofqA9j6QG

You might like

Does changing your transfer narration from "Payment" to "Gift" really matter? According to the new tax reform Acts: "Income" [e.g. from trade, business, or services] is chargeable to tax regardless of how you label it. HOWEVER, you WILL BE CAUGHT and taxed if: Your monthly…

![Taxexplainedng's tweet image. Does changing your transfer narration from "Payment" to "Gift" really matter?

According to the new tax reform Acts: "Income" [e.g. from trade, business, or services] is chargeable to tax regardless of how you label it.

HOWEVER, you WILL BE CAUGHT and taxed if:

Your monthly…](https://pbs.twimg.com/media/G9_jHHLXwAAkUpE.png)

![Taxexplainedng's tweet image. Does changing your transfer narration from "Payment" to "Gift" really matter?

According to the new tax reform Acts: "Income" [e.g. from trade, business, or services] is chargeable to tax regardless of how you label it.

HOWEVER, you WILL BE CAUGHT and taxed if:

Your monthly…](https://pbs.twimg.com/media/G9_jHHJW0AMYKOF.png)

![Taxexplainedng's tweet image. Does changing your transfer narration from "Payment" to "Gift" really matter?

According to the new tax reform Acts: "Income" [e.g. from trade, business, or services] is chargeable to tax regardless of how you label it.

HOWEVER, you WILL BE CAUGHT and taxed if:

Your monthly…](https://pbs.twimg.com/media/G9_jHHTW0AYOW26.png)

![Taxexplainedng's tweet image. Does changing your transfer narration from "Payment" to "Gift" really matter?

According to the new tax reform Acts: "Income" [e.g. from trade, business, or services] is chargeable to tax regardless of how you label it.

HOWEVER, you WILL BE CAUGHT and taxed if:

Your monthly…](https://pbs.twimg.com/media/G9_jHHLWsAALrWa.png)

