TechDev

@TechDev_41

Entrepreneur | #Bitcoin and crypto analysis

Most wish they bought “at the bottom of the bear”. But those thoughts only come in hindsight, and usually to folks that were nowhere near the space when the bottom was being made.

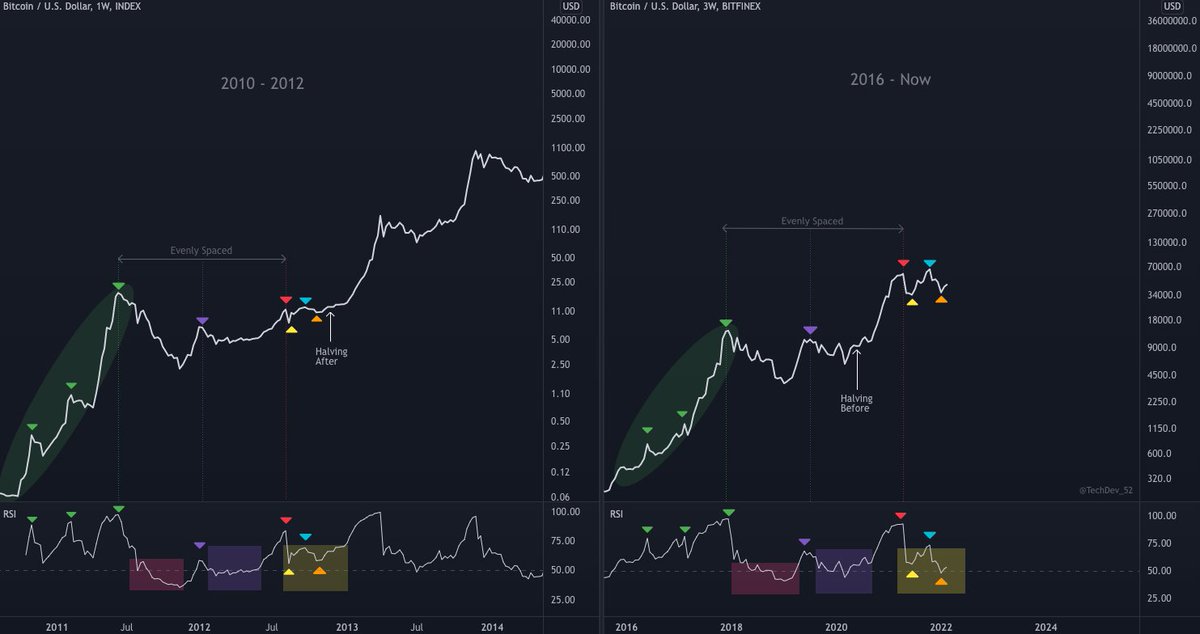

My take on wave timings since 2018 (approximate): Wave 1 Impulse: 112 days Wave 2 Correction: 378 days Wave 3 Impulse: 224 days Wave 4 Correction: 378 days (and counting)... Reaccumulation periods preceded each impulse up.

This chart really does not look like it has much upside from here.

4H #BTC shaded volatility squeeze off a reversal bar with tightening bands. Indicators by @Tradingalpha_ @ZeroHedge_ . Interesting LTF move likely ahead.

This week’s issue covers my 2 most likely paths to the next #Bitcoin impulse. And targets for $QNT $VET $AVAX. getrevue.co/profile/techde…

To me, the market has been correcting for nearly a year. It took this latest downtrend for me to see this as my primary case. The utmost respect for those like @CredibleCrypto who saw it years ago and have played the market accordingly ever since.

THREAD: As expected with a log growth curve, time elapsed from peak to peak is expected to increase while ROI from trough to peak is expected to decrease. The implications are as follows, assuming the low for $BTC is in at 3.1k:

Some called the local Nov top and have swung this downtrend exceptionally well. Some have turned this downtrend into opportunity and used it to add to their long term positions. Respect to them too.

I have been wrong. Plenty. Since summer I’ve maintained this market had another impulse in it. What I thought was its start last fall turned out to be the continuing correction, imo. Many have shifted their views. Some macro bearish, some bullish but slower. Respect to all.

Working #Bitcoin Thesis: Timing of 2021 red🔴 rhymes with 2012 red🔴. Levels of 2021 red🔴 rhyme with 2013 red🔴. Therefore expect shorter extension of next impulse relative to 2013. Might be all coincidence, who knows. Use whatever gives you an edge on your time horizon.

Been impressed with @AurelienOhayon's work. Recommended follow for sharp TA on multiple TFs.

Note the different timeframes. 2016-Now is on a 3W tf vs 2010-2013 on a 1W.

Working #Bitcoin Thesis: Timing of 2021 red🔴 rhymes with 2012 red🔴. Levels of 2021 red🔴 rhyme with 2013 red🔴. Therefore expect shorter extension of next impulse relative to 2013. Might be all coincidence, who knows. Use whatever gives you an edge on your time horizon.

Could certainly see something like this before the next #BTC impulse. And a move from 50K back to 38K would strike fear in most of the market before leaving it behind. Will keep an eye on the structure if we approach high 40s/low 50s. Elegant work by @CredibleCrypto.

The last segment of our corrective structure that preceded the 3rd impulse wave from 10k to 60k+ was a triangle, would be nice to see something similar here if our bottom is in. Remember a longer base typically leads to a stronger impulse. Pullbacks on $BTC to 38-42k are healthy.

Sure looks like #BTC wants the pocket between the upper daily BB (46k) and 50W MA (47k). Interested to see the reaction there.

United States Trendy

- 1. #KonamiWorldSeriesSweepstakes 1,637 posts

- 2. Mitch McConnell 26.4K posts

- 3. #2025MAMAVOTE 1.63M posts

- 4. Term 197K posts

- 5. Andrade 10.2K posts

- 6. Tyla 30.6K posts

- 7. Carter Hart 3,252 posts

- 8. Budapest 20.4K posts

- 9. No Kings 158K posts

- 10. AJ Green N/A

- 11. Big L 11.6K posts

- 12. Somalia 33K posts

- 13. Chanel 30.7K posts

- 14. #TrumpShutdownBadForUS 5,763 posts

- 15. Deport Harry Sisson 35.2K posts

- 16. Yung Miami 3,353 posts

- 17. Anya 16.5K posts

- 18. Caresha 2,138 posts

- 19. Nick Khan N/A

- 20. Dodgers vs Mariners N/A

Something went wrong.

Something went wrong.