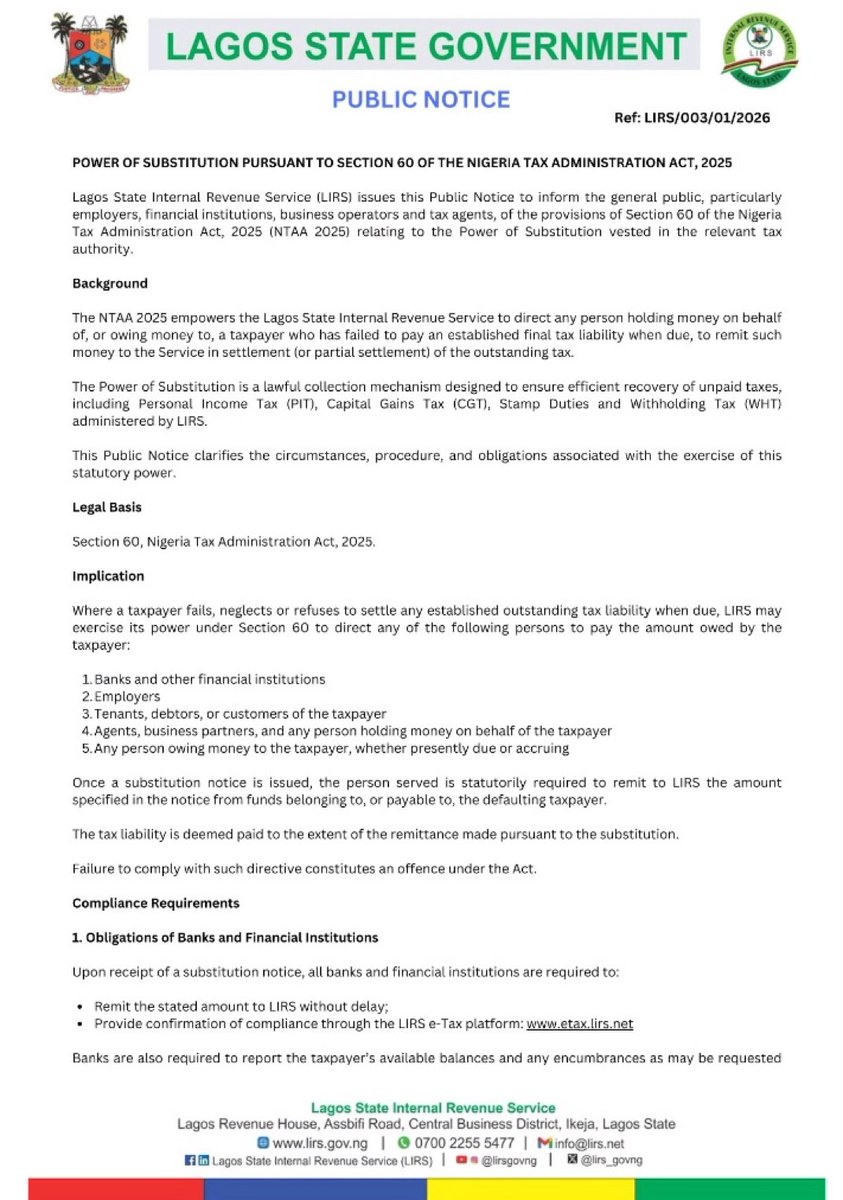

We read it so you don’t have to: • It’s a last-resort tool to recover final tax debts from 3rd parties • Only used after all court appeals are exhausted • Minimum wage earners & small businesses are exempt • It is not new and follows strict due process

𝐅𝐀𝐐𝐬 𝐨𝐧 𝐏𝐨𝐰𝐞𝐫 𝐨𝐟 𝐒𝐮𝐛𝐬𝐭𝐢𝐭𝐮𝐭𝐢𝐨𝐧 𝐢𝐧 𝐓𝐚𝐱 𝐀𝐝𝐦𝐢𝐧𝐢𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧 𝑸1: 𝑾𝒉𝒂𝒕 𝒊𝒔 "𝒑𝒐𝒘𝒆𝒓 𝒐𝒇 𝒔𝒖𝒃𝒔𝒕𝒊𝒕𝒖𝒕𝒊𝒐𝒏"? The power of substitution is a tax recovery mechanism that permits the tax authority to issue a directive to a third…

WE read the full article so you don't have to! 🧵 1/5: PAYE(pay as your earn) Cuts Boost Workers' Take-Home Pay in January 2026 – Taiwo Oyedele, Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, says new tax laws have reduced PAYE deductions, leading to…

PAYE Cuts Increased Workers’ Take-Home Pay In January — Oyedele channelstv.com/2026/01/26/pay…

Nigeria's Tax Admin Act 2025 mandates banks to report personal accts with >₦50M monthly cumulative transactions or corp >₦250M to FIRS for tax monitoring. Specific demands possible below thresholds. Using personal acct for business risks evasion exposure; includes insurers…

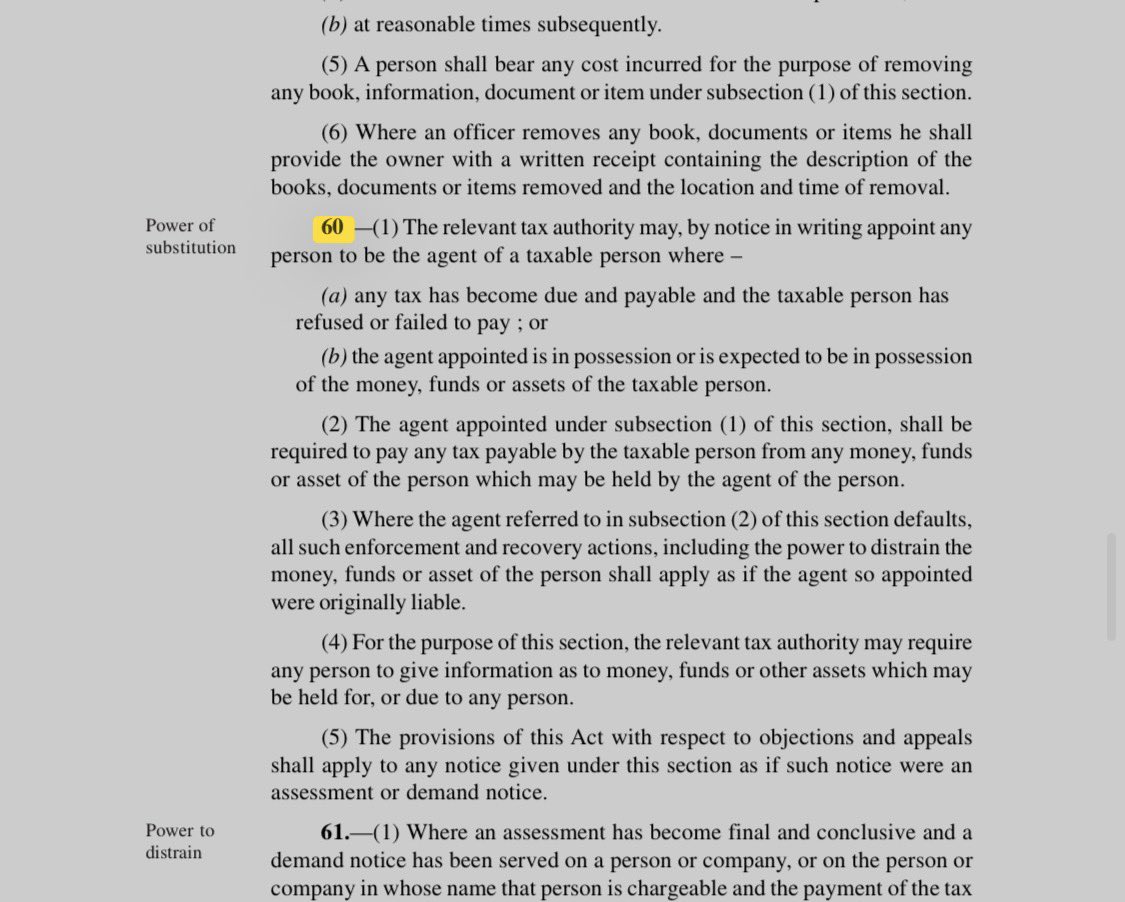

Simplifying Sec 60 NTAA: If you're owed taxes & won't pay, LIRS can make your bank/tenant/employer your "agent" to pay directly from your funds. They must comply or face heat. Can request fund details too. Objections/appeals apply. Smart enforcement! #NigeriaTaxReforms

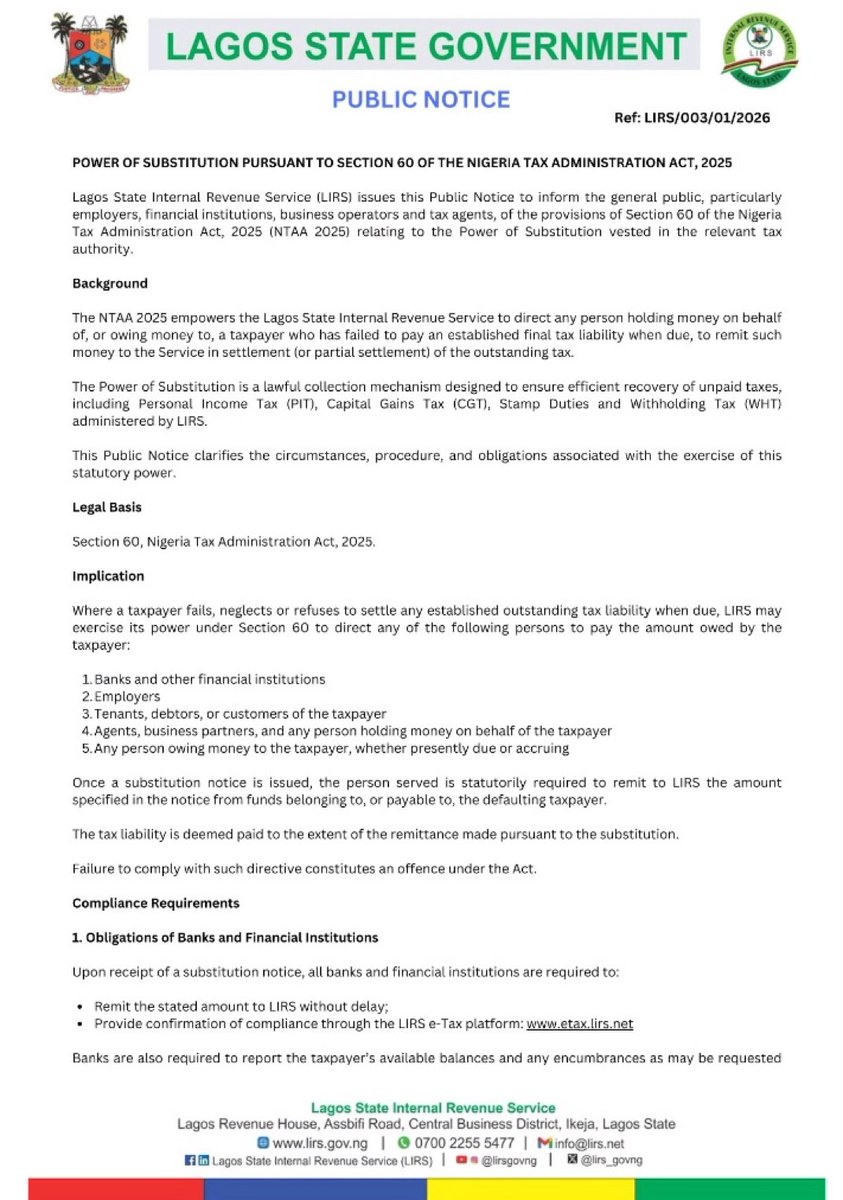

LIRS: Tax law empowers Lagos to recover unpaid taxes through tenants, banks The Lagos State Internal Revenue Service (LIRS) says it will exercise its legal authority to recover outstanding taxes from non-compliant taxpayers through third parties such as banks, employers,…

The new Tax laws connects all your mediums to evade tax However there are still loopholes to legally avoid tax. There a difference

If you earn less than N20m p.a and your tax has gone up - IT IS BECAUSE YOUR COMPANY WAS HELPING YOU TO EVADE TAXES BEFORE NOW by under reporting your emoluments to the TAX MAN. Thank your star that the tax law is not asking for back duty from you. However, your company is not…

If you earn less than N20m p.a and your tax has gone up - IT IS BECAUSE YOUR COMPANY WAS HELPING YOU TO EVADE TAXES BEFORE NOW by under reporting your emoluments to the TAX MAN. Thank your star that the tax law is not asking for back duty from you. However, your company is not…

Nigeria's new Tax Act 2025: Emigrating ("Japa") won't exempt you if you have "Significant Economic Presence" (SEP) in Nigeria, like streaming/selling online to Nigerians or operating shipping/aviation. Non-residents must file returns & pay taxes on derived income. See Sec…

The gazzeted laws

Lagos State Government has taken the lead in the Enforcement of the Tax Laws. Abuja will be next and before you know it, all states will issue this kind of notice. I read the laws line by line, I saw it coming but @taiwoyedele kept coming to the TV stations to say that your…

Lagos State Government has taken the lead in the Enforcement of the Tax Laws. Abuja will be next and before you know it, all states will issue this kind of notice. I read the laws line by line, I saw it coming but @taiwoyedele kept coming to the TV stations to say that your…

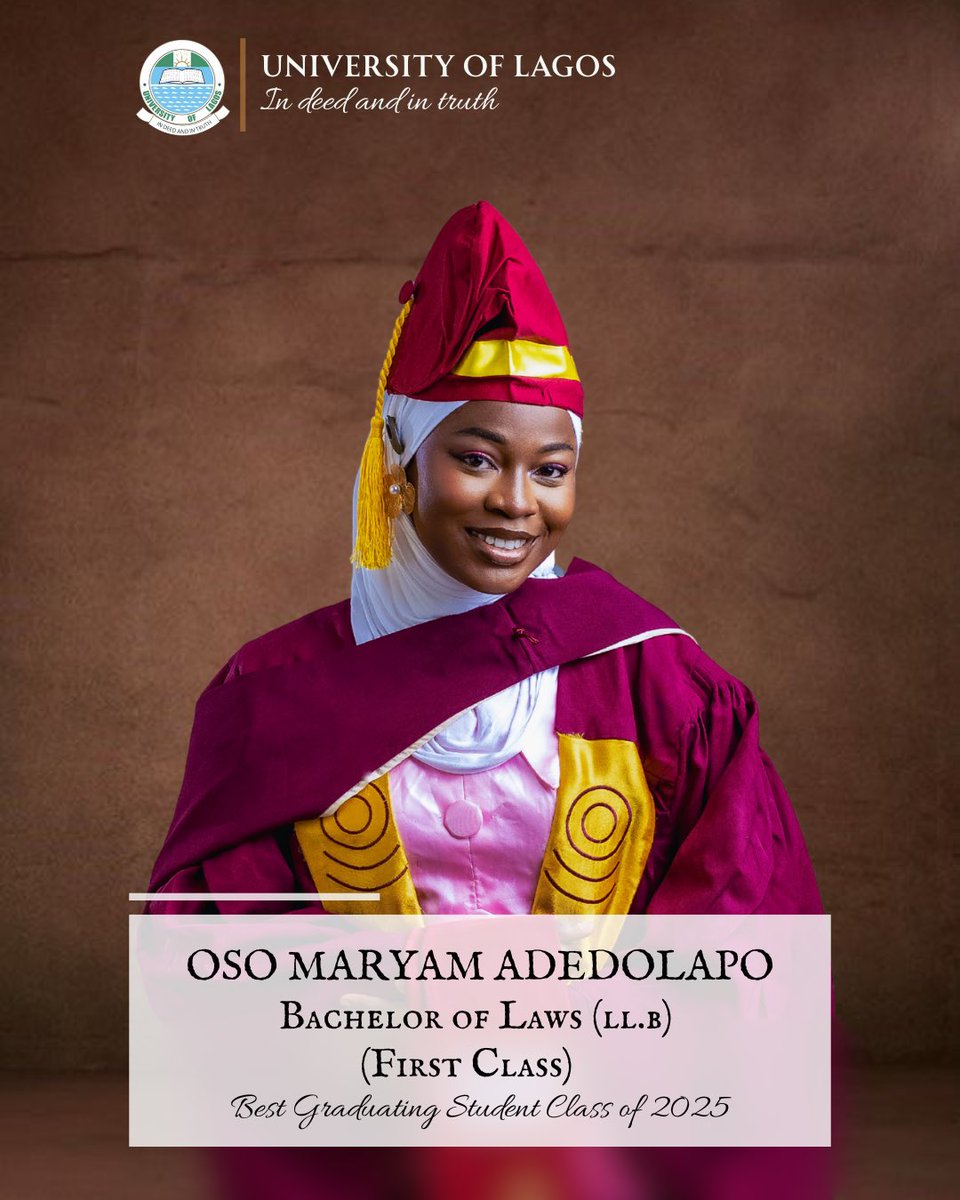

Which of the favours of Allah will I deny? None! Introducing MARYAM ADEDOLAPO OSO, Bachelor of Laws (LL.B.), First Class (Hons) Best Graduating Student, Faculty of Law University of Lagos, Akoka.

No VAT on “Essential Items" like basic food, medical supplies, fertilisers, live cattle, goats, sheep and poultry, non-oil exports, agricultural seeds and seedlings, exported services, medical services and equipments, locally produced agricultural chemicals, veterinary medicine…

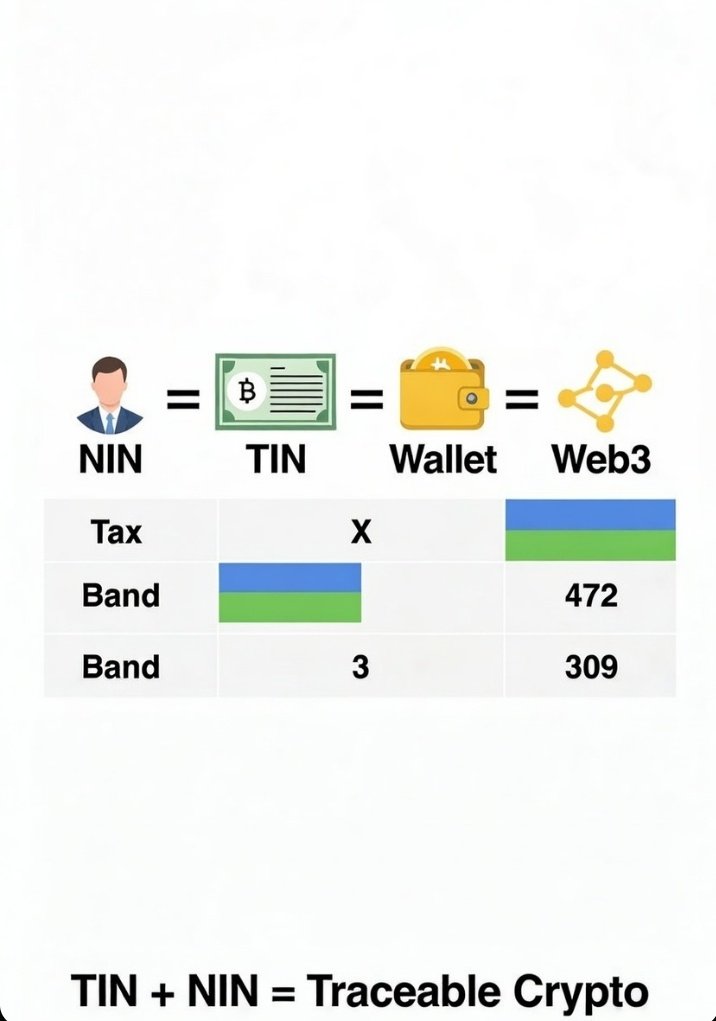

How Govt will tax Crypto. According to the new tax reform Acts: They plan to use "Virtual Asset Service Providers" (VASPs) ie Bybit, as mandatory informants for the tax authority. HOWEVER, it’s a wide net because: 1 Your Exchange Must Report You: Every exchange (Binance,…

🇳🇬 NOW: Nigeria requires crypto transactions to be linked to Tax IDs and National IDs.

How Govt will tax Crypto. According to the new tax reform Acts: They plan to use "Virtual Asset Service Providers" (VASPs) ie Bybit, as mandatory informants for the tax authority. HOWEVER, it’s a wide net because: 1 Your Exchange Must Report You: Every exchange (Binance,…

Nigeria's Crypto Tax Net is Tightening in 2026 Anytime I talk to Crypto Twitter on Taxes, the question I get more often is "how would the Government know about my profits?" Let me break it down for you. See me as a friend not foe 🤣 Under the new Nigerian Tax Administration…

Can P2P Crypto Trading Be Taxed Effectively in Nigeria? Insights on Enforcement, Compliance & the 2026 Reality 1.0 Short answer: Yes. 2.0 Long Answer: It's tricky, and the new 2026 tax framework NTAA amendments is making it harder to hide. 3.0 As a Lawyer specializing in Web3…

How Govt will tax Crypto. According to the new tax reform Acts: They plan to use "Virtual Asset Service Providers" (VASPs) ie Bybit, as mandatory informants for the tax authority. HOWEVER, it’s a wide net because: 1 Your Exchange Must Report You: Every exchange (Binance,…

According to the new tax reform Acts [Nigeria]: Your bank is legally mandated to spy on you

Is your personal bank account a "Confession Statement" to the tax man? According to the new tax reform Acts [Nigeria]: Your bank is legally mandated to spy on you. If your personal account hits N50 Million (Individual) or N250 Million (Corporate) in cumulative monthly…

![Taxexplainedng's tweet image. Is your personal bank account a "Confession Statement" to the tax man?

According to the new tax reform Acts [Nigeria]:

Your bank is legally mandated to spy on you. If your personal account hits N50 Million (Individual) or N250 Million (Corporate) in cumulative monthly…](https://pbs.twimg.com/media/G_RUM9cWgAA5SAY.jpg)

United States Trends

- 1. #WWERaw N/A

- 2. Arizona N/A

- 3. Tony Padilla N/A

- 4. Bovino N/A

- 5. Zverev N/A

- 6. Finn N/A

- 7. Brayden Burries N/A

- 8. Maple Grove N/A

- 9. Jrue N/A

- 10. El Centro N/A

- 11. #TheRookie N/A

- 12. Learner Tien N/A

- 13. Rob Wright N/A

- 14. Homan N/A

- 15. Punk N/A

- 16. Jaden Bradley N/A

- 17. Jaxson Hayes N/A

- 18. Lee Majors N/A

- 19. Highguard N/A

- 20. #RawOnNetflix N/A

Something went wrong.

Something went wrong.